January 2026

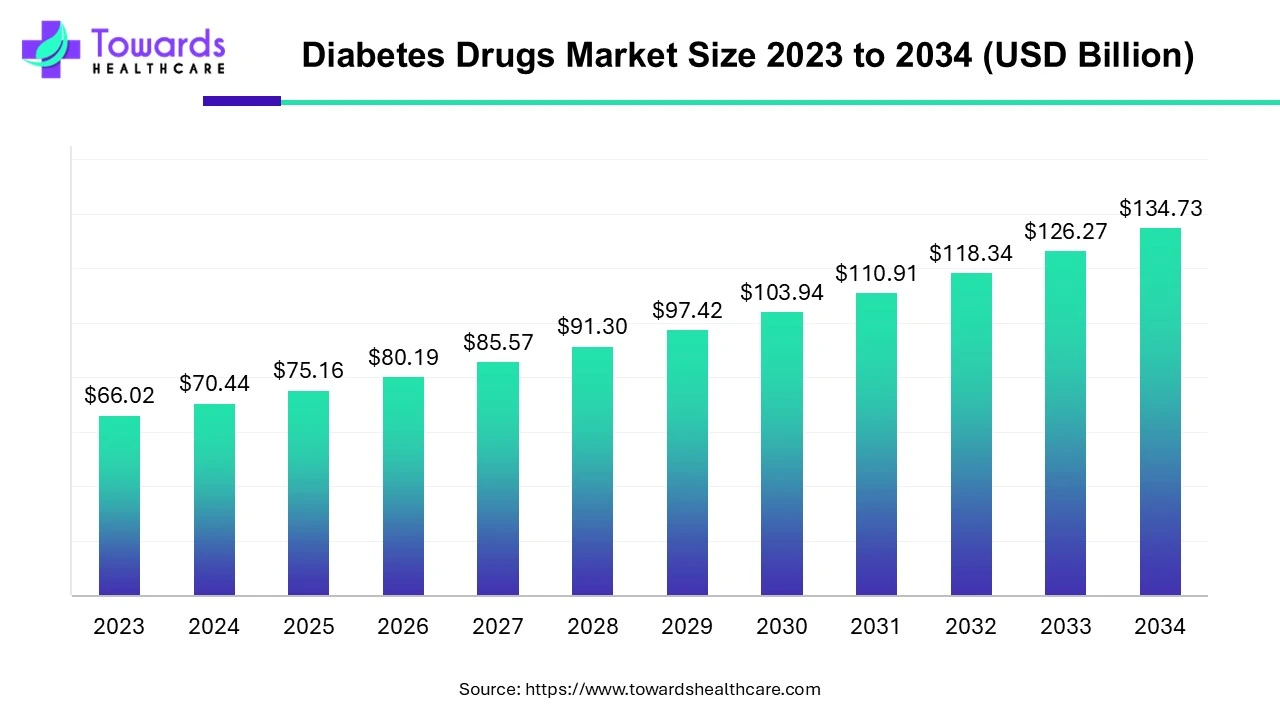

The global diabetes drugs market size is calculated at USD 75.16 billion in 2025 and is expected to be worth USD 143.76 billion by 2035, expanding at a CAGR of 6.7% from 2026 to 2035, as a result of the rising prevalence of diabetes, and rising patient support.

| Key Elements | Scope |

| Market Size in 2026 | USD 80.20 Billion |

| Projected Market Size in 2035 | USD 143.76 Billion |

| CAGR (2026 - 2035) | 6.7% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Diabetes Type, By Route of Administration, By Distribution Channel, By Geography |

| Top Key Players | AstraZeneca, Bayers AG, Boehringer Ingelheim International GmbH, Dr. Reddy’s Laboratories, Eli Lilly and Co., Johnson & Johnson, Merck & Co., Novartis AG, Novo Nordisk, Sanofi, Sun Pharmaceuticals, Takeda Pharmaceuticals |

Rising Prevalence of Diabetes

Technological innovation drives the diabetes drugs market by enabling the development of advanced therapies that improve blood sugar control, reduce side effects, and enhance patient convenience. Innovations like smart insulin, long-acting injectables, and drug-delivery devices make treatment more effective and user-friendly. Additionally, digital health tools, such as glucose monitoring apps and connected devices, support better disease management. These advancements boost patient adherence, treatment outcomes, and market growth.

Large Undiagnosed Patient Population in Emerging Countries

Large undiagnosed patient populations in emerging countries restrain market growth because many individuals remain unaware of their condition and therefore do not seek treatment. This limits the demand for diabetes drugs and reduces healthcare system engagement. Factors such as low awareness, limited access to diagnostic services, and underdeveloped healthcare infrastructure contribute to delayed diagnosis, hindering early intervention and slowing the overall expansion of the diabetes drug market in these regions.

Innovation in Diabetes Treatment

Innovation in diabetes treatment presents a major opportunity for the diabetes drugs market as it leads to the development of more effective, safer, and patient-friendly therapies. Advances such as once-weekly injections, oral GLP-1 receptor agonists, and smart insulin delivery systems improve patient compliance and outcomes. These innovations meet the growing demand for better disease management, open new market segments, and attract investment, ultimately driving market expansion and long-term growth.

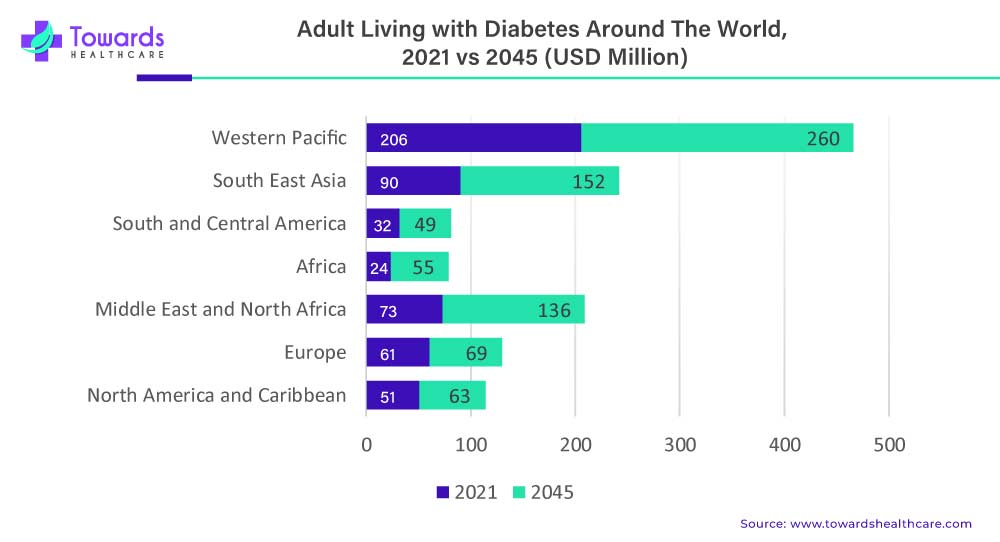

More than 75% of diabetic adults reside in countries with low or middle incomes.

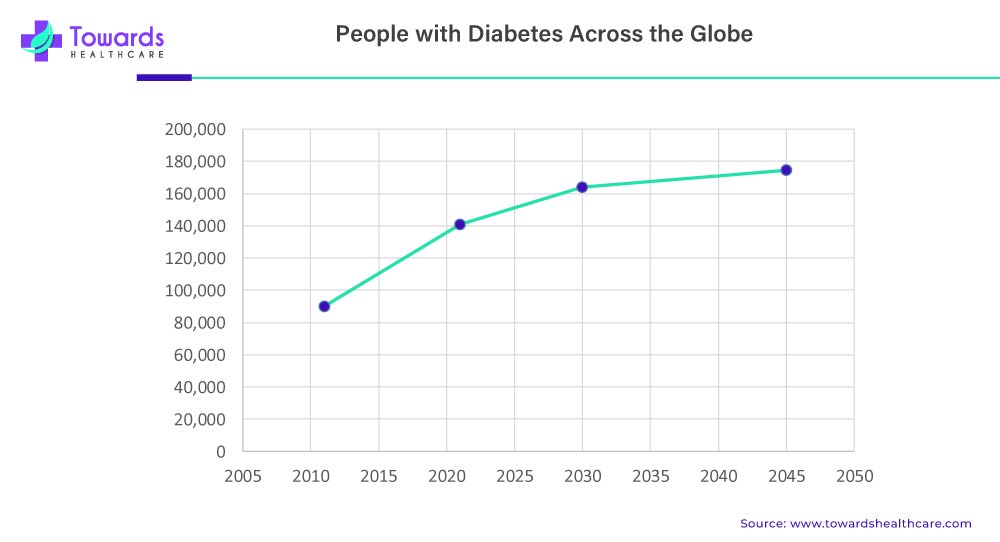

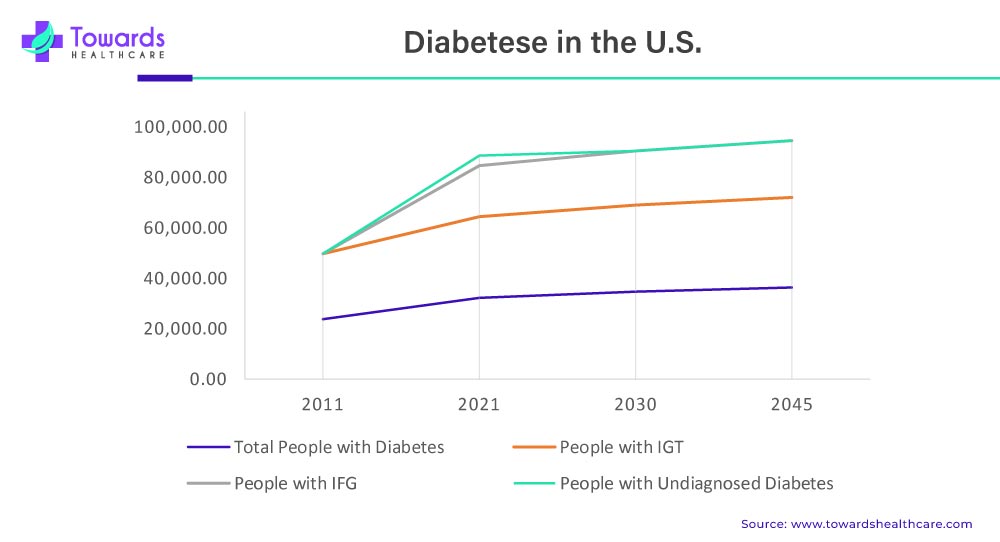

The diabetes drugs market refers to the pharmaceutical market dedicated to the development, production, and sale of drugs used for the treatment of diabetes. Diabetes is a chronic metabolic disorder characterized by high blood sugar levels, either due to inadequate production of insulin or the body's inability to effectively use insulin. In 2021, there were approximately 537 million adults living with diabetes, representing 1 in 10 individuals. Projections indicate that this number is expected to increase to 643 million by 2030 and further to 783 million by 2045, emphasizing the alarming growth and global impact of diabetes as a prevalent health condition.

The market for diabetes drugs is driven by several factors. Firstly, the increasing prevalence of diabetes worldwide is a significant driver of market growth. The growing incidence of obesity, sedentary lifestyles, and unhealthy dietary habits have contributed to the rise in diabetes cases. As a result, there is a higher demand for effective drugs to manage and control blood sugar levels.

Moreover, the advancements in medical research and the understanding of diabetes have led to the development of innovative drug therapies. Pharmaceutical companies are investing in research and development activities to discover new and improved diabetes drugs. These advancements include the development of novel drug classes, such as GLP-1 receptor agonists, SGLT-2 inhibitors, and DPP-4 inhibitors, which provide better glycemic control and fewer side effects compared to traditional therapies.

Diabetes affects over 37 million Americans, with approximately 95% having type 2 diabetes, where the body either does not produce enough insulin or does not use it properly. This can make it challenging to keep blood glucose levels in a safe range. High blood sugar levels can lead to serious complications such as nerve, kidney, eye, and heart problems.

Metformin has long been the first-line medication for type 2 diabetes, often used in combination with diet and exercise. When additional medication is needed, there was no clear consensus on the best options until recently.

A recent study with over 5,000 people already on metformin evaluated the effectiveness of adding one of four treatments: sitagliptin, liraglutide, glimepiride, or long-acting insulin glargine U-100. After about five years, all treatments improved blood glucose control, but liraglutide and insulin glargine U-100 were more effective in maintaining target blood glucose levels for about six months longer compared to sitagliptin. Despite these improvements, nearly 75% of participants struggled to keep their blood glucose in the target range throughout the study, highlighting the ongoing challenge of managing type 2 diabetes.

Type 2 diabetes accounts for the majority of diabetes cases worldwide, making it the largest segment within the diabetes drugs market. The increasing prevalence of type 2 diabetes, particularly due to lifestyle factors and aging populations, has led to a significant patient population requiring pharmacological interventions to manage their condition. In 2021, a significant number of adults, specifically 541 million individuals, have reported having Impaired Glucose Tolerance (IGT). This condition indicates a higher risk of developing type 2 diabetes. This sizable patient base contributes to the overall market size and demand for diabetes drugs.

| Region | 2021 (%) |

| Western Pacific | 47% |

| South East Asia | 9% |

| South and Central America | 7% |

| North America and the Caribbean | 9% |

| Middle East and North Africa | 9% |

| Europe | 10% |

| Africa | 9% |

Type 2 diabetes is a chronic condition that typically requires long-term management. Individuals with type 2 diabetes often rely on pharmacological interventions to control blood glucose levels and reduce the risk of complications. This ongoing treatment demand for type 2 diabetes drives the continuous use of diabetes drugs and creates a consistent revenue stream for pharmaceutical companies operating in the market.

The prevalence and impact of type 2 diabetes have spurred extensive research and development efforts in the pharmaceutical industry. There is a continuous focus on developing novel and more effective medications for type 2 diabetes, including advancements in drug classes, formulations, and delivery methods. This ongoing research and innovation drive the growth of the diabetes drugs market, with pharmaceutical companies striving to provide improved treatment options for individuals with type 2 diabetes.

Type 2 diabetes management involves a multifaceted approach that includes medication, lifestyle modifications, and regular monitoring of blood glucose levels. Healthcare providers emphasize the importance of disease management to prevent complications and improve overall health outcomes for individuals with type 2 diabetes. This focus on comprehensive care and the adoption of integrated treatment strategies contribute to the sustained demand for diabetes drugs within the market.

On the other hand, while type 2 diabetes is more prevalent, type 1 diabetes also plays a significant role in the diabetes drug market. In 2022, approximately 62% of all new cases of Type 1 Diabetes (T1D) were reported in individuals aged 20 years or older. This highlights that T1D can affect individuals beyond childhood and adolescence, contrary to the common perception that it primarily occurs in younger age groups. The increasing prevalence of T1D in adults emphasizes the need for proper diagnosis, treatment, and management strategies tailored to this specific population to ensure optimal health outcomes.

Patient support and education play a significant role in the growth of the generic drugs market. Patient support and education programs aim to improve medication adherence among patients taking generic drugs. Adherence to prescribed medication regimens is crucial for optimal treatment outcomes and cost savings. Patient support initiatives, such as counseling services, reminder systems, and educational materials, help patients understand the importance of medication adherence and provide them with tools and resources to stay on track with their treatment.

Patient education programs raise awareness about generic drugs and their benefits, including cost savings, accessibility, and comparable efficacy to brand-name drugs. By educating patients about the safety, quality, and effectiveness of generic drugs, healthcare providers and pharmaceutical companies can increase patient acceptance and confidence in using these medications. This, in turn, drives market growth as more patients opt for generic drugs instead of higher-priced brand-name alternatives.

Patient support programs focus on making generic drugs more affordable and accessible to patients. This includes initiatives such as patient assistance programs, co-pay assistance, and drug discount cards. By addressing financial barriers, patient support initiatives help ensure that patients can access and afford their prescribed medications, promoting wider adoption of generic drugs in the market.

Thus, patient support, and education programs have a positive impact on the growth of the generic drugs market. By improving medication adherence, raising awareness and acceptance, enhancing affordability and accessibility, promoting disease management and self-care, and addressing health literacy, these initiatives empower patients to choose generic drugs and contribute to market expansion.

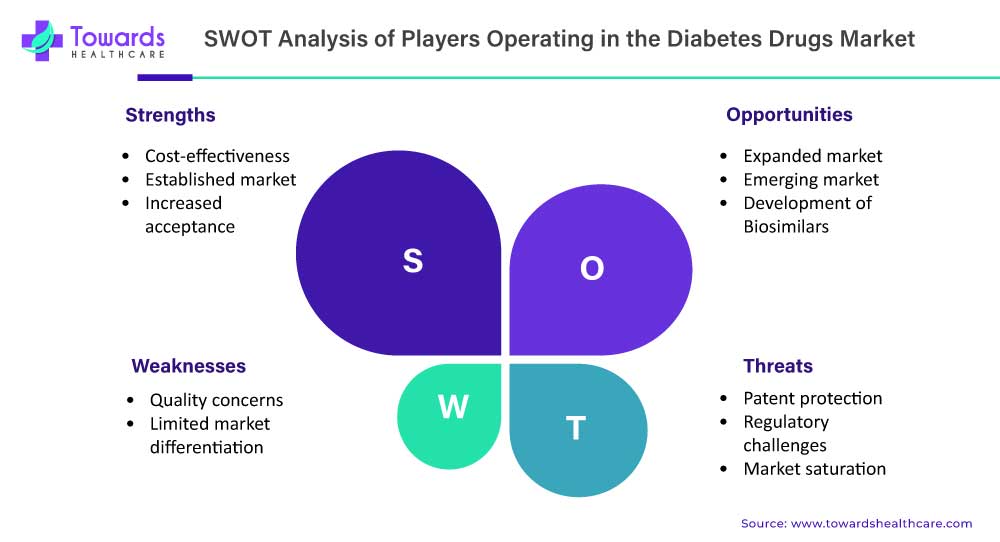

Patent expiration is a significant factor that can impact the diabetes drugs market. When the patents for branded diabetes drugs expire, it allows other pharmaceutical companies to develop and market generic versions of the drugs. This results in increased competition within the market. The expiration of patents for branded diabetes drugs leads to the entry of generic alternatives, which are typically offered at lower prices. Generic drugs are bioequivalent to their branded counterparts, meaning they have the same active ingredients and therapeutic effects. The availability of lower-cost generic options provides cost savings for patients, healthcare systems, and insurers, making diabetes treatment more affordable and accessible.

As generic drugs enter the market, the market share and revenue of the branded drugs may decline. This can pose challenges for pharmaceutical companies that previously held exclusive rights to their patented drugs. They may experience a loss of market exclusivity and face increased competition from generic manufacturers. However, patent expiration can also present opportunities for pharmaceutical companies. Some companies strategically plan for patent expirations by developing new formulations or combinations of existing drugs, securing additional indications or therapeutic uses, or investing in research and development to bring innovative products to market. By leveraging their expertise and resources, companies can navigate the challenges posed by patent expiration and maintain their market position.

Thus, patent expiration in the diabetes drugs market stimulates competition and can lead to lower prices, increased access to medications, and improved affordability for patients. It encourages innovation and drives the development of new treatment options. While it may pose challenges for branded drug manufacturers, it also opens doors for new players and stimulates market dynamics that benefit patients and healthcare systems.

Technological advancements present significant opportunities in the diabetes drugs market. Continuous glucose monitoring devices have revolutionized diabetes management by providing real-time information about blood glucose levels. These devices eliminate the need for frequent fingerstick measurements and allow individuals to make immediate treatment adjustments. The integration of CGM data with insulin pumps and automated insulin delivery systems has the potential to enhance glycemic control and improve patient outcomes. Pharmaceutical companies can explore partnerships or develop their own CGM technologies to complement their diabetes drug offerings.

In addition, Digital therapeutics, including mobile applications and software programs, offer interactive and personalized interventions to support diabetes management. These solutions can provide educational resources, behavior change support, medication adherence reminders, and lifestyle tracking features. Pharmaceutical companies can leverage digital therapeutics to enhance patient engagement, improve treatment adherence, and collect valuable real-world data for drug development and optimization.

Furthermore, AI and machine learning technologies have the potential to revolutionize diabetes care. These technologies can analyze large volumes of patient data, identify patterns, and generate insights that assist in personalized treatment recommendations. AI-powered algorithms can help optimize insulin dosing, predict hypoglycemic events, and identify individuals at high risk of developing complications. Pharmaceutical companies can collaborate with technology firms or invest in AI capabilities to enhance the effectiveness and precision of their diabetes drug therapies.

Wearable devices, such as smartwatches and fitness trackers, offer opportunities for continuous health monitoring and data collection. These devices can track physical activity, sleep patterns, heart rate, and other relevant parameters. By integrating wearable devices with diabetes management platforms, pharmaceutical companies can gather valuable data to understand patient behaviors, tailor treatment strategies, and provide personalized support.

Telemedicine has gained significant momentum, particularly in the wake of the COVID-19 pandemic. Remote consultations and virtual monitoring allow healthcare professionals to connect with patients in real-time, monitor their diabetes management remotely, and provide timely interventions. Pharmaceutical companies can collaborate with telemedicine platforms or develop their own remote patient monitoring solutions to enhance patient access to care and support long-term diabetes management.

Why Did the Insulin Segment Dominate in the Diabetes Drugs Market?

By drug class, the insulin segment is projected to expand rapidly in the diabetes drugs market in the coming years. Insulin is a hormone that helps maintain blood glucose levels and is prescribed to patients who cannot produce sufficient insulin in the body. The rising prevalence of diabetes, advancements in novel insulin formulations, and increasing insulin affordability boost the segment’s growth. Additionally, ongoing research to develop novel approaches to deliver insulin also increases its demand.

How Type 2 Segment Dominated the Diabetes Drugs Market?

By diabetes type, the type 2 segment led the global diabetes drugs market in 2023. Type 2 diabetes mellitus is the most common type of diabetes, affecting almost 96% of cases globally. The cases are rising due to sedentary lifestyles, other chronic disorders, and hereditary reasons. The growing research and development for investigating novel drugs or delivery systems and favorable government policies drive the segment’s growth.

Which Route of Administration Type Segment Held the Dominating Share of the Diabetes Drugs Market?

By route of administration, the oral segment dominated the diabetes drugs market in 2023. Oral formulations are most effectively used due to their ease of administration and low cost. Most of the diabetes drugs are delivered orally. The rise of generic drugs and new drug discovery research promote the segment’s growth. Several researchers are also investigating the delivery of insulin through the oral route to enhance patient adherence.

What Made Hospital Pharmacies the Dominant Segment in the Diabetes Drugs Market?

By distribution channel, the hospital pharmacies segment held a dominant presence in the diabetes drugs market in 2023. The segment growth is attributed to the increasing number of patients in hospitals, favorable reimbursement policies, and the presence of trained professionals. The diabetes drugs prescribed by the doctors are easily available at the respective hospital pharmacies.

A significant majority, specifically over 3 in 4 adults with diabetes, reside in low- and middle-income countries. This highlights the disproportionate burden of diabetes on these regions, emphasizing the importance of addressing healthcare disparities and improving access to diabetes management and prevention resources in those areas.

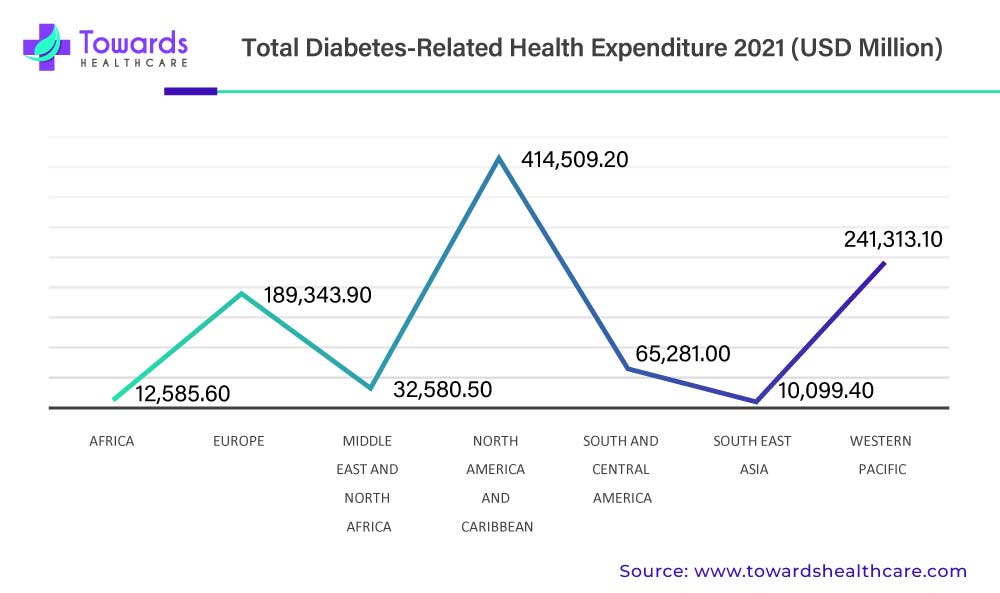

The North American region, particularly the United States, holds a significant share of the diabetes drugs market. Factors such as the high prevalence of diabetes, well-established healthcare infrastructure, favorable reimbursement policies, and a large diabetic patient population drive market growth in this region. The presence of major pharmaceutical companies and ongoing research and development activities further contribute to market expansion. The United States has a high prevalence of diabetes, with millions of people affected by the disease. This large diabetic population creates a substantial demand for diabetes drugs and related healthcare services.

U.S. Diabetes Drugs Market Trends

United States, has a well-developed healthcare infrastructure, which supports the diagnosis, treatment, and management of diabetes. The availability of advanced medical facilities, healthcare professionals, and research institutions contributes to the growth of the diabetes drugs market. In addition, the United States is at the forefront of technological advancements in healthcare, including diabetes management. Innovative technologies such as continuous glucose monitoring devices, insulin pumps, and artificial intelligence-based systems are widely used in the country to enhance diabetes care. These advancements drive the demand for diabetes drugs that complement these technologies.

With the increasing burden of diabetes and its associated complications, there is a growing focus on diabetes management and prevention in the United States. This includes lifestyle modifications, patient education, and medication adherence. As a result, there is a continuous demand for effective diabetes drugs that can help patients manage their condition and improve their quality of life.

Thus, the diabetes drugs market in North America, particularly in the United States, is driven by the high prevalence of diabetes, advanced healthcare infrastructure, technological advancements, favorable regulatory environment, and the presence of key market players. These factors contribute to the growth and development of innovative and effective treatments for diabetes in the region.

Canada Diabetes Drugs Market Trends

Canada's market is expanding due to rising diabetes prevalence, aging population, and obesity rates. Innovative therapies like GLP-1 receptor agonists and SGLT2 inhibitors are reshaping treatment approaches. Government initiatives and healthcare funding support access to treatments. Integration of digital health solutions enhances patient engagement and management.

On the other hand, The Asia Pacific region is projected to experience the fastest growth in the diabetes drugs market. The Asia Pacific region has witnessed a significant increase in the prevalence of diabetes. Lifestyle changes, urbanization, and sedentary lifestyles have contributed to the rise in diabetes cases in countries like China, India, and Japan. As a result, there is an increasing demand for effective diabetes drugs in the region. The Asia Pacific region presents immense growth opportunities for the diabetes drugs market due to the rising prevalence of diabetes, increasing healthcare expenditure, awareness and screening programs, demographic changes, and supportive government initiatives. According to a recent report, anti-diabetic drugs are leading the pharmaceuticals market in India, posting the highest value growth of over INR 155 crore among the new brands launched in 2023.

China Diabetes Drugs Market Trends

China’s market is expanding rapidly due to the country’s high and growing prevalence of diabetes, now affecting over 140 million adults. This increase is driven by urbanization, sedentary lifestyles, and rising obesity rates, with over half of Chinese adults classified as overweight. The market is further propelled by the introduction of innovative treatments such as GLP-1 receptor agonists, government healthcare initiatives under the Healthy China 2030 Plan, and increasing use of digital health technologies.

India Diabetes Drugs Market Trends

India’s market is expanding due to a rising diabetic population driven by lifestyle changes, urbanization, and increasing obesity. Greater awareness, early diagnosis, and improved access to affordable generic medications are boosting treatment uptake. Government health programs and the introduction of innovative therapies like GLP-1 receptor agonists are further supporting market growth and better disease management across urban and rural areas.

Europe's diabetes drug market is expanding due to rising diabetes prevalence, an aging population, and sedentary lifestyles. Advanced healthcare systems in countries like Germany, the UK, and France facilitate early diagnosis and treatment. The adoption of innovative therapies, including GLP-1 receptor agonists and SGLT2 inhibitors, along with supportive government initiatives, further drive market growth. Integration of digital health tools enhances patient management and adherence.

UK Diabetes Drugs Market Trends

The UK's market is expanding due to a rising diabetic population, driven by aging, obesity, and sedentary lifestyles. Innovative therapies like GLP-1 receptor agonists and SGLT2 inhibitors are enhancing treatment options. Government support, improved healthcare access, and digital health tools further contribute to market growth. Notably, the approval of Mounjaro (tirzepatide) for NHS prescription underscores the emphasis on advanced treatments.

Germany Diabetes Drugs Market Trends

Germany’s diabetes drug market is accelerating due to strong pharmaceutical R&D, significant investments by companies like Boehringer Ingelheim and Eli Lilly, and a well-established healthcare system. The launch of advanced drugs and expansion of local manufacturing facilities support growth. Additionally, government focus on chronic disease management enhances treatment accessibility and adoption.

South America is expected to grow significantly in the diabetes drugs market during the forecast period, due to growing diabetes incidences, driven by lifestyle changes and urbanization. This, in turn, is increasing the demand for their effective treatment options, increasing the adoption rates of the drugs, and promoting the market growth.

Brazil Diabetes Drugs Market Trends

The growing incidence of diabetes is increasing the use of diabetes drugs across Brazil. The companies are also developing various advanced therapies, which are further supported by government funding. The growing patent expiries are also increasing the innovation of various diabetes drugs.

MEA is expected to grow significantly in the diabetes drugs market during the forecast period, due to growing government initiatives. The growing incidence of diabetes is also increasing the demand for their drugs, where the growing health awareness is also contributing to the same. The companies are launching and developing various formulations and therapies, along with their generic version which are enhancing the market growth.

Saudi Arabia Diabetes Drugs Market Trends

The presence of a well-developed healthcare sector in Saudi Arabia is increasing the use of various diabetes drugs. Moreover, the growing incidence of diabetes is also increasing the demand, as well as fuelling the development of targeted therapies. Additionally, growing government initiatives are also increasing their accessibility.

R&D

Clinical Trials and Regulatory Approvals

Formulation and Final Dosage Preparation

Packaging and Serialization

Patient Support and Services

The diabetes drugs market is highly competitive, with several key players competing for market share. These companies focus on developing innovative drugs and treatments to meet the evolving needs of patients with diabetes. Several key players dominate the competitive landscape in this field. To gain a larger share of the market, players are using strategies like investments, alliances, acquisitions, and mergers.

Erez Israeli, CEO of Dr. Reddy’s Laboratories Ltd., announced that the company is planning to have 15 GLP-1 agonists used to treat obesity and diabetes in all the markets when they open, including the 2026 markets. The 15 products will be introduced in different timelines. Through this, the company is set to introduce semaglutide, a GLP-1 agonist, in India once the Novo Nordisk patent expires.

Understand how top players are redefining the Diabetes Drugs Market: https://www.towardshealthcare.com/companies/diabetes-drugs-companies

By Drug Class

By Diabetes Type

By Route of Administration

By Distribution Channel

By Geography

January 2026

January 2026

January 2026

January 2026