January 2026

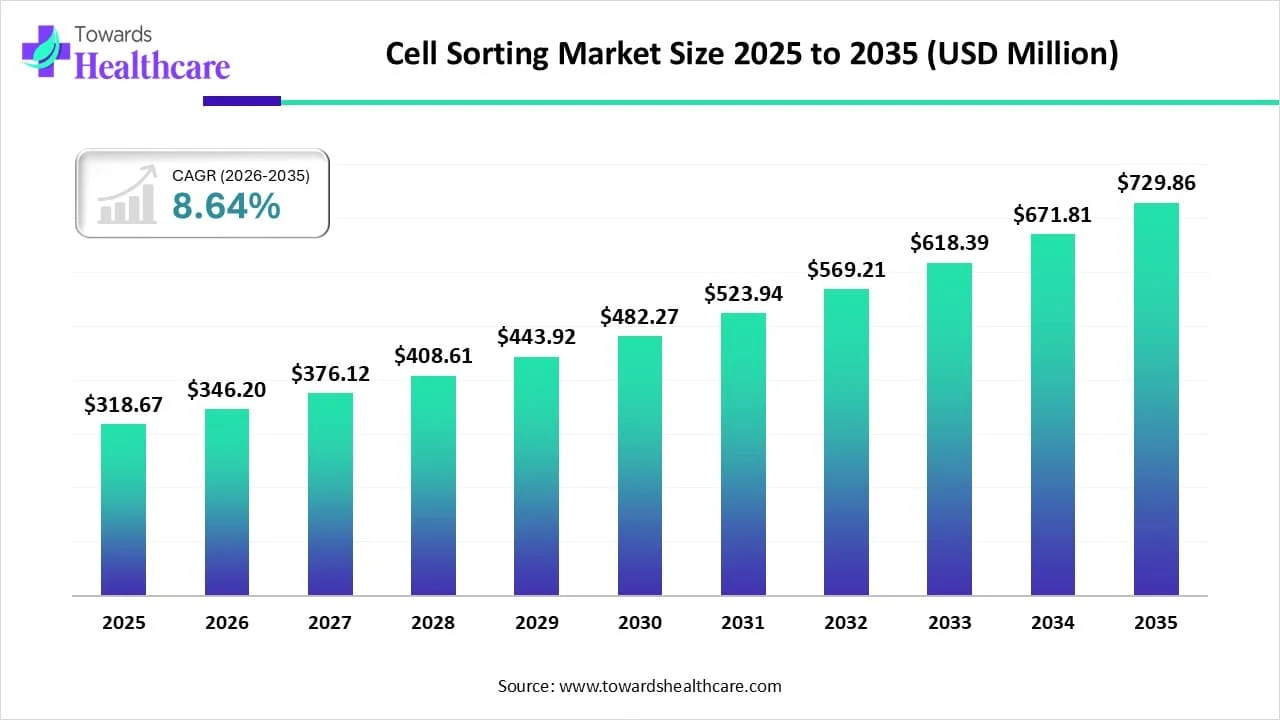

The global cell sorting market size is calculated at USD 318.67 million in 2025, grew to USD 346.2 million in 2026, and is projected to reach around USD 729.86 million by 2035. The market is expanding at a CAGR of 8.64% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 318.67 Million |

| Projected Market Size in 2035 | USD 729.86 Million |

| CAGR (2026 - 2035) | 8.64% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product, By Technology,By Application, By End Use, By Region |

| Top Key Players | BD, Danaher Corporation, Sony Group Corporation, Bio-Rad Laboratories, Inc., uFluidix, Miltenyi Biotec, Thermo Fisher Scientific Inc., Cytonome/ST, LLC, On-chip Biotechnologies Co., Ltd., Union Biometrica, Inc |

A single cell or a homogeneous population of cells is isolated from a complex mixture, with the help of cell sorting, which makes it an important process in biological research. To separate the cells depending on their immunophenotypic or specific functional characteristics, cell sorting works as an analytical process with the use of techniques such as fluorescence-activated cell sorting (FACS). Depending upon the physicochemical properties of the cells, including light scatter properties, pH, electrical impedance, volume, and density, the cells can be isolated. Thus, cell sorting helps in analysis and experimentation in fields such as immunology, oncology, infectious diseases, and regenerative medicine.

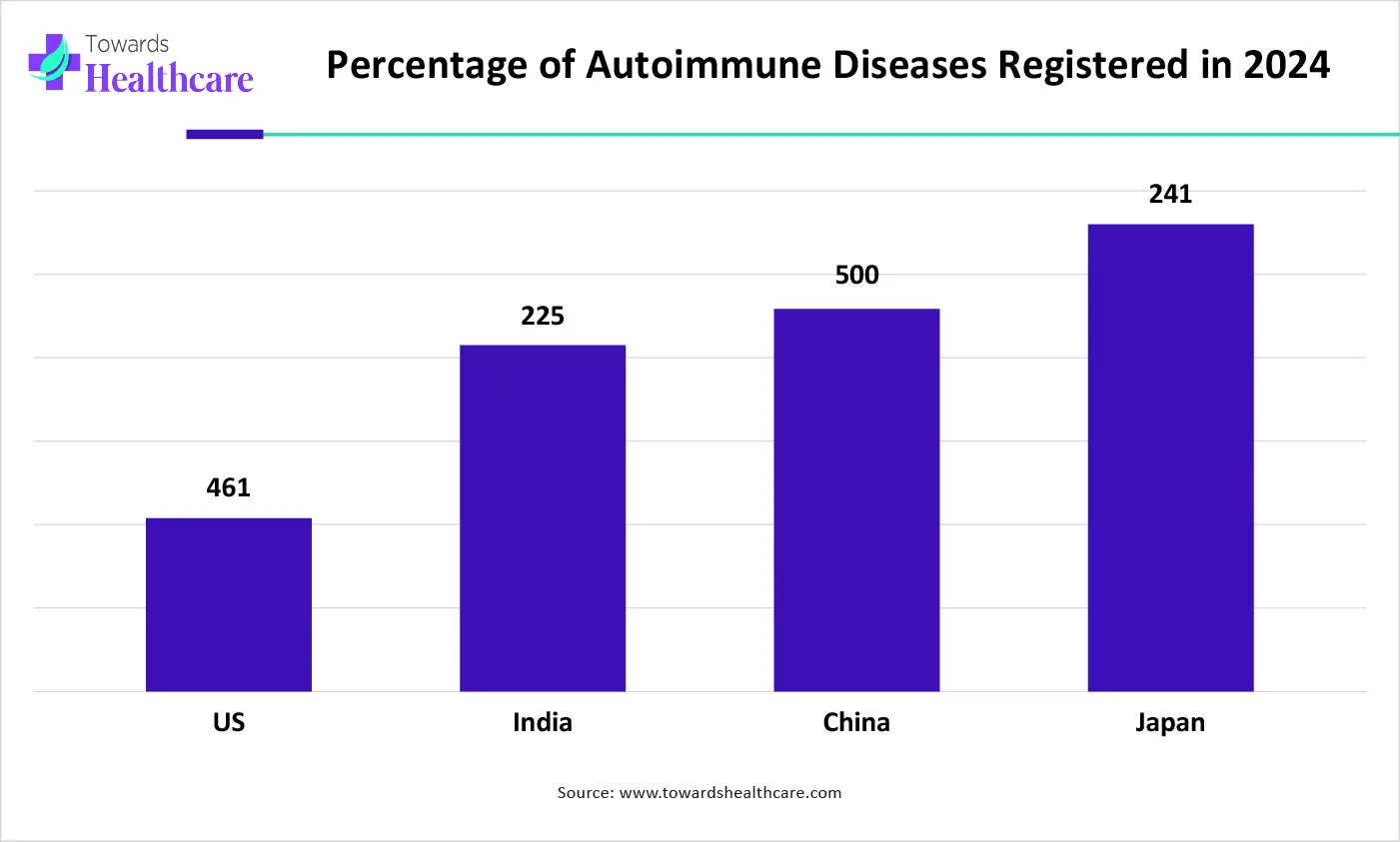

The graph represents the percentage of autoimmune diseases registered in the year of 2024. It indicates that there will be a rise in autoimmune or immunological disorders. Hence, it increases the demand for cell sorting for the effective management of these diseases. Thus, this in turn will ultimately promote the market growth.

With the help of AI integration, various parameters of cell sorting can be enhanced. This, in turn, helps in the development of an AI-assisted cell identification and sorting system on a chip. This system enables for identification and transportation of target cells from a mixture solution. Thus, this AI-assisted arithmetic model helps in locating the position of the target even in the presence of obstacles, helping in sorting the interest cells. Moreover, switchable multiple holographic fields are also generated as they consist of dynamic concurrent manipulations, and the trapping light field is modulated by the SLM. Thus, with the help of AI, automated cell-sorting techniques can be developed.

Growing Developments

Increasing diseases are increasing the use of cell sorting in research being conducted. This, in turn, causes a rise in the development of cell sorters to enhance their applications. Hence, the development of microfluidic-based systems, along with the automated cell sorters, increases. Furthermore, cell sorters integrated with AI are also being developed. All these developments enhance the purity, as well as the speed of the process. Moreover, this leads to their use in the field of stem cell analysis, as well as in cell therapies to rise. Thus, all these developments drive the cell sorting market growth.

Complex Procedure

Cell sorting involves complex procedures, due to which the need for skilled personnel rises. At the same time, the setup, calibration, and interpretation of the instrument and data, respectively, increase their need. Moreover, due to multiple steps, the process becomes time-consuming, as well as increasing the risk of contamination of the cells. Thus, these factors make the process more complex.

Increasing Research

The research on various diseases is increasing due to their growing incidence. This, in turn, increases the use of cell sorting for enhancing the research. It helps in isolating the cell, which is further studied for various characteristics, as well as drug responses. At the same time, it can also be used in diagnosis, drug discovery, and biomarker discovery. Furthermore, growing research in chronic diseases such as cancer, diabetes is also increasing their use for the development of personalized or CAR-T therapies. Thus, all these factors promote the cell sorting market growth.

For instance,

The reagents and consumables segment by product type held the major share in 2024. The use of reagents and consumables contributes to the basic need in all experiments, due to which their demand in the market has increased. This enhanced the market growth.

The fastest growth is expected in the services segment, under product type, during the forecast period. Due to the presence of advanced technologies, skilled personnel, as well as the affordability of services, their use in the market is increasing.

In 2024, the market was led by the fluorescence-based droplet cell sorting (FACS) technology segment by technology type. The FACS provided enhanced accuracy, as well as sorted a large number of cells effectively, which increased its use, contributing to the market growth.

During the forecast period, the fastest growth is expected by the magnetic-activated cell sorting (MACS) technology segment, which is under the technology type. The use of MACS is growing due to its application in cell and stem therapies, along with its affordability and simple procedure.

The research applications segment, by application type, dominated the market in 2024. The rising diseases increased the use of cell sorting in research applications for identifying their mechanisms, as well as in the development of treatment options. This promoted the market growth.

A significant growth is expected in the clinical applications segment, by application type, during the forecast period. The use of cell sorting in clinical diagnosis, cell and stem therapies, and personalized medication developments is growing, which, in turn, increases its use in clinical applications.

In 2024, by end user, the market was dominated by the research institutions segment. Increasing interest in the research of oncology, immunology, etc., contributed to increased research conducted in research institutions. This enhanced the market growth.

During the forecast period, by end user, the fastest growth is expected by the medical schools and academic institutions segment. Due to rising occurrences of diseases, the research conducted in medical schools and academic institutions has increased. This, in turn, is being supported by the funding provided by the government.

Asia Pacific dominated the cell sorting market in 2024. The increasing incidence of disease in the Asia Pacific has increased the use of cell sorters for various research purposes. This, in turn, contributed to the market growth.

Due to a large population, the incidence of disease in China is increasing. This, in turn, increases the demand for the use of cell sorters for conducting the research. Furthermore, for the development of new treatment options, their use is also increasing.

The growing diseases, as well as developing industries in India, are enhancing the use of cell sorters for the identification of various characteristics of the infected cells. Thus, research and development are further supported by the government investments.

North America is expected to grow significantly in the cell sorting market during the forecast period. North America consists of well-developed industries with skilled personnel as well as advanced technologies. Thus, the growing adoption of advanced technologies is enhancing the use of cell sorters in the industries. This enhances the market growth.

The industries in the U.S. are well developed, which in turn, increases the use of cell sorters in various research. At the same time, new developments with the use of advanced technologies are also being made, due to which the number of collaborations among industries is increasing.

The presence of skilled personnel as well as advanced technologies in the industries of Canada is increasing the process efficiency of the cell sorter. At the same time, the use of cell sorters is increasing in cancer research.

Europe is expected to show lucrative growth in the cell sorting market during the forecast period. The industries as well as institutes in Europe are increasing the demand for the use of cell sorting due to growing interest in research. Thus, this promotes the market growth.

The industries as well as institutions in Germany are using cell sorting procedures for different research purposes. This, in turn, helps in the identification of cell characteristics, biomarkers, and the development of new treatment approaches.

The growing use of stem cells, genes, and cell therapies in the UK is increasing the use of cell sorting. At the same time, it also leads to growing research with the help of cell sorters, which in turn, leads to collaborations supported by government investments.

Latin America is considered to be a significantly growing area, due to rising biomedical research and the growing demand for personalized medicines. Government organizations make constant efforts to establish a suitable research and manufacturing infrastructure. This encourages foreign companies to set up their manufacturing facilities in the region and cater to a larger patient population.

Growing research activities result in an increasing number of clinical trials. As of November 2025, 71 studies were registered on the clinicaltrials.gov website related to stem cell therapy. ANVISA is a regulatory agency that regulates the approval of biologics in Brazil. As of May 2023, ANVISA has approved 52 follow-on biologics/biosimilar products.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The rapidly expanding biotech sector, increasing R&D investments, and favorable regulatory support bolster market growth. The rising collaboration among key players and the establishment of new research institutions and labs augment the market. The increasing adoption of advanced technologies and biologics expansion favor market growth.

BD Biosciences, RAUMEDIC, Akadeum Life Sciences, and Advena Bio are some key players that provide advanced cell sorting equipment in the UAE. The UAE government is accelerating growth in biotech, pharmaceutical, and medical technology by leveraging its strategic location and investing in innovation and infrastructure.

By Product

By Technology

By Application

By End Use

By Region

January 2026

January 2026

January 2026

January 2026