January 2026

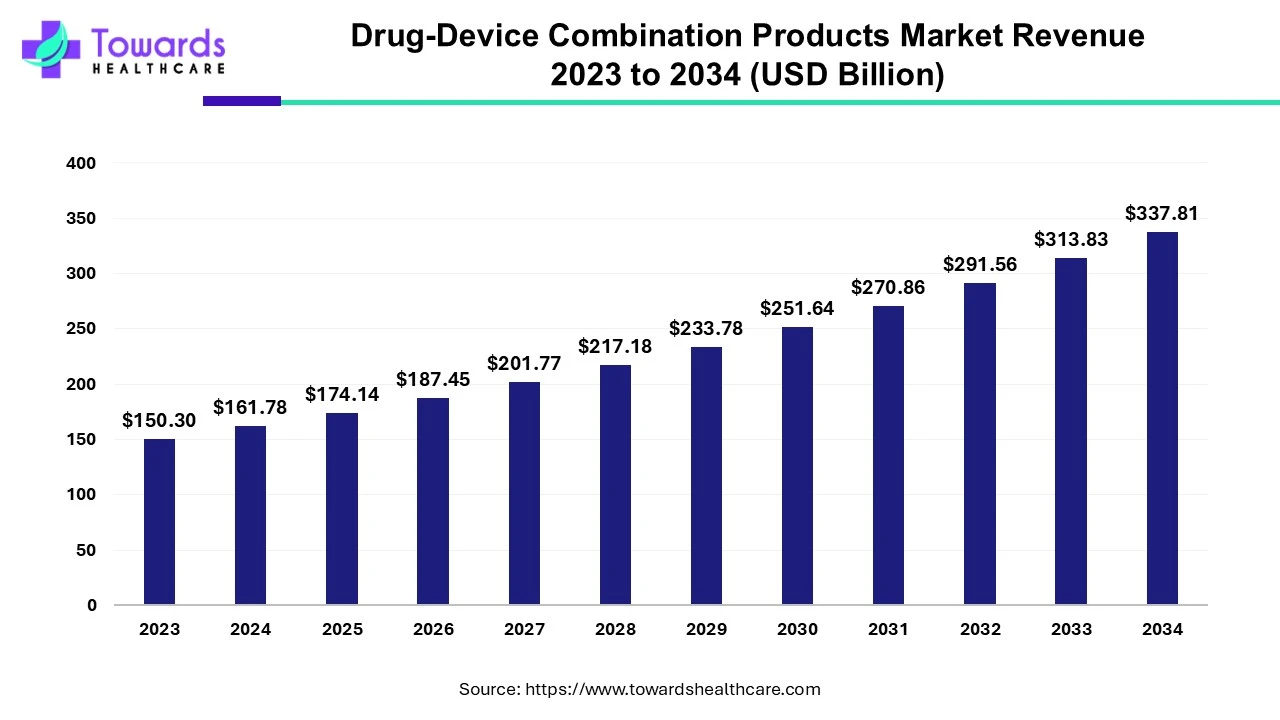

The drug-device combination products market size was estimated at US$ 150.3 billion in 2023 and is projected to grow to US$ 337.81 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.64% from 2024 to 2034.

Drug-device combination products are therapeutic and diagnostic products that combine a drug and a device, leading to safer and more effective treatments. There are generally two main types of combination products: integral and co-packaged. In integral, the drug and device form a single integrated product. In co-packaged, the pharmaceutical and device are separate items but packaged together in the same secondary packaging. Examples of drug-device combination products include autoinjectors, inhalers, pre-filled nebulizers, pre-filled pens, pre-filled syringes, and transdermal patches.

The careful and precise drug targeting, local administration, and individualized therapy favor the development of drug-device combination products. The increasing incidences of chronic disorders and growing research & development activities potentiate market growth. Additionally, favorable government policies and increasing sophistication of the products drive the market. Rising investments & collaborations, and technological advancements also boost the market.

The latest technological advancements like artificial intelligence (AI) and machine learning (ML) foster innovations in the development of drug-device combination products. AI can optimize the research and development process, thereby reducing development costs. ML algorithms can assist in experimental design and predict the pharmacokinetics and toxicity of drug candidates. AI can also aid the development of personalized medicines by analyzing real-world patient data. Additionally, AI can enable the drug to be compatible with the device, leading to more effective treatment outcomes. AI can also manipulate the drug release from the device at the precise time and location within the body. Favorable government policies boost the market. In September 2024, the US FDA established a new internal advisory body for regulating the use of AI during the manufacturing and testing of pharmaceutical products and in the development of complex drug-device combination products.

The major challenge of the market is the evolving regulatory standards for the approval of drug-device combination products. This poses a challenge for many manufacturers and distributors to stay abreast of regulatory changes and guidelines specific to these products. Another major challenge is the drug-device integration. The complex interaction between medications and devices presents a major challenge in product development. The drugs and devices should have precise coordination and compatibility to optimize performance and efficacy.

North America dominated the drug-device combination products market in 2023. The advanced healthcare infrastructure, state-of-the-art research and development facilities, technological advancements, and the presence of key players drive the market. Several government bodies, such as the Food and Drug Administration, the Center for Drug Evaluation and Research, and the Center for Devices and Radiological Health, regulate the approval of drug-device combination products. The rising chronic disorders like cancer and diabetes promote the development of drug-device combination products. The US reported around 1.9 million new cancer cases in 2022, while in Canada, 0.23 million new cancer cases were reported.

Asia-Pacific is anticipated to grow at the fastest rate in the drug-device combination products market during the forecast period. The increasing investments & collaborations, growing research and development, rising chronic disorders, and increasing geriatric population drive the market. In China, approximately 280 million people will be 60 years or older in 2022. In India, around 149 million were above 60 years old in 2022, while in Japan, 36.25 million are currently 65 years and above. The geriatric population is more vulnerable to chronic disorders, necessitating the development of novel drug-device combination products to enhance patient adherence.

Europe is expected to grow significantly in the drug-device combination products market during the forecast period. The rising chronic diseases are increasing the demand for the use of drug-device combination products to manage these conditions. Hence, to meet this increasing demand, the production rates are increasing. This, in turn, increases the research conducted in various industries as well as institutes that are provided with investment or funding by the government. This also increases the collaboration among them. Furthermore, to enhance the safety as well as efficacy of these devices, various rules and regulations are also provided by the regulatory bodies. Thus, these factors promote the market growth.

By product, the drug-eluting stents segment held the largest share of the drug-device combination products market in 2023. Drug-eluting stents are tubes used to treat narrowed or blocked arteries by gradually releasing the drug. They can act both mechanically by opening the arteries and pharmacologically by targeted drug delivery. The rising incidences of cardiovascular disorders and heart attacks potentiate the segment growth.

The infusion pumps segment is expected to grow at the fastest rate in the market during the forecast period. Infusion pumps are medical devices that deliver fluids, such as nutrients and drugs, into a patient’s body in controlled amounts. They are used to self-administer drugs in hospitalized patients or cancer patients for sustained release.

By application, the cardiovascular segment accounted for a considerable share of the drug-device combination products market in 2023. The rising incidences of cardiovascular diseases drive the segment growth. The most common combination product for cardiovascular disease drug-eluting stent provides the desired effect, giving targeted drug delivery.

The cancer treatment segment is anticipated to grow with the highest CAGR in the market during the studied years. The rising cases of cancer disorders and lack of effective treatment for late-stage cancer promote the segment growth. In 2022, approximately 20 million new cancer cases were reported globally.

By end-user, the hospital segment registered its dominance over the global drug-device combination products market in 2023. The increasing number of patients and surgeries, technical expertise, and favorable reimbursement policies in hospitals boost the segment growth.

The ambulatory surgical centers segment is projected to expand rapidly in the market in the coming years. The increasing awareness and demand for same-day discharge are responsible for the use of drug-delivery combination products.

Dr. Mark Ostwald, CEO of Freudenberg Medical, commented that the drug-device combination products are inspiring a new generation of innovative products to improve patients’ outcomes. He added that the company’s investment of $50 million will strengthen its position as a strategic partner to their customers, offering vertically integrated solutions along the entire supply chain.

By Product

By Application

By End-User

By Region

January 2026

December 2025

January 2026

November 2025