December 2025

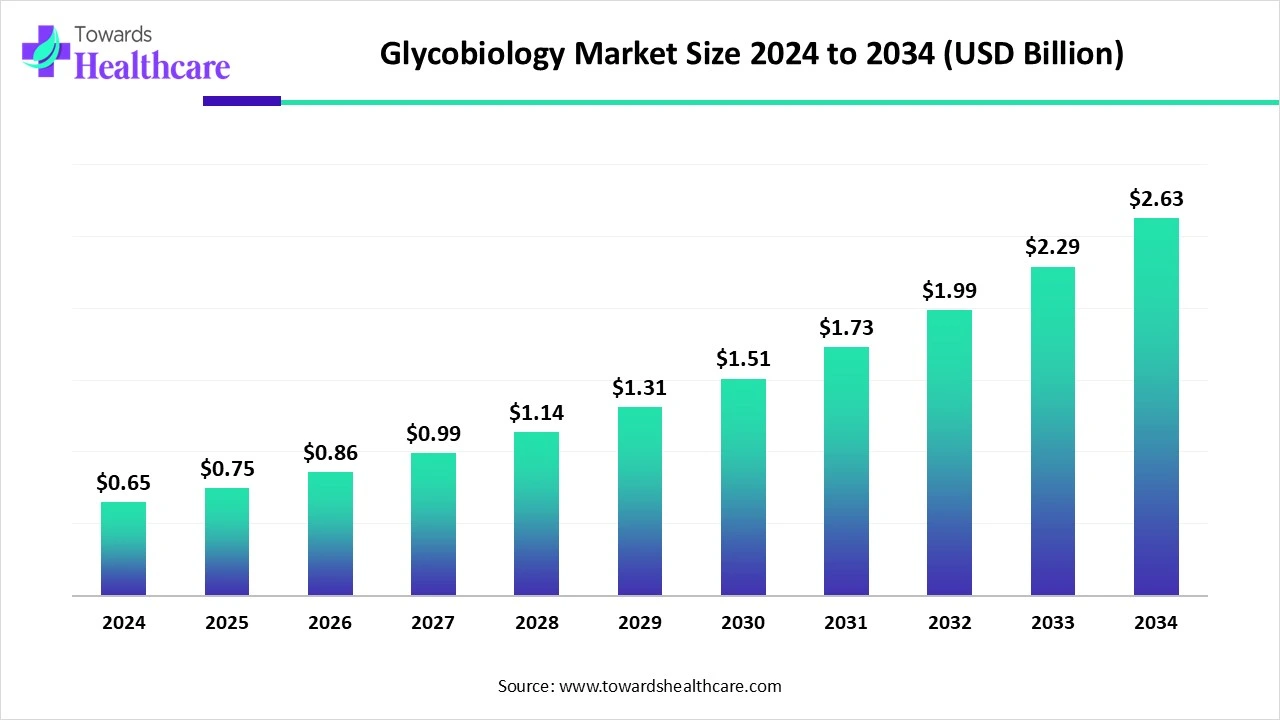

The global glycobiology market size is calculated at US$ 0.65 billion in 2024, grew to US$ 0.75 billion in 2025, and is projected to reach around US$ 2.63 billion by 2034. The market is expanding at a CAGR of 14.91% between 2025 and 2034.

Around the world, the growing burden of cancer and autoimmune disease cases is driving demand for the emergence of novel research activities to develop glycan-based therapies. This helps in the development of drug discovery and precision medicine. Moreover, in the world, many countries and their governments are encouraging initiatives, funding, and other private investments in the research & development area for innovations in biomarker discovery, diagnostic tools. As well as rising advancements in analytical techniques, including glycan microarrays, high-resolution mass spectrometry, and bioinformatic tools, are propelling the global glycobiology market expansion.

| Metric | Details |

| Market Size in 2025 | USD 0.75 Billion |

| Projected Market Size in 2034 | USD 2.63 Billion |

| CAGR (2025 - 2034) | 14.91% |

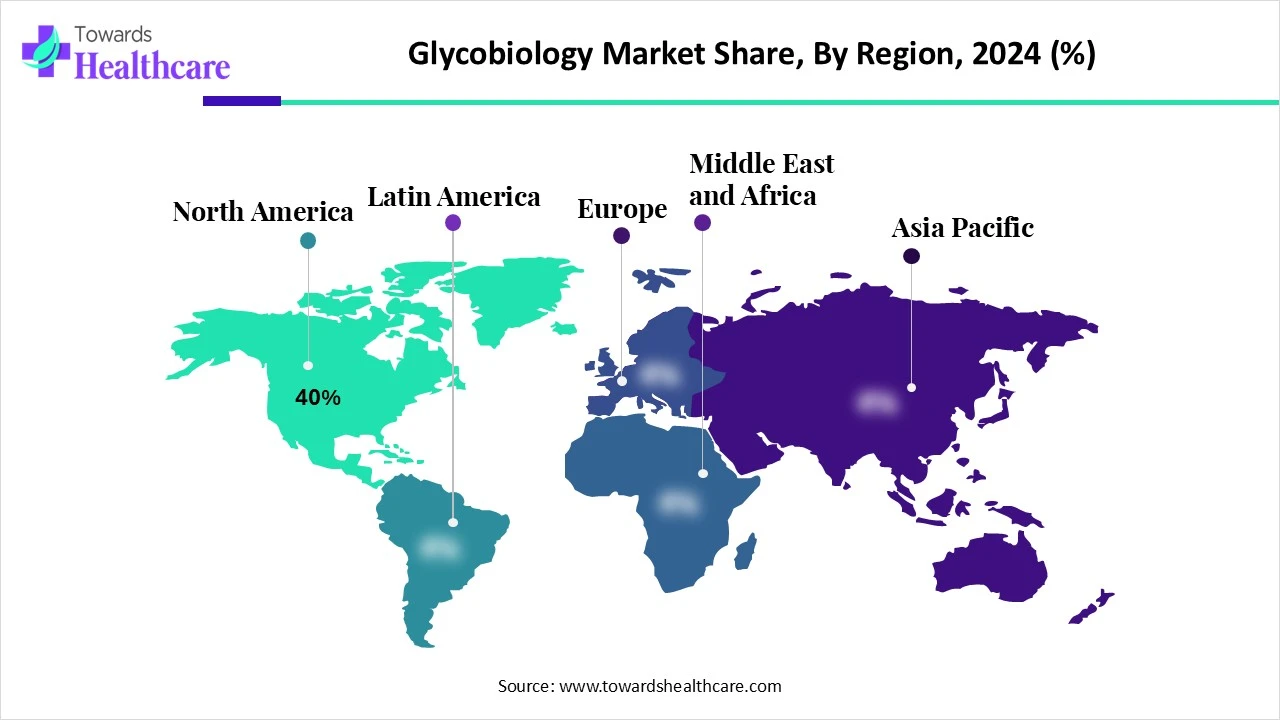

| Leading Region | North America share by 40% |

| Market Segmentation | By Product & Service, By Technology, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Merck KGaA (Sigma-Aldrich), New England Biolabs, Promega Corporation, Vector Laboratories, Ludger Ltd., ProZyme (Shimadzu & Agilent JV), Elicityl SA, Oxford GlycoSciences (OGS), Qiagen, Bruker, JEOL Ltd., Genovis AB, Takara Bio, Sartorius AG, Analytik Jena, MilliporeSigma (Merck), Carbios |

The glycobiology market (also referred to as Glycomics Market) covers technologies, instruments, enzymes, kits, and bioinformatics tools used to study and manipulate glycans, complex carbohydrates attached to proteins and lipids. Glycobiology enables the profiling of glycans, the discovery of biomarkers, the identification of therapeutic targets, and the glycoengineering of biologics. Applications span drug discovery, diagnostics, precision medicine, and glycan-based therapeutics. Nowadays, this market is focusing on breakthroughs in bioseparation resin technology, collaborations for drug discovery, and strategic investments in research centers.

AI is playing a vital role in the market, due to a surge in investments and funding in startups, and developed companies are acquiring AI for research and development. Also, consistence advancements in AI technologies, like its algorithms, computational power, and data analysis techniques, are boosting the adoption of AI in the expanding market. These AI algorithms, coupled with machine learning and network-based models, assist in the analysis and estimation of glycan structures and their interactions, comprising proteins and other biomolecules. As well as AI tools can be employed in drug discovery processes and the development of personalized glycomics.

Accelerating the R&D Area and Innovations in Technologies

The glycobiology market is experiencing major growth is fueled by a raised focus on biomedical research activities, including recognition of the role of glycans in numerous diseases, such as autoimmune disorders, cancer, and infectious diseases. Along with this, many pharmaceutical and biotechnology companies are actively investing in this R&D to make novel discoveries and applications in drug development and diagnostics. Moreover, crucial innovations in glycan microarrays, high-resolution mass spectrometry, and bioinformatic tools are also driving the overall market expansion.

The Expense of Equipment and Reagents

Primarily, ongoing glycomics research activities require highly advanced instruments, especially mass spectrometers and high-performance liquid chromatography (HPLC), with specialized reagents in the analysis of glycans are impacting the complete expenditure of the R&D process, which leads to a major hindrance to market growth. Also, the complexity of glycan structure is creating another barrier for various research activities.

Combined Applications in Glycomics Research and Drug Discovery

In the upcoming years, the glycobiology market will give rise to many opportunities in research, particularly in technological advancements in glycomics instruments, associated with enhanced research funding. Furthermore, the use of this research will widely influence the understanding of protein folding, stability, and transport, making it important for drug discovery and development. As glycan can be highly employed in viral infections like COVID-19, there is a new opportunity for vaccine R&D.

By product & service, the reagents & kits segment held the largest share of the market in 2024. Mainly, the segment is driven by its benefits, like convenience, ease of use, and standardized solutions, in research and clinical approaches. Also, the growing advancements in glycobiology research, including innovations in glycan analysis, modification, and utilization, are immensely demanding for these reagents and kits to streamline the process.

Whereas, the glycoengineering & synthesis services segment is predicted to grow rapidly, due to emerging demand for biologic therapeutic products, such as antibodies, are rely on glycosylation for their efficacy and stability, in which glycoengineering is used to achieve improvements in proteins with accelerated results. Besides this, researchers are expanding cell line engineering by incorporating CHO cells, are enables the production of glycoproteins with desired glycosylation patterns. Alongside, advances in synthetic chemistry and enzymatic methods are boosting the glycoengineering segment by enhancing the production of specific glycans and glycan-containing molecules for research and therapeutic development.

In 2024, the mass spectrometry-based glycomics segment was dominant, due to its advantages, including efficient and high-throughput glycan analysis in drug discovery and development. This advantage helps in the screening of massive samples. Along with this, the contribution of novel developments, like time-of-flight and Orbitrap hybrids, supports the coupling of speed and high mass precision with reduced detection cycles and progressing glycan analysis.

However, the glycan microarrays & lectin arrays segment is anticipated to grow fastest, with its variety of advancements, such as faster and effective analysis of many glycan-binding protein interactions, with enhanced detection and analysis of glycan biomarkers. These tools are increasingly applied in several applications, particularly for the study of glycan-binding specificities, disease-associated antibodies, microbe-carbohydrate interactions, and the activity of glycan-processing enzymes.

The biopharmaceutical development & QC segment led the glycobiology market. Because of rising government initiatives, private investments, and partnerships among academia and industry are propelling research in glycobiology and glycans. Moreover, increasing demand for the development of diverse biopharmaceutical products, like therapeutic antibodies, vaccines, and diagnostics, is acting as a significant driver for this segment.

And, the biomarker discovery & diagnostics segment will register a rapid expansion. The contribution of factors, such as the growing significance of glycomics in tailored medicine by offering data regarding disease subtypes, stages, and treatment responses based on individual glycosylation patterns, is majorly impacting segment growth. Additionally, advances in glycan analysis, especially in glycan microarrays, mass spectrometry, and lectin-based assays, have increased the detection specificity of glycan-based biomarkers. Also, high-throughput glycomic profiling plays a coupled role in clinical applications.

In 2024, the pharmaceutical & biotechnology companies segment dominated the market. Emergence of significant investments in R&D sectors of glycomics and glycobiology by numerous pharmaceutical and biotechnology companies is boosting developments in analytical techniques, platforms, and the evolvement of novel glycan-based candidates. On the other hand, in the case of drug discovery approaches, especially in targeted therapies and drug delivery systems, these companies are showing interest, which ultimately results in their expansion.

Although the contract research organizations (CROs) segment will expand rapidly, with an accelerating outsourcing trend, due to growing expenses and complexity of in-house drug development in pharmaceutical and biotechnology companies, this will help in different stages of the R&D process for CROs, like those specializing in glycobiology. Along with this, CROs offer assistance in many preclinical and clinical studies, relevant to glycan analysis, glycomics studies, and glycobiology-based therapies.

North America experienced dominance in the market by capturing the biggest share by 40% in 2024. Mainly impacting factors are a strong biopharma R&D and sequencing centers are increasingly fueling innovations and research approaches in the glycomics sector. As well as this region is immensely involved in the breakthroughs in analytical techniques, computational tools, and systems biology approaches are providing a robust understanding of glycan structures and their functions, impelling innovation in the field.

The U.S. government is putting efforts into initiatives and funding programs, such as NIH's Glycoscience program, which widely encourages the glycobiology R&D process. Besides this, among the U.S. public, rising preference towards technologically advanced products and services in the healthcare and pharmaceutical sectors, prompting market leaders to develop and expand their services.

For instance,

Canada possesses a major expansion of biotechnology areas with raised understanding of the possibilities of glycans in drug discovery, diagnostics, and biomarker development, resulting in more focused research and product development. Along with this, the Canadian government is also fostering innovations in the development of targeted therapies, personalized treatments, which ultimately impact the adoption of glycomics and the growth of the market.

During the forecast period, Asia Pacific will show the fastest expansion, due to the presence of strong biotechnology hubs in China, India, and Japan. Alongside, ASAP is increasingly promoting investments in biotechnology and life sciences in these countries, which are driving the expansion of research activities, raising awareness about the importance of glycans in disease diagnosis and drug development. Leading companies, such as Thermo Fisher Scientific, RayBiotech, New England Biolabs, and Agilent Technologies, are actively involved in the Asia Pacific market.

Generally, China’s National R&D programs like the National High-Tech R&D Program and the National Basic Research Program are contributing as a major growth factor in the market and lead to expansion in emerging innovations in the life science area. Moreover, China is focusing on improvements in healthcare facilities and research operations, which further drives demand for novel glycobiology technologies and applications.

In India, growing cases of chronic health issues, especially cancer and autoimmune diseases, are propelling the expansion of research in glycobiology for the development of optimized therapies. For this R&D operations, the Indian government is also supporting to boost bioeconomy with a rising aim at innovations in customized medicine, disease diagnostics, and overall drug discovery development process.

Eventually, Europe will grow at a significant CAGR, with rising interest in glycans for drug development and treatment of chronic diseases, and with accelerating efforts in the R&D process by certain biotechnology companies. This will assist in grasping glycomics for therapeutic interventions, diagnostic tools, and biomarker discovery. The presence of sophisticated analytical technologies in Europe is fueling the improvements in personalized medicine, where glycan-based biomarkers are used for disease diagnosis, prognosis, and drug development.

In the UK, widespread developments in glycomics technologies, particularly mass spectrometry and bioinformatics, are increasingly assisting researchers in the assessment of complex glycan structures with enhanced accuracy and effectiveness. This will further boost novel breakthroughs in the detection of glycan biomarkers and the progress of glycan-based therapies. Also, the UK’s powerful biomedical research ecosystem and alliances with international institutions will highly contribute to the overall market development.

Mainly, raised automation in Germany is supporting the expansion of synthesis of glycans, as well as the emergence of microfluidics-based systems are allowing high-throughput glycan analysis. This will also encourage the development of novel diagnostic tools. Besides this, the adoption of integrated artificial intelligence and the Internet of Things (IoT) is providing real-time monitoring and smarter data assessments in glycan analysis workflows.

By Product & Service

By Technology

By Application

By End User

By Region

December 2025

November 2025

November 2025

November 2025