February 2026

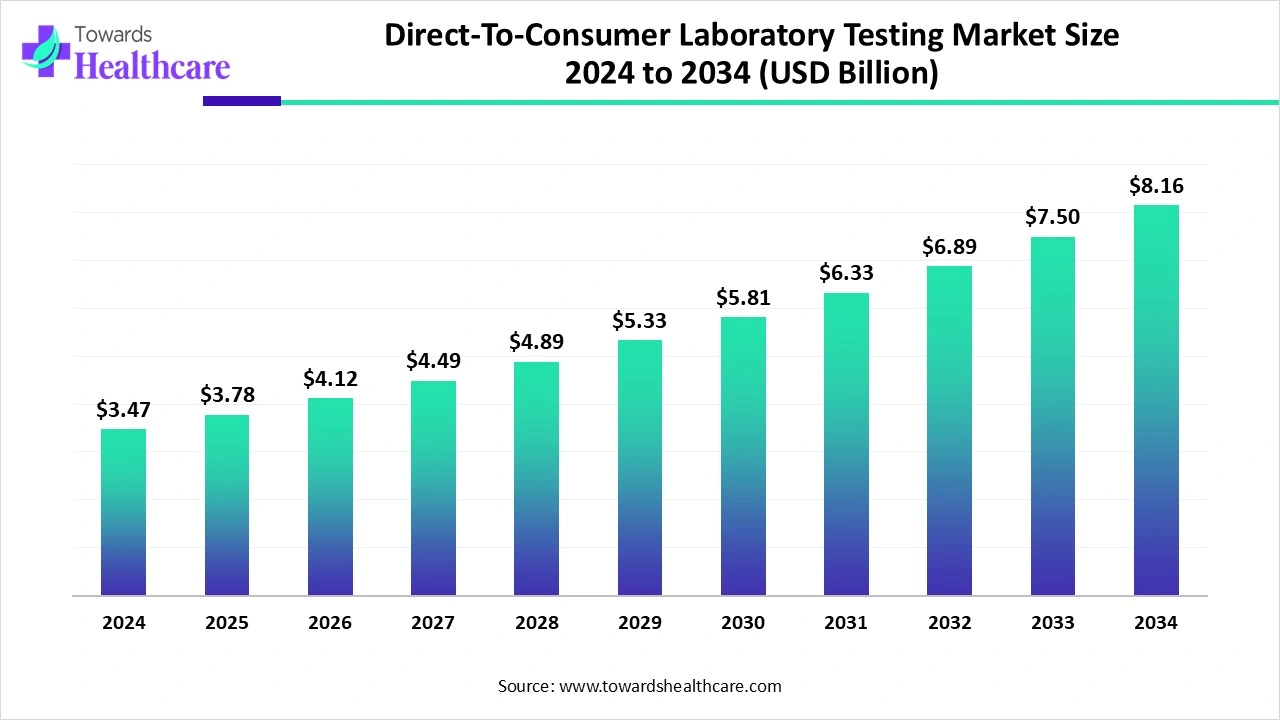

The global direct-to-consumer laboratory testing market size began at US$ 3.47 billion in 2024 and is forecast to rise to US$ 3.78 billion by 2025. By the end of 2034, it is expected to surpass US$ 8.16 billion, growing steadily at a CAGR of 8.94%.

The direct-to-consumer laboratory testing market is growing as individuals increasingly prioritize proactive health monitoring and early disease detection. Technological advancements in portable testing kits and easy-to-use digital reporting platforms make testing more accessible. Rising demand for personalized wellness insights, coupled with the expansion of online health services and telemedicine, is driving adoption. Additionally, regulatory support and growing consumer trust in at-home diagnostics contribute to steady market growth worldwide.

| Table | Scope |

| Market Size in 2025 | USD 3.78 Billion |

| Projected Market Size in 2034 | USD 8.16 Billion |

| CAGR (2025 - 2034) | 8.94% |

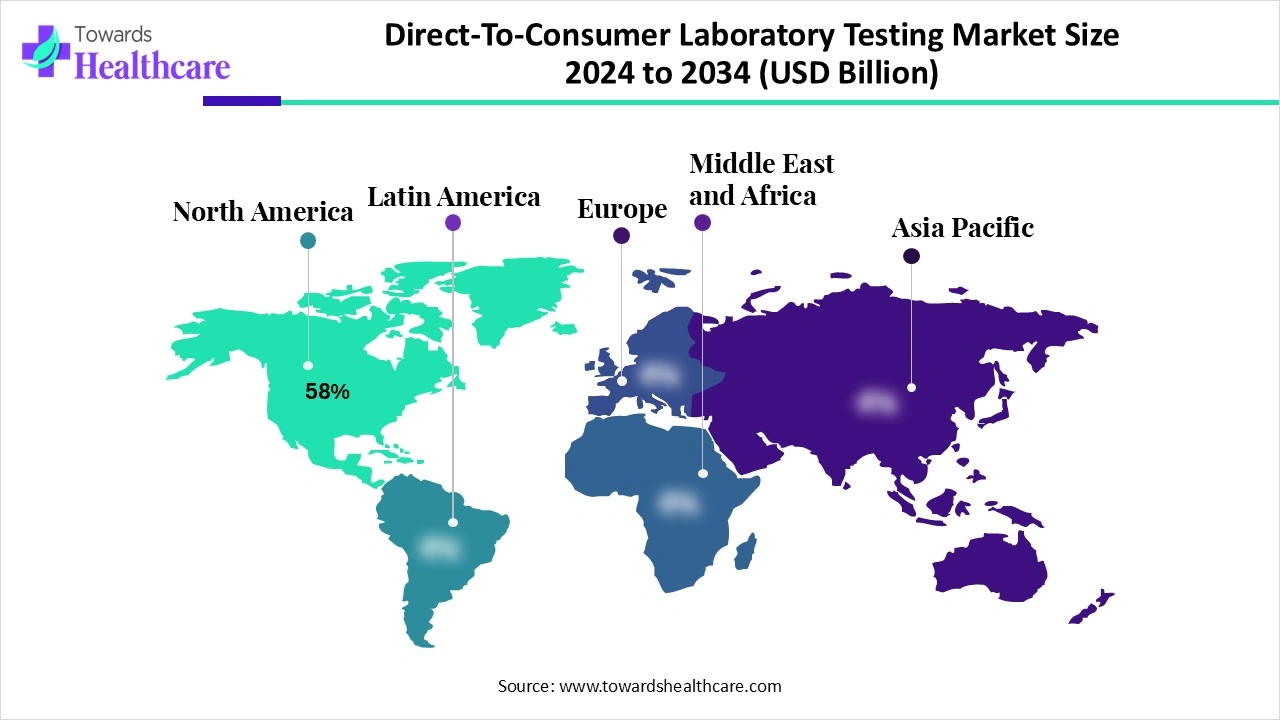

| Leading Region | North America by 58% |

| Market Segmentation | By Test Type, By Sample Type, By End User, By Region |

| Top Key Players | 23andMe, Inc., AncestryDNA (Ancestry.com), Color Genomics, Invitae Corporation, Everlywell, Inc., LetsGetChecked, MyHeritage DNA, Helix, Fulgent Genetics, Vault Health, CircleDNA, DNAfit, Gene by Gene, CRI Genetics, Nebula Genomics, Pathway Genomics, Dante Labs, Veritas Genetics, Orig3n, Genetica |

The Direct-To-Consumer (DTC) Laboratory Testing Market involves diagnostic tests ordered directly by consumers without the need for a physician referral, allowing individuals to assess health, wellness, and disease risk from home or through online platforms. These tests include genetic testing, at-home blood tests, infectious disease screening, hormone panels, and wellness biomarkers. The market is growing due to increasing health awareness, personalized medicine, convenience, digital health platforms, and the rising adoption of preventive healthcare. Regulatory developments, technological innovation, and integration with telehealth are further fueling growth.

The direct-to-consumer laboratory testing market is evolving as companies expand their range of at-home diagnostic and wellness tests, including hormonal, nutritional, and infectious disease panels. Integration with AI-driven analytics providers provides personalized insights and recommendations. Additionally, collaborations with healthcare providers and pharmacies enhance accessibility, while growing consumers' interest in self-monitoring and preventive care fuels continuous market growth and innovation.

Technological Advancements – Innovations in portable testing devices, AI-driven result analysis, and digital reporting improve accessibility, accuracy, and user experience.

Rising Funding and Investments – Venture capital and private equity investments help DTC testing companies expand operations, enhance technology, and enter new markets, fueling growth.

AI can transform the direct-to-consumer laboratory testing market by automating test interpretation, reducing human error, and delivering real-time insights to users. Machine learning algorithms can identify patterns across large datasets, helping detect early signs of diseases and monitor health trends. Furthermore, AI enhances operational efficiency for testing companies by optimizing logistics, sample tracking, and customer support, ultimately improving accessibility, reliability, and consumer confidence in at-home diagnostic services.

Increasing Consumers' Preference for Personalized and Convenient Healthcare Solutions

The preference for personalized and convenient healthcare solutions fuels the direct-to-consumer laboratory testing market as consumers increasingly value autonomy in managing their well-being. Growing interest in wellness tracking, genetic insights, and preventive measures motivates individuals to bypass traditional healthcare settings. The ability to access tailored testing kits online, combined with flexible usage at home, appeals to tech-savvy populations, reinforcing demand for accessible and patient-centered diagnostic services.

For Instance,

Lack of Regulation and Standardization

The absence of clear regulation and standardization limits the direct-to-consumer laboratory testing market by creating confusion around product quality and compliance. Companies face hurdles in gaining approvals across different regions, delaying product launches, and increasing costs. Inconsistent reporting formats and privacy safeguards further complicate integration with traditional healthcare systems. This lack of uniformity reduces acceptance by insurance and providers, making it harder for consumers to fully rely on DTC testing as a trusted health tool.

Integration of Genomics and Personalized Medicine

Integration of genomics and personalized medicine creates a future opportunity in the direct-to-consumer laboratory testing market by allowing expansion beyond basic diagnostics into areas like pharmagenomics, fertility, and nutrition. This widens the scope of services, appealing to consumers seeking deeper insights into lifestyle and treatment optimization. As sequencing costs decline and accessibility improves, DTC companies can offer affordability, genome-informed solutions, positioning themselves as key players in the shift towards individualized health management.

For Instance,

In 2024, the genetic testing segment dominated the direct-to-consumer laboratory testing market as consumers increasingly sought insights into areas like nutrition, fitness, and mental health linked to their DNA. Companies expanded offerings beyond ancestry and disease risk, focusing on lifestyle optimization and preventive care. Marketing campaigns and collaborations with wellness platforms further boosted awareness, making genetic testing a preferred choice among individuals aiming for tailored health and lifestyle guidance.

The wellness & nutritional testing segment is set for the fastest CAGR growth as more people turn to proactive approaches for weight management, athletic performance, and stress reduction. The increasing popularity of holistic health and functional medicine has pushed demand for tests that assess hormonal balance, metabolism, and gut health. Companies offering bundle lifestyle plans with test results are attracting a broader consumer base, making this segment one of the most dynamic in the DTC testing market.

In 2024, the blood-based tests segment dominated the direct-to-consumer laboratory testing market as they supported advanced applications like genetic analysis, hormone profiling, and cardiovascular risk assessment. Their compatibility with multiple high-sensitivity diagnostic platforms made them the preferred choice for labs and companies offering comprehensive health panels. Moreover, growing demand for multi-analyte tests in a single sample and the ability to integrate results into digital health records reinforced the segment’s leadership in revenue shares.

The online/direct-to-consumer platforms segment led the direct-to-consumer laboratory testing market and is projected to grow fastest as companies expand virtual engagement through AI chatbots, personalized dashboards, and teleconsultations linked to test results. Growing trust in digital payment systems and data security has also encouraged more consumers to opt for online purchases. Furthermore, global reach through digital storefronts allows testing providers to serve markets without heavy investment in physical infrastructure, strengthening both adoption and long-term revenue growth.

In 2024, the individual consumers segment dominated the direct-to-consumer laboratory testing market because of rising interest in self-monitoring and lifestyle optimization. Easy access to a wide range of at-home tests, including hormonal, metabolic, and microbiome panels, encouraged independent health tracking. Convenience, privacy, and the ability to make informed wellness decisions without relying on healthcare providers drove adoption, establishing individual consumers as the largest end-user segment and a key revenue contributor in the market.

The healthcare providers segment is projected to grow fastest as medical professionals adopt DTC tests to complement routine diagnostics and improve patient engagement. Hospitals and clinics are using these tests to reduce turnaround times, expand preventive care, and support remote monitoring programs. Increasing partnership between testing companies and healthcare networks, along with demand for scalable, easy-to-use solutions, enables providers to offer more comprehensive services, fueling rapid adoption and market growth in this segment during the forecast period.

In 2024, North America led the direct-to-consumer laboratory testing market share by 58% as consumers increasingly embraced at-home health solutions and personalized wellness tests. The presence of major testing companies, strong R&D capabilities, and a tech-savvy population accelerated adoption. Additionally, collaborations between DTC providers and healthcare institutions, along with high internet penetration and easy access to online ordering, reinforced the region’s dominance, making it the largest contributor to market revenue globally.

The U.S. market is growing due to rising consumer interest in ancestry, heritage, and genetic identity insights. Increasing awareness of personalized health, wellness, and preventive care drives demand for at-home DNA testing kits. Advances in affordable sequencing technologies, easy-to-use collection methods, and online result platforms make testing more accessible. Additionally, marketing campaigns and partnerships with health and wellness brands further boost adoption, positioning demographic testing as a popular segment in the U.S. DTC market.

The Canadian market is growing as more consumers seek convenient and private health monitoring options. Rising adoption of online platforms for ordering test kits, coupled with increasing interest in wellness, nutrition, and chronic disease management, drives demand. Additionally, collaborations between testing companies and local healthcare providers, along with technological improvements in sample collection and processing, are expanding accessibility and reliability, fueling the overall market expansion in Canada.

Asia-Pacific is projected to register the fastest CAGR as growing urbanization and lifestyle-related health concerns drive demand for at-home testing. Rising investments by regional biotech startups and expanding healthcare infrastructure improve accessibility to DTC tests. Additionally, increasing partnerships between global testing providers and local distributors, coupled with a young, tech-savvy population embracing digital health solutions, accelerates adoption, positioning the region as a rapidly expanding market for direct-to-consumer laboratory testing.

R&D in direct-to-consumer laboratory testing is advancing through AI and machine learning, portable and miniaturized devices, next-generation sequencing (NGS), and CRISPR-based diagnostics, aiming to enhance test accuracy, ease of use, and accessibility for consumers.

Regulatory approval for direct-to-consumer laboratory testing requires compliance with multiple authorities, including FDA clearance for testing devices and CMS oversight under CLIA to ensure laboratory quality and standards.

Direct-to-consumer (DTC) lab testing allows individuals to monitor their health and assess disease risks independently, offering convenience and control. However, it often lacks the oversight and guidance provided by traditional healthcare, which can lead to misinterpretation, variable test quality, and misinformation. While DTC platforms assist with ordering, scheduling, and delivering results, users must interpret the medical implications themselves, as professional guidance and standardized quality checks are not always guaranteed (NIH).

In October 2024, ADLM highlights the rapid growth of DTC testing, urging labs to ensure accuracy, data privacy, and professional support, while encouraging consumers to consult healthcare providers for questions. The statement also calls for regulators, including the FTC, to take action against misleading practices and to conduct further research on consumer-initiated versus traditional testing. ADLM stresses that DTC testing can provide timely health insights when used appropriately, with laboratory professionals playing a key role in guiding safe and informed use.

By Test Type

By Sample Type

By End User

By Region

February 2026

January 2026

January 2026

January 2026