February 2026

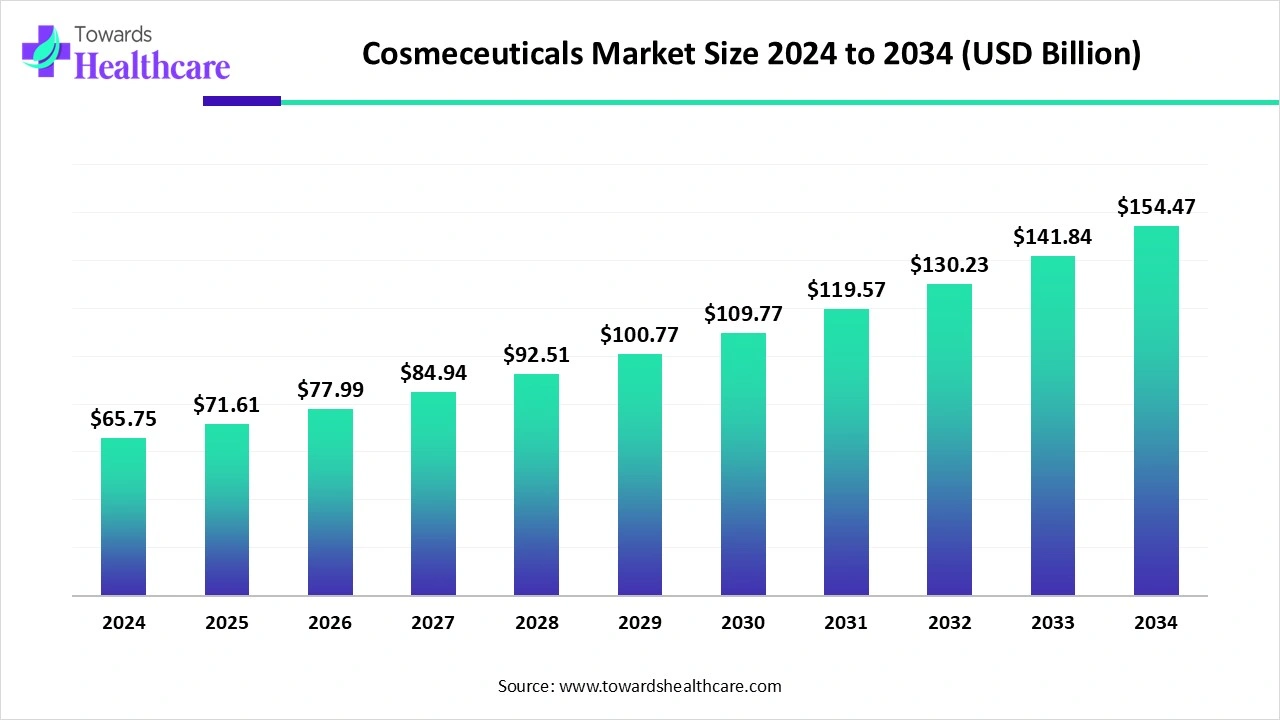

The global cosmeceuticals market size is calculated at US$ 71.61 billion in 2025, grew to US$ 77.98 billion in 2026, and is projected to reach around US$ 167.98 billion by 2035. The market is expanding at a CAGR of 8.9% between 2026 and 2035.

The use of cosmeceuticals is increasing globally due to growing consumer awareness. This, in turn, is increasing the collaboration and funding to enhance the development. AI is also being used for novel ingredient discovery, formulation optimization, and sustainability practices. At the same time, expanding healthcare, K-beauty trends, growing demand for organic cosmetics, etc, are increasing their adoption in various regions. Moreover, the companies are also contributing by forming new partnerships and launches. Thus, all these advancements are promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 71.61Billion |

| Projected Market Size in 2035 | USD 167.98 Billion |

| CAGR (2025 - 2034) | 8.9% |

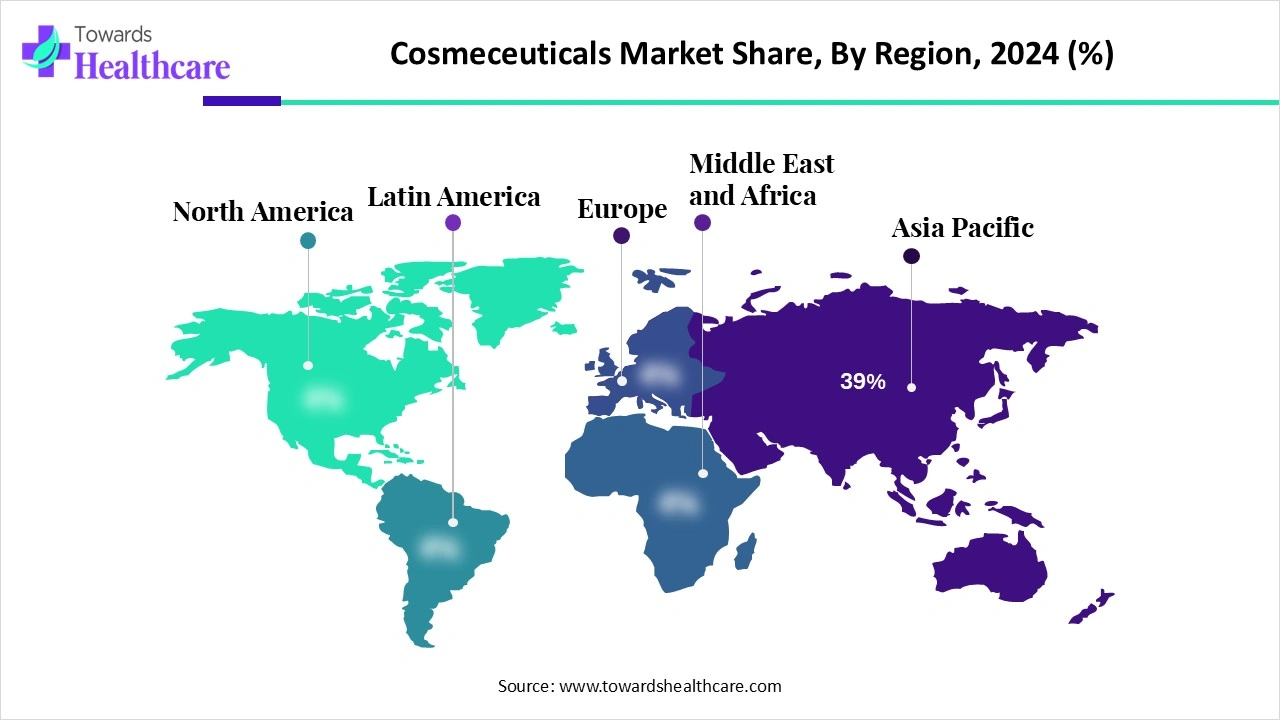

| Leading Region | Asia Pacific by 39% |

| Market Segmentation | By Product Type, By Active Ingredient, By Distribution Channel, By End User, By Region |

| Top Key Players | L’Oréal Group, Estée Lauder Companies Inc., Procter & Gamble (P&G), Unilever plc, Johnson & Johnson, Shiseido Company, Limited, Beiersdorf AG (Nivea, Eucerin), Amorepacific Corporation, Kao Corporation, Coty Inc., Revlon, Inc., Oriflame Holding AG, Mary Kay Inc., Himalaya Wellness Company, Clarins Group, Galderma S.A., Pierre Fabre Group, Avon Products Inc., Innisfree, Dr. Reddy’s Laboratories |

The cosmeceuticals refer to cosmetic products with biologically active ingredients that provide medical or drug-like benefits beyond traditional skincare and beauty. These products are positioned between cosmetics and pharmaceuticals, addressing concerns like anti-aging, acne, hyperpigmentation, sun protection, hair loss, and skin hydration. Growth is fueled by rising consumer awareness of skin health, increasing disposable incomes, aging populations, urban lifestyles, and demand for premium, science-backed beauty products. Innovations in botanicals, peptides, stem cell extracts, nanotechnology, and personalized skincare are also driving adoption.

Growing awareness: There is a growth in consumer awareness, which is increasing the use of clinically approved cosmeceuticals. This is increasing their R&D, leading to new innovations. At the same time, new funding rounds and collaborations are also being formed to accelerate and support their development.

For instance,

The rules of cosmeceuticals research and development (R&D) are being rewritten with the use of AI. With the use of AI, complex regulatory landscapes can be navigated with unprecedented precision, novel ingredients can be discovered, can enhance clinical trials can be enhanced and optimized. It also offers seamless integration with existing scientific methodologies, responsible implementation, and high-quality data with the use of a powerful set of tools. The testing and launch of the cosmeceuticals are also being transformed with AI-driven solutions. Moreover, refining ingredient discovery, enhancing regulatory compliance, optimizing formulation processes, and encouraging sustainability practices using AI can help in tackling various challenges.

Growing Demand for Natural Products

The demand for natural products is increasing due to growing consumer awareness. Therefore, consumers are selecting cosmeceuticals that are natural and chemical-free. This is also increasing the development of herbal and eco-friendly products. These products are also considered to be safe and gentle, which is increasing their use by consumers with sensitive skin. This, in turn, is also increasing the innovations focusing on cruelty-free and green chemistry, along with the use of products such as aloe vera and turmeric, enhancing their development. Thus, this is driving the cosmeceuticals market growth.

Complex Formulation

The development of cosmeceuticals is complex, as it consists of various active ingredients that may be incompatible with each other. Their stability and bioavailability can also be affected when mixed inappropriately. Some of the ingredients may show a short shelf life, which reduces the potency of the products. The development of delivery systems is also complex, which may affect the skin penetration. Thus, this may restrict the development of cosmeceuticals.

Enhanced Use of Anti-Aging Serum

As there is a growth in the aging population, the demand for antiaging cosmeceuticals is increasing. This, in turn, is driving the use and innovations of anti-aging serums. They consist of various antioxidants, peptides, and growth factors that help in reducing or reversing the aging signs. Their growing adoption rates are increasing their innovations to improve their skin protection and stability. New delivery systems such as liposomes or nanoencapsulation are also being developed. New antiaging serums targeting elasticity, firmness, brightness, and hydration are also being developed. Thus, these growing advancements are increasing their use in both women and men, promoting the cosmeceuticals market growth.

For instance,

By product type, the skin care segment dominated the market with approximately 55% share in 2024, due to the growing use of anti-acne and skin brightening products. At the same time, the demand for anti-aging products also increased due to a growth in the aging population. Additionally, the growing applications addressing various skin conditions are also enhancing their use. The growing online platforms increased their awareness and accessibility as well.

By product type, the hair care segment is expected to show the highest growth during the predicted time. Their demand is increasing to reduce hair fall or dandruff formation. Additionally, growing beauty standards and demand for natural products are also contributing to the same. They are also being used by men for beard grooming.

By active ingredient type, the antioxidants segment held the dominating share of the market in 2024, driven by their antiaging advantages. They minimized skin aging by protecting it against UV rays and pollution. Similarly, it also reduced the visible signs of aging, such as wrinkles and fine lines. It also reduced pigmentation. Thus, it provided photoprotection, brightening, and moisturizing effects, which increased their use.

By active ingredient type, the botanicals & herbal extracts segment is expected to show the fastest growth rate during the predicted time. Their demand is growing due to increasing shit in safer and gentler natural products. They provide various applications such as soothing effect, antibacterials, and anti-inflammatory properties. Moreover, they show minimal side effects and promote sustainability, which is increasing their adoption rates.

By distribution channel type, the pharmacies & drug stores segment led the market with approximately a 41% share in 2024, due to trusted outlets for dermatologist-recommended products. Therefore, they provided various clinically supported cosmeceuticals. Moreover, they also offered various branded products. Thus, this enhanced the market growth.

By distribution channel type, the online/e-commerce platforms segment is expected to show the highest growth during the upcoming years. They offer D2C brands, subscription models, and personalized recommendations to consumers. Additionally, the presence of a wide range of products and discounts attracted the consumers. Furthermore, the home delivers enhanced convenience, which is increasing its use.

By end user, the women segment held the largest share of approximately 64% in the global market in 2024, as they served as the primary consumer base for skincare and anti-aging solutions. At the same time, the growth in beauty awareness increased the use of various skin care and hair care cosmeceuticals. This, in turn, is driving the demand for natural, branded, and personalized skin care products.

By end user, the men segment is expected to show the fastest growth rate during the upcoming years. There is a rise in the demand for grooming and skincare products for men. This, in turn, is enhancing their innovations, focusing on anti-aging and anti-hair loss cosmeceuticals. Additionally, the growing online platforms are also increasing their adoption rates.

Asia Pacific dominated the cosmeceuticals market share 39% in 2024. Due to a growth in the beauty consciousness in various countries of the Asia Pacific, the use of cosmeceuticals has increased. At the same time, the growing K-beauty trends also increased their use. Additionally, there is a rise in the demand for skin-brightening and anti-aging products. Thus, this enhanced the market growth.

China consists of a large population, which is increasing the use of various skin care products. The presence of a well-developed healthcare sector is also enhancing their R&D, promoting their innovations. Moreover, the growing awareness about the beauty standards is leading increasing demand for flawless and youthful skin products. The use of natural or traditional cosmeceuticals and K-beauty products is also growing.

The expanding healthcare sector in India is increasing the development of various cosmeceuticals. At the same time the urbanization and growing awareness are increasing their use to tackle the growing skin, hair, and oral problems. Moreover, the cosmeceuticals targeting the male population are also increasing along with the growing advancements in the natural or herbal formulations.

Europe is expected to host the fastest-growing cosmeceuticals market during the forecast period. The skin and oral health awareness within the European population is increasing, which is increasing the demand for organic cosmeceuticals. This, in turn, is also increasing the demand and use of plant-based cosmeceuticals. Moreover, the growing aging population is increasingly using anti-aging products. At the same time, due to strict regulations, the companies are focusing on developing sustainable products. Additionally, the presence of online platforms is increasing their availability and adoption rates. Thus, this is promoting the market growth.

The R&D of the cosmeceuticals focuses on the discovery, formulation, and testing of the biologically active ingredients and delivery systems for developing products that can offer both cosmetic as well as pharmaceutical advantages.

Key Players: L’Oréal Group, Unilever plc, Procter & Gamble, Johnson & Johnson, Estée Lauder Companies Inc.

The formulation and final dosage preparation of cosmeceuticals includes the development of a safe, effective, and stable combination of active ingredients to formulate them into different dosage forms, such as cream, lotion, or serum.

Key Players: L’Oréal Group, GlaxoSmithKline, Johnson & Johnson, Galderma S.A.

Product regimen guidance, patient education, and support for potential side effects are offered in the patient support and services of the cosmeceuticals.

Key Players: L’Oréal Group, Unilever plc, Procter & Gamble, Johnson & Johnson, Estée Lauder Companies Inc., Galderma S.A., Beiersdorf AG.

In July 2025, after revealing its latest range of professional skin treatments and skin care range and collaboration with Esskay Beauty Resources, Export Area Manager at Casmara Spain, Kenza Bourezgui, stated that, to suit the needs of Indian consumers, their innovation team will be developing products which was inspired by the diverse complexions and beauty goals of India. Thus, the new collection, with formulation embracing the natural process of aging and maintaining the skin health while boosting confidence, will be launched by them. Moreover, the availability of these products in the Indian market will be ensured by the collaboration between Esskay Beauty.

By Product Type

By Active Ingredient

By Distribution Channel

By End User

By Region

February 2026

February 2026

February 2026

February 2026