February 2026

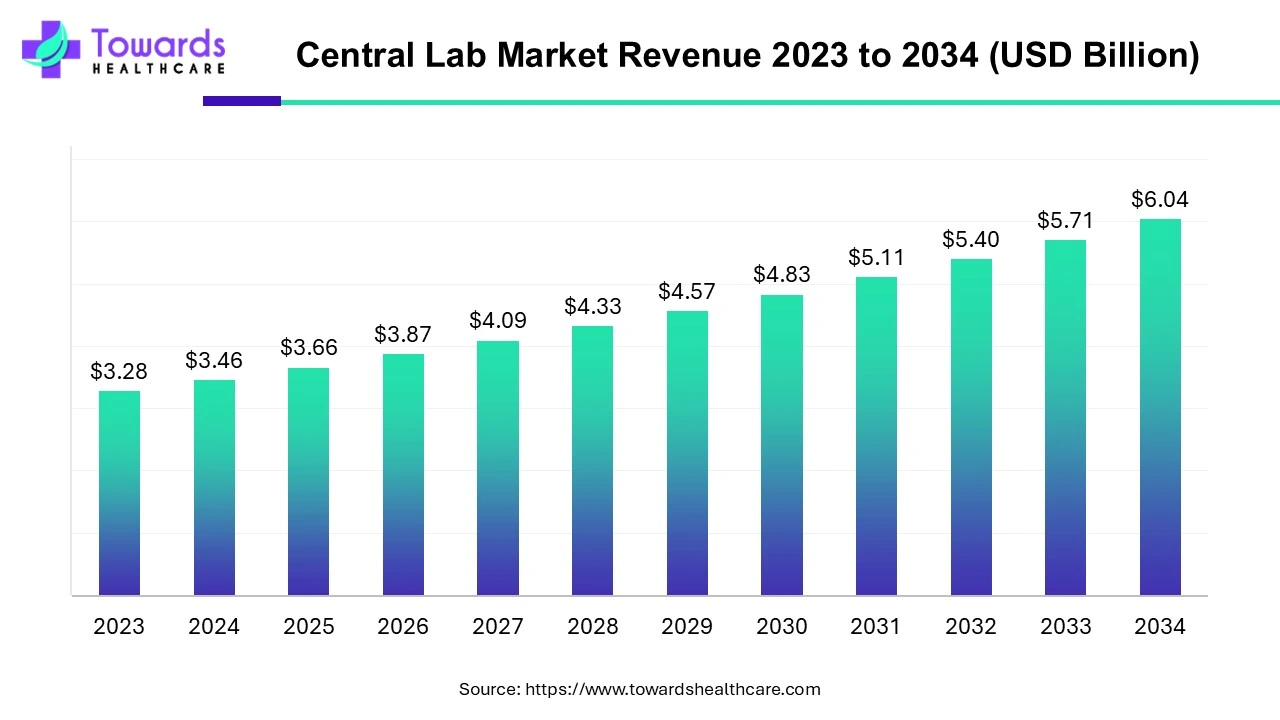

The global central lab market size is calculated at USD 3.46 billion in 2024 and is expected to be worth USD 6.04 billion by 2034, expanding at a CAGR of 5.71% from 2024 to 2034, as increasing clinical trials & increase in investment in research and development.

A central laboratory is a medical lab that provides services to numerous sites or institutions and this concept also covers off-site laboratories that provide support services to clinical laboratories housed in healthcare facilities, it exclusively serves one hospital or institution. The corporate-type labs and national reference laboratory systems are two more words that are used to describe central lab services. Central lab lowers costs for the pharmaceutical and biotechnology industries and also guarantees that results are delivered more quickly and accurately.

The pharmaceutical and biopharmaceutical firms have completely outsourced central labs. During the evaluation period, the worldwide central lab market will continue to have strong potential due to rising pharmaceutical and biotechnology company activity as well as the rising need for novel medications and vaccines. Moreover, from covid 19 pandemic crisis the demand for central laboratories is continuously driving an increase in research & development and conducting clinical trials.

The desire for affordable solutions is being further fueled by the high cost of treating the older population's many ailments. Some of the key factors propelling the global central lab market are the high complexity of clinical trials, rising disease prevalence around the world, growing demand for novel drugs and vaccines, the surge in the number of central labs, and the growing need to lower the cost of drug research and development processes. advantages they provide, such as their great efficiency and speed, decreased costs associated with product manufacture, and superior flexibility, central labs have become extremely popular all over the world. Due to the elimination of extra stages, these central labs let multinational corporations introduce new substances to the market more swiftly.

Relying on central labs can lead to a delay in obtaining results. Researchers from local labs need to send the sample to a central lab for analysis. This delay can be problematic in some cases where an immediate result is required to allow dosing or entry into the trial. Thus, such a delay in obtaining results reduces confidence among researchers, restricting market growth.

Central lab boosting from covid & providing several opportunities from covid 19 central lab plays an important role in sample testing. The desire for affordable solutions is being further fueled by the high cost of treating the older population's many ailments. The more trending market for central labs worldwide is being overrun by a multitude of technology and software advances. Clinical trial laboratory service providers are assisting central labs with advances including next-generation flow cytometry result reporting automation, sample & consent tracking, and AI protocol reading.

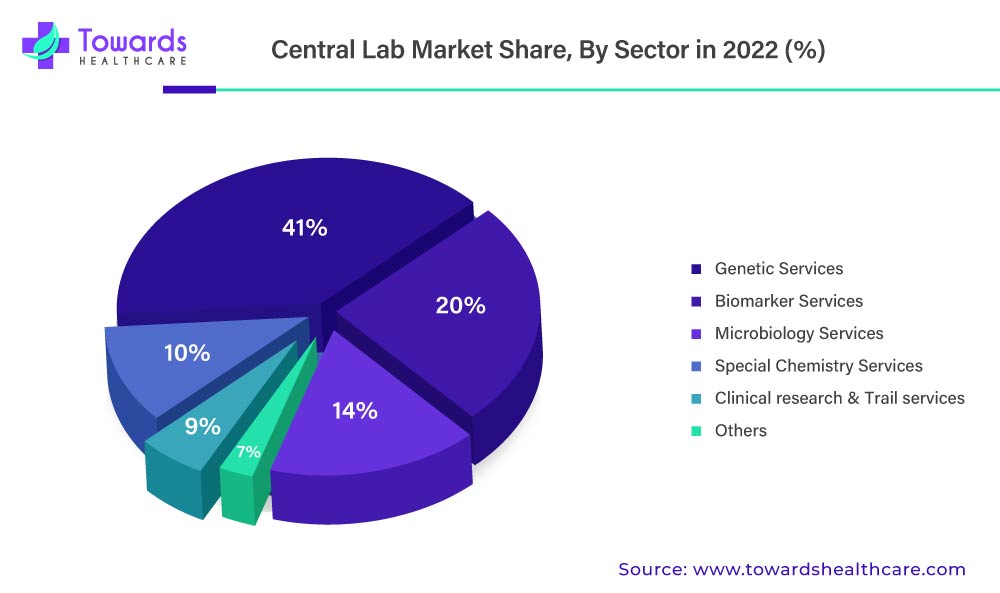

By services, the biomarker services held a dominant share. The co-creation of medications and diagnostics as well as the choice of suitable assay development platforms, which open up new possibilities for the incorporation of biomarkers in clinical procedures, can be credited with the segment's rise. When it comes to central labs, combining biomarker services with other trial support services can improve the offerings by making it easier to assess biomarker assays. Due to the growing importance of genetic analysis in clinical investigations, genetic services are gaining ground. Identifying the underlying genetic causes of certain diseases can help with the creation of targeted treatments, including the number of central lab-based trials has gone up since 2009, that time an average of six to eight trials were outsourced to central labs every month and more than 70% of all clinical trials are using central laboratories.

The pharmaceutical industry is on the brink of another milestone in big data. The latest analysis by the American Association of clinical research shows that last year, more than 50% of clinical trials were conducted at central labs while outsourcing laboratories only had about 29%. Before the usage of central labs in clinical research for pharmaceutical trials, clinics had to send samples back and forth between several laboratories for testing. This process is time-consuming; it can also cause problems in preventing laboratory workers from sharing information about participant samples with each other, which may lead to errors or bias.

By services, the genetic services segment is expected to grow at the fastest CAGR in the market during the forecast period. Equipment and techniques required for genetic testing are expensive and require specialized infrastructure. The central lab comprises specialized equipment for testing genetic samples for various purposes. The rising prevalence of genetic disorders potentiates clinical trials related to their prevention, diagnosis, and treatment. It is estimated that approximately 2.9 million tests were performed in 2024 for precision medicine.

By end-use, the pharmaceutical companies segment led the global market in 2024. Pharmaceutical companies focus on the development of drugs and medical devices, necessitating their testing for various purposes. They conduct clinical trials to assess their safety and efficacy in healthy and diseased humans. The growing R&D activities lead to the development of novel pharmaceuticals or assess extended applications of existing pharmaceuticals. The central lab offers a wide range of analytical solutions, including safety testing, as well as pharmacokinetic and pharmacodynamic properties.

By end-use, the biotechnology companies segment is expected to expand rapidly in the market in the coming years. Biologics are emerging as exceptional therapeutics for the prevention, diagnosis, and treatment of chronic disorders. The increasing competitiveness among biotech companies enables them to develop novel biologics. Advancements in genomic technologies and increasing investments facilitate the segment’s growth. The efficacy and toxicity profile of biologics are tested in central labs. The central labs also assist in complex and rapidly evolving biologics development.

North America generated more than the presence of a favorable regulatory environment and a sizeable portion of R&D in the area together drive the market. Additionally, it is projected that the high prevalence of sexually transmitted diseases (STIs) and tuberculosis in the area will increase the need for clinical research related to the development of diagnostic tools and therapies. High technological adoption rates in North America, supported by appropriate quality controls, are crucial for providing high-quality, effective service to the expanding healthcare sector.

The region's market is primarily driven by an increase in the elderly population, rising patient awareness of the need for laboratory testing, and an increase in the prevalence of infectious and chronic diseases. Seven out of ten deaths are caused by chronic diseases, which account for more than 1.7 million fatalities annually in the nation.

Asia-Pacific is expected to host the fastest-growing market in the coming years. The rising prevalence of chronic disorders and the growing geriatric population necessitate researchers to develop novel therapeutics. The increasing number of clinical trials in the region, owing to growing drug development, favors market growth. The burgeoning pharmaceutical & biotech sectors and the rising adoption of advanced technologies propel the market. The presence of favorable infrastructure and affordable, skilled professionals encourages foreign players to set up their labs in Asia-Pacific countries.

South East Asia conducted about 7,907 clinical trials in 2024. (Source: WHO) According to GlobalData analysis, China has become a major contributor to the global clinical trials, and the per-patient trial cost is less than that in the U.S. Moreover, the number of Chinese companies conducting trials at China-only sites increased from 18% to 26% between 2019 and 2023.

Europe is expected to grow at a considerable CAGR in the central lab market in the upcoming period. Government organizations launch initiatives and provide funding for R&D activities, leading to the development of novel products. The rising prevalence of genetic and rare disorders increases demand for diagnostic services, thereby potentiating the need for central labs. Advancements in medical technologies enable labs to provide state-of-the-art services, improving patient outcomes. The growing demand for personalized medicines also contributes to market growth.

It is estimated that around 4 million people in Germany and approximately 3.5 million people in the UK suffer from rare diseases. Government organizations from Germany, the UK, and France develop action plans to address rare diseases and provide enhanced patient care. In Germany, approximately 9 million laboratory tests are performed daily. In England and Wales, an average of 14 tests for each person are performed annually.

David Morris, Chief Operating Officer at IQVIA Laboratories, commented that Site Lab Navigator and its differentiated e-Requisition solution will significantly reduce administrative burden on sites and improve the quality and execution of clinical trials for its customers. He also said that the company streamlines workflows, improves data integrity, and accelerates the path to high-quality results by equipping investigator sites with cutting-edge tools. (Source: IQVIA)

By Services

By End User

By Geography

February 2026

February 2026

February 2026

February 2026