February 2026

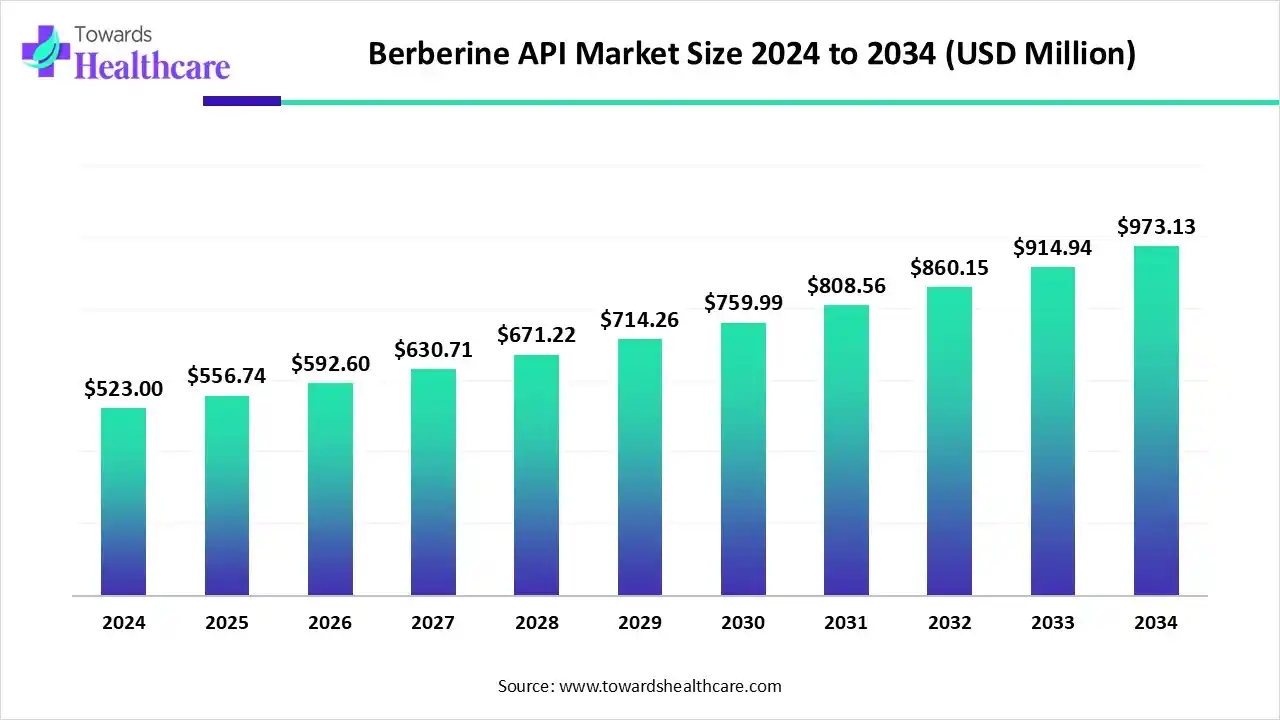

The global berberine API market size is estimated at US$ 523 million in 2024 and is projected to grow to US$ 556.74 million in 2025, reaching around US$ 973.13 million by 2034. The market is projected to expand at a CAGR of 6.45% between 2025 and 2034.

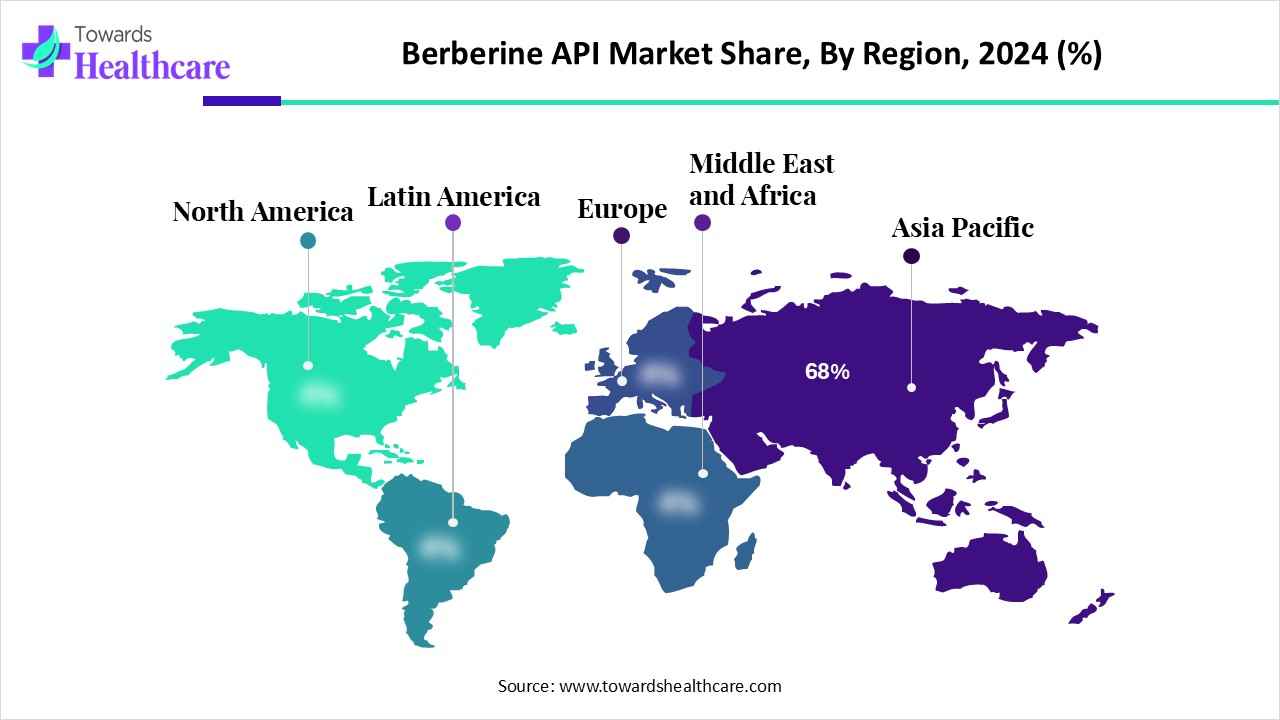

The berberine API market is growing because of increasing demand for plant-based and natural therapeutics. It is widely used for anti-inflammatory, cardiovascular, and anti-diabetic benefits. Asia Pacific is dominated by the increasing prevalence of metabolic disorders and consumer preference for natural medicine, while North America is the fastest growing due to increasing government support and massive raw material availability.

| Table | Scope |

| Market Size in 2025 | USD 556.74 Million |

| Projected Market Size in 2034 | USD 973.13 Million |

| CAGR (2025 - 2034) | 6.45% |

| Leading Region | North America by 68% |

| Market Segmentation | By Product Grade / Quality, By Source / Manufacturing Route, By Form / Salt Type Offered, By Application / End Use, By Business Model / Sales Channel, By Region |

| Top Key Players | Spectrum Chemical / Spectrum Nutraceuticals, Ningbo / Zhejiang regional botanical extract manufacturers, Hunan / Anhui botanical extract suppliers, Nutraceutical API trading houses & distributors, AdvanSix, Contract API CDMOs, Sabinsa-style formulators, Lonza / Catalent / other large CDMOs, Nutraceutical brand, Botanical farms, Natural ingredient brokers |

The berberine API market covers production, purification, supply, and sale of berberine as an active pharmaceutical ingredient or botanical extract used in finished products. Berberine is an isoquinoline alkaloid naturally present in several plants (e.g., Berberis species, Coptis chinensis, Phellodendron) and is used for metabolic health (blood glucose and lipid management), gut health, antimicrobial indications, and a growing set of investigational clinical uses. The market includes plant extraction and purification producers, synthetic/semisynthetic API makers, nutraceutical-grade suppliers, pharmaceutical-grade API producers, and contract manufacturers providing berberine-containing formulations.

Integration of AI in Berberine API drives the growth of the market, as the increasing applications of AI and machine learning technology for clinical trials and drug discovery have sped up the identification of novel applications for Berberine. AI-based research is allowing the discovery of new disease pathways, leading to the advancement of novel formulations and treatment regimens. AI-assisted virtual screening and ADMET prediction support selecting significant active molecules from the multifaceted components of the herb. The growing integration of AI agents and APIs is allowing organizations to mechanize multifaceted tasks and make data-driven decisions more proficiently, renovating business operations in the industries.

In product grade/quality, the nutraceutical/dietary-supplement grade segment led the berberine API market with approximately 52% share, as berberine is a compound that is related to numerous advantages, including lowering blood sugar levels, increased weight loss, and better heart health. Taking berberine supplements regularly appears to lower total cholesterol, “bad” cholesterol, and triglycerides in people with high cholesterol. Berberine appears to activate SIRT1 proteins, which contribute to cellular processes like metabolism and inflammation, and AMP-activated protein kinase, which can help regulate the body's use of blood sugar.

On the other hand, the custom/formulation-ready premixes & blends segment is projected to experience the fastest CAGR in the berberine API market from 2025 to 2034, as formulation-ready berberine premixes provide important advantages for manufacturers by increasing the stability, bioavailability, and effectiveness of berberine, which has usually been poorly absorbed. Berberine supplements have broad-ranging advantages, including for women’s health concerns like disease prevention, perimenopause, weight management, and PCOS. Berberine supplements are available in numerous forms, including powders, capsules, gummies, and liquid drops.

By source, the plant-extracted segment led the berberine API market in 2024 with approximately 72% share, as many patients believe that whole-plant-derived berberine provides additional health advantages because of the supportive effect, the idea that whole plant compounds work better together than in isolation. It is safer, with minimal concerns related to synthetic chemicals or additives. Potential disparities in potency and quality between various products. The natural form varies slightly in attentiveness, based on the plant source and the technique of extraction.

On the other hand, the semi-synthetic/synthetic segment is projected to experience the fastest CAGR from 2025 to 2034, as semi-synthetic berberine molecules are manufactured by chemical processes that reduce or replicate the structure originating in natural berberine. Synthetic berberine provides a standardized and reliable dose of the active compound, which is helpful for people tracking their intake for specific dosing. Usually, more cost-effective than natural berberine, making it more accessible for steady use. The synthesis of berberine in the lab removes issues related to sustainability or sourcing.

By form/salt type offered, the berberine chloride/berberine HCl segment led the berberine API market in 2024 with approximately 62% share, as it is a salt form manufactured by merging berberine with hydrochloric acid. This makes it additional water-soluble and easier for the body to absorb than pure berberine. Due to its solubility, Berberine HCl has become the most common form used in clinical research and supplements. This form is also simple to standardize, so supplement makers ensure a consistent dose is provided.

On the other hand, the micronized/particle-engineered berberine segment is projected to experience the fastest CAGR from 2025 to 2034, as this type of berberine improves solubility. Some of the procedures that have been used so far are particle-size lessening, solid dispersion, and appearance of a drug in the form of nanoparticles (NPs). NPs are smaller in size than conventional drug particles, and so there is an enlarged surface area of the drug. Drug nanocrystals are produced by some technologies, such as top-down and bottom-up strategies.

By application/end use, the dietary supplements and nutraceuticals segment led the berberine API market in 2024 with approximately 60% share, as numerous studies present that berberine can predominantly lower blood sugar levels in patients with type 2 diabetes. Berberine offers significant advantages that are tied to its capability to influence metabolic functions in a way similar to some pharmaceutical medications, particularly by triggering an enzyme inside cells called AMP-activated protein kinase (AMPK).

On the other hand, the pharmaceutical/prescription products segment is projected to experience the fastest CAGR from 2025 to 2034, as berberine API use in pharmaceutical products manufacturing due to its additive effects with drugs that reduce blood glucose and interact with medications metabolized by CYP3A4, CYP2D6, and CYP2C9. Also, it promotes insulin secretion, enhances resistance of insulin resistance, inhibits lipogenesis, lessens adipose tissue fibrosis, lowers hepatic steatosis, and reduces intestinal microbiota disorders.

By business model/sales channel, the bulk API sales to formulators/brand owners segment led the berberine API market in 2024 with approximately 55% share, as bulk active pharmaceutical ingredients (APIs) play a significant role in the worldwide medicinal supply chain. Instead of manufacturing APIs in-house, companies can leverage the expertise and economies of scale of dedicated bulk manufacturers to gain a cheap edge.

On the other hand, the direct-to-brand white-label & co-packing segment is projected to experience the fastest CAGR from 2025 to 2034, as white labelling offers exclusive business opportunities for vendors to expand their product list deprived of dealing with product advancement. White labelling of products cuts costs on production while focusing on marketing, sales, and branding.

Asia Pacific is dominant in the market in 2024 with approximately by 68% share, due to a strategic government support in countries like China, which has steadily supported the pharmaceutical and herbal medicine manufacturing through favourable subsidized loans, tax regulation, and infrastructure development in manufacturing zones. Government initiatives to help pharmaceutical exports further drive the growth of API manufacturing, which contributes to the growth of the market.

In China, increasing berberine API manufacturing due to growing consumer interest in natural healthcare products and precautionary healthcare is a major growth driver of the market. Berberine is a significant ingredient in dietary supplements for blood sugar treatment, heart issues, and weight loss.

Berberine API production is increasing in India due to the increasing incidence of chronic diseases, such as diabetes and obesity, therefore expanding demand for natural and plant-based therapies, and India's increasing role in the global pharmaceutical market. The presence of a large old-age population, growing middle-class income, and a greater adoption of herbal medicines also contribute to the rise in demand and manufacturing of berberine, which drives the growth of the market. Increasing export of berberine from India to other regions contributes to the growth of the market.

For instance,

North America is the fastest-growing region in the berberine API market in the forecast period, due to massive customer preference for herb-based supplements, the increasing prevalence of long-term diseases such as diabetes and cardiovascular issues, and strong support for innovation from government initiatives. The increasing trend of online sales has predominantly increased access to berberine supplements, contributing to the growth of the market.

The research and development (R&D) process for berberine API mainly contains two primary processes such as traditional plant extraction and modern synthetic or biosynthetic methods. It also involves developing co-crystals, encapsulation, complexation, and phytosome technology.

Key Players: BOC Sciences and Cayman Chemical

Clinical trials of berberine API significantly focused on its effects on metabolic disorders, such as diabetes, non-alcoholic fatty liver disease (NAFLD), and hyperlipidemia. A genotype-stratified clinical trial goal to examine the safety and preliminary effectiveness of berberine supplementation in adult patients with chronic health conditions.

Key Players: Fengchen Group Co., Ltd. and LKT Laboratories

Berberine API is a significant component of medicines and supplements used to manage numerous health conditions. As such, patient services associated with Berberine API would involve the clinical care, support, and monitoring offered to patients taking berberine-based products.

Key Players: Merck KGaA and Santa Cruz Biotechnology, Inc.

By Product Grade / Quality

By Source / Manufacturing Route

By Form / Salt Type Offered

By Application / End Use

By Business Model / Sales Channel

By Region

February 2026

February 2026

February 2026

February 2026