February 2026

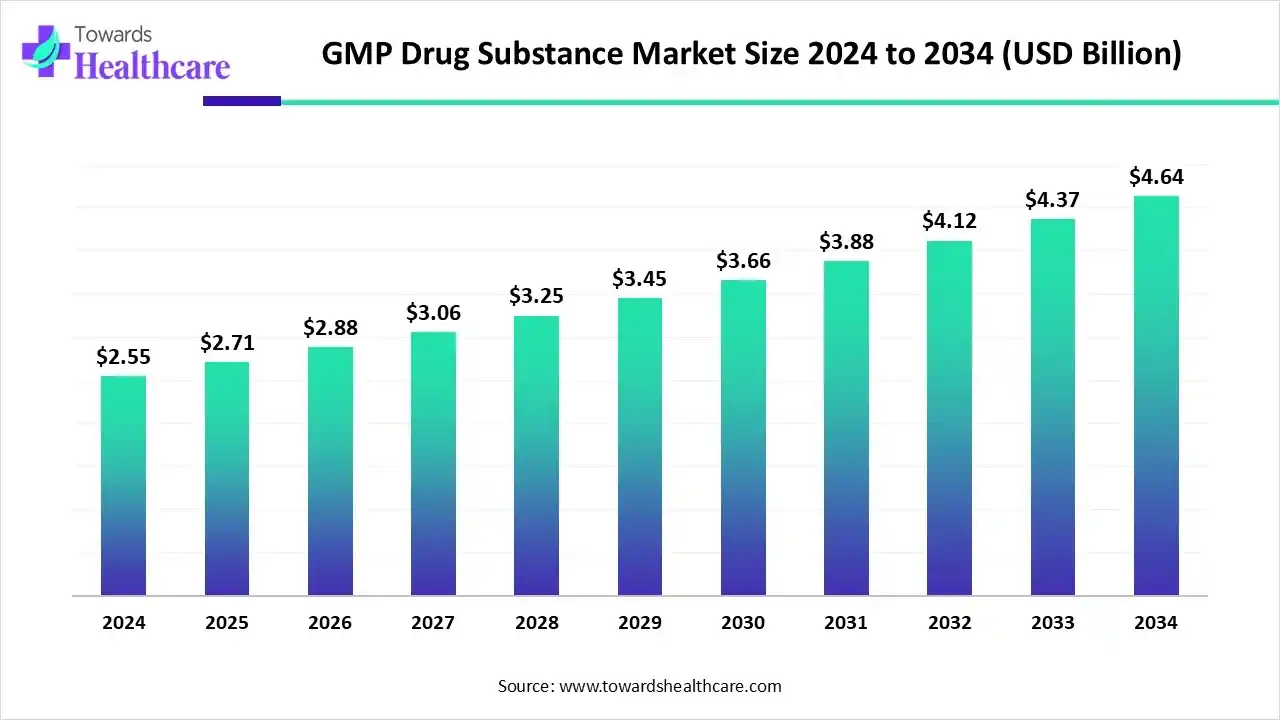

The GMP drug substance market size was estimated at US$ 2.71 billion in 2025, projected to increase to US$ 2.87 billion in 2026 and reach US$ 4.91 billion by 2035, showing a healthy CAGR of 6.14% across the forecast years.

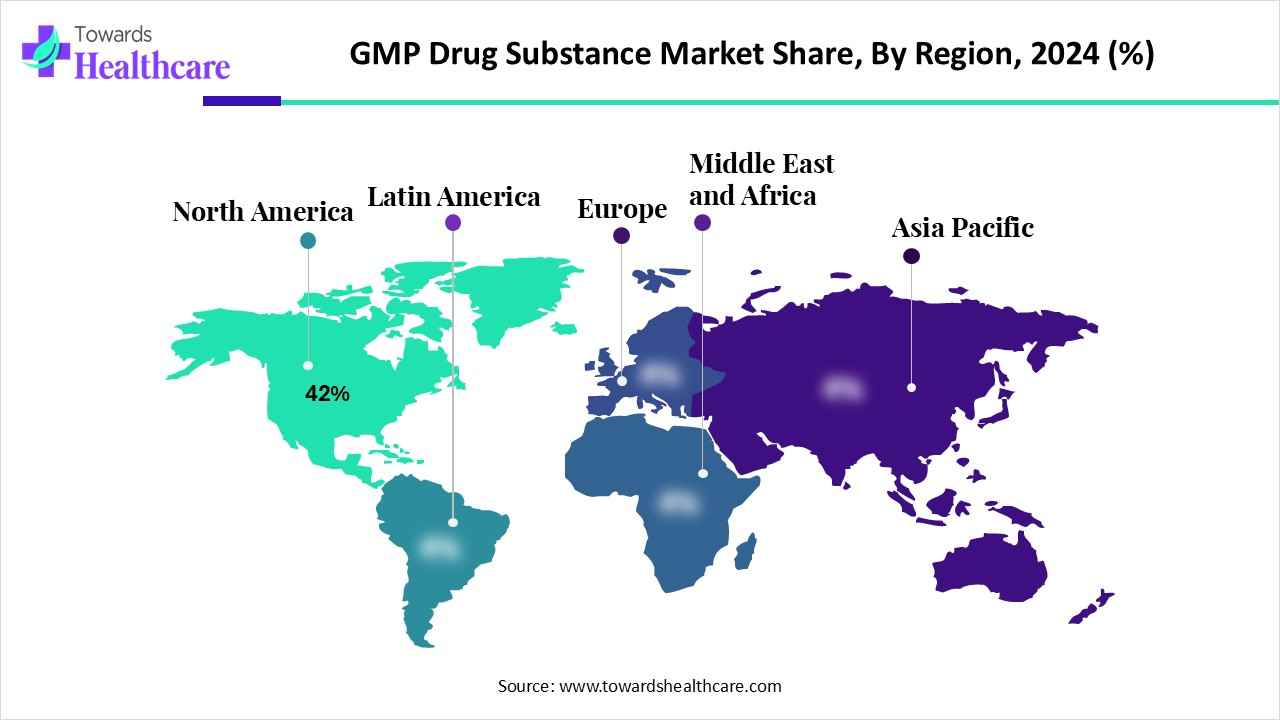

The global GMP drug substance market is witnessing strong growth driven by rising demand for high-quality active pharmaceutical ingredients, biologics, and cell and gene therapies. North America dominates the market, supported by robust pharmaceutical infrastructure, strict regulatory compliance, and the presence of leading pharmaceutical and biotechnology companies. Growth is further fueled by increasing investments in R&D, adoption of advanced manufacturing technologies, and expansion of contract manufacturing organizations. The rising prevalence of chronic diseases and the need for safe, effective therapies continue to drive market demand globally.

| Table | Scope |

| Market Size in 2026 | USD 2.87 Billion |

| Projected Market Size in 2035 | USD 4.91 Billion |

| CAGR (2026 - 2035) | 6.14% |

| Leading Region | North America by 42% |

| Market Segmentation | By Modality/Drug Substance Type, By Manufacturing Platform/Process Type, By Scale/Use Case, By End User/Buyer Type, By Region |

| Top Key Players | Lonza Group, Samsung Biologics, WuXi Biologics / WuXi AppTec, Catalent, Inc., Thermo Fisher Scientific / Patheon, Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim BioXcellence, Rentschler Biopharma, AGC Biologics, Novasep, Cambrex Corporation, Evonik (Custom Pharma & Biotech Services), Patheon (Thermo group), Jubilant Life Sciences / Jubilant HollisterStier, Siege/ Siegfried (API & finished dosage CDMO), PCI Pharma Services / Alcam, SK Pharmteco / Samyang / Dongkwang, Lonza-scale smaller players & regional CMOs, Specialist viral vector CDMOs (multiple fast-scaling firms), Peptide specialists & oligo CDMOs |

The GMP drug substance market is driven by the rising prevalence of chronic diseases, increasing demand for biologics and cell & gene therapies, stringent regulatory requirements, and growing outsourcing of active pharmaceutical ingredient (API) production to contract manufacturing organizations. GMP drug substances refer to active pharmaceutical ingredients (APIs) or raw materials that are manufactured following Good Manufacturing Practice guidelines, ensuring consistent quality, safety, and efficacy. These substances are used in the production of finished pharmaceutical products and must comply with stringent quality standards, including proper documentation, validated processes, and controlled environments, to prevent contamination and guarantee patient safety.

In October 2025, the U.S. FDA launched a pilot program aimed at expediting the review process for generic drugs that are tested and manufactured entirely within the United States. This initiative seeks to bolster domestic drug production by providing faster approvals for generics made with U.S.-sourced ingredients. The move is part of broader FDA efforts to strengthen the U.S. drug supply chain and reduce reliance on foreign manufacturing.

The GMP biologics market is experiencing significant growth, with projections indicating an expansion. This growth is driven by technological advancements in bioprocessing and personalized medicine particularly in the development of monoclonal antibodies and cell and gene therapies. North America is expected to secure a substantial share of this market due to its technological leadership.

With the growing adoption of digital tools and interconnected systems in pharmaceutical manufacturing, cybersecurity has become a top priority. The implementation of Zero Trust Architecture is being explored to enhance security and resilience within the pharmaceutical supply chain. This approach aims to protect sensitive data and ensure the integrity of manufacturing processes against potential cyber threats.

Regulatory bodies are continuously updating guidelines to improve compliance and manufacturing efficiency. For instance, in 2025, the European Medicines Agency (EMA) clarified that a blanket extension of Good Distribution Practice (GDP) certificates would no longer be granted, emphasizing the need for regular on-site inspections. Such updates ensure that manufacturing practices align with current standards and maintain product quality and safety.

The integration of artificial intelligence (AI) in the market enhances manufacturing efficiency, quality control, and process optimization. AI-powered tools enable predictive maintenance, real-time monitoring, and data-driven decision-making, reducing errors and contamination risks. Additionally, AI accelerates drug development, improves batch consistency, and supports regulatory compliance, ultimately increasing productivity, lowering production costs, and ensuring safer, high-quality pharmaceutical products.

| Date | Company | Launch | Category |

| Sep 2024 | Flash BioSolutions | Initiated GMP production of FlashRNA technology for next-generation mRNA vaccines and therapies. | mRNA Vaccine Technology |

| Jul 2025 | Aragen Biotechnologies | Commenced GMP manufacturing at Bangalore facility using an intensified fed-batch platform (>25 g/L). | Biologics Manufacturing |

| Aug 2025 | WuXi Biologics | Received EMA approval for commercial manufacturing of an innovative biologic at the Dundalk, Ireland site. | Biologics Manufacturing |

| Mar 2025 | Syngene International | Acquired a U.S. biologics facility in Baltimore, enhancing large molecule manufacturing capacity | Biologics Manufacturing |

| Jul 2025 | AGC Biologics | Entered partnership with Valneva SE to supply GMP drug substance for the tetravalent Shigella vaccine. | Vaccine Manufacturing |

| Aug 2025 | Bharat Biotech | Launched oral cholera vaccine, Hillchol, following successful Phase 3 trials; aims for 200 million doses annually. | Vaccine Manufacturing |

| May 2024 | ImmunityBio | Completed GMP drug substance manufacturing sufficient for 170,000 doses of ANKTIVA (nogapendekin alfa inbakicept-pmln). | Cell & Gene Therapy |

Which Dosage Form Segment Dominated the GMP Drug Substance Market?

The small-molecule APIs segment dominates the market with a share of approximately 52% due to its widespread use in treating chronic and prevalent conditions such as oncology, cardiovascular diseases, and diabetes. Their versatility allows integration into both generic and branded pharmaceutical formulations. The segment benefits from established synthetic manufacturing processes, reliable quality control, and strong regulatory compliance.

The viral vectors & other cell/gene therapy drug substances segment is estimated to be the fastest-growing in the GMP drug substance market due to the rising demand for personalized and advanced therapies, increasing investment in gene and cell therapy R&D, strict regulatory compliance, and the need for high-quality, scalable, and innovative manufacturing solutions.

Why Did the Chemical Synthesis Segment Dominate the GMP Drug Substance Market?

The chemical synthesis segment dominates the market with a share of approximately 42% due to its well-established, cost-effective, and scalable manufacturing processes. It enables the production of a wide range of active pharmaceutical ingredients (APIs), including small molecules and intermediates, with high purity and consistency. The segment benefits from robust quality control measures, regulatory compliance, and widespread adoption across pharmaceutical and biotechnology companies.

The viral-vector upstream/downstream platforms segment is anticipated to be the fastest-growing in the GMP drug substance market due to the rising demand for gene and cell therapies, advancements in bioprocessing technologies, and the need for efficient large-scale viral vector production. Increasing regulatory approvals and expanding biopharmaceutical manufacturing capabilities further accelerate this segment’s rapid growth.

What Made Commercial-scale manufacturing the Dominant Segment in the GMP Drug Substance Market?

The commercial-scale manufacturing segment dominates the market with a share of approximately 58% due to the increasing production of biologics, vaccines, and cell-based therapies. Its scalability, stringent quality standards, and advanced biomanufacturing technologies enable consistent large-scale production, meeting the growing global demand for high-quality GMP-compliant therapeutic products.

The clinical scale (Phase I–III) & tech transfer segment is estimated to be the fastest-growing in the GMP drug substance market due to the increasing number of biopharmaceuticals entering clinical trials, demand for flexible manufacturing, and efficient technology transfer. This growth is supported by rising R&D activities and collaboration between biotech firms and CDMOs for GMP compliance.

Which End User/Buyer Type Segment Led the GMP Drug Substance Market?

The large pharmaceutical companies segment dominates the market with a market share of approximately 48% due to their extensive manufacturing capabilities, strong financial resources, and advanced technological infrastructure. They maintain robust global supply chains and adhere to stringent regulatory standards, ensuring consistent production of high-quality drug substances. Their continuous investments in research, development, and facility expansion enhance their capacity to produce complex biologics and APIs. Additionally, strong partnerships with CDMOs and regulatory expertise allow them to efficiently scale production and meet the growing global therapeutic demand.

The biotech/emerging developers segment is anticipated to be the fastest-growing in the GMP drug substance market due to increasing innovation in biologics, cell, and gene therapies. These companies focus on novel therapeutic platforms and personalized medicine, driving demand for GMP-compliant manufacturing. Limited in-house capacity pushes them to collaborate with CDMOs for advanced process development and production. Supportive funding environments, regulatory flexibility for startups, and rising venture capital investments further accelerate their growth, positioning them as key contributors to the evolving biopharmaceutical landscape.

North America dominates the market share by 42% thanks to its advanced pharma infrastructure, strong regulatory environment, and concentrated presence of global pharmaceutical and biotechnology firms. Its high R&D investment and mature CDMO ecosystem support complex manufacturing. The region also faces a heavy burden of chronic diseases. For instance, in October 2024, according to the data published by the U.S. Centers for Disease Control and Prevention, about 11.6% of U.S. adults have diabetes, and around 805,000 Americans suffer a heart attack annually. This drives intensified demand for safe, high-quality therapeutics and GMP-compliant APIs, strengthening North America’s market leadership.

What are the U.S. GMP Drug Substance Market Trends?

The U.S. holds a leading position in the market because of its highly advanced biotech and pharmaceutical ecosystem. Strong regulatory oversight via the FDA ensures strict quality compliance, boosting trust in domestically manufactured APIs. The country’s robust CDMO landscape supports large-scale outsourcing and innovation in biologics, cell, and gene therapies. Further driving growth is the high burden of chronic diseases, continual R&D investment, and government support for reshoring pharmaceutical manufacturing and supply chain resilience.

What are the Ongoing Trends in the Canada GMP Drug Substance Market?

Canada’s market is growing steadily, anchored by a solid regulatory framework under Health Canada and active oversight of GMP practices. Domestic biotech firms and CDMOs, such as Therapure BioPharma, contribute to local manufacturing capacities for biologics and proteins. Canada also leverages its close ties to U.S. markets and regulatory alignment, attracting cross-border investments and outsourcing. The pharmaceutical contract manufacturing sector is expanding rapidly, supporting innovation and allowing emerging Canadian developers to participate in global GMP API production.

The Asia-Pacific region is the fastest-growing in the GMP drug-substance market due to escalating demand for biologics and biosimilars, favorable regulatory reforms, and cost-competitive manufacturing infrastructure. Rising prevalence of chronic diseases, especially diabetes, fuels this growth: in 2024, the Western Pacific region had about 215 million adults aged 20-79 with diabetes, ~12.4% prevalence among that age group. Government incentives, increasing R&D spending, and enhancements in GMP compliance also strengthen the region’s appeal.

What are the Ongoing Trends in the China GMP Drug Substance Market?

China's market is expanding rapidly, driven by robust pharmaceutical infrastructure, increasing demand for biologics and biosimilars, and supportive regulatory reforms. The country is a global leader in API production, with a significant share in the generic drug market. Strategic investments in healthcare and biotechnology sectors, along with government initiatives to strengthen domestic manufacturing and innovation, further support growth. China’s emphasis on quality compliance and technological advancements ensures its strong position in the global GMP drug substance market.

What are the India Market Trends?

India's GMP drug substance market is experiencing significant growth, fueled by its role as a leading supplier of generic medicines globally. A major driver is the rising prevalence of cardiovascular diseases, with CVDs accounting for approximately 27% of total non-communicable disease deaths, according to the data published by the World Health Organization in July 2025. This increasing burden of chronic diseases, including cardiac arrests, creates demand for high-quality GMP-compliant drug substances. Supportive regulatory reforms, growing biotech startups, and partnerships with CDMOs further enhance India’s capacity to meet both domestic and international pharmaceutical needs.

What are the Japan GMP Drug Substance Market Trends?

Japan's market benefits from advanced manufacturing capabilities, stringent regulatory standards, and a strong focus on innovation. Growth is driven by an aging population, increasing demand for personalized medicine, and advancements in biotechnology and cell and gene therapies. The country’s strict adherence to GMP compliance, coupled with continuous R&D investment and efficient contract manufacturing infrastructure, enables high-quality production of APIs and biologics. Japan’s commitment to technological excellence positions it as a key contributor to the global GMP drug substance market.

Europe is expected to grow significantly in the GMP drug substance market during the forecast period, due to the presence of stringent regulations. The presence of well-developed industries and growing healthcare investments are also increasing their demand. Additionally, increasing use of biologics, biosimilar and advanced therapies are also increasing their use, promoting the market growth.

UK GMP Drug Substance Market Trends

The UK consists of advanced pharmaceutical industries, which are increasing the development of various GMO drug substances. At the same time, the stringent regulations are also ensuring their safety, efficacy, and quality, where the growing demand for advanced therapies are also increasing their adoption rates.

MEA is expected to grow significantly in the GMP drug substance market during the forecast period, due to growing healthcare investments. At the same time, the expanding industries and increasing demand for medications due to increasing chronic diseases are also enhancing the market growth.

Saudi Arabia GMP Drug Substance Market Trends

The growing government initiatives in Saudi Arabia are increasing the development of GMP drug substances. The growing healthcare investments, expanding biologics R&D, and blooming medical tourism are also increasing their demand. Moreover, growing chronic diseases are also increasing their use.

The R&D process begins with target identification and validation, followed by lead compound discovery and optimization. Preclinical testing in in vitro and in-vivo models is conducted to assess efficacy and safety. This is followed by formulation development and process optimization to ensure GMP-compliant manufacturing readiness.

Organizations: Key organizations involved in R&D include Amgen, Pfizer, Biocon, Lonza, and WuXi AppTec, along with academic and government research institutions supporting novel drug discovery.

Clinical development is initiated with Phase I trials to assess safety in healthy volunteers, followed by Phase II trials to evaluate efficacy and dosing in patients. Phase III trials expand patient populations to confirm efficacy, monitor side effects, and compare with standard treatments. Data is compiled and submitted to regulatory authorities for approval, ensuring compliance with GMP standards throughout.

Organizations: Prominent organizations include the FDA, EMA, Health Canada, PMDA (Japan), and CDMOs such as Catalent and Lonza that assist with GMP-compliant clinical manufacturing.

After regulatory approval, patient support programs provide education, adherence monitoring, and therapy management. This includes assisting patients with access to medication, insurance navigation, and adverse event reporting. Support services also gather real-world evidence to improve therapy outcomes and optimize future drug development.

Organizations: Major providers include Pfizer’s Patient Assistance Program, Novartis Patient Support Services, Roche’s Global Patient Support, and local healthcare organizations that ensure effective patient outreach and support.

Overview: Lonza is a leading global Contract Development and Manufacturing Organization (CDMO) specializing in biologics and small molecules.

Key Offerings:

Overview: WuXi AppTec is a global platform offering comprehensive services for the discovery, development, and manufacturing of new therapeutics.

Key Offerings:

Overview: Samsung Biologics is a leading CDMO providing integrated services for the biopharmaceutical industry.

Key Offerings:

Overview: Fujifilm Diosynth Biotechnologies is a global CDMO specializing in the development and manufacture of biologics.

Key Offerings:

Overview: Boehringer Ingelheim is a global pharmaceutical company offering contract manufacturing services for biologics and small molecules.

Key Offerings:

Overview: Recipharm is a global CDMO providing development and manufacturing services for the pharmaceutical industry.

Key Offerings:

Overview: MilliporeSigma is the life science division of Merck KGaA, Darmstadt, Germany, offering a wide range of products and services for the pharmaceutical industry.

Key Offerings:

By Modality/Drug Substance Type

By Manufacturing Platform/Process Type

By Scale/Use Case

By End User/Buyer Type

By Region

February 2026

February 2026

February 2026

February 2026