January 2026

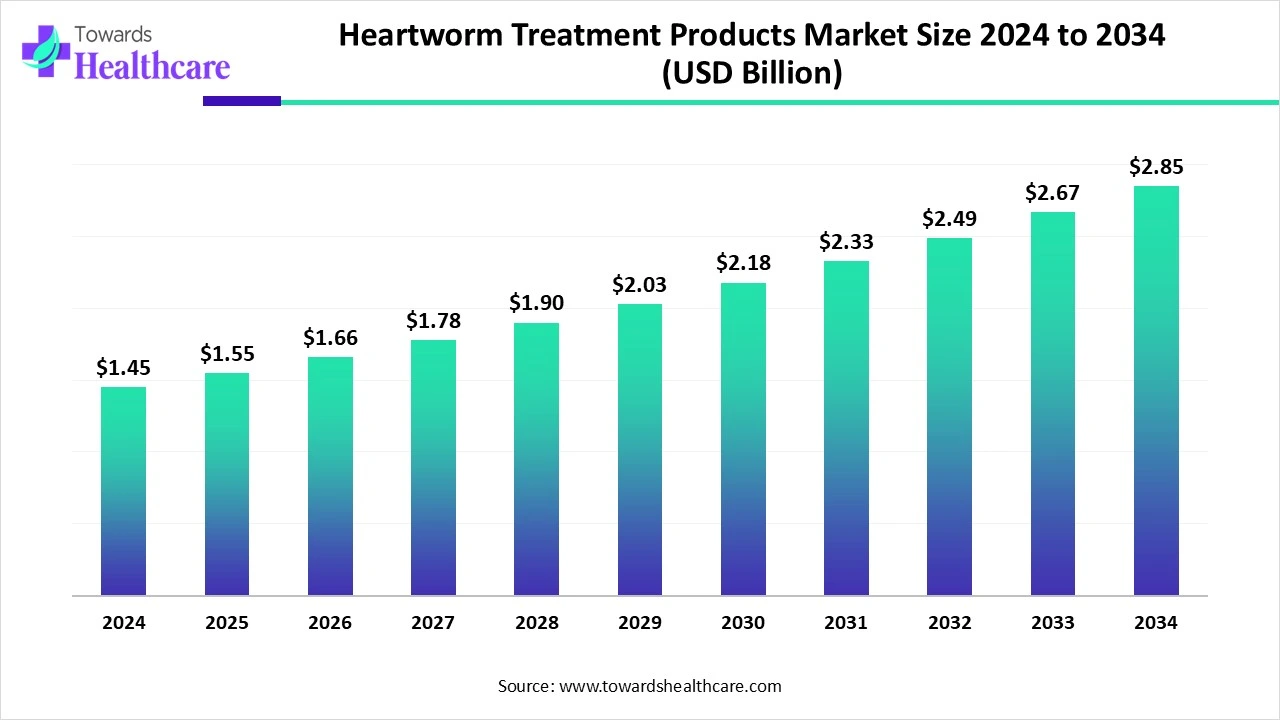

The global heartworm treatment products market size is calculated at US$ 1.45 billion in 2024, grew to US$ 1.55 billion in 2025, and is projected to reach around US$ 2.85 billion by 2034. The market is expanding at a CAGR of 7.04% between 2025 and 2034.

There is an expanding companion animal population, including dogs and cats are who are highly prone to heartworm diseases are boosting the growth of the global heartworm treatment products market. Along with this, the rapidly developing veterinary sector and specialized professionals are increasingly adopting sophisticated diagnostic tools to detect this issue early. Preventive measures, pet ownership, and high disposable incomes are assisting the widespread adoption of innovative heartworm treatment solutions and online emerging approaches, such as online pharmacies & e-commerce.

| Table | Scope |

| Market Size in 2025 | USD 1.55 Billion |

| Projected Market Size in 2034 | USD 2.85 Billion |

| CAGR (2025 - 2034) | 7.04% |

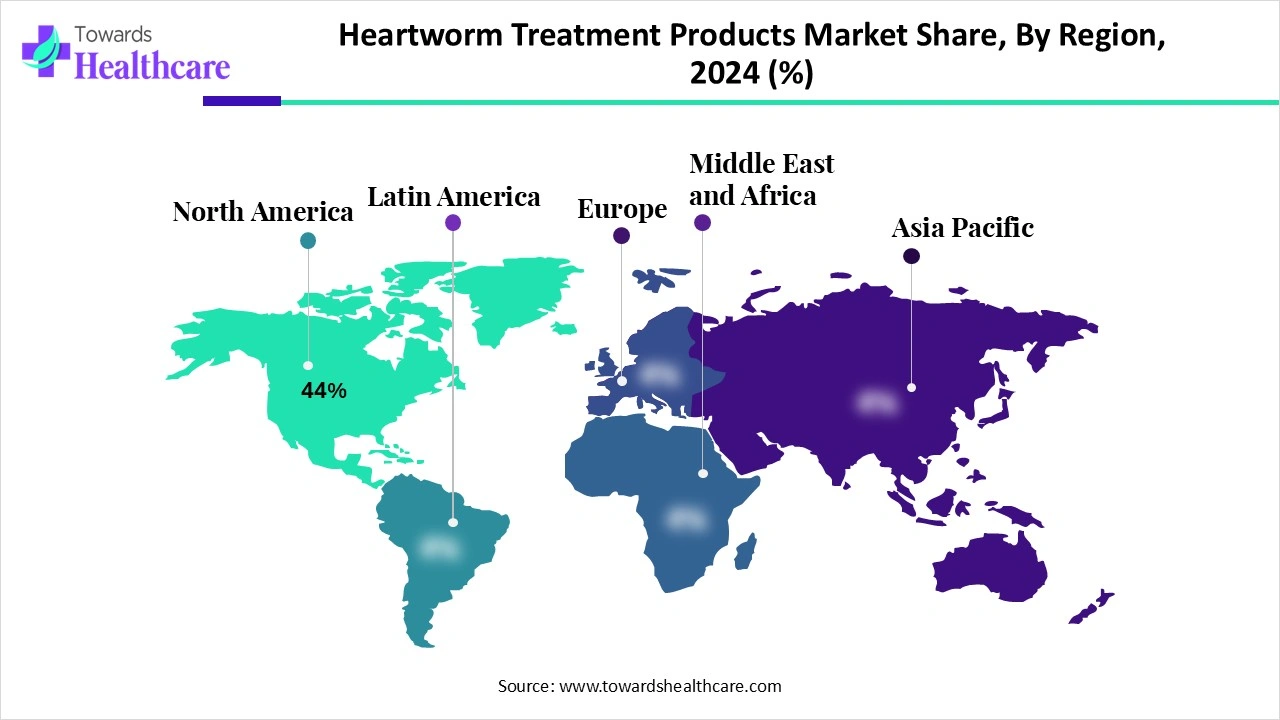

| Leading Region | North America 44% |

| Market Segmentation | By Product Type, By Animal Type, By Distribution Channel, By End User, By Region |

| Top Key Players | Zoetis Inc., Elanco Animal Health, Boehringer Ingelheim Animal Health, Merck Animal Health, Ceva Santé Animale, Virbac SA, Vetoquinol SA, Dechra Pharmaceuticals, Bayer Animal Health, Bimeda Inc., Norbrook Laboratories, Chanelle Pharma, Krka Animal Health, SavaVet (Sava Healthcare), Pharmgate Animal Health, Zydus Animal Health, Aurora Pharmaceuticals, Aratana Therapeutics, Kyoritsu Seiyaku, Provet Pharma |

The heartworm treatment products market covers the range of pharmaceuticals, biologics, and supportive therapies developed to prevent, manage, and cure heartworm disease, a parasitic infection caused by Dirofilaria immitis that primarily affects dogs, cats, and other companion animals. Rising pet adoption rates, growing awareness of zoonotic diseases, and increasing expenditure on companion animal healthcare are driving market growth. Preventive care is the largest revenue generator, as veterinarians emphasize early intervention and regular prophylaxis over expensive late-stage treatment.

Primarily, AI plays a major role in the development of novel molecules, with a wide range of improvements in the formulation and delivery of heartworm treatments. This can be done by analyzing data to enhance drug structure and delivery systems for robust efficiency and minimized side effects. Alongside AI-enabled models, especially deep learning, assist in the analysis of microscopic images to find heartworm larvae with increased accuracy. This further helps in automating a critical step in clinical trials, probably saving years of work.

Enhancement in Products and Disposable Incomes

In 2025, the rising pet ownership is accelerating the broader developments in products, including novel, increased efficacy, and safe active pharmaceutical ingredients (APIs) like macrocyclic lactones (e.g., ivermectin, moxidectin) impact the heartworm treatment products market growth. These developments further offer reliable measures for prevention. Nowadays, there is a rise in financial resources are allowing pet owners to higher expenditure on premium pet healthcare and wellness products, which expands the purchase of heartworm treatments.

Barriers to Awareness

In the development of the respective market, there is a major hurdle, especially a lack of awareness. It mainly comprises a general lack of understanding regarding heartworm disease, which restricts the demand for preventive and treatment products, mainly in underpenetrated markets.

A Progress in Diverse Products

The heartworm treatment products market will have various opportunities in the future, such as the advancements in combination products. As well as continuous technological advances are supporting online sales and e-commerce to provide convenient and broader availability for pet owners. Also, pet owners are stepping into the adoption of health-conscious choices, like natural and organic treatments. Moreover, smart dosing reminders and mobile health tracking can optimize customer engagement and treatment compliance.

In 2024, the preventive medications segment registered dominance in the market. The widespread usage of macrocyclic lactones (MLs), such as ivermectin, milbemycin oxime, and moxidectin, led to the preventive medications area. They possess high efficiency and safety in eliminating heartworm larvae before they mature. The broader activity of moxidectin, against other parasitic infections, like fleas, ticks, and intestinal worms, is also impacting the huge adoption of these kinds of products. Alongside the high-dose moxidectin formulations, like Proheart 12, that show strong activity against ML-resistant heartworm populations.

Although the adulticidal treatments segment is estimated to register the fastest growth during 2025-2034. The segment is primarily driven by a rise in cases and the economic impact of heartworm disease, the progression of the companion animal health sector. Immense contribution of adulticide, called melarsomine, is a major product, with protocols that comprise one or two injections to kill adult worms in the heart and pulmonary arteries. Recently, the American Heartworm Society (AHS) has developed a three-step protocol that combines a macrocyclic lactone (ML) and doxycycline as a pre-treatment for 2-3 months before melarsomine administration, aiming to gradually minimize the worm burden and enhance safety.

In the heartworm treatment products market, the dogs segment accounted for a major revenue share in 2024. A combination of several factors is driving this segment expansion, such as the growing pet ownership and the emerging owner awareness of parasite risks. As well as the greater susceptibility of dogs to heartworm disease, the proactive role of veterinary practices in recommending preventatives and regular testing is widely influencing the overall market growth. In the dog's critical infestations, mechanical removal of adult heartworms by employing retrieval devices (e.g., alligator forceps, basket retrieval devices) is another rigorous and more effective, and less invasive alternative to surgical removal.

Whereas the cats segment is predicted to expand rapidly during the predicted timeframe. Eventually, the factors, including urbanization and climate change, which boost mosquito populations that transmit the parasite among the cat population, are playing a crucial role in the broader adoption of the heartworm treatments. Besides this, the escalating efforts for quality life in cats, to improve their well-being, are also enhancing the application of these preventive and safe treatments. Moreover, the continuous research into the development of more efficient drug delivery methods, the application of doxycycline to decrease microfilaria (larvae) transmission, and the implementation of new therapeutic targets, especially the worm's metabolism and immune recognition, are fostering the overall growth.

By distribution channel, the veterinary clinics & hospitals segment held the biggest share of the heartworm treatment products market. As these areas offer detailed care, particularly including diagnostics and treatments, this raises patient visits and the demand for products within these respective facilities. Along with this, the well-trained veterinarians of these clinics are providing specialized expertise and are trusted by pet owners. This further enables more precise diagnosis and treatment plans, making them a preference for these required medications.

Eventually, the online pet pharmacies & e-commerce segment is anticipated to expand at a rapid CAGR. The vast adoption of e-commerce approaches is propelled by the emerging pandemic; the application of online platforms for pet products, specifically heartworm preventatives, has been highly purchased by consumers. Ongoing advancements in smart reminders and mobile pet health tracking are optimizing owner compliance and involvement in preventative treatments. These kinds of platforms widely offer same-day delivery and subscription-based services, which ultimately accelerate their adoption among pet owners to fulfill their essential needs faster.

In 2024, the pet owners segment registered dominance with the largest revenue share of the market. Along with the rising healthcare expenditure and awareness regarding heartworm concerns, there is a widespread pet owners are treat pets as family members. Additionally, they are emphasizing pet health and well-being, eventually expanding demand for preventive care like heartworm treatments. Also, these pet owners are working with a veterinarian due to the only approved drug to kill adult heartworms is melarsomine (Immiticide), which can be administered via injection in the vet's office.

However, the veterinary practitioners segment will register rapid expansion during 2025-2034. Involvement of wider advancements in diagnostic and treatment technologies, the vital role veterinarians play in prescribing and administering prescription medications, and a rise in the need for patient monitoring are fostering the market development. Nowadays, the comprehensive market is aiming at mechanical heartworm removal for severe concerns, novel non-arsenical treatments, such as moxidectin-doxycycline, and an enhanced focus on addressing heartworm resistance to MLs in some areas. They also recommend severely restricted activity for the complete treatment period to reduce the risk of complications from the death of adult worms.

In the heartworm treatment products market, North America accounted for the dominating market share 44% in 2024. This has occurred due to integrated factors, such as high pet ownership, strong veterinary infrastructure, and escalating preventive care adoption. Moreover, the significant recommendation given by the American Heartworm Society (AHS) on resistance barrier is a 12-month-a-year preventive schedule. This further assists in continuous coverage against larvae, mitigating their development into adult worms that are the toughest to treat.

For instance,

In the US, the participation of bodies like the Companion Animal Parasite Council (CAPC) and the AHS is suggesting continuous, year-round preventive use of macrocyclic lactone (ML) preventives, expanding the use of these products.

For this market,

Canada’s heartworm treatment products market is expanding due to the increasing R&D activities by companies in the animal health sector for the emergence of newer therapies and treatments. As well as developing robust diagnostic tools and methods are support the detection of heartworm infections as soon as possible.

In the upcoming years, the Asia Pacific will register the fastest growth in the market. The growing companion animal population, as well as a rise in awareness about parasitic diseases, are boosting ASAP’s heartworm treatment products market development. This further assists in raising veterinary services, including novel preventive and adulticidal approaches. Apart from this, ASAP’s seasonal changes and accelerating temperatures in the region are evolving more susceptible environments for mosquitoes that transmit heartworm, which ultimately results in greater incidence rates and enhanced demand for prevention and treatment.

For instance,

This mainly includes the discovery of potential active compounds, formulation development, robust clinical and laboratory testing to evaluate efficiency and safety for target species (dogs, cats, ferrets), and finally, regulatory approval and post-market surveillance, with ultimate guidance from organizations, especially the FDA and the American Heartworm Society.

Key Players: Merck Animal Health, Zoetis, Virbac, etc.

The heartworm treatment products market encompasses the distribution through manufacturers who are delivering drugs to licensed wholesalers and distributors, who then supply them to specialized veterinary hospitals and pharmacies.

Key Players: Vetraise Remedies, Pet Meds, Mars Petcare, Norway Veterinary Hospital, etc.

This can be fostered by broader veterinary consultation and diagnosis, treatment protocol, exercise restriction, preventive medication, and post-treatment care.

Key Players: Boehringer Ingelheim, Elanco Animal Health, Merial, etc.

By Product Type

By Animal Type

By Distribution Channel

By End User

By Region

January 2026

January 2026

January 2026

January 2026