February 2026

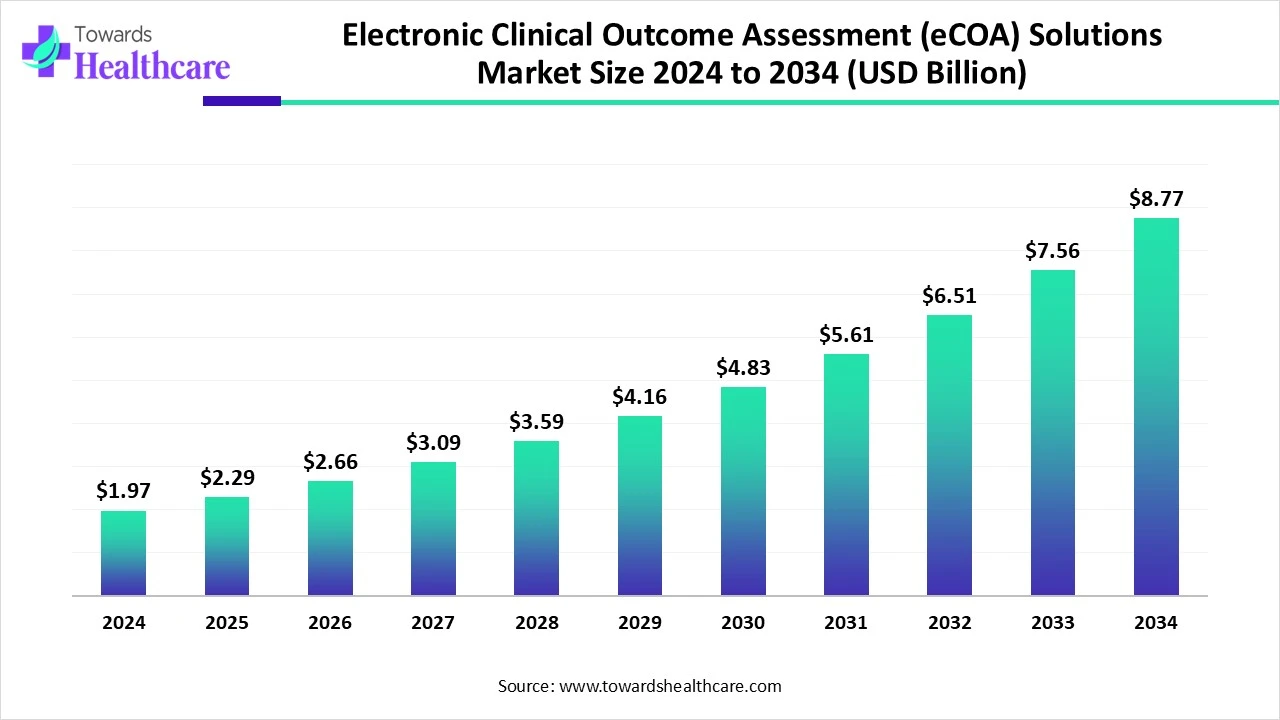

The global electronic clinical outcome assessment (eCOA) solutions market size is calculated at US$ 1.97 in 2024 billion, grew to US$ 2.29 billion in 2025, and is projected to reach around US$ 8.77 billion by 2034. The market is expanding at a CAGR of 16.04% between 2025 and 2034.

Ongoing numerous clinical trials for novel drug discovery used in chronic diseases, like cancer, neurological disorders, and other rare conditions, are fueling demand for advanced and efficient data collection and analysis approaches, such as eCOA solutions.

Moreover, the global electronic clinical outcome assessment (eCOA) solutions market consists of patient-reported outcomes (PRO), clinician-reported outcomes (ClinRO), observer-reported outcomes (ObsRO), and performance outcomes (PerfO), which are used for robust data collection and management. Whereas, the rising developments in digital health technologies, integration of eCOA solutions with wearable devices, and widespread transformation in AI algorithms are impacting overall market expansion.

| Table | Scope |

| Market Size in 2025 | USD 2.29 Billion |

| Projected Market Size in 2034 | USD 8.77 Billion |

| CAGR (2025 - 2034) | 16.04% |

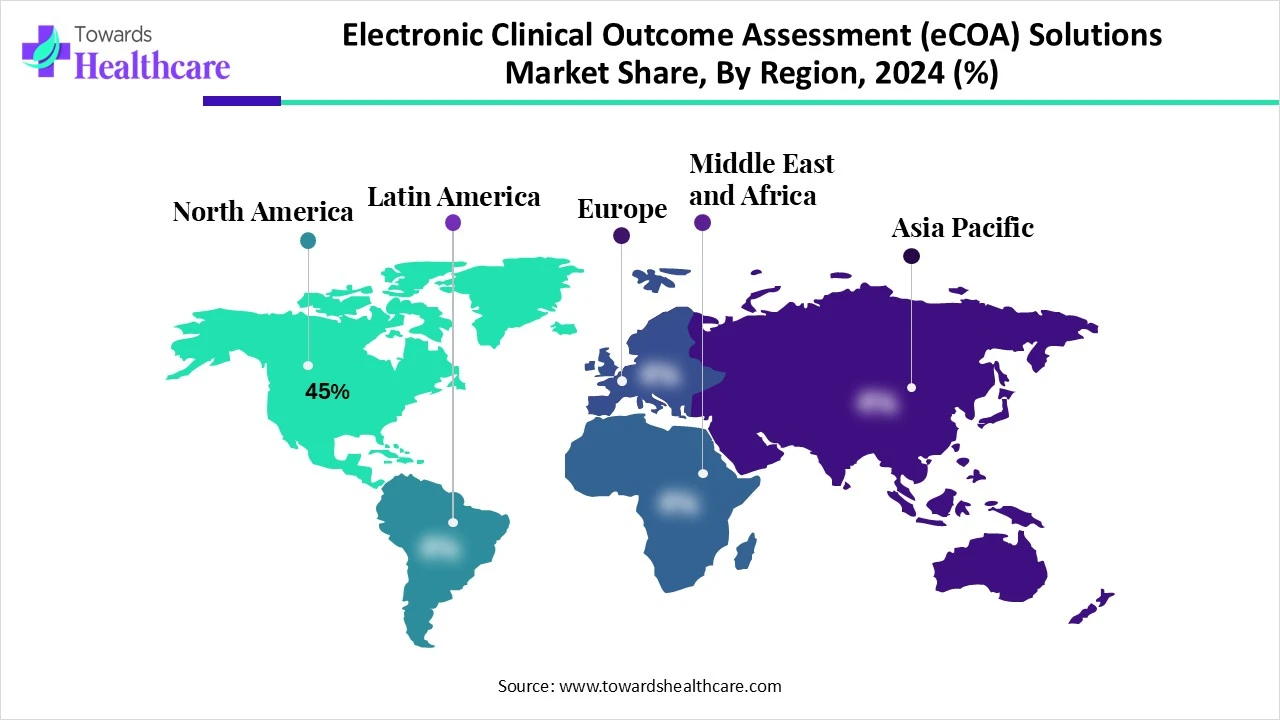

| Leading Region | North America Share 45% |

| Market Segmentation | By Product Type, By Deployment Mode, By End User, By Therapeutic Area, By Region |

| Top Key Players | Medidata Solutions, Oracle Health Sciences, ERT, CRF Health, Signant Health, Parexel International, IQVIA, ICON plc, Covance, BioClinica, Inc., Castor EDC, Veeva Systems, Clario, PHASTAR, Yprime, Datatrak International, Brady PLC, Complion, Greenphire, Science 37 |

The electronic clinical outcome assessment (eCOA) solutions market includes digital tools and platforms used to collect, manage, and analyze patient-reported outcomes (PRO), clinician-reported outcomes (ClinRO), observer-reported outcomes (ObsRO), and performance outcomes (PerfO) electronically during clinical trials and real-world studies. These solutions improve data accuracy, compliance, and patient engagement compared to traditional paper-based methods. The market is driven by increasing clinical trial complexity, regulatory emphasis on patient-centric data, and rising adoption of mobile health technologies.

In this era, AI has capabilities in improving trial efficiency and data quality with automated tasks, which further enhance patient engagement and offer real-time insights. By analyzing unstructured medical data for the identification of eligible patients, simplifying data validation, and even anticipating possible concerns in trial design or patient adherence, it accelerates its overall adoption in the market.

For instance,

A Major Emphasis on Patient-Oriented Healthcare

Across the globe, along with the rising chronic health issues are fueling demand for the development of patient-centric healthcare approaches. This results in facilitation of the collection of patient-reported outcomes (PROs) by eCOA solutions, which are important to understand the patient and treatment response. The electronic clinical outcome assessment (eCOA) solutions market is further experiencing several significant technological advances, such as a rise in the utilization of mobile health (mHealth) devices, like smartphones and tablets are also impacting the creation of a feasible platform for eCOA data collection.

High Cost for Security

While using novel technologies, one of the crucial challenges that arises is data security issues, which ultimately hinder the market expansion. Strong security solutions with regulations, including HIPAA (in the US) and GDPR (in Europe), are vital, but this can be expensive and complex to execute.

Enhancement in Decentralized Trials and Other Integrations

In the coming years, the electronic clinical outcome assessment (eCOA) solutions market will have vital opportunities in the decentralized clinical trials (DCTs). Alongside, eCOA allows remote monitoring with the provision of data collection outside conventional clinical settings. This further assists pharmaceutical companies that are looking for minimal expenditure and optimized patient recruitment and retention. Likewise, eCOA solutions will be integrated with wearable devices and the IoT to achieve consistent physiological data, offering a more comprehensive picture of patient health.

The ePRO (Electronic Patient-Reported Outcomes) segment was dominant in the electronic clinical outcome assessment (eCOA) solutions market in 2024. This segment has various benefits over the other types, such as directly focusing on a patient-centric approach, enabling real-time data collection. Additionally, its reduced errors and enhanced data quality are driving the segment expansion. These ePROs are widely used in tracking and reporting the severity and frequency of patients' symptoms. Besides this, in assessing patient satisfaction with their treatment regimen, ePROs have widespread significance.

However, the ePerfO (Electronic Performance Outcomes) segment is predicted to register the fastest growth during 2025-2034. The numerous advantages of this product type are impacting its development. Inclusion of its ability to boost accuracy, raise effectiveness, and accelerate patient engagement is fueling its incredible adoption. In the case of remote mode, ePerfO can be immensely employed, which allows trials to be conducted in a virtual mode and provides broader access to patients. Moreover, it leverages the data of a patient's gait speed, balance, or ability to climb stairs, which is involved in a clinical trial for a mobility-related treatment.

By deployment mode, the cloud-based segment led the electronic clinical outcome assessment (eCOA) solutions market in 2024 and is estimated to expand rapidly during the forecast period. As this mode omits the requirement for expensive hardware and local installations, this further enables scalable trials and minimized infrastructure expenses, particularly for large-scale studies, which mainly empower the adoption of this mode. Also, this mode possesses integration with other clinical trial systems, especially Electronic Data Capture (EDC) and Clinical Trial Management Systems (CTMS), which are evolving a unified data ecosystem and lessening data silos.

In 2024, the pharmaceutical & biotechnology companies segment held a major share of the electronic clinical outcome assessment (eCOA) solutions market. Due to the growing complexity of clinical trials, the need for robust data collection approaches is fueling the segment growth. Furthermore, drivers like variations in data collection methods, such as mobile devices (smartphones and tablets), web-based portals, and interactive voice response systems (IVRS), allowed in huge patient populations and trial designs, are influencing overall market expansion.

Although the medical device companies segment will register the fastest growth in the upcoming years. Different medical device companies are providing a comprehensive eCOA solution, including ePRO, eClinRO, and eObsRO, which is a major part of a widespread clinical trial technology platform. This further enhances focus on effectiveness, real-time insights, and regulatory documentation. Moreover, they are emphasizing the replacement of traditional paper-based methods by allowing electronic collection of patient-reported and other clinical outcome data in clinical trials.

The oncology segment registered dominance in the electronic clinical outcome assessment (eCOA) solutions market in 2024. Primarily, in quality of life assessments, eCOA is employed to offer insights regarding treatment effects on patients’ overall well-being. Alongside, it also supports monitoring medication adherence and other treatment-relevant behaviors, which further assist in examining the efficacy of interventions in cancer patients. Tools like Functional Assessment of Cancer Therapy (FACT) scales, MD Anderson Symptom Inventory (MDASI), Patient Reported Outcomes Measurement Information System (PROMIS), and European Organisation for Research and Treatment of Cancer (EORTC) questionnaires are widely used in the oncology domain.

The respiratory diseases segment is anticipated to expand rapidly during 2025-2034. The utilization of eCOA platforms in these concerns is allowing symptom recording, like coughing, wheezing, and shortness of breath, in real-time using electronic diaries, either on-site or remotely. In addition, customized eCOA for specific respiratory issues, such as asthma, COPD, cystic fibrosis, and pulmonary fibrosis, with related questionnaires and assessments, is highly propelling the segment expansion. Examples, like Vitalograph, with their COMPACT™ Medical Workstation and In2itive e-Diary, can collect eCOA data in the clinic and at remote mode, respectively. Further, this data, coupled with other respiratory endpoints, is handled through the Spirotrac software, centralizing data collection and analysis.

In the electronic clinical outcome assessment (eCOA) solutions market share by 45% in 2024, North America accounted for the biggest share in 2024. This region’s market is mainly driven by its highly developed research centers and supportive government and private sector investments in R&D. The US’s rigorous regulatory framework is focusing on the collection and application of patient-centric data, which further expands the demand for eCOA measures. Besides this, ongoing various drug development processes in this region are fueling the adoption of eCOA to simplify the data analysis by confirming compliance with regulations.

The U.S. has a robust hub of pharmaceutical and clinical companies that are highly innovative, novel candidates for emerging, diverse, and rare health concerns.

Across Canada, the growing awareness regarding innovative technologies and tools involved in data collection and analysis is driving this region’s market effectively.

During 2025-2034, the Asia Pacific will register the fastest growth in the electronic clinical outcome assessment (eCOA) solutions market. Eventually, the involvement of China, India, Japan, and South Korea in the development of pharmaceutical production and clinical research is generating major opportunities for eCOA providers. Numerous multinational corporations and contract research organizations (CROs) are accelerating their investments in the Asia Pacific region to expand drug discovery efforts. Alongside, contribution of increasing clinical research activities, including international multi-center trials, is also propelling the overall development.

• In December 2024, Harvest Integrated Research Organization (HiRO), a boutique global clinical research organization (CRO), collaborated with CHA University Bundang Medical Center (CBMC), a renowned medical institution in Seoul, South Korea, to deliver comprehensive solutions to global biotech and pharmaceutical companies across Phase I through Phase IV clinical trials.

In 2025, Europe is experiencing notable expansion in the electronic clinical outcome assessment (eCOA) solutions market. In this region, healthcare systems are highly adopting different digital health solutions, such as mHealth devices, cloud-based platforms, and integration with wearable devices, etc. This further assists in the effective data collection and management in clinical trials and healthcare provisions. Whereas the European Medicines Agency (EMA) and other regulatory bodies are promoting the use of eCOA tools to make clinical research feasible and escalate data quality.

This market’s R&D sectors are aimed at the development of innovative technologies, reshaping existing ones, and exploring newer applications for eCOA within the drug development lifecycle.

Key Players: IQVIA, Parexel, Syneos Health, and ICON,

These regulatory approvals are playing a critical role in the electronic clinical outcome assessment (eCOA) solutions market by providing guidance and requirements for eCOA implementation to ensure data quality, patient safety, and ethical conduct of trials.

Key Players: the U.S. Food and Drug Administration (FDA), EMA, and CDSCO (India), MHRA (UK), and PMDA (Japan).

The electronic clinical outcome assessment (eCOA) solutions market encompasses the provision of easy-to-use devices, intuitive interfaces, patient recruitment, and retention for patient support and services.

Key Players: Clariness, Curavit, Lindus Health, TrialSpark, and Continuum Clinical

By Product Type

By Deployment Mode

By End User

By Therapeutic Area

By Region

February 2026

February 2026

February 2026

February 2026