February 2026

The global gastrointestinal drugs market size is calculated at USD 40.21 in 2024, grew to USD 41.55 billion in 2025, and is projected to reach around USD 55.85 billion by 2034. The market is expanding at a CAGR of 3.34% between 2025 and 2034.

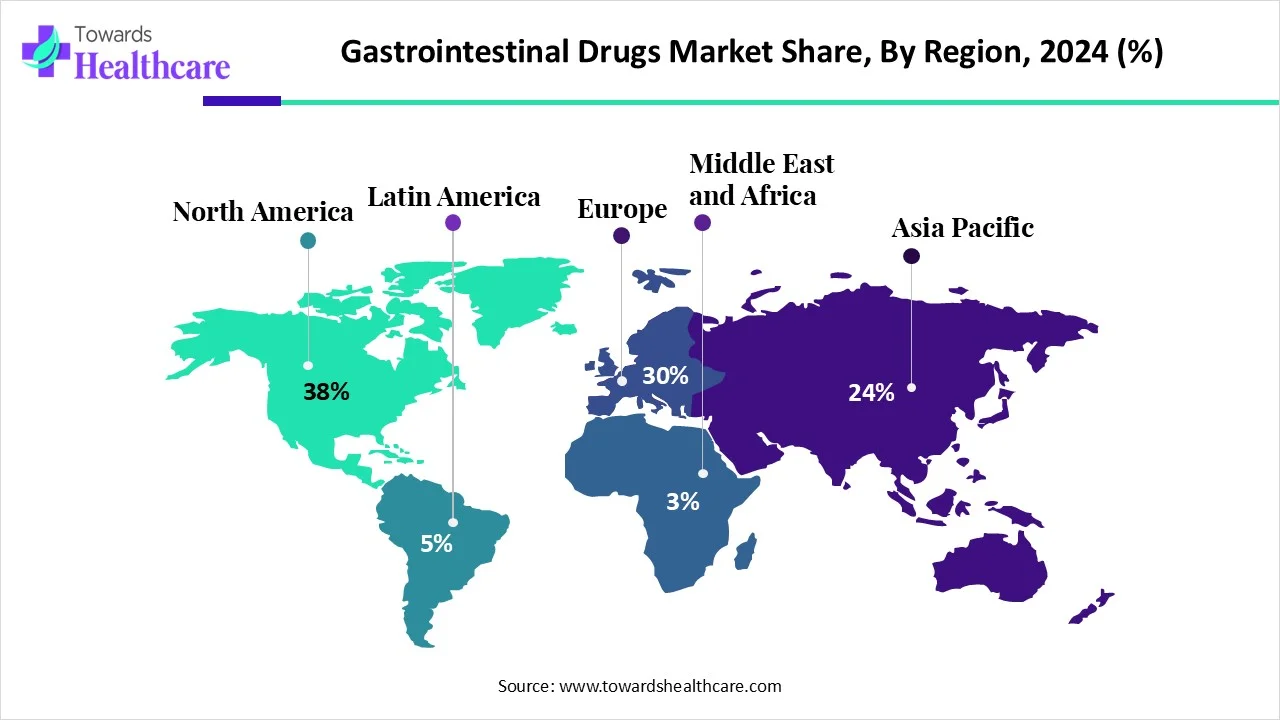

The gastrointestinal drugs market is rapidly expanding because of the increasing prevalence of gastrointestinal diseases such as ulcers, irritable bowel syndrome, acid reflux, and various other diseases. North America is dominated by increasing awareness, adoption of early diagnostic techniques, and a growing aging population. Asia Pacific is the fastest-growing region due to high healthcare spending, strong pharmaceutical infrastructure, and increasing healthcare-related issues.

| Metric | Details |

| Market Size in 2025 | USD 41.55 Billion |

| Projected Market Size in 2034 | USD 55.85 Billion |

| CAGR (2025 - 2034) | 3.34% |

| Leading Region | North America |

| Market Segmentation | By Type, By Drug Class, By Route of Administration, By Application, By Distribution Channel, By Region |

| Top Key Players | AbbVie Inc., AstraZeneca, Salix Pharmaceuticals, Takeda Pharmaceutical Company Limited, Pfizer Inc., Bayer AG, Abbott, Janssen Pharmaceuticals NV, Sun Pharmaceutical Industries Ltd., Cipla Inc., Gilead Sciences, Inc., Biogen, Organon Group of Companies |

The gastrointestinal drugs market is growing rapidly due to its applicability in a wide range of digestive system-related diseases, such as acid-related diseases, motility disorders, infections, and other applications like antiemetics and bowel preparation. Drugs for gastrointestinal symptoms and diseases contain prescription and nonprescription medication, conventional and unconventional agents, modest small molecules, complex macromolecules, and large recombinant proteins. These drugs are classified in different categories, like laxatives, proton pump inhibitors, and antacids, each category targeting particular symptoms and underlying causes.

AI integration in the gastrointestinal drugs drives the market growth as AI is rapidly being incorporated into advanced clinical practice and technology. Recently, AI-driven technology has become a significant tool for healthcare drug manufacturing. In the field of gastroenterology, AI-driven technology is a tool to assist in pathologic identification, diagnosis, and challenges stratification. Particularly, AI has become of great interest in gastrointestinal drug research as a technology with huge potential to revolutionize the practice of a modern gastroenterologist. This technology allows advancements in diagnostics, drug development, and personalized treatments, which causes the growth of the market.

Increasing Incidence of Gastrointestinal Diseases

The rise in gastrointestinal diseases is linked to excessive caffeine, alcohol, smoking, and a growing intake of fatty and spicy foods. While the virus isn't the direct cause of these issues, the pandemic's stress impacts the digestive system. Additionally, aging is an inevitable factor that contributes to gastrointestinal conditions. As we get older, digestive glands naturally become less active, which can result in problems such as reduced gut motility, reflux, and digestive issues. The likelihood of developing certain gastrointestinal cancers also increases with age, contributing to the expansion of the gastrointestinal drugs market.

Challenges in Gastrointestinal Drugs

Challenging the human gastrointestinal tract is complex and has several physiological barriers that impact drug delivery. Among these challenges are poor drug stability, low drug solubility, and limited drug permeability across the mucosal barriers, which restricts the growth of the gastrointestinal drugs market.

Recent Advancements in Prebiotics and Probiotics

Prebiotics and probiotics are known to positively influence the gut microbiome, highlighting their potential advantages for gastrointestinal (GI) conditions. However, providing clear public recommendations for these dietary supplements has been challenging due to the considerable variation in strains, doses, and treatment durations explored in various studies, alongside safety concerns about administering live organisms. Probiotics may help shape intestinal microbiota, potentially aiding in the management of various bowel diseases and enhancing overall wellness, which opens up opportunities for growth in the gastrointestinal drug market.

By type, the branded segment dominated in the gastrointestinal drugs market in 2024, as these drugs have a high level of trust among consumers. Because branded drugs undergo wide-ranging clinical trials and have been proven to be effective and safe, patients feel confident that they are receiving the highest-quality possible treatment and management for their condition.

The generic segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as generic drugs offers many advantages, such as affordability, enlarged accessibility, therapeutic equivalence, and truthful quality and safety. By selecting generic drugs, patients can access cost effective treatments without compromising on safety or efficacy. The availability of generic drugs increases treatment options in the healthcare systems.

By drug class, the biologics/biosimilar segment is dominant in the gastrointestinal drugs market in 2024, and is anticipated to expand at the fastest rate during the projection period, as biologics/biosimilars improve gut problems and bring about and maintain remission in patients with moderate to severe gastrointestinal disorders. They are exactly targeted at the factors responsible for the condition. It also effectively controls chronic pain and inflammation, avoiding the requirement for corticosteroids. Biologics/biosimilars are cost-effective compared with the originator drug, which will benefit health care.

By route of administration, the injectable segment is dominant in the gastrointestinal drugs market in 2024, as gastrointestinal injectables have a significantly enhanced rate of absorption compared to other administration methods. By avoiding the first-pass metabolism, the therapeutic substances directly reach the intended site, confirming efficient and rapid absorption. Gastrointestinal injectables provide targeted delivery of therapeutic drugs, allowing healthcare professionals to administer medications to the affected areas.

The oral segment is expected to fastest-growing over the forecast period 2025 to 2035, as it is the most chosen route by patients, due to its benefits, like simplicity of use, non-invasiveness, and suitability for self-administration. Its formulations are designed to enhance drug delivery to a particular site in the upper or lower gastrointestinal tract.

By application, the Crohn’s disease (CD) segment is dominant in the gastrointestinal drugs market in 2024, as these disorders can also occur at any age and are becoming more common in the world. Crohn's disease has no exact cause. Researchers speculate that the recent rise is related to industrialization and a Western-style meal, rich in meat and highly processed foods, which is a rising demand for effective treatments, increasing the need for gastrointestinal drugs.

The ulcerative colitis (UC) segment is expected to fastest-growing over the forecast period 2025 to 2035, as ulcerative colitis raises challenges of developing other diseases that may require early treatment and monitoring. Ulcerative colitis treatment generally includes either drug therapy or surgery. Various categories of medicines are effective in managing symptoms of ulcerative colitis. The treatment type is based on the severity of the condition. The aim of treatment in UC is the fast induction of a steroid-free remission and the prevention of complications of the disease itself.

By distribution channel, the retail pharmacies segment is dominant in the gastrointestinal drugs market in 2024, as retail pharmacies play a significant role in medical care by offering convenient access to drugs, a broad range of products, and additional appreciated services. Retail pharmacies provide a familiar environment for patients, providing health consultations and immunizations. Retail pharmacies are an important part of healthcare systems and, in major countries, are responsible for providing a large proportion of health products and related services.

The online pharmacies segment is expected to grow at the fastest CAGR over the forecast period, as it provides many benefits such as competitive pricing, discounts, and generic replacements, leading to potential expense savings for patients. This affordability is predominantly relevant for those with chronic conditions who need long-term medication. It also provides a widespread database of medication information, offering both healthcare professionals and patients access to detailed drug profiles, possible side effects, and appropriate precautions.

North America is dominant in the gastrointestinal drugs market share by 38% with the largest revenue share, due to the growing gastrointestinal disease burden in the United States is substantial, increasing, and associated with health mortality and disparities. In North America, gastrointestinal infections include a wide range of gastrointestinal diseases. These diseases include inflammatory bowel disease, such as ulcerative colitis, Crohn's disease, irritable bowel syndrome (IBS), gastrointestinal cancer, gastritis, and acute diarrhea, which contribute to the growth of the gastrointestinal drugs market.

For Instance,

In the United States, GI-associated disorders are estimated to affect around 60 to 70 million people annually, which increases the demand for gastrointestinal drugs. Strong presence of key players such as Boston Scientific, Medtronic, Olympus Corporation, Oshi Health, Gastro Health, and many others drives market growth. Increasing regulatory approval for various GI drugs, as in 2023, the US Food and Drug Administration approved five new gastrointestinal targeted drugs, including for GERD, IBD, and colonoscopy prep, such as Vonoprazan, Upadacitinib, Etrasimod, mirikizumab-mrkz, and Suflave Colonoscopy Prep, which contributes to the growth of the market.

Canada’s medical care field is increasing with opportunity, fueled by an aging population, growing prevalence of chronic diseases requires strong government investment. Therefore, increasing spending towards preventive and chronic care programs ultimately leads to enhanced health and well-being at an affordable cost, which drives the market growth.

For Instance,

The Asia Pacific region is projected to experience the fastest growth in the gastrointestinal drugs market during the forecast period, due to the growing prevalence of GI-related diseases, smart healthcare infrastructure, increasing awareness about early diagnosis and treatment, and rising government initiatives to help healthcare advancements. An increase in the number of gastrointestinal trials in the Asia Pacific last decade has driven market growth. Several Asia Pacific firms are specializing in manufacturing GI products to meet growing demand. Jinshan Science and Technology Co. (Chongqing, China) is one such company that has produced several notable capsule endoscopy systems, which contribute to the growth of the gastrointestinal drugs market.

In China, a growing number of people with paying more attention to their digestive system health, and a growing income so people to afford advanced healthcare services. Also, increasing government initiatives and projects related to gastrointestinal drug manufacturing. For Instance, China initiated the Gastrointestinal Health Index project to improve prevention and control efforts for digestive system diseases and enhance the monitoring ability.

In India, growing government healthcare initiatives, Programs as Ayushman Bharat and Rashtriya Swasthya Bima Yojana, are intended to provide health coverage to the financially weaker sections of society. Increasing income levels, an ageing population, growing health awareness, and a transformative attitude towards preventive healthcare are estimated to increase healthcare services demand, which contributes to the growth of the market.

Europe is expected to grow significantly in the gastrointestinal drugs market during the forecast period, as Europe’s growing focus on onshoring and manufacturing older, generic medicines is an approach at odds with the EU’s long-term industrial policy aims, which help in manufacturing advanced gastrointestinal drugs. Europe’s leading hubs for manufacturing and R&D are Belgium, Germany, and Ireland.

In March 2025, Tony Wood, Chief Scientific Officer, GSK, “The approval of Blujepa is a crucial milestone with uUTIs the most common infections in women. We are proud to have developed Blujepa, the first in a novel class of oral antibiotics for uUTIs in nearly three decades, and to bring an additional option to patients given recurrent infections and increasing rates of resistance to existing treatments.” (Source - GSK)

By Type

By Drug Class

By Route of Administration

By Application

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026