January 2026

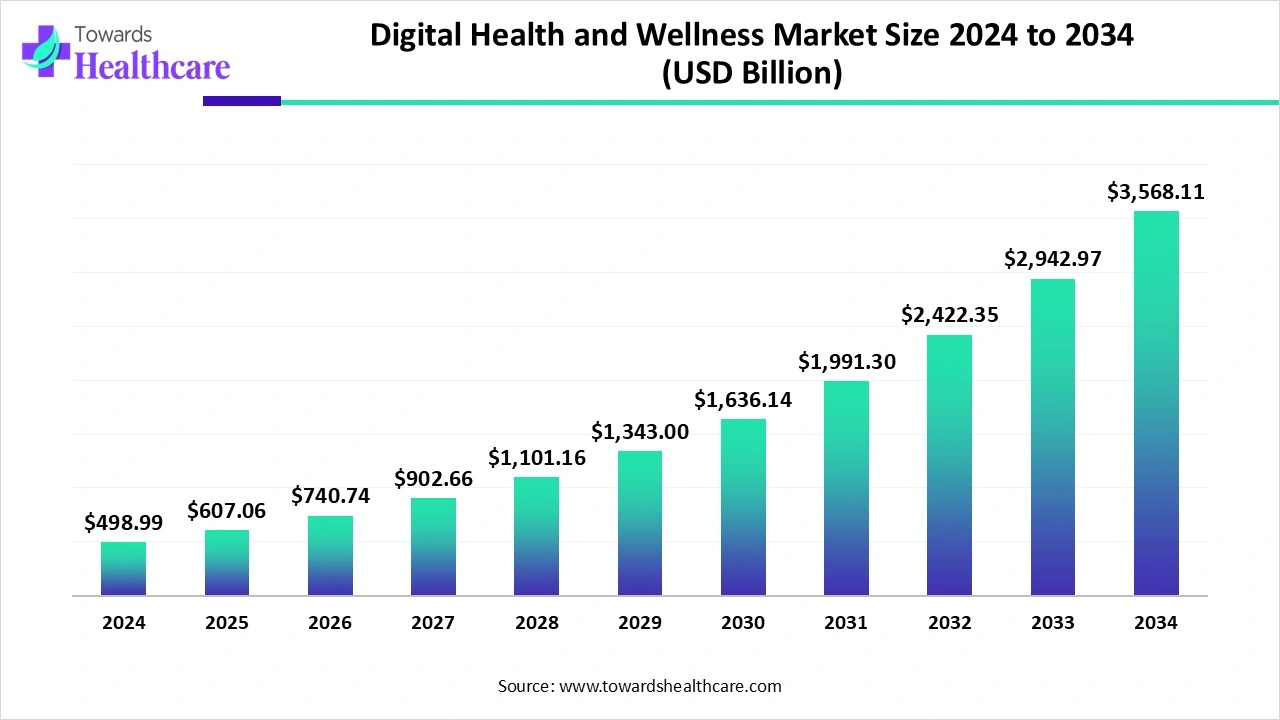

The global digital health and wellness market size is calculated at US$ 498.99 billion in 2024, grew to US$ 607.06 billion in 2025, and is projected to reach around US$ 3568.11 billion by 2034. The market is expanding at a CAGR of 21.92% between 2025 and 2034.

The growing need for accessible and customised exercise solutions among customers is driving considerable growth in the digital health and wellness market. The expansion of the market is also fueled by underlying macroeconomic variables. Growing urbanisation and disposable affluence have made customers more concerned about their health and well-being. Because people are motivated by their success stories and want to follow their fitness regimens, the advent of social media influencers and fitness superstars has also aided in the expansion of these groups.

| Table | Scope |

| Market Size in 2025 | USD 607.06 Billion |

| Projected Market Size in 2034 | USD 3568.11 Billion |

| CAGR (2025 - 2034) | 21.92% |

| Leading Region | North America |

| Market Segmentation | By Component, By Solution Category, By Technology, By Application/Use Case, By End-User, By Region |

| Top Key Players | Apple (Health, Fitness+), Google / Fitbit, Samsung Health, Garmin, Huawei Health, Withings, Oura, WHOOP, Peloton, Strava, MyFitnessPal, Noom, Headspace, Calm, Teladoc Health (incl. Livongo), Omada Health, Virgin Pulse, Philips (HealthSuite), Ada Health, Eight Sleep |

The digital health and wellness market spans consumer- and enterprise-grade solutions that monitor, improve, and sustain physical, mental, and lifestyle health. It includes mobile apps, connected wearables, smart home health devices, virtual care, remote monitoring, and AI-driven coaching that help users track activity, sleep, stress, nutrition, vitals, and chronic conditions. Platforms integrate behavioral science with analytics to deliver personalized insights, promote habit formation, and provide preventive recommendations, while enabling providers, payers, and employers to support improved outcomes, adherence, and cost control. Core technologies include IoT sensors, cloud platforms, AI/ML, and data interoperability. Offerings range from fitness and mindfulness to chronic disease and health improvement in women. Revenue models blend subscriptions, employer/payer contracts, and freemium upgrades across app stores and B2B channels globally.

Government initiatives: Digitalization in healthcare has transformed patient care and support. The governments of different countries have realized the importance of digital health and wellness and are taking efforts to improve it by investing in digital platforms.

For instance,

A branch of computer science called artificial intelligence (AI) may be utilised to create DH solutions. Incorporating artificial intelligence (AI) into health technology, including wearables, mobile apps, online platforms, and medical equipment, can improve their performance and usefulness or use the data they collect to propel personalised and precision treatment. Artificial Intelligence (AI) is a broad field that includes rule-based systems, robots, machine learning (ML), natural language processing (NLP), and more. It excels at managing numerical and perceptual data.

Rising Digitalization to Improve Mental Health

According to recent World Health Organisation (WHO) data, over 1 billion people suffer from mental health issues, with diseases like depression and anxiety having a significant negative impact on both lives and the economy. Globally, e-health services are upending and undermining established mental health treatment systems as they grow quickly. Improved access to care is promised by telemedicine and health applications in the field of mental healthcare, which appears especially beneficial given the ongoing global mental health crisis and consistently rising prevalence rates.

Patient Data Privacy & Security

The extensive use of digital technology in healthcare presents privacy and security issues. There are serious dangers to the confidentiality, availability, and integrity of patient data from security lapses, unauthorised access, cyberattacks, and privacy violations. Strong privacy protections and security measures are essential for digital healthcare systems.

Partnering with Individuals for Chronic Health Improvement

Since the majority of managing chronic diseases takes place outside of the conventional healthcare setting, meeting people where they are physically and mentally and collaborating with them to enable them to fully participate in their own care are crucial to improving health outcomes, enhancing quality of life, and cutting down on health care costs. In order to build a strong relationship between patients, families, and physicians, more technologies that allow patient-centered, simple, and safe two-way communication for scheduling appointments, self-check-in, and feedback surveys must be used.

By component, the software & mobile apps segment held the major share of the digital health and wellness market in 2024. Software technologies are becoming widely adopted and used, which is creating new and creative opportunities to enhance health and the provision of healthcare. People may monitor their own health and well-being, encourage healthy living, and obtain helpful information whenever and wherever they need it with the use of mobile applications. Nearly as fast as they can be created, these tools are being accepted. Patients, customers, and medical professionals are examples of users.

By component, the devices & wearables segment is estimated to grow at the highest rate during the upcoming period. Wearable technology has been a prominent area of healthcare in recent years due to the rise of technical innovation and the extensive use of semiconductor materials, showing a great deal of promise for future growth. Many benefits, such as remote patient monitoring, personalised healthcare, patient empowerment and involvement, telemedicine, and virtual care, have been made available to the healthcare industry 5.0 by integrating smart wearables like fitness trackers, smartwatches, and biosensors.

By solution category, the fitness & activity tracking segment led the digital health and wellness market in 2024. A fascinating new gadget that has recently caught the interest of the current generation is the fitness tracker. With the help of fitness trackers, people can easily keep tabs on their levels of physical activity and make well-informed decisions regarding their health and well-being. These gadgets keep changing as a result of technological advancements, adding new features and capabilities to improve the user experience even more.

By solution category, the stress, mindfulness & mental wellness segment is anticipated to witness the highest growth during 2025-2034. An emotional reaction brought on by outside stimuli, stress is a widespread issue that has an impact on both mental and physical health. For stress management, a variety of digital therapy approaches work well. Numerous mindfulness applications have developed quickly as a result of the potential benefits of app-based therapies. One of the most popular app categories for improving mental health and well-being is mindfulness, with around 300 applications now available for download.

By technology, the IoT & wearable sensor platforms segment was dominant in the digital health and wellness market in 2024. The Internet of Things, or IoT, has grown in popularity and is employed in a variety of medical contexts. Wearable sensors and smart devices are two examples of technological advancements that are speeding up the expansion of IoT in healthcare monitoring.

By technology, the AI/ML analytics & personalization segment is estimated to be the fastest-growing during the studied timeframe. All stakeholders find healthcare systems to be complicated and difficult, but artificial intelligence (AI) has revolutionised a number of industries, including healthcare, and has the potential to enhance patient care and quality of life. ML may help with decision-making, workflow management, and timely and economical job automation.

By application, the prevention & lifestyle management segment held the dominant revenue of the digital health and wellness market in 2024. People, families, companies, and governments all bear financial costs as a result of lifestyle disorders. 71% of all fatalities globally are caused by them, with 41 million deaths annually. 15 million people between the ages of 30 and 69 pass away each year from lifestyle-related illnesses. Effective use of digital treatments has been demonstrated in promoting psychological and general well-being as well as facilitating the self-management of chronic illnesses.

By application, the chronic conditions support (RPM) segment is expected to witness the highest growth during the predicted period. The prevalence of chronic illnesses is increasing. Frequent hospital visits are necessary for the treatment and monitoring of chronic illnesses, which puts more strain on both patients and hospitals. The healthcare system is now being enhanced by developments in wearable sensors and communication protocols, which will soon change the nature of healthcare services. The most advanced of these developments is remote patient monitoring (RPM).

By component, the individual consumers segment led the digital health and wellness market in 2024. Digital health innovations, in contrast to many other medical goods and services, are frequently marketed to and utilised by individual patient customers. Through direct patient engagement, the rapidly expanding field of direct-to-consumer digital health may meet unmet patient demands. The direct-to-consumer strategy may be especially beneficial for people who lack regular access to care due to social, cultural, economical, or geographic constraints.

By component, the employers & wellness program sponsors segment is estimated to grow at the highest CAGR during 2025-2034. Wellness programmes are used by businesses to provide their staff with tools to improve their emotional and physical well-being. Employee engagement may be raised and burnout can be avoided by providing this sort of incentive. There are many different types of wellness programmes, including subscriptions to meditation apps, life coaching, fitness courses, virtual counselling, and gym memberships.

North America dominated the digital health and wellness market in 2024. Because of advancements in technology, increased healthcare IT spending to upgrade infrastructure, supportive government initiatives, the emergence of startups, a readiness to adopt innovative technological solutions, prospects for growing smartphone adoption, enhanced internet connectivity, and lucrative funding. Additionally, government support and collaborations are motivating healthcare experts and app developers to provide better digital solutions.

The U.S. was by far the leader in science and technology. This is due to the fact that the U.S. leads the globe in the number of newly authorised pharmaceuticals and medical devices. The country also ranks near the top in terms of per capita scientific Nobel prizes, university scientific impact, and research and development investment. These achievements have made it possible for Americans to receive some of the most innovative and cutting-edge medical treatment options accessible globally before they are made available elsewhere.

In June 2024, the Honourable The Connected Care for Canadians Act, Bill C-72, was introduced by Health Minister Mark Holland. The goal of this Act is to give Canadians safe access to their own health information, which will enhance patient decision-making and the quality of treatment they get from Canadian healthcare professionals. This Act describes strategy of Canada to facilitate a contemporary, networked healthcare system where patients may safely access health information and providers can exchange it when necessary.

Asia Pacific is estimated to host the fastest-growing digital health and wellness market during the forecast period. Rising healthcare costs and the growing use of eHealth platforms are the main drivers of this development in the region. This development is mostly due to the increasing usage of electronic health records (EHR) and electronic medical records (EMR). EHR systems are in place countrywide in nations like China and Japan. The National Electronic Health Record (NEHR) in Singapore gives medical professionals access to thorough patient data, which enhances diagnosis, treatment planning, and overall patient care.

Due to the need to address structural issues including uneven access to high-quality healthcare and an overworked hospital system, China has achieved notable advancements in digital healthcare. Businesses like WeDoctor of Tencent and Good Doctor of Ping An have created extensive digital health platforms that increase access, lower expenses, and improve the standard of medical care.

Technology breakthroughs, legislative changes, and government efforts are all contributing to the digital transformation of healthcare system in India. As the population grows quickly and the need for high-quality healthcare rises, digital health solutions are becoming increasingly important in improving accessibility, cost, and effectiveness. Digital healthcare infrastructure in India is developing to use telemedicine, electronic health records (EHRs), and diagnostics powered by artificial intelligence (AI) to close the gap between urban and rural healthcare facilities.

Europe is estimated to host a significantly growing digital health and wellness market during the forecast period. motivated by the abundance of telemedicine programmes and solutions in the region. The market is expanding as a result of this expansion as well as the spread of digital technology, particularly wearables and mobile apps.

A significant turning point for the European Health Data Space (EHDS), which was introduced in 2025, has been reached with recent large expenditures in the digital transformation of its national healthcare system in Germany. The European Union (EU) recognises the value of using transnational data in a meaningful way. The EHDS seeks to improve access to and control over their own electronic health data while facilitating the use of secondary data for scientific study, public interest, and policy support among people. One of its components is the creation of a standardised technological and legal foundation for electronic health record systems.

In August 2025, two new items were introduced by health-tracking ring manufacturer Oura to help women during important life phases. Chief product officer of Oura, Holly Shelton, said in a statement that these releases mark a new era in health technology, one that is supported by science, based on empathy and privacy, and based on the idea that all life stages should be recognised, understood, and assisted.

By Component

By Solution Category

By Technology

By Application/Use Case

By End-User

By Region

January 2026

January 2026

January 2026

January 2026