February 2026

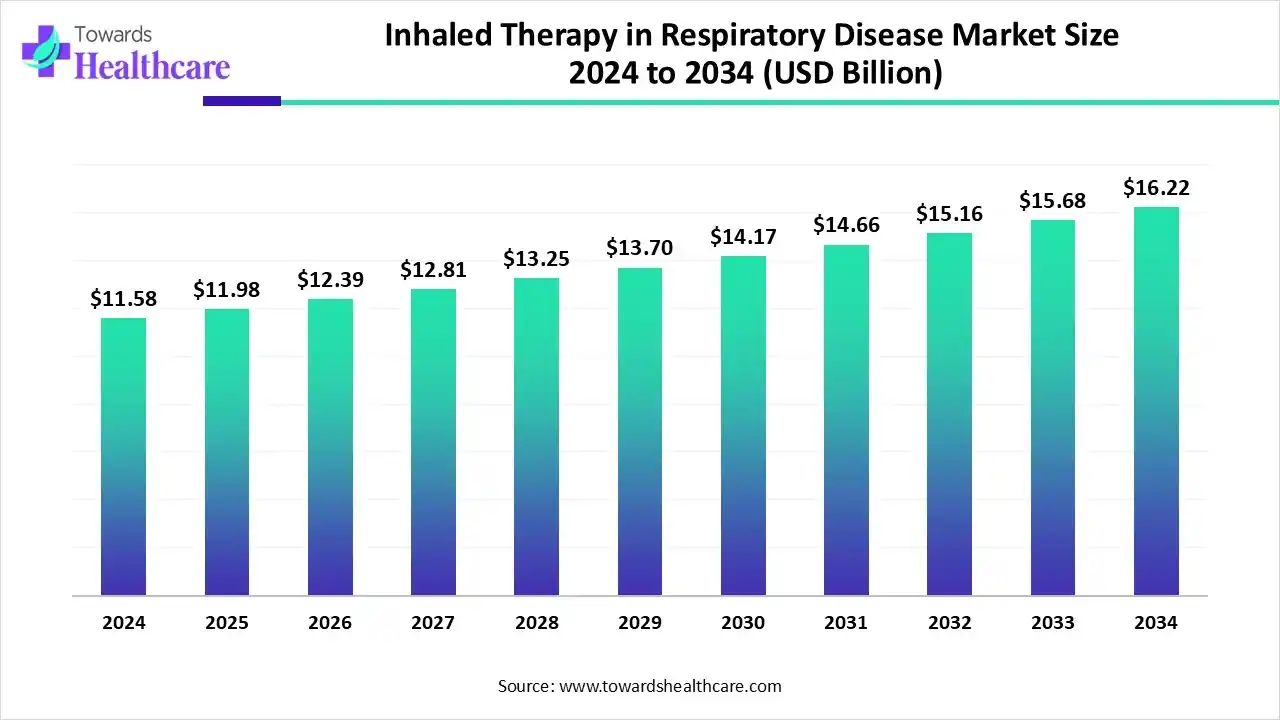

The global inhaled therapy in respiratory disease market size is calculated at US$ 11.58 billion in 2024, grew to US$ 11.98 billion in 2025, and is projected to reach around US$ 16.22 billion by 2034. The market is expanding at a CAGR of 3.44% between 2025 and 2034.

Due to growing respiratory diseases, there is a rise in the use of inhaled therapies, which in turn is driving their innovations. These are mostly being used in the treatment of COPD and asthma, where companies are utilizing AI technologies to develop personalized treatment options as well as smart inhalers. At the same time, the growing awareness and R&D are encouraging their use in different regions, where the companies are also contributing by collaborating, developing, and launching new innovative therapies. Thus, this promotes the market growth.

| Table | Scope |

| Market Size in 2025 | USD 11.98 Billion |

| Projected Market Size in 2034 | USD 16.22 Billion |

| CAGR (2025 - 2034) | 3.44% |

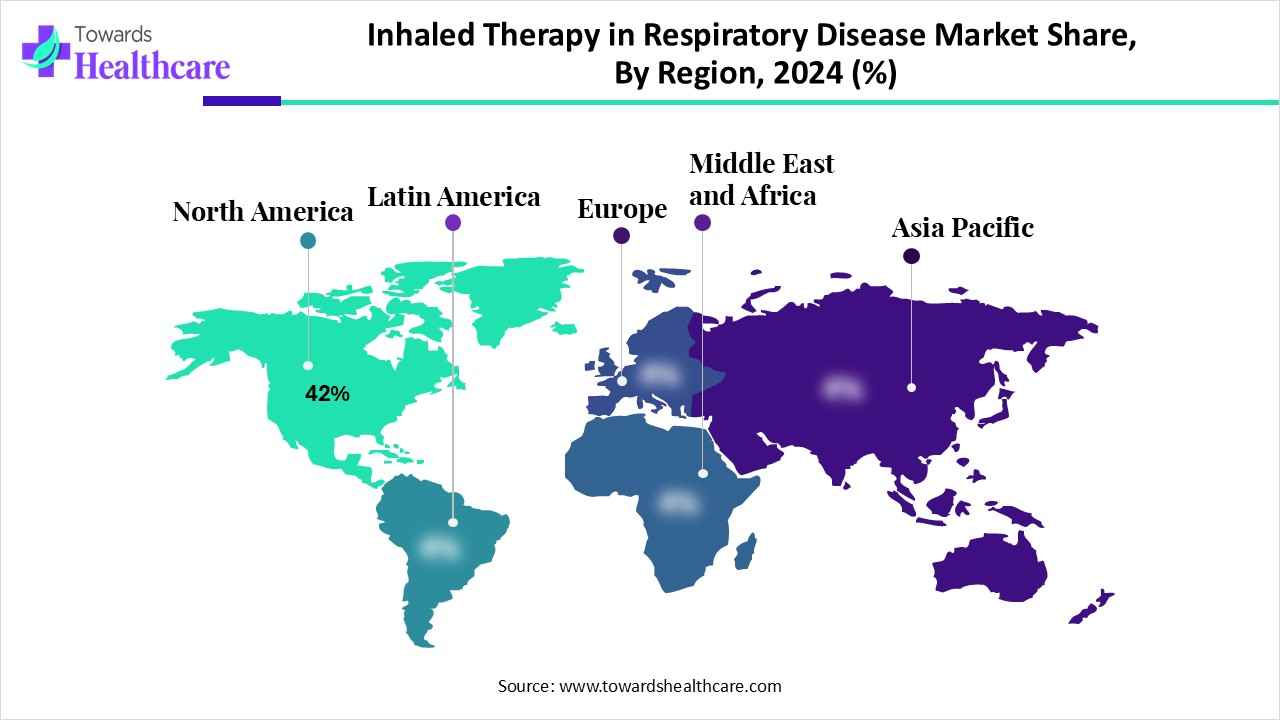

| Leading Region | North America |

| Market Segmentation | By Drug Class/Therapy Type, By Delivery Device Type, By Indication/Clinical Use, By End User/Distribution Channel |

| Top Key Players | Chiesi Farmaceutici, Teva Pharmaceutical/ProAir Digihaler, Novartis, Viatris/Mylan, Insmed, Vertex Pharmaceuticals, PARI GmbH, Philips Respironics, Omron Healthcare, Aptar Pharma, Nemera, Vectura Group/specialist inhalation formulators, Propeller Health (part of ResMed), Adherium, Catalent/Lonza (CDMO partners) |

The inhaled therapy in respiratory disease market is driven by growing global incidences of chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD). The inhaled therapy in respiratory disease covers drugs and delivery systems administered via the respiratory tract (nasal or pulmonary) for the treatment of chronic diseases, acute exacerbation management, and targeted pulmonary delivery for systemic or local therapy. Additionally, innovation in inhaled formulations and devices, digital adherence solutions, and the development of inhaled antibiotics and biologics are other market drivers.

The use of AI in inhaled therapy in respiratory disease market is increasing as it is promoting real-time monitoring as well as enhancing the development of personalized treatment plans. Additionally, they are also being used in the development of smart inhalers, which can monitor inhaler usage and provide accurate drug dosing. Moreover, they are also being used in the development of targeted and personalized treatment regimes.

For instance,

Growing innovations: Due to increasing respiratory diseases, there is a growth in the demand for inhaled therapies. This, in turn, is increasing their innovations, leading to an increase in their clinical trials and launches. Moreover, new acquisitions and collaborations are also being formed among the companies, which is enhancing the inhaled therapy in respiratory disease market.

For instance,

| Company | Product | Application | Source |

| Jiangsu Hengrui Pharmaceutical | HRS-9821 | An inhaled dual phosphodiesterase (PDE) 3/4 inhibitor for chronic obstructive pulmonary disease (COPD) | Hengrui's HRS-9821: Pioneering Inhalation Therapy and Cementing Respiratory Leadership in China |

| Cambridge Healthcare Innovations (CHI) | Quattrii | First-ever dry powder inhaler (DPI) engine delivering large volumes of biologic and mRNA molecules in a single inhalation | 'First of its kind' inhaler to reshape respiratory drug delivery - Med-Tech Insights |

| AlveoGene | AVG-002 | Novel inhaled gene therapy for lethal neonatal Surfactant Protein B (SP-B) deficiency. | US FDA grants rare paediatric disease designation to AlveoGene’s novel, inhaled gene therapy, AVG-002 for lethal neonatal surfactant protein B deficiency |

By drug class/therapy type, the short-acting & long-acting bronchodilators segment held the largest share of approximately 28% in the inhaled therapy in respiratory disease market in 2024, as they were used in COPD and asthma cases. At the same time, they also provided fast relief along with long-term action. This increased their use in emergency situations.

By drug class/therapy type, the inhaled biologics & nucleic-acid therapies segment is expected to show the fastest growth rate during the predicted time. These therapies provide targeted action, which is increasing their use. This is enhancing their innovation to minimize their side effects and enhance their action duration.

By delivery device type, the metered-dose inhalers (MDI) segment led the inhaled therapy in respiratory disease market with approximately a 35% share in 2024, driven by their wide availability. Moreover, due to their long duration of action, they were the preferred choice. Additionally, their affordability and portability also enhanced their use.

By delivery device type, the smart/digital inhaler add-ons & connected devices segment is expected to show the highest growth during the predicted time. They help in providing accurate doses and reminders to the patient if the dose is missed. Additionally, their real monitoring is enhancing their use in the management of various respiratory diseases and enhancing patient adherence as well.

By indication/clinical use type, the COPD segment held the dominating share of approximately 38% in the inhaled therapy in respiratory disease market in 2024, due to growing incidences. At the same time, their chronic nature increased the use of inhaled therapies for a long time. Additionally, combination therapies were also recommended to these patients.

By indication/clinical use type, the acute respiratory infections/hospital-administered inhaled therapies segment is expected to show the fastest growth rate during the upcoming years. Their growing occurrences are increasing demand for fast-action inhaled therapies. Moreover, the use of smart inhalers, or inhaled antibiotics, is also increasing.

By end user/distribution channel type, the retail/outpatient pharmacies (prescription & OTC) segment led the global inhaled therapy in respiratory disease market with approximately 60% share in 2024, driven by their wide availability. They helped the patient by providing a quick refill of the inhaler, which enhanced the patient's convenience. At the same time, patient counseling also enhanced the patient outcomes.

By end user/distribution channel type, the homecare & long-term care segment is expected to show the highest growth during the upcoming years. For the chronic management of the respiratory disease, the patients prefer at-home care and home treatments. Additionally, the growing aging population and advances in portable devices are also encouraging the same to enhance patient convenience and comfort.

North America dominated the inhaled therapy in respiratory disease market with 42% in 2024, due to the growth in respiratory diseases. At the same time, growth in RD, along with technological innovation, increased their development. Moreover, with the use of AI technologies, access to these devices was also enhanced, which contributed to the market growth.

Due to growing respiratory diseases like COPD and asthma, the use of inhaled therapies is increasing. These developments and their innovations are being supported by the healthcare investments. Additionally, they are also promoting the development of personalized therapies and smart inhalers to reduce the rate of hospitalization.

For instance,

The presence of advanced health care systems is increasing the use of advanced inhaled therapies in Canada. Smart inhalers are also being used to deal with chronic respiratory diseases. Moreover, the industries as well as the institutes are also contributing to their development by forming new collaborations.

Asia Pacific is expected to host the fastest growth in the inhaled therapy in respiratory disease market in the forecast period, due to growing air pollution, which is increasing the respiratory disease burden, driving the demand for inhaled therapies. Moreover, the expanding healthcare sector is utilizing advanced technologies to accelerate the development of smart or digital inhalers to enhance patient adherence to the treatment. These factors, along with growing R&D and government support, are promoting the market growth.

For instance,

The development of highly efficient drug delivery systems through advancements in device engineering and nanotechnology to enhance the therapeutic outcomes and reduce the side effects by providing targeted and optimal lung deposition of the drugs is the focus of R&D for inhaled therapy in respiratory diseases.

Key Players: GlaxoSmithKline, AstraZeneca, Teva Pharmaceutical, and Boehringer Ingelheim.

The confirmation of the therapeutic equivalence, safety, and efficacy of drug formulation and specific delivery device is the main focus in the clinical trials and regulatory approval of the inhalation therapy in respiratory diseases.

Key Players: GlaxoSmithKline, AstraZeneca, Teva Pharmaceutical, and Boehringer Ingelheim.

The patient support and services for inhaled therapy in respiratory diseases consist of personalized programs like pulmonary rehabilitation, continuous monitoring and adherence with the diagnostic health tool and telehealth, and comprehensive education for patients in inhaler techniques.

Key Players: GlaxoSmithKline, AstraZeneca, Teva Pharmaceutical, and Boehringer Ingelheim.

By Drug Class/Therapy Type

By Delivery Device Type

By Indication/Clinical Use

By End User/Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026