February 2026

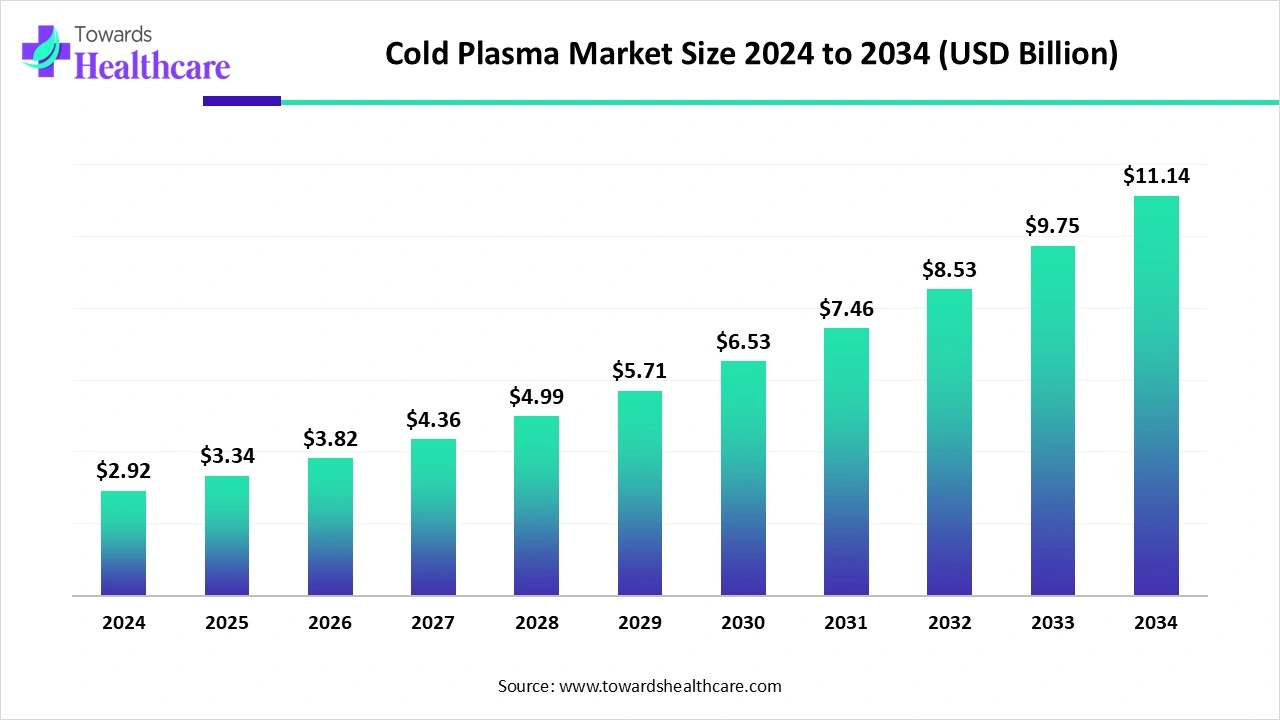

The global cold plasma market size touched US$ 2.92 billion in 2024, with expectations of climbing to US$ 3.34 billion in 2025 and hitting US$ 11.14 billion by 2034, driven by a CAGR of 14.35% over the forecast period.

The cold plasma market is expanding rapidly, driven by its applications in healthcare, food processing, and material industries. It offers eco-friendly, non-thermal solutions for sterilization, wound healing, food decontamination, and surface treatment. Rising demand for sustainable technologies, growing awareness of hygiene and safety, and advancements in plasma research are fueling adoption. Additionally, increased investment in medical technologies and food safety regulations further support market growth, making cold plasma a promising area for future innovation and commercialization.

| Table | Scope |

| Market Size in 2025 | USD 3.34 Billion |

| Projected Market Size in 2034 | USD 11.14 Billion |

| CAGR (2025 - 2034) | 14.35% |

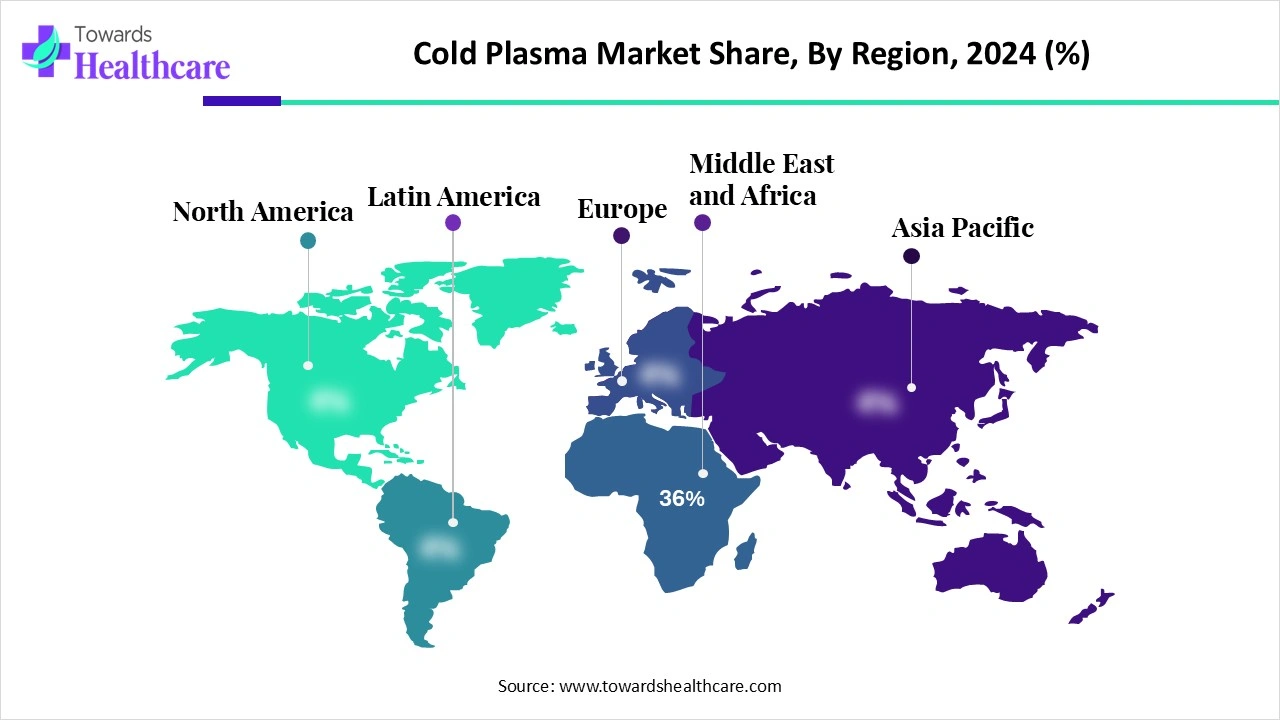

| Leading Region | Europe Share 36% |

| Market Segmentation | By Application, By Device Type / Technology, By End User, By Business Model / Revenue Stream, By Region |

| Top Key Players | neoplas tools GmbH, Adtec Medical, Apyx Medical, Bovie Medical / Apyx, Erbe Elektromedizin, Olympus / Pentax / major endoscopy OEMs, PlasmaDerm, Cynosure / Hologic, Plasmacure / small-to-mid startups, Cryoplas / industrial plasma OEMs, Cold Plasma Research Centers, Atmospheric plasma OEMs for surface treatment, Sterilization & Disinfection service providers using plasma, Medical device contract manufacturers/integrators, Plasma-to-liquid / plasma-activated liquid developers, Dental plasma device startups, Veterinary device vendors, Air & HVAC plasma/UV integrators, Consumable applicator & single-use tip suppliers, Clinical trial & service CROs specializing in plasma medicine trials |

The cold plasma market (also called non-thermal atmospheric plasma, plasma medicine, or low-temperature plasma) covers devices, consumables, and services that generate ionized gas (plasma) at temperatures safe for use on or near living tissue. Medical and adjacent applications include wound healing and dermatology (antimicrobial, tissue-stimulating effects), oncology (adjuvant tumor treatments in development), dentistry (disinfection), sterilization & surface decontamination, and device-level surface functionalization. Advantages of cold plasma include strong antimicrobial activity, ability to promote tissue regeneration, minimal thermal damage, and potential as an alternative or adjunct to antibiotics/antiseptics. Commercialization is moving from research into clinical devices (wound care, dermatology) and sterilization/disinfection systems.

The cold plasma market is evolving as companies focus on miniaturized devices, portable systems, and integration with automation for broader usability. Its role in precision processing and nanotechnology is expanding, enabling advanced material modification. Growing collaboration between research institutes and industries is fostering innovative applications beyond healthcare and food, such as textiles, packaging, and environmental remedies. This diversification, along with increasing regulatory support, is shaping the market toward wider commercialization and long-term growth.

For Instance,

Sustainability Focus – Collaborative projects are developing eco-friendly, chemical-free plasma technologies, meeting regulatory and environmental standards.

Technological Advancements – Innovations in portable, cost-effective, and automated plasma devices are expanding usability.

AI can significantly impact the market by enabling precise control and optimization of plasma generation parameters, improving efficiency and consistency in medical, food, and industrial applications. It facilitates real-time monitoring, predictive maintenance, and process automation, reducing errors and downtime. AI-driven data analysis can accelerate research, enhance treatment personalization in healthcare, and optimize surface modification processes. By integrating AI with cold plasma systems, manufacturers can achieve higher productivity, improved safety, and faster development of innovative applications.

Growing Prevalence of Hospital-Acquired Infections

The increasing incidence of hospital-acquired infections is fueling the cold plasma market because healthcare providers are prioritizing innovative disinfection methods that minimize antibiotic use. Cold plasma offers a rapid, effective, and residue-free way to sterilize surgical tools, medical devices, and surfaces, reducing infection risks. Its non-thermal and selective action ensures safety for patients and staff. As hospitals face stricter infection control regulations, the demand for cold plasma solutions is expected to rise steadily.

For Instance,

High Cost of Cold Plasma Equipment and Technology

The expensive nature of cold plasma market growth as many potential users find the upfront investment prohibitive. High costs for device installation, calibration, and integration into existing workflow deter smaller laboratories and industrial facilities from adoption. Moreover, the limited availability of cost-effective alternatives and ongoing expenses for maintenance and consumables make scaling up challenging. These financial constraints, combined with cautious investment in new technologies, slow the broader deployment and adoption of cold plasma solutions across various sectors.

Integration of IoT Cold Plasma Systems

The integration of IoT with cold plasma systems offers future growth potential by enabling automated process optimization and adaptive control based on real-time feedback. These technologies can enhance treatment precision, reduce operational downtime, and improve reproducibility across healthcare and industrial applications. Remote monitoring and predictive analytics also allow proactive maintenance and resource efficiency. As demand rises for smart, connected, and data-driven solutions, combining IoT with cold plasma is poised to open new market opportunities and innovative applications.

For Instance,

The wound care & dermatology segment led the market due to increasing demand for efficient, minimally invasive treatments for chronic wounds, ulcers, and dermatological conditions. Cold plasma's ability to sterilize wounds, stimulate tissue repair, and reduce treatment time makes it highly valued by healthcare providers. Additionally, rising awareness among patients and clinicians about advanced skin therapies, coupled with the expansion of specialized dermatology clinics, has driven widespread adoption, securing this segment's top revenue position.

The surface sterilization & disinfection segment is projected to grow rapidly as cold plasma technology gains traction for decontaminating hard-to-reach surfaces and complex equipment in healthcare, food, and industrial settings. Its non-toxic, residue-free nature makes it safer and more sustainable than traditional chemical methods. Increasing emphasis on preventing cross-contamination, coupled with the need for faster turnaround times in high-volume facilities, is fueling the adoption of cold plasma for efficient and reliable surface sterilization.

The atmospheric pressure cold plasma jets/handheld plasma devices segment held the largest revenue share of the cold plasma market in 2024 because these compact systems enable quick, on-demand treatments and surface sterilization in diverse settings. Their lightweight, portable design allows clinicians and technicians to operate them easily in multiple locations without extensive infrastructure. Additionally, growing adoption in outpatient care, research labs, and small-scale industrial applications, along with increasing preference for user-friendly and flexible plasma solutions, drives their strong market performance.

The dielectric barrier discharge (DBD) panels & pads segment is projected to grow rapidly because they enable efficient, wide-covering plasma treatment for chronic wounds, skin therapies, and sterilization applications. Their flexible, adaptable design allows use on irregular surfaces and in varied settings, from hospitals to research labs. Innovations improving energy monitoring technologies are increasing their attractiveness. As demand for scalable, non-invasive, and versatile cold plasma solutions rises, this segment is set for the fastest growth.

The hospitals & wound-care clinics segment led the market in 2024 due to their patient volumes and need for efficient, non-invasive treatment solutions. Cold plasma devices are increasingly used for outpatient procedures, post-surgical care, and routine dermatology treatment, driving adoption. Investments in modern medical infrastructure, combined with a focus on improving patient outcomes and reducing hospital-acquired infections, further boosted demand. These factors positioned hospitals and specialized clinics as the largest end-users in the market.

The ambulatory & dermatology clinics segment is anticipated to grow at the fastest CAGR as these facilities increasingly adopt cold plasma for outpatient skin treatments, cosmetic procedures, and wound care. Their smaller-scale, high-patient-turnover settings benefit from portable, easy-to-use plasma devices that deliver effective, non-invasive therapies. Rising patient demand for quick, minimally invasive dermatological treatments, coupled with the expansion of outpatient and specialty clinics, is driving rapid adoption, making this segment a key growth area in the cold plasma market.

The device sales & consumables segment led the market due to its sustainable revenue model, where initial device purchases are complemented by frequent replacement of consumables needed for operation. Hospitals, clinics, and industrial users rely on these consumables for consistent performance and treatment efficacy. Additionally, as cold plasma applications expand across dermatology, wound care, and sterilization, the recurring demand for accessories and consumables grows, securing a dominant market share and ensuring long-term profitability for manufacturers.

The services & sterilization contracts segment is poised to grow fastest as organizations seek cost-effective, hassle-free solutions for maintaining cold plasma systems. By outsourcing sterilization and maintenance, hospitals, clinics, and industrial facilities can ensure high-quality, compliant operations without investing heavily in equipment or training. The increasing focus on hygiene, regulatory adherence, and operational efficiency is driving demand for professional service agreements, positioning this segment as a key growth driver and preferred business model in the cold plasma market.

Europe dominated the market share 36% in 2024 due to the region’s strong adoption of advanced medical technologies and well-established healthcare infrastructure. Leading research institutions and companies are investing heavily in plasma-based solutions for wound care, dermatology, and sterilization applications. Strict regulatory standards and growing focus on infection control, combined with high awareness of innovative, non-thermal treatment methods, further fueled demand. These factors positioned Europe as the largest revenue-generating region in the global cold plasma market.

The UK market is expanding due to increasing adoption of advanced medical technologies in hospitals and clinics, particularly for wound care, dermatology, and infection control. Growing awareness of non-thermal, chemical-free sterilization methods and rising demand for minimally invasive treatments are driving usage. Additionally, supportive government initiatives, investments in healthcare research, and collaborations between academia and industry are accelerating innovation and commercialization of cold plasma devices, fueling market growth across both clinical and industrial applications in the UK.

The German market is growing due to strong investment in medical technology and research, particularly in wound care, dermatology, and sterilization applications. Hospitals and clinics are increasingly adopting non-thermal, chemical-free plasma solutions for safer and more efficient treatments. Additionally, collaborations between research institutes and industry players, along with supportive regulatory frameworks, are accelerating innovation and commercial deployment. Rising awareness of advanced, sustainable healthcare and industrial solutions further drives the market’s expansion in Germany.

The Asia-Pacific cold plasma market is projected to grow rapidly as emerging economies adopt innovative, cost-effective healthcare and industrial solutions. Increasing medical tourism, expansion of outpatient clinics, and rising demand for advanced wound care and dermatology treatments are fueling adoption. Moreover, growing collaborations between local companies and global technology providers, along with rising awareness of plasma-based sterilization and surface treatment solutions, are accelerating commercialization. These factors position the region for the fastest CAGR during the forecast period.

R&D in cold plasma is centered on using its non-thermal, environmentally friendly reactive species for healthcare applications, such as sterilization, wound therapy, and cancer treatment, as well as in the food industry for decontamination, preservation, and improving food quality and functionality.

Cold plasma treatment packaging uses specialized materials, such as biopolymers or cellulose, to hold food while allowing plasma to improve surface characteristics or perform in-package microbial decontamination. Serialization adds unique identifiers to track products through the supply chain, ensuring safety and integrity, and can be integrated with cold plasma packaging processes for enhanced quality control.

Patient support for cold plasma treatments includes clinical evaluations to confirm suitability, access to specialized centers like Germanten Hospital, continuous monitoring by healthcare professionals, and follow-up care to manage side effects and evaluate treatment outcomes.

In June 2025, Hyped About Science launched PHLAS, the first professional-grade cold plasma skincare device for home use, on Kickstarter. Based on Max Planck research, the chemical-free, anti-inflammatory device targets skin issues like acne. It exceeded funding goals by over 400%, highlighting strong consumer demand and representing a significant milestone in the commercial adoption of cold plasma technology.

By Application

By Device Type / Technology

By End User

By Business Model / Revenue Stream

By Region

February 2026

February 2026

February 2026

February 2026