February 2026

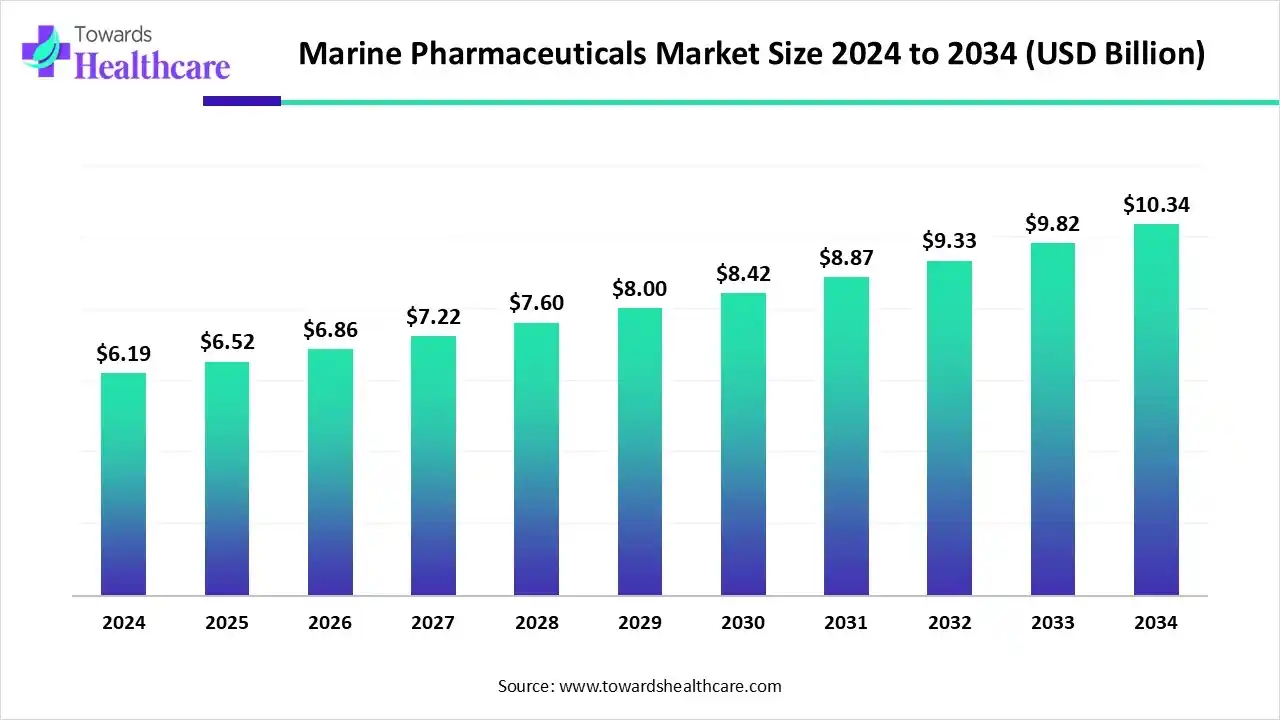

The global marine pharmaceuticals market size is calculated at US$ 6.19 billion in 2024, grew to US$ 6.52 billion in 2025, and is projected to reach around US$ 10.34 billion by 2034. The market is expanding at a CAGR of 5.29% between 2025 and 2034.

Due to the amount of untested pharmacological technologies and materials that may be used for medication administration and development, biotechnologists and the pharmaceutical business have recently developed an interest in unknown marine life. Of the previously identified marine microorganisms, only a few number have shown promise as medicinal sources. Soft corals, sea fans, and sponges are a few examples. Particular advancements have recently been achieved in laboratories worldwide in an effort to find possible marine technologies that might help treat illnesses like HIV/AIDS and cancer.

| Table | Scope |

| Market Size in 2025 | USD 6.52 Billion |

| Projected Market Size in 2034 | USD 10.34 Billion |

| CAGR (2025 - 2034) | 5.29% |

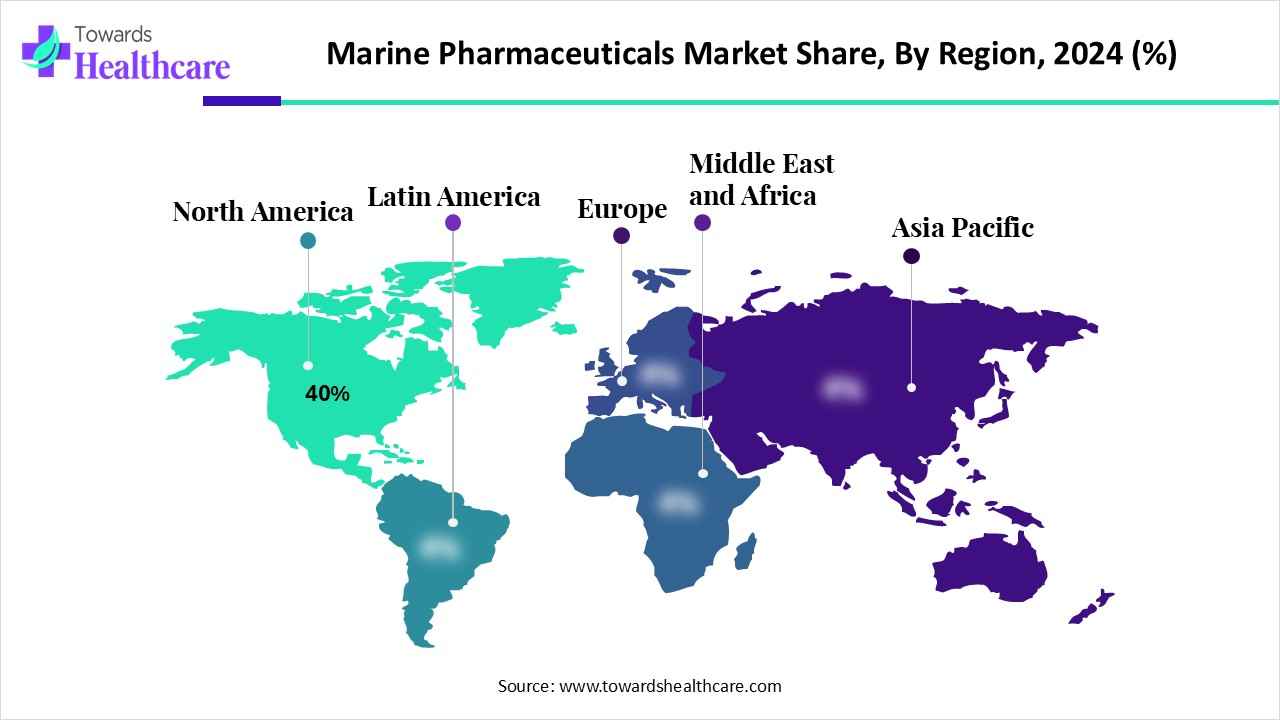

| Leading Region | North America by 40% |

| Market Segmentation | By Source, By Compound Type, By Therapeutic Application, By Product Type, By Region |

| Top Key Players | PharmaMar S.A., Nereus Pharmaceuticals, Sirenas (Sirenas Marine Discovery/Sirenas LLC), GlycoMar Ltd, Marinomed Biotech AG, Aker BioMarine, Cyanotech Corporation, Marinova Ptd Ltd., SeaPharm, Inc., Biomar Microbial Technologies, Martek Biosciences / DSM, InnovaSea , Abyss Ingredients , Salinomycin , OncoMarine, Kancor Ingredients , Evotec , Aquapharm |

The marine pharmaceuticals market growth is driven by unique marine biodiversity, advances in marine bioprospecting and synthetic biology, growing R&D investment, and partnerships between marine biotech firms and large pharmaceutical companies to translate novel marine leads into clinical candidates.

The marine pharmaceuticals market covers the discovery, development, production, and commercialization of therapeutic and bioactive compounds derived from marine organisms (algae, sponges, tunicates, mollusks, marine bacteria, fungi, and venoms). These marine natural products include peptides, polysaccharides, alkaloids, lipids, and other small molecules with applications in oncology, anti-infectives, anti-inflammatory, metabolic, and neurological disorders. The market spans research & discovery services, extraction & purification technologies, formulation and finished drug products, and ingredient supply for pharma and nutraceutical applications.

AI can assist with marine drug development and be included into several stages of NP drug research. Artificial Intelligence can assist with the assessment of marine drug action, target prediction, toxicity prediction, and drug repositioning research. Identification, characteriszation, and optimisation of marine bioactive chemicals are greatly accelerated and improved by the integration of AI technology into marine drug discovery pipelines. The discovery of new therapeutic agents to treat a variety of illnesses is made easier by this technical synergy, which is essential to releasing the enormous pharmacological potential of marine natural products.

The integration of marine-derived ingredients in functional meals, partnerships between pharmaceutical corporations and marine research institutes, and the discovery of new compounds are some of the most recent trends. As the industry develops to satisfy the needs of contemporary healthcare, the overall development prospects appear bright.

For instance,

| Company Name | Headquarters | Market Position & Differentiation | Recent Products Focus |

| PharmaMar S.A. | Madrid, Spain | Leader in marine-derived oncology therapeutics; strong pipeline in cancer treatments | Focus on oncology drugs derived from marine organisms; recent developments include new cancer therapies |

| Nereus Pharmaceuticals | San Diego, USA | Specializes in marine-derived natural products for cancer and infectious diseases | Development of novel compounds targeting cancer and infectious diseases from marine sources |

| Sirenas (Sirenas Marine Discovery/Sirenas LLC) | San Diego, USA | Utilizes marine biodiversity to discover novel bioactive compounds for drug development | Research into marine natural products for potential therapeutic applications |

| GlycoMar Ltd. | St Andrews, Scotland | Expertise in glycobiology and polysaccharide isolation from marine sources; focuses on immunomodulation | Development of novel personal care ingredients and anti-inflammatory drug candidates from marine polysaccharides |

| Marinomed Biotech AG | Korneuburg, Austria | Innovator in solubilization technology (Marinosolv®); focuses on respiratory and immunology treatments | Development of Budesolv (enhanced budesonide nasal spray), Tacrosolv (dry eye treatment), and Solv4U services |

By source, the marine microorganisms segment dominated the marine pharmaceuticals market in 2024, with a revenue of approximately 35%. Marine microorganisms have drawn increasing interest as sources of bioactive metabolites and provide a special chance to accelerate the development of marine natural products and increase the number of them in clinical trials. Drug development continues to focus on marine natural ingredients, which have produced several significant therapeutic medicines.

By source, the macroalgae/seaweeds segment is estimated to be the fastest-growing during the forecast period. Benefits of seaweed include its availability, renewability, and favourable environmental impact. Bioactive substances with a variety of medicinal uses, including proteins, pigments, polysaccharides, and polyphenols, are abundant in seaweeds. These substances have demonstrated promise as antioxidants, anti-inflammatory, antibacterial, antiviral, and anticancer agents, among others.

By compound type, the peptides & peptidomimetics segment dominated the marine pharmaceuticals market in 2024, with a revenue of approximately 30%. Nearly 7000 peptides and peptidomimetics are thought to have been found in natural resources. Given that they account for half of all biodiversity worldwide, marine sources are the greatest source of peptides and other naturally occurring small molecules. These peptides can exhibit a wide range of action against various infections due to the characteristics of the marine environment. Most of these peptides come from molluscs, ascidians, and sponges.

By compound type, the polysaccharides & glycoconjugates segment is estimated to be the fastest-growing during the forecast period. Marine biomass is a wealth of resources. The qualities of marine polysaccharides include abundance, cheap cost, non-toxicity, biodegradability, and biocompatibility. Applications for marine polysaccharides in biomedical materials are numerous and include wound dressings, tissue engineering, medication delivery, and sensors.

By therapeutic application, the oncology/anticancer segment dominated the marine pharmaceuticals market in 2024, with a revenue of approximately 30-35%. One of the biggest problems facing public health systems throughout the world is cancer, which is expected to rise by 50% over the next 20 years, reaching 21 million new cases, according to U.S. National Cancer Institute predictions. Based on these forecasts, Africa, Asia, and Central and South America will account for seven out of ten cancer-related fatalities. For the acquisition of necessary medications to treat various malignancies and associated illnesses, marine sources are crucial.

By therapeutic application, the anti-infective segment is estimated to be the fastest-growing during the forecast period. Bioactive chemicals are abundant in the marine environment. Research on marine-derived plants, animals, and microorganisms over the past few decades has produced a remarkable array of structurally varied anti-infective drugs with antiviral, antifungal, antibacterial, or antiprotozoal properties.

By product type, the active pharmaceutical ingredients (APIs) segment dominated the marine pharmaceuticals market in 2024, with a revenue of approximately 40%. APIs produced from marine sources have exciting prospects for cutting-edge pharmaceutical companies, offering safe and efficient treatments for a range of illnesses. They are perfect for next-generation goods because of their sustainability and multipurpose qualities. To find novel bioactive substances and increase their medicinal potential, ongoing study into marine ecosystems is crucial.

By product type, the semi-synthetic/synthetic derivatives segment is estimated to be the fastest-growing during the forecast period. Both synthetic and semi-synthetic derivatives of marine medicines are completely synthesised copies of marine molecules or chemically modified natural marine substances to produce new medications with enhanced qualities. This method uses the chemical variety of marine creatures to create therapeutic agents and anticancer medications such as eribulin and derivatives of bryostatin.

North America dominated the marine pharmaceuticals market in 2024, with a revenue share of approximately 40%. This is due to its substantial investment in marine biotechnology, robust pharmaceutical ecosystem, and advanced R&D infrastructure. Development and distribution of drugs originating from marine sources are accelerated by the region's strong clinical trial networks, regulatory expertise, and strategic funding.

Due to substantial government and commercial investment in R&D, a solid R&D infrastructure, and rising demand for organically derived goods, the U.S. marine pharmaceuticals market is expanding rapidly. Due to creative medication development from marine species and solid biotechnology collaborations, North America, especially the U.S., is a worldwide leader in this field, and the industry is expected to expand significantly over the next several years.

Canada is a major participant in the North American market for pharmaceuticals derived from marine sources and a growing supplier of marine pharmaceutical compounds. This industry is predicted to develop significantly as a result of rising research, government funding, and consumer desire for natural goods. By creating treatments derived from marine life and utilising its abundant marine biodiversity, Canada helps to fuel this growing industry.

Asia Pacific is estimated to host the fastest-growing marine pharmaceuticals market during the forecast period. Government programmes are encouraging cooperation between academics and business, and nations like South Korea, China, and Japan are making significant investments in marine biotechnology. The market is growing as a result of the region's abundant marine resources and the quick developments in biotechnology. Furthermore, the region's growing need for plant-based and natural medications fuels the expansion of marine pharmaceuticals, positioning it as a major participant in the worldwide market.

Gathering marine species, extracting possible chemicals, evaluating for bioactivity, separating and clarifying compound structures, doing preclinical and clinical studies, and securing regulatory permissions are all part of marine pharmaceutical research and development.

Key companies include: Sanofi S.A., Aphios Corporation, Sea Run Holdings Inc., Aker BioMarine AS., AbbVie Inc., GlaxoSmithKline PLC, Pharma Marine USA.

Like creating any other medication, creating a marine pharmaceutical involves a multi-step formulation and dose production procedure to guarantee its efficacy, stability, and safety. Because of issues including limited availability, chemical complexity, and possible toxicity, this procedure is particularly difficult for chemicals originating from marine sources. Comprehensive research, formulation design, and optimisation for a particular delivery technique are among the general phases.

Key companies include: Sanofi S.A., Aphios Corporation, Sea Run Holdings Inc., Aker BioMarine AS., AbbVie Inc., GlaxoSmithKline PLC, Pharma Marine USA.

In order to handle the particular difficulties of new treatments made from marine sources, patient support for marine medicines entails a number of actions. Although the fundamental procedures are comparable to those of general patient support programmes, targeted tactics are necessary due to the complexity of these frequently specialised therapies.

By Source

By Compound Type

By Therapeutic Application

By Product Type

By Region

February 2026

February 2026

February 2026

February 2026