February 2026

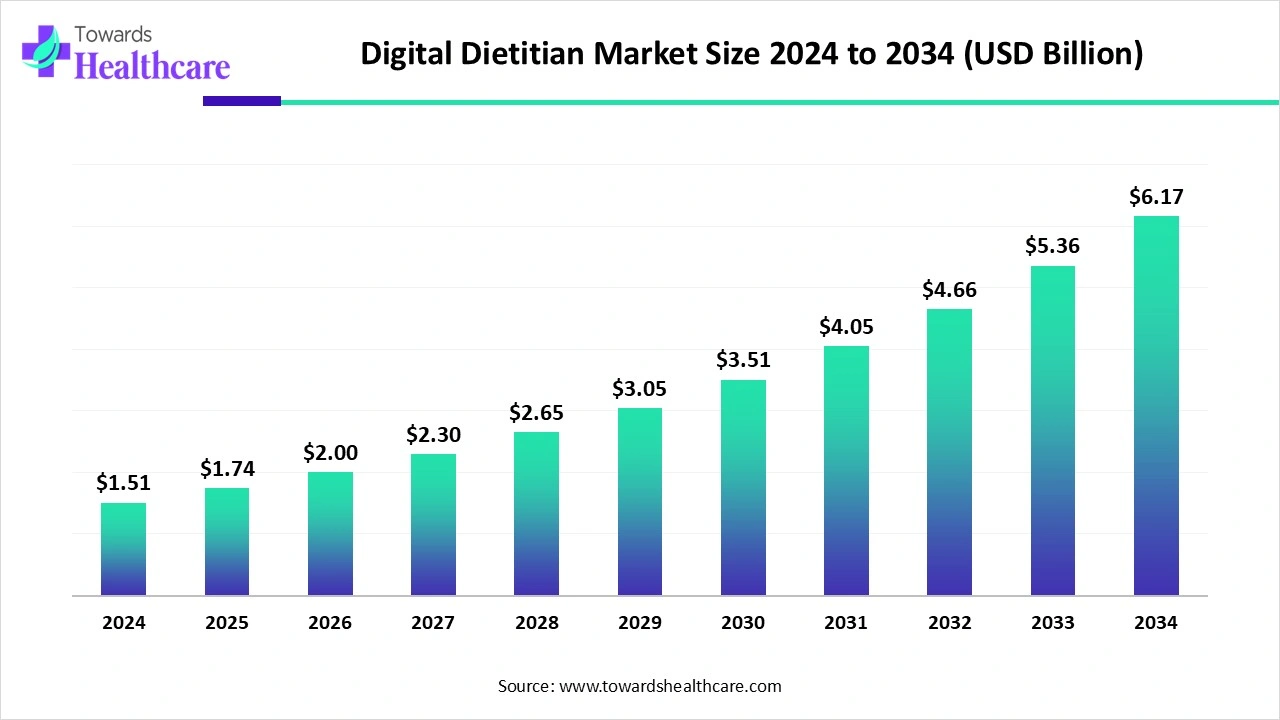

The global digital dietitian market size is calculated at US$ 1.51 billion in 2024, grew to US$ 1.74 billion in 2025, and is projected to reach around US$ 6.17 billion by 2034. The market is expanding at a CAGR of 15.16% between 2025 and 2034.

The rise of the digital dietitian market presented several digital applications for diet planning, diet monitoring, and precision nutrition for healthcare professionals and the global population. Some of the digital applications for nutritionists available in the market for diet planning and monitoring include Evolution Nutrition, Healthie, Metadieta, MyFitnessPal for Professionals, NutriAdmin, Nutrihand, Nutritics, Nutrium, and Practice Better. Digital precision nutrition solutions are available for use by researchers and physicians. The key technologies, including AI, wearable devices, IoT, telehealth platforms, and genetic and microbiome testing, are shaping the future of digital dietetics.

| Table | Scope |

| Market Size in 2025 | USD 1.74 Billion |

| Projected Market Size in 2034 | USD 6.17 Billion |

| CAGR (2025 - 2034) | 15.16% |

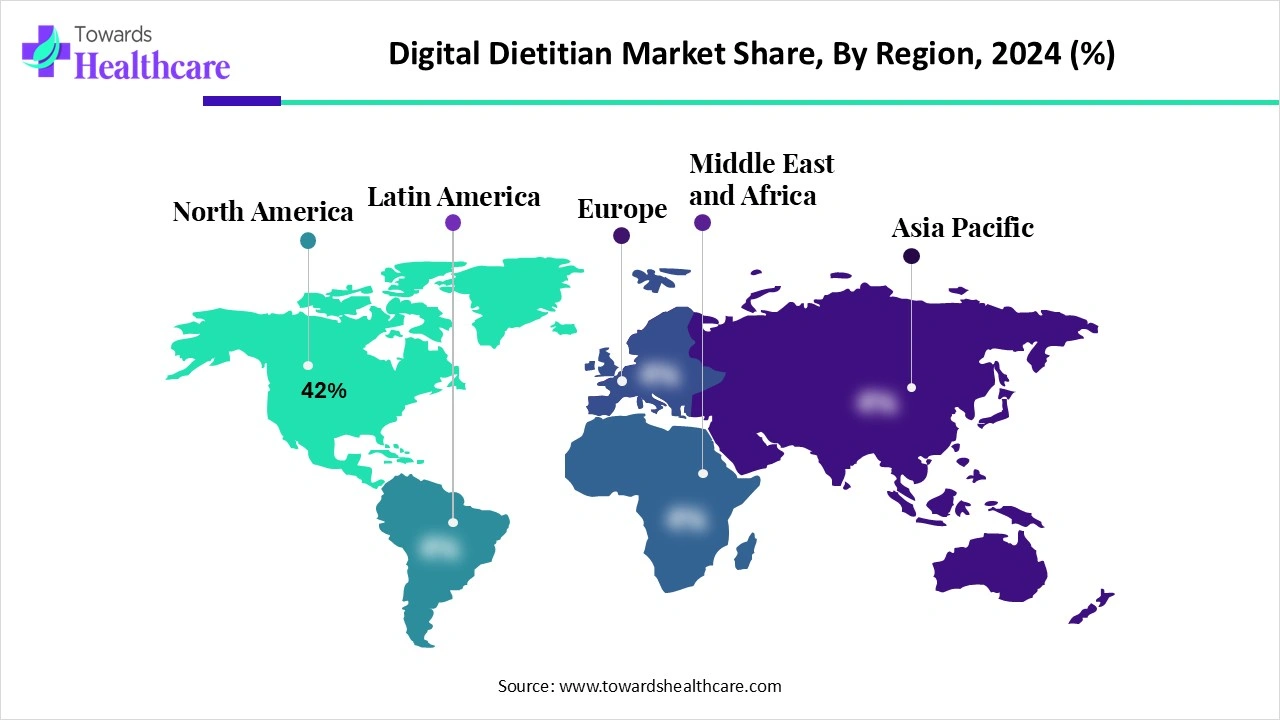

| Leading Region | North America |

| Market Segmentation | By Service Type, By Application, By Technology, By End User, By Region |

| Top Key Players | Lumen, Zoe Nutrition, Nutrino Health, Ate Food Journal, MyFitnessPal, Noom, Lifesum, Nutrigenomix, Wellory, Foodvisor, NutriSense, PlateJoy , DietSensor, Yazio, Cronometer, Lose It!, WW International, HealthifyMe, FitGenie, Nutripal |

The digital dietitian market refers to AI-driven platforms, mobile applications, and virtual consultation services that provide personalized nutrition advice, dietary monitoring, and wellness coaching. These systems integrate data from wearables, genetic testing, electronic health records, and lifestyle trackers to deliver tailored recommendations for weight management, chronic disease management (diabetes, hypertension, obesity), sports nutrition, and preventive healthcare. The rise of telehealth, AI-enabled chatbots, and real-time diet monitoring has accelerated adoption among healthcare providers, insurers, fitness platforms, and individual consumers. The market is driven by the growing demand for personalized nutrition, the rise in chronic lifestyle diseases, and consumer preference for digital-first healthcare experiences.

Advancements in digital healthcare tools are supported by favorable funding and investment initiatives by major market players. For instance, in February 2025, Berry Street, a dietitian startup, raised $50 million in a funding round from investors including Sofina, FJ Labs, and Northzone to expand its portfolio of providing registered dietitians with tools for managing self-practice of nutrition.

The global consumers are becoming more aware of health and nutrition, which fosters the need for strengthening nutrition care. For instance, in December 2024, Culina Health raised $7.9 million in Series A to bridge the gap in payer-sponsored nutrition services.

Artificial intelligence helps in the optimization of software to support equity of access. AI also assists in creating clinical notes, letters, images, meal plans, and leaflets. AI-powered solutions can provide nutritional guidance to pregnant women and ensure that they obtain essential nutrients during pregnancy.

What are the Major Drifts in the Digital Dietitian Market?

The emergence of many advanced technologies, such as AI-driven precision nutrition, telehealth, remote monitoring, real-time dietary assessment tools, and many other tech advancements, drives the rapid growth of digital dietitian services. The increased focus on women’s health through personalized nutrition and care raises the importance of the healthcare revolution. The extensive research on nutrigenomics, epigenetics, and integrative health boosts the development of novel products and services.

What are the Potential Challenges in the Digital Dietitian Market?

The major challenges are associated with the integration of new technologies, overcoming AI limitations, the adoption of personalized nutrition, and dealing with misinformation. Certain issues are related to security, privacy, and regulatory aspects, which include data privacy concerns, inconsistent regulation, and reimbursement issues.

What is the Future of the Digital Dietitian Market?

There is a rising demand for digital dietitians in the role of virtual nutrition counsellor, health and wellness coach, nutrition educator, content creator, health tech product specialist, corporate wellness consultant, freelance nutritionist, or freelance dietitian. Moreover, digital dietetics holds an immense scope to refurbish essential skills like telehealth proficiency, marketing, communication, data analysis, business, entrepreneurship, and cultural competency.

The personalized nutrition platforms segment dominated the market in 2024, owing to the major role of these systems in enhanced and automated client assessment, which includes comprehensive data collection, AI-driven analysis, and real-time monitoring. They assist with scalable, precise, and personalized meal planning while enabling efficient workflow management. They allow improved client management through expanded service offerings, which drive strategic growth of businesses.

The virtual dietitian consultations segment is expected to grow at the fastest CAGR in the market during the forecast period due to exciting offerings such as flexible, convenient scheduling, increased privacy, and expanded access to specialists. These services provide enhanced and personalized care through personalized meal plans, targeted disease management, and data-driven insights. They provide support, hold accountability, and enable affordable access to them.

The weight management segment dominated the market in 2024, owing to the benefits of digital tools to people in need, with reduced travel and increased comfort and privacy. The wearables, fitness trackers, and many digital applications provide real-time data on weight, activity levels, and other metrics. The various digital platforms help people with regular virtual check-ins, messaging, and reminders with a health coach or dietitian.

The sports & fitness nutrition segment is expected to grow at the fastest CAGR in the market during the forecast period due to the key role of extensive research in genetics and epigenetics to tailor highly specific nutrition plans based on the metabolic needs of people. Athletes and clients take remote consultations with dietitians virtually from any location due to telehealth capabilities.

The mobile apps segment dominated the market in 2024, owing to the time savings, patient management, and continuous evaluation through mobile applications. They enable better patient communication, evidence-based practice, and enhanced interventions. They provide 24/7 support, remote monitoring, and easy tracking for health status.

The AI & machine learning algorithms segment is expected to grow at the fastest CAGR in the market during the forecast period due to tailored recommendations, early risk detection, and improved clinical care. AI algorithms help in automated assessment, monitoring, and time management. They enable more accurate dietary assessment and streamlined research. They help to better understand food and nutrition.

The individual consumers segment dominated the market in 2024, owing to the numerous benefits of digital dietetics to people in lifestyle and health tracking, customized meal plans, and genetic analysis. The digital health technologies allow flexible scheduling and provide comfort and privacy to end users. The consumers experience real-time feedback, advanced progress tracking, and behavioral coaching.

The corporate wellness programs segment is expected to grow at the fastest CAGR in the market during the forecast period due to higher energy and productivity of employees through health and wellness sessions. They enhance company culture and encourage reduced healthcare costs. The employees benefit from these programs in terms of improved mental health and long-term lifestyle changes.

North America dominated the market share 42% in 2024, driven by high telehealth adoption, AI-driven nutrition startups, and chronic disease management needs. In May 2025, the U.S. Food and Drug Administration (FDA) and the National Institutes of Health (NIH) introduced their joint nutrition regulatory science program to transform healthcare.

The leading medical education organizations of America are urged by the U.S. Department of Health and Human Services (HHS) and the U.S. Department of Education to implement detailed nutrition education and training in August 2025.

The NIH Common Fund’s Nutrition for Precision Health is supported by the All of Us Research Program and aims to develop algorithms that can predict individual responses to food and dietary patterns. The Nutrition for Precision Health (NPH) program is based on recent advances in biomedical science, microbiome research, and AI. America has also adopted the new strategy named the ‘Make Our Children Healthy Again Assessment’ along with the ‘Make America Healthy Again’ (MAHA). The White House has set its national strategy through which it has launched new programs on nutrition, physical activity, and Women’s Life Skills.

Under the Make America Healthy Again Commission, certain dietary guidelines were updated for Americans by the U.S. Department of Agriculture (USDA) and the U.S. Department of Health and Human Services (HHS) in March 2025.

Aramark stands as one of the largest employers of registered dietitians in the U.S. In January 2024, Aramark launched a new telehealth program to digitally connect its hospital inpatients with highly skilled clinical dietitians through cloud-based technologies.

This initiative will expand access to clinical nutrition services in the U.S.

The Government of Canada launched calls for proposals for community projects to help seniors in healthy aging, prevent senior abuse, celebrate diversity, promote inclusion, and support financial security. Canada has set its digital ambition by focusing on secure, smarter, and citizen-centric services. The government is committed to harnessing modern technologies and data to ensure security, accessibility, service delivery, and reliability across the nation.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to increasing health awareness, mobile-first adoption, and urban lifestyle-related conditions in China, India, and Southeast Asia. In September 2024, the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) and the Government of Kazakhstan organized a conference in which the Asia-Pacific governments committed to collaborating on innovative solutions to fill the digital gaps and drive sustainability.

This region is adapting to digital innovations across nutrition and dietetics for sustainable development across the region. The AI-powered healthcare sector in the Asia Pacific is driven by the growth in clinical data that is powered by AI, GenAI, and Agentic AI.

According to the World Bank Group, India is experiencing a transformation in its nationwide nutrition program named the ‘Poshan Abhiyan’ in September 2024.

For this purpose, Poshan Tracker, the world’s largest mobile phone-based application, was launched to drive household management, home visit scheduling, daily feeding, and growth monitoring. In February 2025, the World Economic Forum (WEF) announced the launch of the India Digital Health Activator to boost digital health adoption, innovation, and interoperability through public-private collaboration.

In July 2024, the National Health Commission of China launched a new awareness campaign to empower people with the knowledge of weight control, lifelong commitment, active monitoring, physical activity, a balanced diet, good sleep, targets, and family action.

The government subsidies in China have boosted digital product sales to $20 billion in four months since May 2025.

China has set its plan to advance the development of digital China.

Europe is expected to grow at a notable rate in the market in 2024. This regional growth is attributed to the consumer demand for personalized health, telehealth adoption, and supportive policies. According to the World Health Organization (WHO), the new EU-funded project aims to strengthen digital health in Kyrgyzstan. The Digital Europe Program (DIGITAL) is an EU-funding program that aims to bring digital technology to citizens, businesses, and public administration. According to the United Nations World Food Program, European leaders united to strengthen school meal programs at national, regional, and global levels in February 2024.

In March 2025, Team Europe pledged €6.5 billion at the Nutrition for Growth Summit held in Paris to fight global malnutrition.

In April 2025, the WHO announced the launch of the new collaborating center on digital health in Germany.

Germany raised its support for developing economies in meeting trade standards and food safety. The German Digital Health Applications (DiGA) Fast Track supports diabetes management. It also creates favorable opportunities for manufacturers and healthcare providers.

France provided funding to the United Nations World Food Program (WFP) in Sri Lanka with EUR 500,000 to support food delivery to young children at risk of malnutrition. In April 2025, the Government of France held the Nutrition for Growth Summit in Paris, which displayed the importance of nutrition at the heart of the development of France.

France also planned to organize its international nutrition for growth summit in Paris on March 2025.

In February 2025, Noah Kotlove, co-founder and CEO of Berry Street, said that the positive momentum of GLP-1 medications for dietitians is the biggest accelerating factor for the company’s growth and profitability in the American healthcare system.

By Service Type

By Application

By Technology

By End User

By Region

February 2026

February 2026

February 2026

February 2026