February 2026

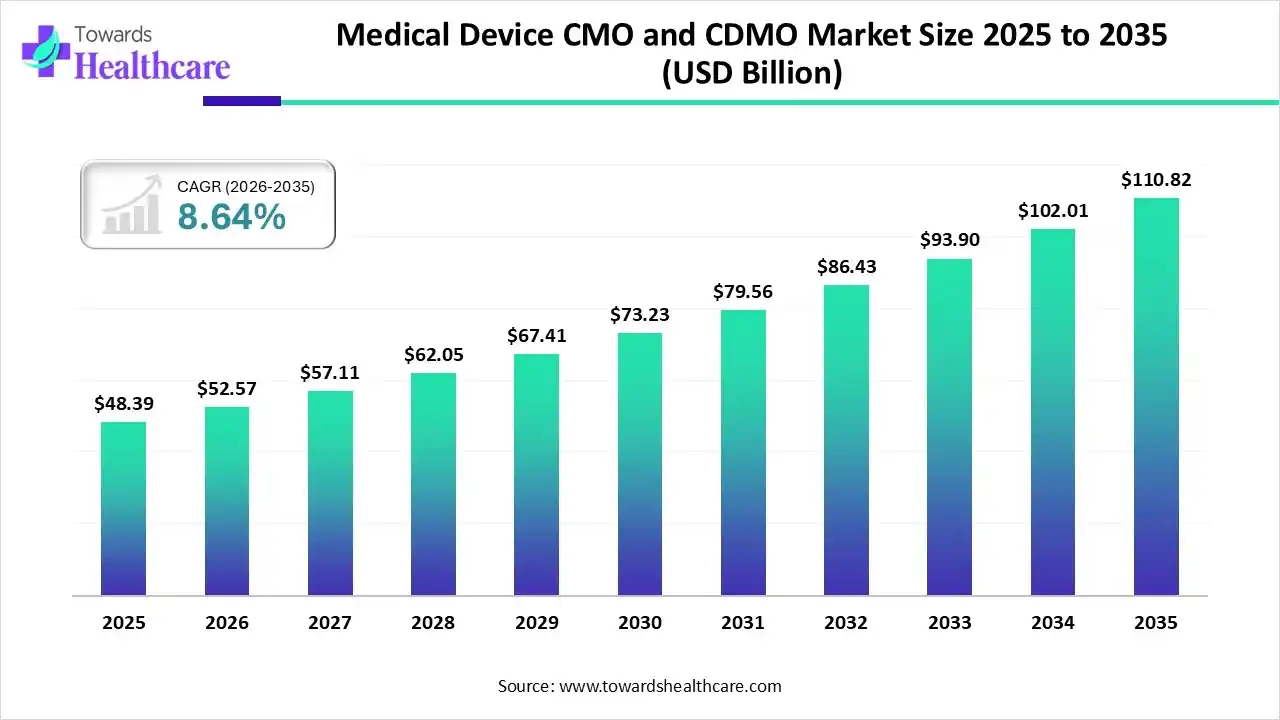

The medical device CMO and CDMO market size was valued at US$ 48.39 billion in 2025 and is projected to grow to 52.57 billion in 2026. Forecasts suggest it will reach approximately US$ 110.82 billion by 2035, registering a CAGR of 8.64% during the period.

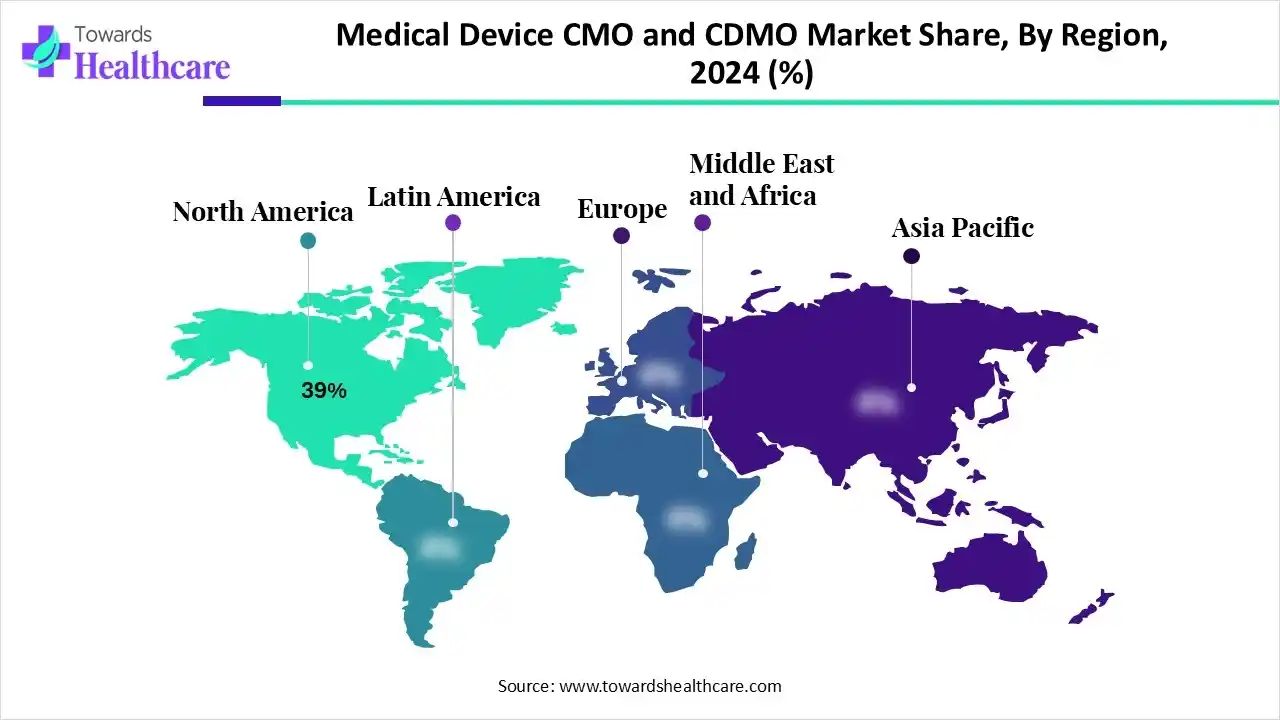

The medical device CMO and CDMO market is expanding as manufacturers increasingly outsource production, assembly, and development services to enhance efficiency, reduce costs, and accelerate time-to-market. Rising demand for advanced medical devices, regulatory compliance requirements, and technological innovations are driving growth. North America leads the market due to a strong medical device industry and robust healthcare infrastructure, while Europe and Asia-Pacific are witnessing rapid adoption, creating significant opportunities for contract manufacturing and development services globally.

| Key Elements | Scope |

| Market Size in 2026 | USD 52.57 Billion |

| Projected Market Size in 2035 | USD 110.82 Billion |

| CAGR (2026 - 2035) | 8.64% |

| Leading Region | North America by 39% |

| Market Segmentation | By Service Type, By Device Class, By Device Type, By Material/Technology Platform, By End User, By Region |

| Top Key Players | Phillips-Medisize (a Molex company), Tecomet Inc., Celestica Inc., Gerresheimer AG (medical device CDMO division), Viant Medical, Tessy Plastics, Nypro (Jabil subsidiary), Nolato AB, Benchmark Electronics, Providien (a Carlisle company), Creganna Medical (part of TE Connectivity), West Pharmaceutical Services (drug-device combination CDMO), Nemera (drug delivery device CDMO), SMC Ltd., Orchid Orthopedic Solutions |

Rising demand for personalized and high-complexity medical devices is driving the growth of the market. The Medical Device CMO and CDMO Market comprises third-party providers that design, develop, manufacture, and package medical devices and diagnostics for original equipment manufacturers (OEMs). While CMOs primarily provide manufacturing services, CDMOs offer broader end-to-end solutions covering product design, prototyping, regulatory strategy, clinical trial support, sterilization, packaging, and full-scale production.

The market is expanding rapidly due to rising demand for cost optimization, faster product development cycles, growing complexity of devices, and increasing regulatory pressure that favors outsourcing to specialized partners. Emerging opportunities lie in digital health devices, connected wearables, and advanced minimally invasive devices.

The market is expanding as companies seek specialized expertise, faster regulatory compliance, and flexible production capacities to meet the rising demand for advanced and customized medical devices.

AI can transform the medical device CMO and CDMO market by enabling real-time monitoring of production processes and predictive analytics for demand forecasting. It supports automated testing, process optimization, and enhanced decision-making in R&D. Additionally, AI-driven digital twins and simulation models allow faster prototyping and risk reduction, improving product quality and consistency. This adoption helps companies meet complex device requirements more efficiently, driving innovation and market growth.

In 2024, the component manufacturing segment led the market with the revenue shares of approximately 41% as medical device makers increasingly relied on outsourcing for specialized materials and micro-engineered parts. The surge in customization for patient-specific devices and the complexity of multi-functional systems heightened the need for advanced component solutions. Furthermore, partnerships with CMOs and CDMOs offering integrated supply chain support and rapid prototyping strengthened this segment’s position, ensuring efficiency and timely delivery in a competitive healthcare market.

The finished device assembly segment is set to grow at the fastest CAGR in the medical device CMO and CDMO market as companies focus on outsourcing to reduce operational burdens and streamline production. Rising demand for single-source partners that can handle packaging, sterilization, and labeling alongside assembly enhances efficiency for medical device firms. Additionally, expanding global trade and the need for standardized, high-quality final products encourage reliance on CMOs and CDMOs, boosting this market's rapid growth throughout the forecast period.

In 2024, the Class II devices segment dominated the market with the revenue shares of approximately 24% as it covers a broad range of essential medical technologies widely used in everyday clinical practice. The segment benefited from frequent product upgrades, rising demand for portable and home-care devices, and faster regulatory clearance compared to Class III products. Moreover, increasing investment by CMOs and CDMOs in scalable production of these mid-risk devices supported their availability and adoption, solidifying their leading revenue position.

The Class III devices segment is anticipated to witness the fastest CAGR in the medical device CMO and CDMO market as healthcare systems increasingly adopt innovative solutions like robotic-assisted implants and personalized prosthetics. Rising patient preference for technologically advanced, durable treatment options is boosting demand. Additionally, supportive reimbursement frameworks and faster innovation cycles, aided by strategic partnerships between OEMs and CDMOs, are encouraging broader use of these devices. This combination of technological progress and collaborative development is driving strong growth in the Class III category.

The orthopedic devices segment dominated the market with the revenue shares of approximately 22% as the demand for advanced implants, prosthetics, and corrective devices increased across both aging populations and active patients. Innovations in custom-fit implants, smart orthopedic devices, and minimally invasive solutions enhanced effectiveness and patient comfort. Additionally, rising sports injuries and orthopedic procedures in emerging markets, combined with outsourcing to specialized CMOs and CDMOs for precision manufacturing, contributed to market expansion.

The drug-device combination products segment is expected to grow rapidly as healthcare providers and patients favor convenient, all-in-one therapies that reduce dosing errors and enhance adherence. Increasing prevalence of chronic and lifestyle-related conditions, coupled with innovations in wearable and connected delivery systems, is boosting demand. Additionally, medical device manufacturers are increasingly partnering with CMOs and CDMOs for specialized production and regulatory support, enabling faster commercialization and fueling strong growth in this market during the forecast period.

The ceramics segment led the market as it enables lightweight, durable, and highly precise components for medical devices, particularly in orthopedics and dental applications. Its chemical stability and compatibility with imaging technologies make it suitable for advanced implants and diagnostic tools. Growing investments by CMOs and CDMOs in ceramic processing and additive manufacturing techniques have further increased their use, driving the market's dominance in medical device production.

The electronics/mechatronics segment is projected to grow rapidly medical device CMO and CDMO market as healthcare shifts toward digital and connected medical devices, including smart monitoring systems and automated therapy equipment. Increasing focus on miniaturization, precision actuation, and integration of IoT-enabled components drives demand for these technologies. Furthermore, manufacturers are increasingly partnering with CMOs and CDMOs to leverage expertise in electronic assembly, mechatronic integration, and testing, enabling faster development cycles and supporting the market's fastest growth in the forecast period.

In 2024, the large medical device OEMs segment dominated the market with the revenue shares of approximately 52% as they outsource complex manufacturing processes to CMOs and CDMOs to manage production scalability and reduce operational risks. Their preference for integrated supply chain solutions, advanced quality control, and access to specialized technologies ensures the timely delivery of high-demand products. Strategic partnerships with contract manufacturers allow these OEMs to accelerate innovation, maintain competitive advantage, and meet growing global healthcare demands, securing the largest revenue share in the market.

The mid-size & emerging OEMs segment is projected to grow rapidly as these companies seek agile manufacturing partners to scale production without heavy capital investment. Increasing demand for novel, high-tech, and customized medical devices encourages collaboration with CMOs and CDMOs for design, prototyping, and regulatory support. Their focus on faster time-to-market, access to advanced technologies, and global distribution through contract partners drives strong adoption, making this market the fastest-growing end-user category during the forecast period.

North America led the market with the revenue share of approximately 39% in 2025 due to high healthcare expenditure, increasing outsourcing of complex manufacturing, and a large base of skilled professionals. Strong collaborations between OEMs and contract service providers, coupled with early adoption of cutting-edge technologies like smart devices and minimally invasive systems, drove demand. Furthermore, the presence of supportive government policies and a mature supply chain network enabled efficient production and distribution, securing the region’s dominant revenue share.

In October 2024, Ardena signed an agreement to acquire Catalent’s advanced facility in Somerset, New Jersey, aiming to strengthen its late-stage and small-scale oral drug manufacturing capabilities. This move positions Ardena as a leading global CDMO, offering comprehensive, integrated solutions for drug development and production.

In August 2024, the Canadian government announced a $22.4 million contribution via the Strategic Innovation Fund to support Eurofins CDMO Alphora Inc.’s $64.1 million project to build a new biologics facility in Mississauga. The facility will boost domestic antibody and protein therapeutic production, accelerate clinical testing, create 120 jobs and 65 co-op positions, and enable production of up to 24.9 million vials annually, strengthening Canada’s preparedness for future pandemics.

Asia-Pacific is projected to register the fastest CAGR as the region experiences rapid industrialization in healthcare, increasing adoption of advanced medical devices, and a rising middle-class population demanding better healthcare solutions. Growing investments by international OEMs in local CMOs and CDMOs, coupled with favorable trade policies and infrastructure improvements, enhance production capabilities. Additionally, the availability of cost-efficient skilled labor and emerging markets’ focus on innovative therapies and diagnostics are accelerating the region’s market expansion during the forecast period.

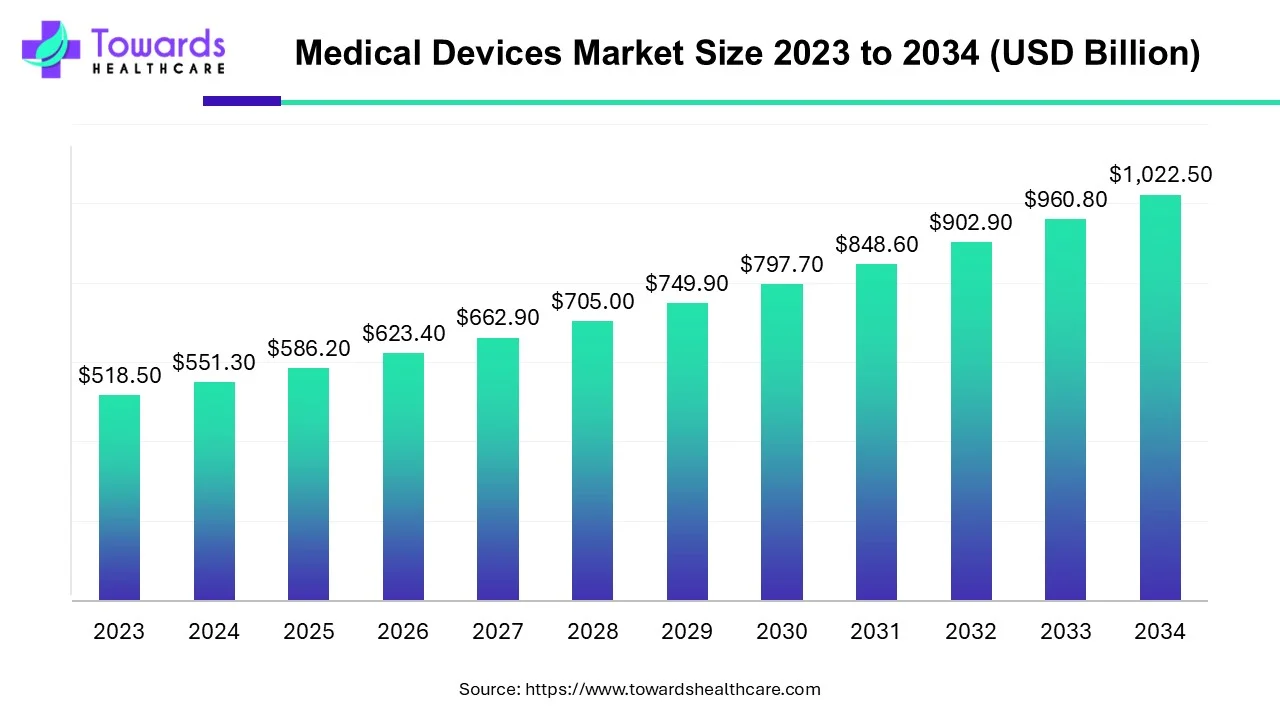

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

By Service Type

By Device Class

By Device Type

By Material/Technology Platform

By End User

By Region

February 2026

February 2026

February 2026

February 2026