January 2026

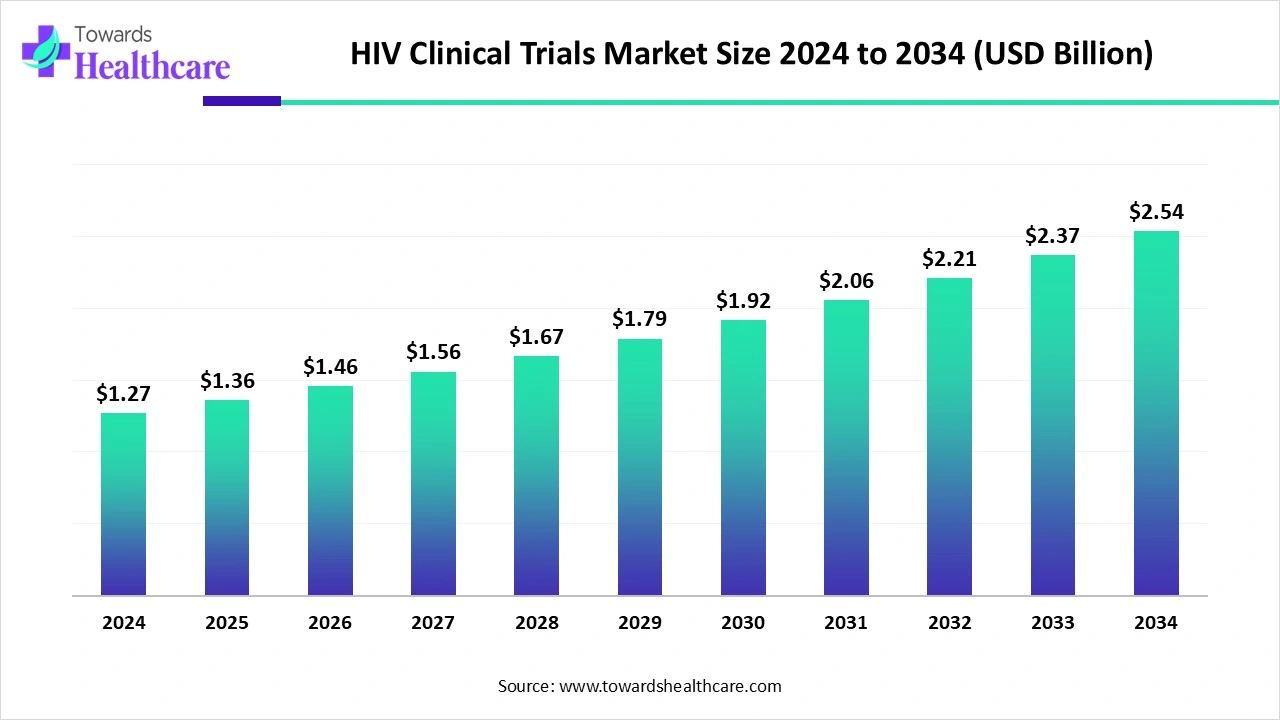

The global HIV clinical trials market size is calculated at US$ 1.27 billion in 2024, grew to US$ 1.36 billion in 2025, and is projected to reach around US$ 2.54 billion by 2034. The market is expanding at a CAGR of 7.17% between 2025 and 2034.

The global HIV burden is increasing, which is enhancing the demand for new treatments and prevention options. This is increasing the number of innovations and collaborations, leading to a rise in the clinical trials for HIV treatment and prevention. AI is also being used to enhance the workflow of clinical trials. Moreover, the growing R&D and government funding are promoting HIV clinical trials in different regions. Additionally, the companies are actively participating in these trials with their new candidates. Thus, these growing advancements are promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 1.36 Billion |

| Projected Market Size in 2034 | USD 2.54 Billion |

| CAGR (2025 - 2034) | 7.17% |

| Leading Region | North America |

| Market Segmentation | By Trial Phase, By Therapeutic Modality/Intervention Type, By Sponsor Type, By Region |

| Top Key Players | Gilead Sciences, ViiV Healthcare, GlaxoSmithKline (GSK), Janssen Pharmaceuticals (Johnson & Johnson), Merck & Co. (MSD), Pfizer, Bristol-Myers Squibb, AbbVie, Sanofi, Moderna, BioNTech, Novavax, Sangamo Therapeutics, IQVIA, ICON plc |

The HIV clinical trials market comprises all clinical research activities (interventional and observational) conducted to discover, develop, evaluate, and validate therapies, prevention strategies, vaccines, diagnostics/biomarkers, and potential cures for Human Immunodeficiency Virus (HIV). It covers trials across all phases (Phase I → Phase IV), across modalities (small molecules, biologics, long-acting formulations, gene and cell therapies, vaccines), and across sponsor types (big pharma, biotech, CROs, academia, governments, NGOs, and PPPs). The market includes site-based, multicenter, decentralized/virtual, and real-world studies and is driven by scientific advances (long-acting agents, gene editing, mRNA/vaccine platforms), global public-health funding, and demand for improved prevention, treatment, and cure strategies.

Growing innovations: Due to a growth in the HIV incidences, there is a rise in the demand for HIV prevention and treatment approaches. This, in turn, is leading to their growing innovations, driving the clinical trials. Moreover, new collaborations are also being formed to accelerate these developments and clinical trials.

For instance,

AI plays an important role in HIV clinical trials in recruiting suitable participants. This, in turn, helps in enhancing the speed and quality of the recruitment process. With the use of AI models, the progression of HIV, as well as the drug responses, can be identified. Additionally, it can analyse the HIV mutations and transmission pathways. It also helps in accelerating the drug development process and promotes clinical trials. Moreover, it can also be used for monitoring the drug effects in clinical trials for early detection of side effects. It also helps in optimizing the trial designs.

Growing Demand for HIV Preventive Therapies

Due to growing incidences of HIV, the demand for preventive therapies is increasing. This, in turn, is increasing the development, which is leading to multiple clinical trials. Different types of PrEP, injectables, microbicides, gene therapies, etc, are being developed. Therefore, the clinical trials are being conducted to evaluate their safety and efficacy. Similarly, novel nanomedicines and antibodies are also being developed. Moreover, the companies are investing in their innovation to develop treatments that can eliminate HIV. Thus, this is driving the HIV clinical trials market growth.

Regulatory Barriers

The HIV clinical trials are time-consuming, which in turn requires documentation of every step for their approval. At the same time, for initiating their trials, it is necessary to navigate the regulatory standards of the respective countries. The changes in the regulation can delay the trial. Moreover, the cost of the trials also increases depending on their time period. Thus, this can limit the innovations of HIV treatment approaches.

Growing HIV Vaccine Development

There is a rise in the vaccine development to prevent HIV incidences. Multiple candidates are being developed and are in clinical trials, which in turn is encouraging their development. Moreover, clinical trials are also being conducted on mRNA and vector-based vaccines. This, in turn, is encouraging the development of antibodies or protein-based vaccines as well. Additionally, new platforms are also being developed to accelerate their development. Thus, this is increasing the clinical trials of HIV, which in turn are supported by the funding of the government and private sectors. Hence, this is promoting the HIV clinical trials market growth.

For instance,

By trial phase type, the phase III segment held the dominating share of the market in 2024, as it focuses on the safety and efficacy of the drugs. The HIV candidates were also tested for their side effects in this phase. Moreover, this data was crucial for their approval. Thus, this enhanced the market growth.

By trial phase type, the phase II segment is expected to be the fastest growing at a notable CAGR during the forecast period. Due to growing innovations, there is a rise in Phase II clinical trials. Moreover, these activities are also being supported by funding from various sources. Additionally, it is less costly than other phases.

By therapeutic modality/intervention type, the small-molecule antiretrovirals segment led the market in 2024, because of their oral route of administration. These drugs provided enhanced efficacy in reducing HIV replication. Additionally, they were widely available and affordable. This increased their adoption rates.

By therapeutic modality/intervention type, the gene therapy & genome editing segment is expected to be the fastest growing during the forecast period. These modalities can provide potential cures for HIV. They also offer target-specific action on HIV-infected cells, reducing the side effects. This, in turn, is increasing their development and use.

By sponsor type, the big pharma/industry sponsors segment held the largest share of the market in 2024, due to their growing HIV research and development. At the same time, they are investing in promoting the development of HIV candidates as well as trials. Additionally, they also offer regulatory expertise and advanced technologies for enhancing the trials. This contributed to the market growth.

By sponsor type, the biotech/small-cap sponsors segment is expected to be the fastest growing during the forecast period. These sponsors are focusing on developing new therapies for HIV treatment. This, in turn, is increasing their clinical trials. Moreover, their growing collaboration is also increasing their development.

North America dominated the HIV clinical trials market in 2024. North America consists of a well-developed research and development infrastructure, which in turn has enhanced the HIV clinical trials due to growing innovations. These trails were also supported by government funding as well as investments from the private sector. Thus, this contributed to the market growth.

The research and development conducted in the industries and institutions of the U.S. are being encouraged by government funding. Moreover, the presence of advanced infrastructure is accelerating their development. Similarly, this is also driving their clinical trials. Additionally, the regulatory bodies are also supporting these developments by providing first-track approval.

The healthcare system in Canada is providing funding to accelerate the development of HIV treatment and prevention approaches. At the same time, the companies or institutes are collaborating to design and conduct the clinical trials. Moreover, research is also being conducted for developing new vaccines and curative solutions. This, in turn, is driving the clinical trials for vaccines and novel therapies.

Asia Pacific is expected to host the fastest-growing HIV clinical trials market during the forecast period. Asia Pacific is experiencing a rise in the incidence of HIV cases. This is driving the demand for new treatment approaches. Therefore, new innovations are being conducted in the industries. Additionally, the government is increasing awareness through campaigns and is supporting the growing development. This, in turn, is leading to a rise in the number of HIV clinical trials. Thus, this is enhancing the market growth.

The R&D for HIV clinical trials focuses on discovering, validating, and testing new vaccines, treatments, and prevention methods in human candidates to ensure their safety and effectiveness.

Key Players: Janssen Pharmaceuticals, Gilead Sciences, Merck & Co., ViiV Healthcare, Excision BioTherapeutics.

The clinical trials and regulatory approval of HIV clinical trials focus on conducting multi-phased studies for evaluating the safety and effectiveness profile of the treatments in human volunteers.

Key Players: Janssen Pharmaceuticals, Gilead Sciences, Merck & Co., ViiV Healthcare

The formulation in HIV clinical trials must be usable, stable, and effective, while the final dosage preparation involves the evaluation of safety, efficacy, concentration, and method of delivery.

Key Players: Gilead Sciences, ViiV Healthcare, Janssen Pharmaceuticals, Merck & Co.

The packaging and serialization of HIV clinical trials focus on ensuring the product integrity, unique identifiers for tracking, safe and secure delivery of investigational products, and preventing counterfeiting.

Key Players: Gilead Sciences, ViiV Healthcare, Janssen Pharmaceuticals

The patient support and services of HIV clinical trials focus on helping the participants to overcome hurdles such as stigma and economic hardships by supplying them with medical, logistical, and psychological assistance and ensuring their consistent engagement in the trials, and enhancing their well-being.

Key Players: Gilead Sciences, ViiV Healthcare

In March 2025, after presenting the data of injectable HIV-1 capsid inhibitor that is once-yearly formulations of lenacapavir from its Phase 1 study, Senior Vice President, Virology Therapeutic Area Head, Gilead Sciences, Jared Baeten, stated that, to help people with the right HIV prevention choice, they are contributing to innovate additional person-centered long-acting injectables along with oral options. Moreover, the persistent challenges for people around the world wanting pre-exposure prophylaxis (PrEP) or to address PrEP adherence, the once-yearly lenacapavir can prove an important new HIV prevention option, if approved.

By Trial Phase

By Therapeutic Modality/Intervention Type

By Sponsor Type

By Region

January 2026

December 2025

December 2025

December 2025