February 2026

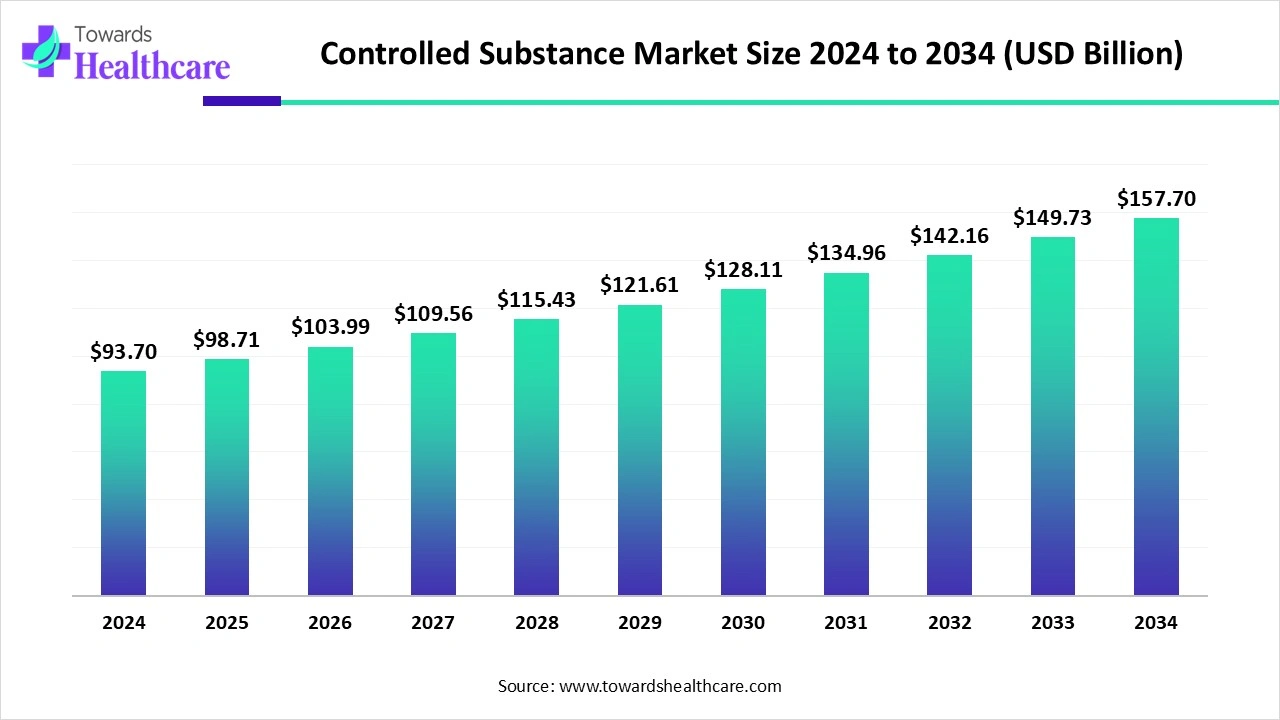

The global controlled substance market size marked US$ 93.7 billion in 2024 and is forecast to experience consistent growth, reaching US$ 98.71 billion in 2025 and US$ 157.7 billion by 2034 at a CAGR of 5.35%.

The controlled substance market is witnessing significant growth driven by the rising prevalence of chronic pain, neurological disorders, and mental health conditions, along with increasing demand for opioids, stimulants, and other regulated medications. Stringent government regulations and monitoring systems ensure safe distribution and use, while pharmaceutical innovations and new drug approvals expand treatment options. North America remains the dominant region due to well-established healthcare infrastructure, high awareness of controlled substance management, advanced regulatory frameworks, and strong R&D investment by pharmaceutical companies, supporting market leadership.

| Table | Scope |

| Market Size in 2025 | USD 98.71 Billion |

| Projected Market Size in 2034 | USD 157.7 Billion |

| CAGR (2025 - 2034) | 5.35% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Applications, By Sales Channel, By Region |

| Top Key Players | Johnson & Johnson Services, Inc., Pfizer Inc., Sanofi, Merck & Co., Inc., Gilead Sciences, Inc., Amgen Inc., Novartis Pharmaceuticals Corporation, AbbVie Inc., GSK PIc., AstraZeneca, Bristol-Myers Squibb Company, Eli Lilly and Company, Teva Pharmaceutical Inc., Bayer AG, Novo Nordisk A/S, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Aspen Holdings, Astellas Pharma Inc. |

The controlled substance is a drug or chemical whose manufacture, possession, use, and distribution are regulated by government laws due to its potential for abuse, addiction, or harmful effects. These substances include opioids, stimulants, depressants, hallucinogens, and certain prescription medications. They are classified into schedules based on their medical use, potential for abuse, and safety profile. Controlled substances are strictly monitored to prevent misuse, diversion, and illegal distribution. Regulatory authorities, such as the U.S. Drug Enforcement Administration (DEA), oversee compliance, ensuring that these drugs are used safely for legitimate medical, scientific, or industrial purposes.

Policy reforms in the market are actively reshaping regulatory landscapes in 2025. A significant development occurred when, in August 2025, the Drug Enforcement Administration (DEA) proposed rescheduling cannabis from Schedule I to Schedule III, acknowledging its medical uses and lower abuse potential, though the final decision is pending.

Inorganic strategies like acquisitions and partnerships are propelling growth in the controlled substance market by enhancing R&D capabilities, expanding product portfolios, and improving regulatory compliance. For instance, in August 2025, Aurobindo Pharma's acquisition of Lannett Company for US$250 million enables entry into non-opioid controlled substances, particularly ADHD therapeutics, and provides access to a compliant U.S. manufacturing facility. Similarly, in September 2025, Strides Pharma's partnership with Kenox Pharmaceuticals focuses on developing nasal spray products, accelerating the delivery of affordable, high-quality medicines in the U.S. These strategic moves enhance market competitiveness and align with regulatory standards.

Growing regulatory and legal pressure on pharmacies is reshaping the controlled substance market by enforcing stricter compliance and safer dispensing practices, which ultimately builds trust among patients, providers, and regulators. Tighter monitoring reduces misuse and diversion, encouraging broader acceptance of controlled medications for legitimate medical needs. This also compels pharmaceutical companies to innovate safer formulations and improve supply chain transparency, fueling growth. For instance, in 2025, the U.S. Department of Justice filed a lawsuit against Walgreens for allegedly filling unlawful opioid prescriptions, underscoring heightened oversight that is pushing the industry toward more responsible, sustainable, and growth-oriented practices.

AI integration can significantly improve the controlled substance market by enhancing efficiency, safety, and compliance across the value chain. In manufacturing, AI-driven predictive analytics optimize production processes, reduce errors, and ensure regulatory compliance. In market and distribution, AI supports real-time monitoring of prescription patterns, helping to detect misuse and ensure accurate supply chain management. For healthcare providers, AI enables precision prescribing by analyzing patient data, improving treatment outcomes while minimizing risks of abuse. Additionally, AI-powered drug discovery accelerates R&D, enabling faster identification of new compounds and delivery methods, ultimately driving innovation and sustainable growth in the controlled substance industry.

Expanding Therapeutic Applications

Expanding therapeutic applications are significantly driving the growth of the controlled substance market. As medical research uncovers new uses for controlled substances, such as opioids, stimulants, and cannabinoids, their role in treating various conditions is broadening. This expansion not only increases the demand for these substances but also encourages pharmaceutical companies to invest in developing new formulations and delivery methods. For instance, in 2025, the U.S. Food and Drug Administration (FDA) recommended classifying the compound 7-OH, found in vapes, as a Schedule I controlled substance due to its opioid-like properties and widespread availability in consumer products. This move underscores the evolving understanding of controlled substances and their potential therapeutic applications, further fueling market growth.

Social Stigma & Limited Access in Emerging Regions

The key players operating in the market are facing issues due to limited access in emerging regions, which is estimated to restrict the market growth. Patients may avoid using certain controlled drugs due to fear of addiction or social judgment, reducing demand. Poor healthcare infrastructure and a lack of trained professionals restrict distribution and adoption in developing countries.

Advancement in Drug Formulation and Delivery Systems

Advancements in drug formulation and delivery systems are significantly driving the growth of the controlled substance market. Innovations such as controlled-release formulations, transdermal patches, and nasal sprays enhance the efficacy and safety of controlled substances by ensuring precise dosing and reducing side effects. These advancements improve patient compliance and expand therapeutic applications.

For instance, in 2025, a team of scientists developed a silk nanogel injector for targeted drug delivery, which received a patent from the Controller General of Patents, Designs, and Trademarks. This technology utilizes biocompatible, biodegradable materials for localized and sustained drug release, particularly benefiting cancer therapy, wound healing, and regenerative medicine. Such innovations not only enhance treatment outcomes but also open new avenues for the application of controlled substances in various medical fields.

The opioids segment represents the dominant segment in the market, primarily due to their widespread use in managing acute and chronic pain, post-surgical recovery, and cancer-related pain. Despite strict regulations, opioids remain the most prescribed controlled drugs globally because of their high therapeutic effectiveness. The growing prevalence of chronic pain conditions, aging populations, and the need for advanced palliative care sustain their demand. Moreover, continuous innovation in abuse-deterrent formulations and extended-release products strengthens their position. While stimulants, hallucinogens, and anabolic steroids have specific applications, opioids’ broad medical necessity makes them the leading segment in the market.

The stimulants segment is anticipated to be the fastest-growing in the controlled substance market, driven by the rising prevalence of Attention Deficit Hyperactivity Disorder (ADHD), narcolepsy, and certain mental health conditions. Increased diagnosis rates in both children and adults, coupled with greater awareness and acceptance of treatment, are fueling demand for stimulant-based medications. Pharmaceutical advancements in extended-release and abuse-deterrent formulations are further supporting safer use and compliance. Additionally, expanding therapeutic applications beyond ADHD, along with strong prescription adoption in North America and growing acceptance in emerging markets, make stimulants the fastest-growing drug class segment in the market.

The pain management segment is the dominant application segment in the market, largely due to the widespread use of opioids and related medications to treat acute, chronic, and cancer-related pain. The growing prevalence of musculoskeletal disorders, post-surgical pain, and palliative care needs further reinforce its dominance. Healthcare providers prioritize effective pain relief to improve quality of life, making controlled substances central to treatment protocols. Despite concerns of misuse, advancements in abuse-deterrent formulations and stringent monitoring programs sustain their adoption. Compared to anxiety, insomnia, ADHD, or narcolepsy, the broader and more frequent clinical use of pain management drugs secures its leading position.

The attention-deficit/hyperactivity disorder (ADHD) segment is estimated to be the fastest-growing application segment in the controlled substance market. Rising diagnosis rates in both children and adults, coupled with increasing awareness and acceptance of treatment, are driving strong demand for stimulant-based therapies. Pharmaceutical advancements, particularly in extended-release and non-addictive formulations, have improved patient compliance and broadened adoption. In addition, telemedicine and digital health platforms are making ADHD diagnosis and prescription management more accessible, further fueling growth. Compared to anxiety, insomnia, or narcolepsy, the rapidly expanding ADHD patient base and innovation in tailored treatments position it as the fastest-growing application segment.

The hospitals & clinics segment is the dominant sales channel in the market, as they serve as the primary point of prescription, administration, and monitoring for these highly regulated drugs. Controlled substances, particularly opioids and stimulants, require strict oversight, which hospitals and clinics provide through specialized healthcare professionals and prescription monitoring systems. Their direct involvement in pain management, surgical care, mental health treatments, and chronic disease management ensures safe distribution and compliance, making them the leading sales channel over retail pharmacies or other outlets.

The pharmacies segment is anticipated to be the fastest-growing sales channel in the controlled substance market, driven by rising prescription volumes, improved accessibility, and patient preference for convenience. Retail and specialty pharmacies play a critical role in dispensing controlled medications for pain, ADHD, and mental health conditions, while ensuring compliance with regulatory requirements through prescription monitoring systems. The expansion of e-pharmacies and digital health platforms in 2025 has further accelerated growth, making controlled drugs more accessible under strict oversight. This combination of accessibility, technology integration, and compliance positions pharmacies as the fastest-growing sales channel.

North America dominates the market due to its well-established healthcare infrastructure, stringent regulatory frameworks, and advanced monitoring systems that ensure safe prescription and distribution of controlled drugs. Strong pharmaceutical R&D capabilities, coupled with significant investment in drug innovation and advanced delivery technologies, position the region as a leader in therapeutic solutions. High awareness among healthcare providers and patients regarding controlled substance management, alongside robust insurance coverage and government initiatives for chronic disease management, further strengthens market adoption. Additionally, strategic collaborations, partnerships, and a mature supply chain ecosystem enable efficient commercialization, reinforcing North America’s leadership in the controlled substance market.

The U.S. controlled substance market benefits from a robust healthcare system, high patient awareness, and stringent regulatory oversight, making it a global leader. Strong R&D infrastructure supports the development of innovative formulations, including opioids, stimulants, and non-opioid alternatives, while advanced delivery technologies improve safety and efficacy. Federal and state-level regulations, including prescription monitoring programs and DEA scheduling, ensure controlled distribution and reduce misuse. Additionally, strategic collaborations, mergers, and partnerships among pharmaceutical companies expand product portfolios and geographic reach. High adoption in chronic pain management, neurological disorders, and mental health treatments further drives market growth across the country.

The U.S. controlled substance market is valued at about US$ 52.3 billion in 2024 and is expected to rise to US$ 55 billion in 2025. Looking further ahead, the market could reach nearly US$ 84.95 billion by 2034, growing at a steady CAGR of 5.24% between 2025 and 2034.

Canada’s controlled substance market is growing steadily due to the increasing prevalence of chronic pain, neurological, and mental health conditions, coupled with strong regulatory oversight. Federal policies, including Health Canada’s controlled substances framework and prescription monitoring initiatives, ensure safe use and distribution while supporting innovation. Canadian pharmaceutical companies focus on developing advanced formulations and delivery methods, including non-opioid alternatives and extended-release therapies, to enhance patient compliance. Collaborative ventures, partnerships, and acquisitions facilitate market expansion and technology adoption.

The Asia Pacific region is the fastest-growing market for controlled substances due to the rising prevalence of chronic pain, neurological disorders, and mental health conditions, coupled with increasing healthcare awareness and accessibility. Expanding healthcare infrastructure, a growing number of specialty clinics, and improving regulatory frameworks are enabling safer prescription and distribution of controlled drugs. Pharmaceutical companies are investing heavily in research, innovative formulations, and advanced delivery technologies tailored to regional needs. Additionally, rising disposable incomes, urbanization, and growing adoption of prescription medications across emerging economies such as China, India, and Japan are driving rapid demand, positioning the Asia-Pacific region as a key growth hub in the market.

Steps:

Steps:

Organizations Involved:

U.S. FDA, Health Canada, EMA, Contract Research Organizations (CROs) like ICON, Parexel, and Covance, Patient Support and Services

Steps:

In June 2025, Co-Founder of Elkedonia and Delphine Charvin, Chief Executive Officer, stated that the Elkedonia SAS company has closed an oversubscribed seed funding round worth EUR 11.25 million. Argobio, Angelini Ventures, CARMA Fund, Capital Grand Est, and Sambrinvest participated in the round, which was co-led by Kurma Partners, WE Life Sciences, and the French Tech Seed fund run by Bpifrance on behalf of the French government as part of France 2030.

By Drug Class

By Applications

By Sales Channel

By Region

February 2026

February 2026

February 2026

February 2026