January 2026

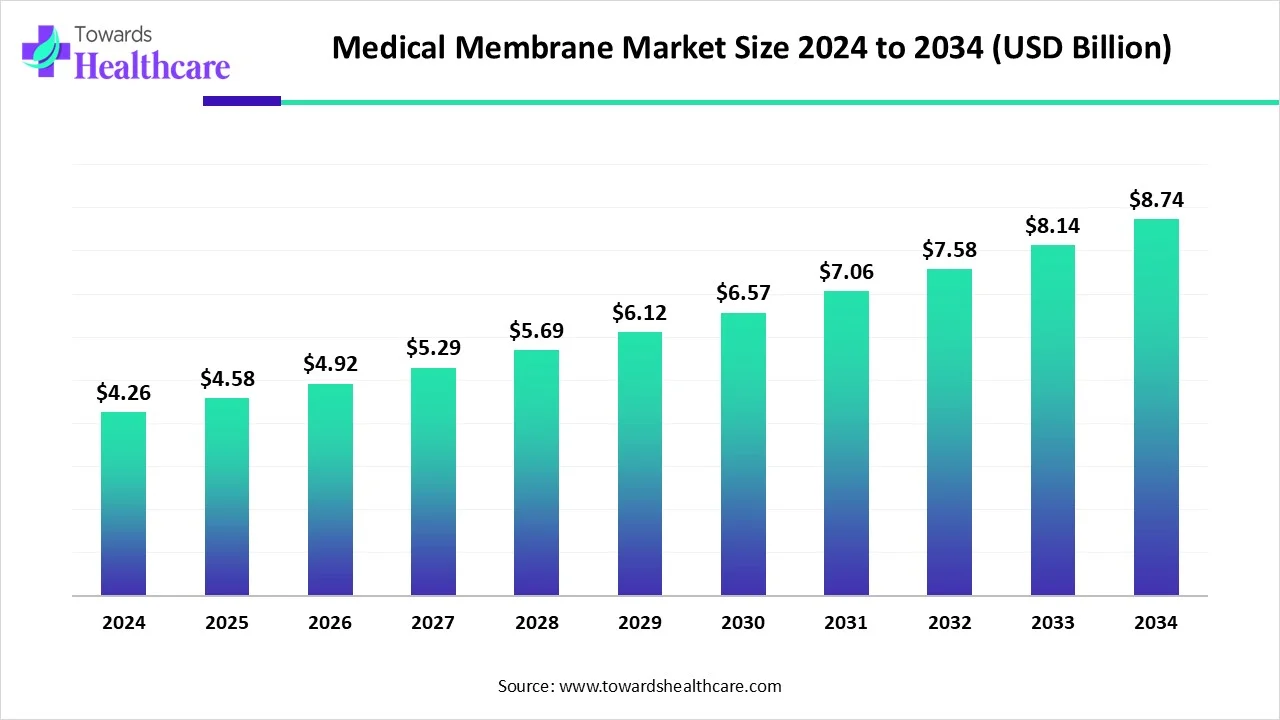

The global medical membrane market size is calculated at USD 4.58 billion in 2025, grew to USD 4.92 billion in 2026, and is projected to reach around USD 9.39 billion by 2035. The market is expanding at a CAGR of 7.45% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 4.92 billion |

| Projected Market Size in 2035 | USD 9.39 billion |

| CAGR (2026 - 2035) | 7.45% |

| Leading Region | Europe |

| Market Segmentation | By Material, By Technology, By Application, By Region |

| Top Key Players | Amniox Medical, Asahi Kasei, Danaher Corporation, Hangzhou Cobetter Filtration Equipment, Koch Membrane Systems, Merck Group, Mann Hummel, Sartorius AG, W. L. Gore & Associates, 3M Company |

Membrane technology is essential in medical applications, particularly for some life-saving medicinal strategies. In general, a wide range of synthetic and natural materials is used in biological membrane applications. Membranes are used in a variety of applications, including drug administration, bioseparations, medical device coatings, tissue regeneration, artificial organs, and diagnostic devices. The overall area of industrial membrane applications is about equivalent to the total area of membranes produced for medical purposes.

The design, optimization, and management of membrane-based systems particularly Reverse Osmosis (RO) and Ultrafiltration (UF) have changed as a result of the application of Artificial Intelligence (AI) approaches. Two fascinating new areas include combining AI with sensor technologies for real-time monitoring and control and developing membrane materials using generative adversarial networks. As artificial intelligence in membrane separation develops, interdisciplinary cooperation is crucial to overcoming current challenges and grasping future possibilities.

Stringent Regulations for High-Purity Products

High-purity products are desperately needed in the pharmaceutical and biopharmaceutical industries. Medical membranes are crucial for the sterility and purity of pharmaceuticals, vaccines, and other biological products. Because of the stringent requirements for the safety and effectiveness of medications, advanced membrane technologies are needed to maintain high levels of purity and contamination control. The pharmaceutical industry's growing emphasis on sterility and purity has significantly raised the need for medical membranes, driving market expansion.

High Cost of Membrane Technologies

One major obstacle to commercial expansion is the high cost of advanced membrane technology. The high upfront costs of research, development, and production prevent many technologies from being widely adopted, even if they provide improved performance and innovative solutions. Medical membrane-based products' price and accessibility are impacted by this pricing issue, especially in areas with little healthcare funding.

How does Advanced Medical Treatment Increase Medical Membrane Demand?

The growing need for innovative medical treatments is contributing to the growth of the medical membrane market. Advances in medical research have enabled the development of sophisticated therapies such as organ transplants, improved wound care, and biopharmaceutical manufacture, all of which rely on precise and effective filtration. Medical membranes are crucial in these applications because they ensure accurate fluid filtration and purification. High-performance medical membranes are becoming more and more in demand as a result of factors such as an aging global population, escalating healthcare expenses, and improved access to state-of-the-art medical services.

By material, the polysulfone (PSU) & polyether sulfone segment captured the dominant share of the market in 2024. This segment dominated because high physical strength, chemical resistance, and exceptional biocompatibility are characteristics of polysulfone and poly(aryl)ethersulfone membranes. Any common method may be used to sterilize them as well. Both the high-flux and low-flux varieties exhibit reasonable performance characteristics, but the high-flux variety filters out sizable amounts of β2-M. Additionally, polysulfones, but not poly(aryl)ethersulfones, can operate as endotoxin adsorbers because of their structure.

By material, the polypropylene segment is anticipated to witness significant CAGR in the medical membrane market during the predicted timeframe. The pure polypropylene medium used to create polypropylene (PP) membranes is a type of membrane filter material used for deep filtration. In addition to being naturally hydrophobic, polypropylene membranes have excellent chemical stability and compatibility and can tolerate a wide range of organic solvents. Tough and long-lasting, polypropylene membrane is non-toxic, uniformly strong, and difficult to break. Additional medical and laboratory uses for polypropylene membranes include gas filtration in medical devices, pre-filter of infusion solvent, and more.

By technology, the nanofiltration segment led the market in 2024. The technological benefits of nanofiltration separation at room temperature make it difficult for other separation methods to take its place. It has several potential uses in purification, refinement, and other procedures that can increase the pace at which active substances are transferred in pharmaceutical operations and raise the caliber of final goods.

By technology, the ultrafiltration segment is expected to be the fastest-growing in the medical membrane market during the forecast period. The pharmaceutical and healthcare sectors depend on ultrafiltration to separate process streams, treat waste streams for safe disposal or reuse, and provide purified water to guarantee product safety and uniformity. The pharmaceutical sector uses ultrafiltration extensively for the recovery of fermentation broths used in the manufacture of antibiotics. Plasma processing and blood product separation are two further uses for ultrafiltration in the healthcare sector.

By application, the pharmaceutical filtration segment dominated the market in 2024. Filtration technology is necessary for pharmaceutical products to be both safe and of high quality. Particles and liquids, or gases, are separated using advanced filters. This process is essential to pharmaceutical companies because it helps sterilize and purify drugs, ensuring that they meet strict safety and effectiveness standards. Filtration technology plays a crucial role in achieving the high purity levels required for the manufacturing of pharmaceutical goods that are safe for human consumption.

By application, the IV infusion & sterile filtration segment is estimated to witness rapid growth in the medical membrane market in the upcoming period. For parenteral nutrition, drug administration or volume substitution, daily creation of diverse infusions, and patient applications, infusion therapies have become indispensable in everyday clinical practice. Drug compositions are changing, and subcutaneous distribution is becoming more popular than intravenous infusion. The subcutaneous administration trend has gained popularity and is considered the ideal option by both patients and healthcare professionals due to the potential benefits of reduced infusion periods and enhanced patient convenience.

Europe dominated the medical membrane market in 2024. The region's substantial market share is mostly due to the aging of the population and the rise of end-stage renal disease (ESRD) patients. Furthermore, it is anticipated that the prevalence of chronic illnesses like diabetes and hypertension would have an impact on the region's rapid development. Germany was the biggest membrane water and wastewater treatment market in Europe. This is due to increased water treatment activities in northern Germany. Furthermore, safeguarding human health and the environment is highly valued in Germany, which significantly contributes to the expansion of the market.

As per Germany Trade & Invest (GTAI), the pharmaceutical market in Germany is the biggest in Europe and the fourth largest worldwide. It is growing faster than the economy of Germany. In the country, there are about 600 pharmaceutical companies that employ over 140,000 people. According to their market value, the top ten biotech and pharmaceutical companies in Germany as of 2023 are covered in this article.

The pharmaceutical industry is one of the most significant industrial sectors in the United Kingdom, contributing over £15 billion in gross value added (GVA) to the economy each year and supporting over 70,000 jobs. The yearly GVA of biopharma research is an additional £4 billion. The United Kingdom is home to two of the largest pharmaceutical companies globally, GSK and AstraZeneca, in addition to several smaller companies involved in research and development. These are surrounded by a wider network of companies and groups that provide services and inputs, such as studies and drug trials.

North America is expected to grow significantly in the medical membrane market during the forecast period. Due to North America's significant investment in R&D, innovative medical devices, including membrane-based filtration systems, have been more widely used. Strong membrane systems are also required for gas separation, water purification, and sterilization due to strict legal requirements for the purity of the air and water in medical facilities. Additionally, the need for novel medical solutions is being driven by the aging of the population and the growth of chronic illnesses in North America, where membranes are essential for procedures like medication administration and dialysis.

One of the key developments in the U.S. pharmaceutical industry is the increased focus on specialty drug research and development. Often costly, these medications are used to treat complex or rare medical conditions. The 50 new drugs that CDER approved in 2024 were referred to as "novel" medicines since they had never been approved or marketed in the U.S. A number of noteworthy milestones were reached by CDER's activities on biosimilar biological products (biosimilars) throughout 2024. More than ever before, CDER approved 18 biosimilars for 8 reference pharmaceuticals in 2024.

Innovative Medicines Canada (IMC) is committed to working with and supporting provincial governments to ensure that Canada’s healthcare system has access to the most advanced treatments. Innovative Medicines Canada is the national association that represents Canada's innovative pharmaceutical industry. The group encourages legislation that makes it easier for researchers, developers, and distributors of innovative drugs and vaccines to improve the lives of all Canadians, and it supports members' commitment to being an important participant in the country's healthcare system.

Asia Pacific is estimated to host the fastest-growing medical membrane market during the forecast period. The reason for this is that medical membrane equipment is becoming more and more important in this field. Furthermore, many manufacturers of medical equipment are extending their manufacturing operations, mostly into Asia Pacific countries, due to the region's low labor costs and liberal laws. It is projected that changing demographics and the presence of rising economies like China and India would drive the expanding medical membrane devices market in the Asia Pacific region. Furthermore, China, India, and Japan are expected to dominate the Asia-Pacific market.

A total of 228 new drug applications (NDAs) were authorized by the China National Medical Products Administration (NMPA) in 2024, including 12 (5%) traditional Chinese medicines (TCMs), 93 (41%) therapeutic biological products (TBPs), and 123 (54%) chemical medications. The concurrent development, registration, and launch of their drugs for new indications in China has become a greater concern for multinational pharmaceutical corporations.

India's leading drug regulatory agency, the Central Drugs Standard Control Organization (CDSCO), has approved 19 new drugs so far in 2024. First-in-class drugs for long-term conditions like cancer and other proprietary, next-generation drugs developed by global pharmaceutical corporations are among them. Prominent pharmaceutical companies, including Sun Pharma, Dr. Reddy's, Lupin, Cipla, and Zydus Life Sciences, have been successful in establishing partnerships or alliances to bring these medications into India. In India, many foreign companies are also launching their drugs directly. By 2023, the CDSCO had authorized over 27 new drugs for manufacturing and sale in India.

Latin America is expected to grow at a considerable CAGR in the medical membrane market in the upcoming period. The growing research and development activities and the burgeoning medical device sector boost the market. The increasing number of organ donations and the growing demand for biologics as targeted treatment potentiates the demand for medical membrane. The increasing use of filters in pharmaceutical industries and biotech companies promote the market. The rising R&D investments and favorable government support contributes to market growth.

Mexico is emerging as a global leader in biotech and pharma manufacturing and research, including genetic research, drug development, and medical devices. Mexico is home to about 186 pharmaceutical companies, employing more than 65,000 people. The Mexican government supports pharmaceutical research through several initiatives.

Brazil is the leader in Latin America and is the seventh largest pharmaceutical market in terms of revenue globally. The Brazilian government initiatives like the “Greater Brazil Plan” and R&D incentives promote indigenous production of complex biologics and build an innovative industrial base.

In December 2024, Amazon Filters created a high-temperature vent filter for pharmaceuticals and biotech. Mafalda Silva, Market Manager for Pharmaceutical & Healthcare at Amazon Filters, stated that sterilizing air or other process gases is necessary for a number of high-flow filtration processes in the biotech and pharmaceutical sectors in order to eradicate the potential for particle or microbiological contaminants. Making the correct filter choice can extend the filtering system's useful life and reduce production downtime, operating costs, and the need for frequent changeouts. (Source - Fluid Handling)

By Material

By Technology

By Application

By Region

January 2026

January 2026

January 2026

January 2026