January 2026

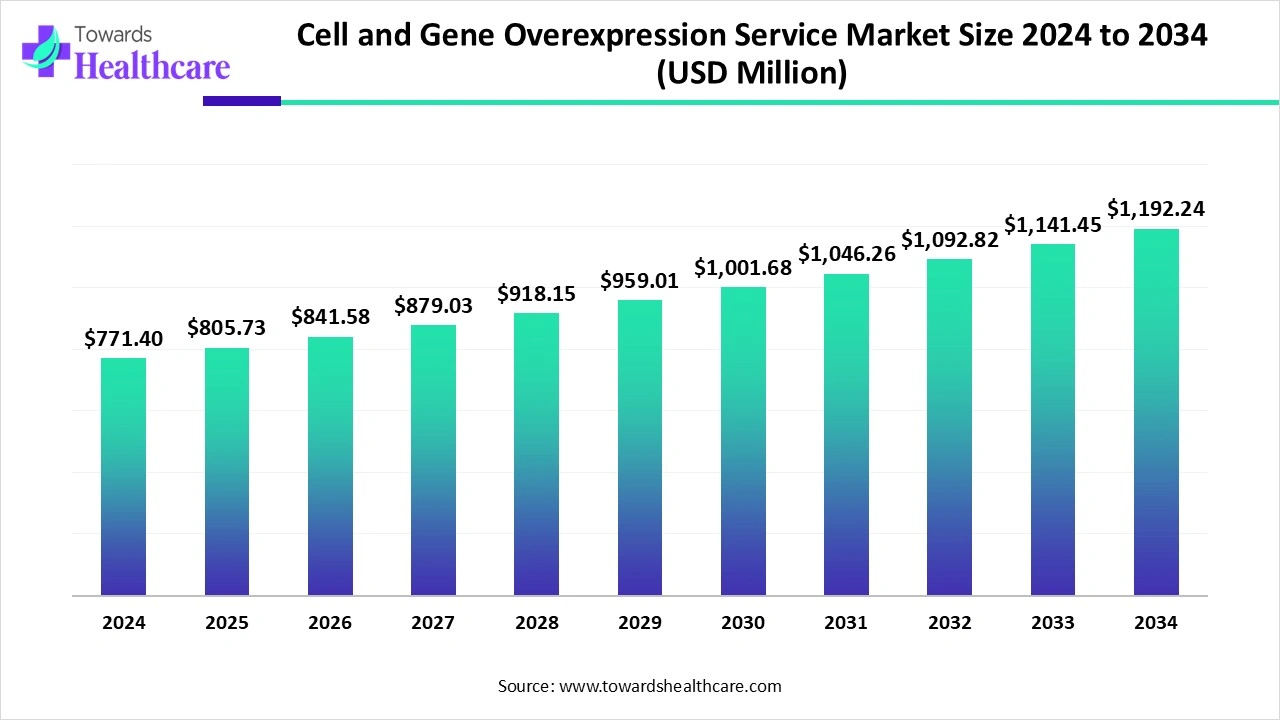

The global cell and gene overexpression service market size is calculated at US$ 771.40 million in 2024, grew to US$ 805.73 million in 2025, and is projected to reach around US$ 1,192.24 million by 2034. The market is expanding at a CAGR of 4.45% between 2025 and 2034.

There is a rise in the use of cell and gene overexpression services to deal with the growing diseases. Their use is increasing due to the growing use of targeted therapies and collaborations. AI is also being used to enhance and optimize its applications. The growing technological advancements and biologics development are also increasing their use. The presence of well-developed industries and growing research and development is also increasing its utilization for various purposes. The industries are also collaborating and launching new such platforms. Thus, this is promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 805.73 Million |

| Projected Market Size in 2034 | USD 1,192.24 Million |

| CAGR (2025 - 2034) | 4.45% |

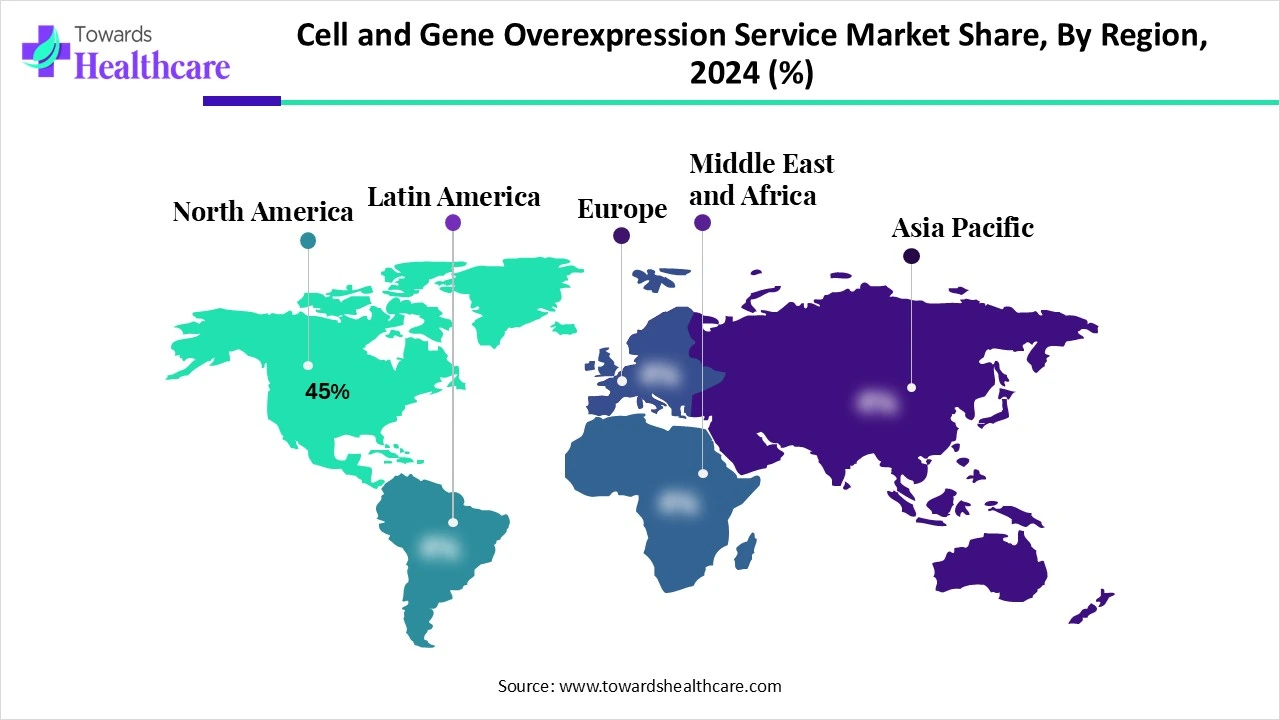

| Leading Region | North America Share 45% |

| Market Segmentation | By Application, By Gene Delivery Method, By Therapeutic Area, By End User, By Region |

| Top Key Players | GenScript Biotech, Charles River Laboratories, Lonza Group, WuXi AppTec, Thermo Fisher Scientific, Creative Biogene, VectorBuilder, Vigene Biosciences (Charles River), OriGene Technologies, Addgene, Takara Bio, Eurofins Scientific, BioIVT, Cyagen Biosciences, Evotec SE, Horizon Discovery (PerkinElmer), Sangamo Therapeutics (Service Division), Miltenyi Biotec, Cobra Biologics (Charles River), SBI System Biosciences |

The cell and gene overexpression service market involves laboratory-based solutions that artificially increase the expression of specific genes or proteins in cells to study their function, develop therapies, or manufacture biopharmaceuticals. These services are critical for drug discovery, preclinical studies, functional genomics, antibody development, and therapeutic production. Overexpression can be achieved through plasmid-based transfection, viral vector-mediated transduction (e.g., lentivirus, adenovirus, AAV), or CRISPR-based activation systems. With the growing demand for cell & gene therapies, precision medicine, and biologics, the overexpression services market is expanding rapidly, especially for viral vector-based and CRISPR-enabled approaches.

Growing Demand for Targeted Therapies: Due to the growing demand for targeted therapies, the use of cell and gene overexpression services is increasing for target identification. They promote the development of precision medicines. This is increasing their use in cancer and rare diseases, as well as for the research of combination therapies.

Increasing Collaborations: There is a rise in collaborations due to growing interest in the research and development focusing on gene therapies, gene activation systems, etc. Similarly, the partnerships to accelerate the development or to leverage the platforms are also increasing. Additionally, the growing outsourcing trends are also contributing to the same.

For instance,

The use of AI is increasing in the cell and gene overexpression service market as it helps in the optimization of therapeutic or gene targets. It also helps in the production of the plasmid sequences with enhanced stability. The off-target effects can be minimized, and the toxic gene overexpression can be avoided with the use of AI. Moreover, the interaction and pathways can be discovered using AI, as it helps in providing fast and accurate data interpretation and analysis. It can also optimize the transfection conditions and CRISPR-based gene activation.

Growing Genomic Technologies

Due to growing diseases, there is a rise in the use of cell and gene therapies, which is increasing the use of genomic technologies. Their innovations are also increasing to enhance their applications. The CRISPR-based technologies are being used to enhance the specificity of the therapies. To increase production, techniques like automated DNA synthesis and modular cloning are being used. Additionally, for the overexpression of multiple genes, new genomic platforms are also being developed. Thus, this drives the cell and gene overexpression service market growth.

High Cost and Safety Concerns

For the cell and gene overexpression services, advanced equipment, technologies, facilities, and reagents are required. Due to the complex technologies, the training of the personnel is needed. This increased the cost of the services. Additionally, cytotoxic effects or unwanted immune responses, or activation of unintended genes are observed while overexpressing a gene or cell. Thus, these concerns may limit the use of the cell and gene overexpression service.

Why is the Increasing Use of Plasmid-Based Transfection an Opportunity in the Market?

The plasmid-based transfection is being used for the development of proteins as well as for analysis purposes. Moreover, due to their simplicity, they are being used to observe gene expression by introducing the plasmid DNA into the cells. It also helps in providing transient expression of the target gene, which can be used for gene target validation and drug candidate screening. Moreover, to improve its scalability and efficiency, different types of transfection reagents, plasmid DNA, and electroporation devices are being developed. Thus, this promotes the cell and gene overexpression service market growth.

For instance,

By application type, the drug discovery & development segment held the largest share of approximately 41% in the cell and gene overexpression service market in 2024, due to target identification. It also helps the researchers to understand the drug mechanism. It was also used for screening of the compounds. Thus, this contributed to the market growth.

By application type, the gene therapy development segment is expected to show the highest growth at a notable CAGR during the predicted time. The cell and gene overexpression services help in accelerating their development. They can also be used for personalised therapy development. Moreover, the growing rare diseases is increasing their demand.

By gene delivery method type, the viral vector-mediated overexpression segment led the cell and gene overexpression service market with approximately a 46% share in 2024, as they have high efficiency. It provides stable expressions. At the same time, it was used for large-scale viral vector production. Furthermore, vectors with target-specific action were also developed.

By gene delivery method type, the CRISPR-based activation systems segment is expected to show the fastest growth rate during the predicted time. They provide target-specific action. Moreover, due to its integration with the genome, it ensures safety. Additionally, it can provide simultaneous activation of multiple genes.

By therapeutic area type, the oncology segment held the dominating share of approximately 49% in the cell and gene overexpression service market in 2024, due to growing cancer rates. They are being used to identify the cancer targets. They are also being used for developing cancer models. Furthermore, they were used for the development of gene and CAR-T therapies.

By therapeutic area type, the rare genetic disorders segment is expected to show the highest growth during the upcoming years. The cell and gene overexpression services are being used for gene therapies. They are being used to detect the mutating targets. They are also being used for the development of personalized therapies, which are supported by the various investments.

By end user, the pharmaceutical & biotechnology companies segment led the global cell and gene overexpression service market with approximately 54% share in 2024, because of increased drug discovery and development. They were used for the development of gene therapies and biologics. They were also used for drug screening. Thus, this enhanced the market growth.

By end user, the contract research organizations (CROs) segment is expected to show the fastest growth rate during the upcoming years. Due to the growing outsourcing trend, there is a rise in the use of cell and gene overexpression services by CRO. They also offer overexpression platforms, enhancing drug development. They are being used for understanding gene expression and developing personalized therapies.

North America dominated the cell and gene overexpression service market share 45% in 2024. North America consisted of well-developed pharmaceutical as well as biotechnology industries. They contributed to the increased use of cell and gene overexpression services for various purposes. Thus, this enhanced the market growth.

The cell and gene overexpression services are used by the industries for drug discovery and gene therapy development in the U.S. At the same time, the institutions are also using them for target validation. New collaborations are also being formed, which are utilizing them for functional genomics and disease modelling. These studies are further supported by the investments.

The biotechnology industries are increasing in Canada, which is increasing the use of cell and gene overexpression services. They are being used for accelerating the development of gene therapies and biologics. Additionally, the growing research and development in molecular biology is also increasing its use. Funding is provided by the government, which is enhancing these developments

Asia Pacific is expected to host the fastest-growing cell and gene overexpression service market during the forecast period. Due to the growing incidence of chronic diseases in the Asia Pacific, there is a rise in research and development. This, in turn, is increasing the use of cell and gene overexpression services for the development of new drugs and targeted therapies. Moreover, new collaborations with CRO are also increasing their use for the production of viral vectors, biologics, or gene editing tools. Thus, this is promoting the market growth.

With the use of advanced technologies such as refined CRISPR-based gene editing, next-generation vectors, etc., the precision, efficiency, and safety of genetic material expression and delivery will be enhanced in the R&D of cell and gene overexpression services.

Key Players: Vertex Pharmaceuticals, CRISPR Therapeutics, Novartis, Gilead Sciences.

The dosage, safety, and efficacy will be monitored for clinical trial approvals, while risk-benefit profiles, manufacturing quality, and clinical benefits will be the focus for the regulatory approvals for the cell and gene overexpression services.

Key Players: Gilead Sciences, CRISPR Therapeutics, Novartis, Bluebird Bio.

The patient support and services for cell and gene overexpression services focus on offering comprehensive care while addressing the complex emotional, educational, financial, and logistical needs of the patient throughout their treatment.

Key Players: Novartis, Sarepta Therapeutics, Gilead Sciences.

In January 2025, after the launch of RASTRUMTM Allegro, the Founder and CEO of Inventia Life Science, Julio Ribeiro, stated that, for advancing the work, the scientists are well-versed with the value of biologically relevant models. For better representation of human biology, they have developed RASTRUM Allegro, which will provide researchers with the ability to generate complex 3D cell models. To propel the discovery and uncover deeper biological insights, the scalability and precision will be offered by this system.

By Application

By Gene Delivery Method

By Therapeutic Area

By End User

By Region

January 2026

January 2026

January 2026

January 2026