December 2025

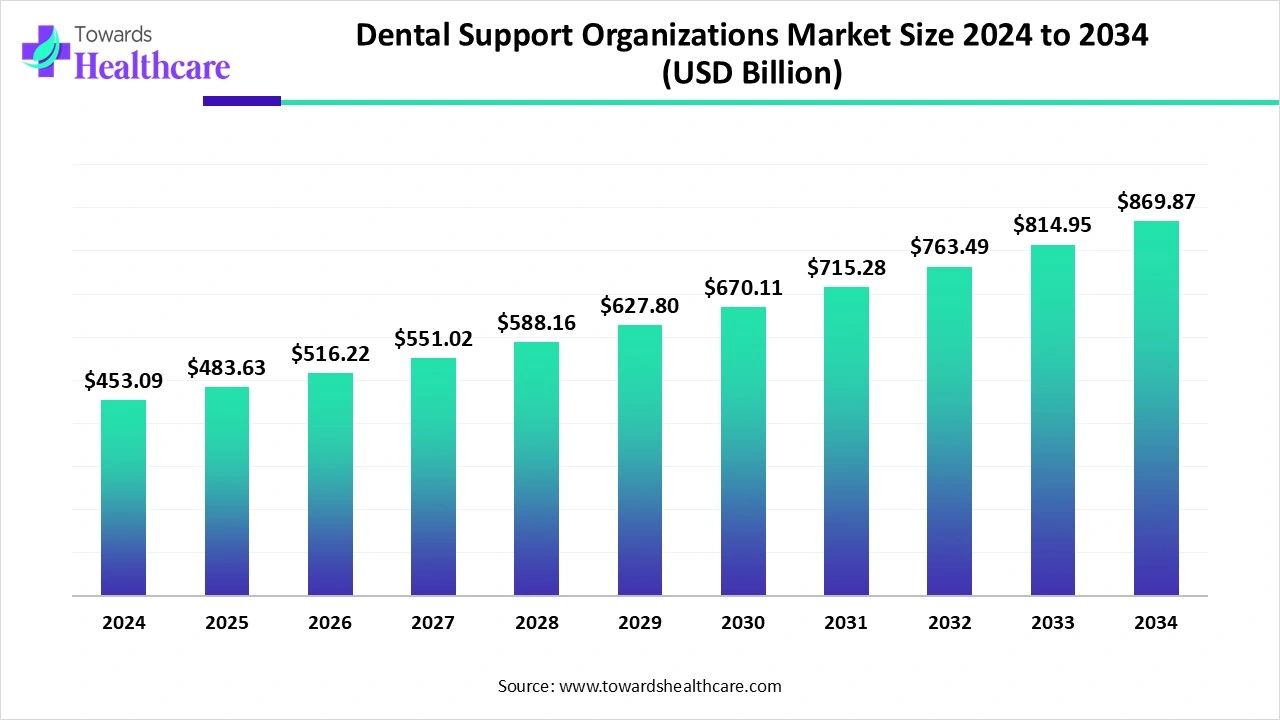

The global dental support organizations market size is calculated at USD 453.09 billion in 2024, grew to USD 483.63 billion in 2025, and is projected to reach around USD 869.87 billion by 2034. The market is expanding at a CAGR of 6.74% between 2025 and 2034.

The dental support organizations market is primarily driven by the increasing need for personalized dental care and growing awareness of oral health. Government organizations play a vital role in creating awareness about oral health and hygiene. Dental support organizations (DSOs) help dentists spend more time with patients and have a better work-life balance. Artificial intelligence (AI) introduces automation in various functionalities of a DSO. Technological advancements present future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 483.63 Billion |

| Projected Market Size in 2034 | USD 869.87 Billion |

| CAGR (2025 - 2034) | 6.74% |

| Leading Region | North America |

| Market Segmentation | By Operating/Ownership Model, By Service Offering, By Clinical Scope, By Customer, By Region |

| Top Key Players | Heartland Dental, The Aspen Group / Aspen Dental, PDS Health / Pacific Dental Services, Smile Brands Inc., Dental Care Alliance, Western Dental & Orthodontics, Benevis, MB2 Dental, Colosseum Dental Group, Bupa Dental Care, Dentex Health, ClearChoice Dental Implant Centers, Great Expressions Dental Centers, Affordable Care / Affordable Dentures & Implants, InterDent |

The dental support organizations market is experiencing robust growth, driven by the increasing collaborations among dentists, growing awareness of oral health, and technological innovation. DSOs provide centralized business and administrative services that support affiliated dental practices, including non-clinical functions such as HR, billing, procurement, IT/tech, marketing, compliance, real estate, and finance, enabling dentists to focus on clinical care. DSOs operate under models ranging from full ownership to affiliation/management agreements and serve general dentistry and specialty chains across retail, clinical, and institutional channels.

Increasing Collaboration: Dentists collaborate to expand their services to a large patient population and deliver personalized care.

Increasing Investments: Dental startups raise funding to expand their services and develop innovative solutions.

AI is revolutionizing various functions of DSOs by introducing automation and redefining patient care. AI-based diagnostic tools can help standardize treatment planning, thereby improving accuracy and reducing variability in care. They help dentists in making effective clinical decisions. AI streamlines administrative tasks and ensures 24/7 support, enabling dentists to focus on patient care. By leveraging AI in DSOs, dentists can improve patient satisfaction, boost retention, and generate more revenue. It also helps in revenue cycle management, leading to faster claims processing and error detection.

Increasing Collaborations

The major growth factor for the dental support organizations market is the increasing collaboration among dentists. Dentists collaborate to provide multidisciplinary expertise to patients, providing personalized care. DSOs enable dentists to focus more on clinical care and less on the administrative burdens of practice ownership. Collaborating with dentists may benefit from practice location flexibility, mentoring programs, and continuing education. DSOs may also simplify financing and the nuances of marketing and reimbursement.

Talent Acquisition

Acquiring and retaining skilled talent in large-scale clinics is difficult due to the shortage of dentists and specialized staff. It is estimated that 20,000 dental practitioners are required to serve 60 million residents of Dental Health Professional Shortage Areas, based on a conservative ratio of 1:3,000. DSOs must develop robust recruitment strategies and offer attractive compensation packages.

What is the Future of the Dental Support Organizations Market?

The market future is promising, driven by the integration of multi-specialty practices and technology innovation, making dental care more affordable. Multi-specialty services, such as orthodontics, periodontics, endodontics, and oral surgery, enhance patient convenience and maximize revenue. These services overcome limitations of a single-service model, like fragmented care and patient attrition. Additionally, technological advancements also enhance patient experience and reduce operational costs. The advent of 3D printing technology has led to the development of customized and precise dental solutions. Leveraging advanced technologies strengthens the position of DSOs.

By operating/ownership model, the affiliation/partnership model segment held a dominant presence in the market in 2024. This is due to the collaboration between dentists and DSOs. In dental partnership groups, the dentist retains majority ownership of their practice, accounting for more than 51%. Dentists benefit from shared responsibility as DSOs help with administrative tasks while maintaining some degree of control over their practice. DSOs also assist in HR, marketing, and financial management.

By operating/ownership model, the management service organization (MSO)/contract management segment is expected to grow at the fastest CAGR in the market during the forecast period. DSOs enter into a contract with dentists to provide non-clinical support to dentist-owned professional entities. The availability of favorable purchase models enables dentists to prefer MSOs. The contract is combined with the purchase by the DSO of non-clinical assets from the dental practice.

By service offering (non-clinical), the administrative & back-office segment held the largest revenue share of the market in 2024. This segment dominated because DSOs assist in numerous administrative tasks, such as accounting, tax management, insurance compliance, credentialing, and onboarding new staff. DSOs leverage professional teams and their expertise to assume and improve these back-office operations, enabling dentists to spend more time on personal, family, and clinical care.

By service offering (non-clinical), the IT/EHR/analytics/tele-dentistry segment is expected to grow with the highest CAGR in the market during the studied years. The growing demand for telemedicine and remote monitoring boosts the segment’s growth. Digital tools are increasingly adopted by DSOs to benefit both dentists and patients. DSOs can handle networking, digital information exchange, and remote consultations. Apart from these, IT and EHR solutions can handle patient records and billing information.

By clinical scope/specialty focus, the general dentistry segment contributed the biggest revenue share of the market in 2024. This is due to the increasing awareness of oral health among the general population. Government and private organizations launch oral health campaigns and encourage individuals to conduct regular dental check-ups. People are also becoming aware of the connection between long-term dental disorders and chronic disorders, enabling them to seek preventive and restorative care.

By clinical scope/specialty focus, the multi-specialty segment is expected to expand rapidly in the market in the coming years. Numerous dentists offer multi-specialty services, such as orthodontics, endodontics, oral surgery, and periodontics. This benefits patients as they do not need to visit multiple facilities for different treatments. Dental organizations with multi-specialty services possess advanced equipment and skilled professionals to provide enhanced patient care.

By customer/end-user, the private dental practitioners segment led the market in 2024. The segmental growth is attributed to the lack of suitable capital investment and a team for non-clinical tasks. Young dental professionals collaborate with DSOs to simplify several clinical and non-clinical tasks. This eliminates the need for a separate team for HR, marketing, and administration work. Private dental practitioners collaborate with DSOs to serve a large patient population.

By customer/end-user, the retail & community clinics segment is expected to witness the fastest growth in the market over the forecast period. Retail & community dental clinics are widely preferred by patients, especially from low- and middle-income groups. They provide enhanced patient care at affordable rates. The increasing number of patients necessitates retail & community clinics to affiliate with DSOs, enabling dentists to provide personalized care.

North America dominated the global market in 2024. The availability of a robust healthcare infrastructure, the increasing number of DSOs, and favorable reimbursement policies are the major growth factors that contribute to North America’s dominance. The rising number of dentists and favorable capital deployment propel the market. Dental organizations across North America adopt advanced technologies to provide personalized services.

Key players, such as Heartland Dental, PDS Health, Dental Care Alliance, and InterDent, are the major contributors to the market in the U.S. As of 2023, there were over 2,000 DSOs in the U.S. The American Dental Association reported that around 13% of American dentists are affiliated with DSOs.

Canada is home to 16,000 dental practices with more than 25,500 licensed dentists. The Canadian Dental Association (CDA) announced funding of $13 billion over five years (2023-2027), as well as $4.4 billion to Health Canada to implement the Canadian Dental Care Plan. The policy paper launched in February 2023 also serves as a roadmap for the government to increase access to dental care for all Canadians.

Asia-Pacific is expected to grow at the fastest CAGR in the dental support organizations market during the forecast period. The rising prevalence of dental disorders and the increasing awareness of oral health augment the market. The rapidly expanding healthcare sector in Asia-Pacific countries is driving the development of DSOs to cater to a huge population. Government and private organizations launch campaigns or conduct seminars, workshops, and conferences to train individuals and share the latest updates. The increasing private investment also contributes to market growth.

According to the 3rd National Oral Survey of China, dental caries affects around 28.9% of China’s total population. In August 2025, the local Hong Kong government, in collaboration with NGOs, implemented the community dental support programme to offer dental scaling services, root canal treatment, and denture fittings for free to homeless people.

A national survey revealed that around 90% of Indians have dental problems, of which 41% are at high risk for cavities, 44% for gum disease, and 14% for tooth staining. The Digital Dentistry Society – International and the Indian Dental Association organize the International Digital Dentistry Congress annually in Mumbai to emphasize the advantages of digital dentistry in a practitioner’s life.

Dr. Anna Singh, SVP of Clinical Operations at Heartland Dental, commented that Leixir consistently delivers high-quality, competitively priced products and tailored services that support Heartland’s growing network of supported doctors. Their digital expertise and training resources enhance the efficiency and patient care for supported doctors. The company looks forward to building this strong partnership.

By Operating/Ownership Model

By Service Offering (Non-clinical)

By Clinical Scope/Specialty Focus

By Customer/End-User

By Region

December 2025

December 2025

December 2025

November 2025