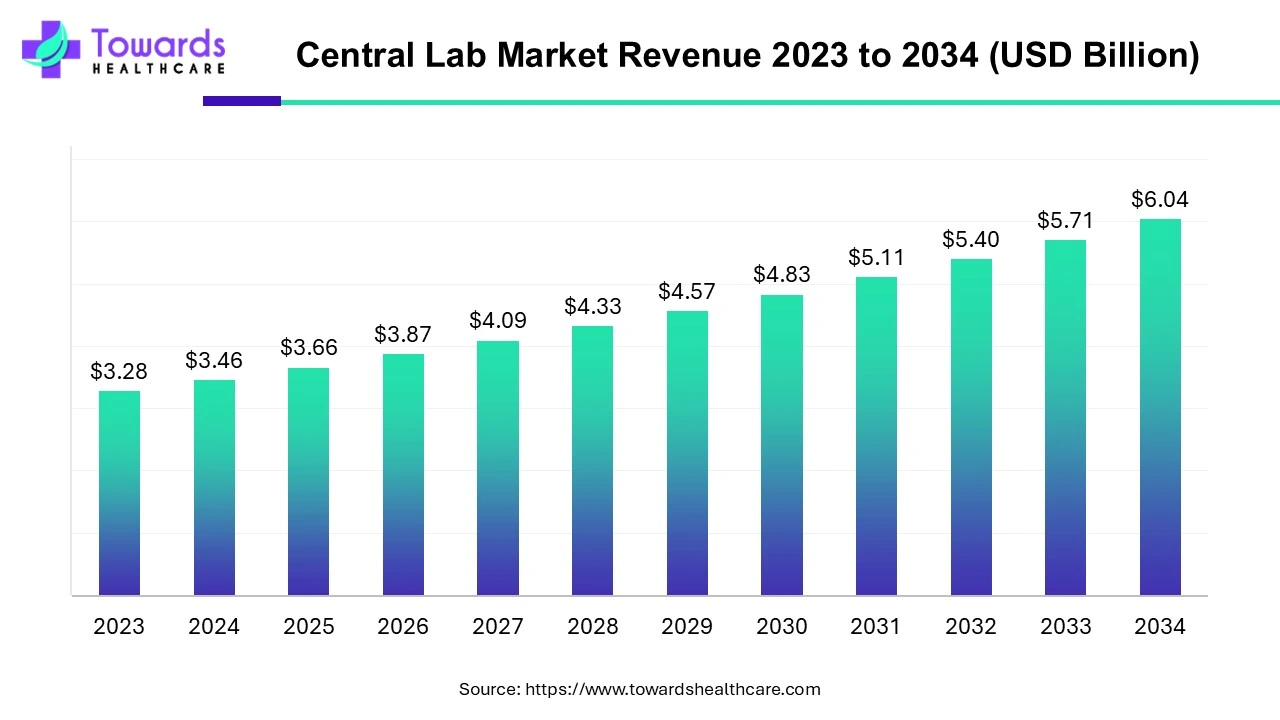

The global central laboratory market, valued at USD 3.46 billion in 2024, is projected to reach USD 6.04 billion by 2034, growing at a CAGR of 5.71% due to rising R&D investments and increasing demand for clinical trials.

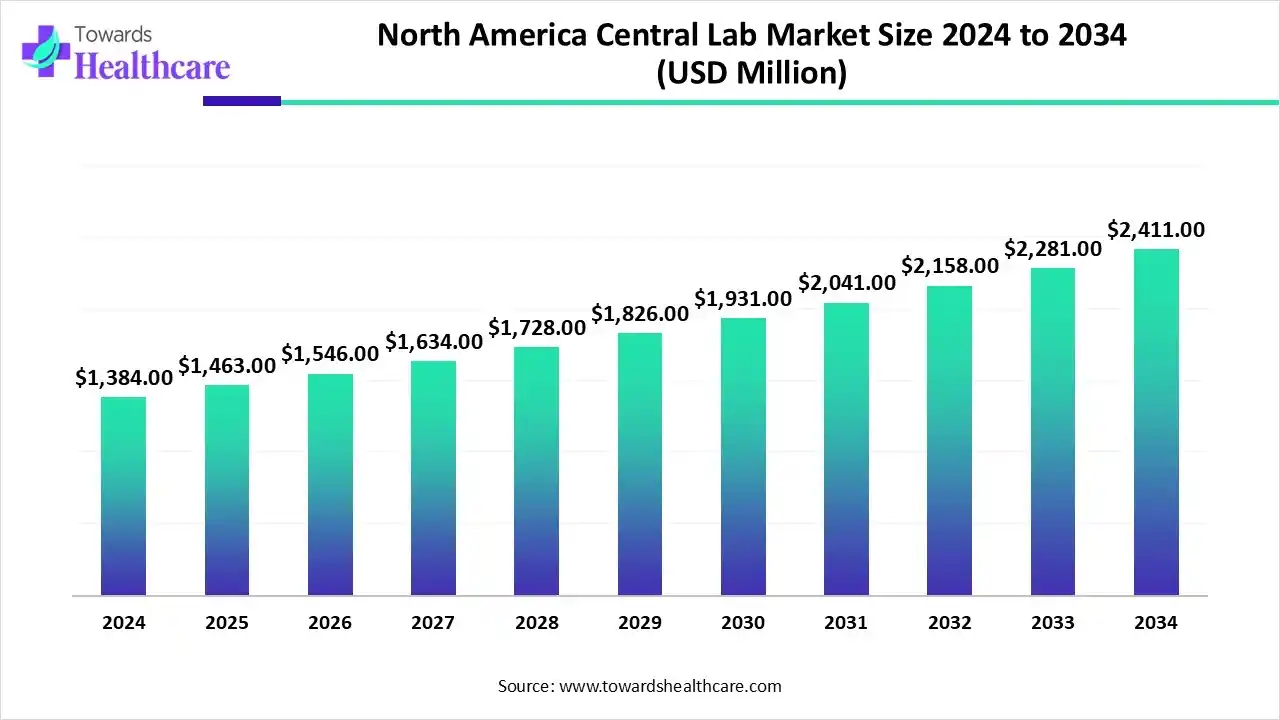

The North America central lab market size is calculated at USD 1.46 billion in 2025, grew to USD 1.54 billion in 2026, and is projected to reach around USD 2.54 billion by 2035. The market is expanding at a CAGR of 5.71% between 2026 and 2035.

The North America central lab market is primarily driven by the increasing number of clinical trials and favorable regulatory policies. North American countries have specialized infrastructure to set up central labs and perform complex experiments. Government organizations provide funding to support clinical trials and research activities. Prominent players collaborate to access advanced technologies and tailored services. Artificial intelligence (AI) and big data analytics are set to become more instrumental in clinical research.

The North America central lab market is experiencing robust growth, driven by the rising prevalence of chronic disorders, growing demand for personalized medicines, and technological advancements. It refers to providing a wide range of services related to clinical trials, from sample preparation and consistent testing procedures to quality control measures. A central lab is a large, specialized facility that is independent of the trial sponsor and processes the laboratory samples drawn from study participants

AI plays a vital role in central labs by introducing automation in laboratory operations, enhancing the efficiency and accuracy of research outcomes. Automation streamlines various tasks, including sample preparation, sample tracking and processing, data handling, and quality control management. AI and machine learning (ML) algorithms can analyze vast amounts of data and help researchers interpret complex datasets. They can also streamline the supply chain and logistics of clinical trial products, ensuring the timely delivery. AI can be used to oversee data tracking and integration across multiple trial sites, enabling accurate recording and transmission of sample data.

| Countries | Regulation | Objectives |

| United States | Clinical Laboratory Improvement Amendments (CLIA) | To ensure quality laboratory testing. Clinical labs require CLIA certification to accept human samples for testing. |

| Canada | Laboratories Canada's strategy | To strengthen federal science through collaboration, bringing scientists together in modern, sustainable laboratories specially designed to support their work. |

| Table | Scope |

| Market Size in 2026 | USD 1.54 Billion |

| Projected Market Size in 2035 | USD 2.54 Billion |

| CAGR (2026 - 2035) | 5.71% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Services, By End-User, By Geography |

| Top Key Players | SGS SA, REPROCELL, Frontage Central Labs, LabConnect, IQVIA, ACM Global Laboratories, Celerion, MLM Medical Labs, Medpace, CTI Clinical Trial and Consulting Services, Inc., Central Testing Laboratory |

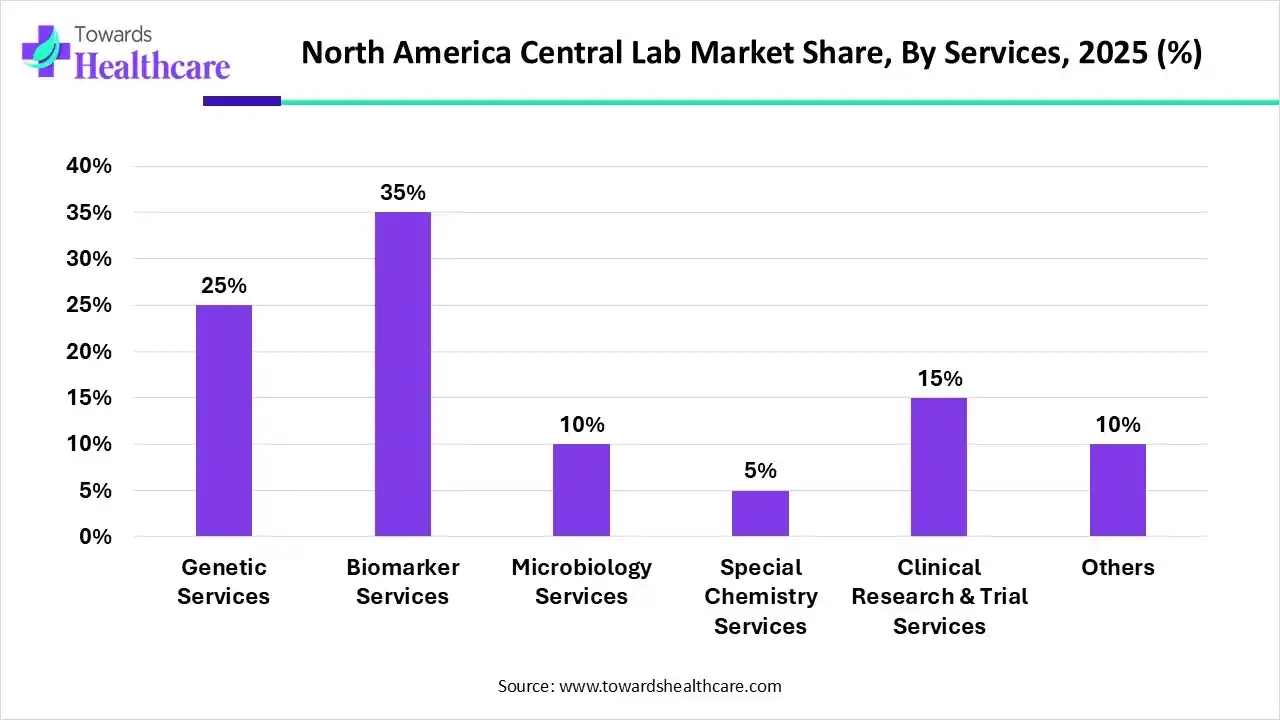

How the Biomarker Services Segment Dominated the North America Central Lab Market?

By services, the biomarker services segment held a dominant presence in the market by 35% in 2025, due to the need for studying disease mechanisms and the growing demand for personalized medicines. Central labs offer tailored biomarker services to develop custom assays, validate bioanalysis, and integrate a multi-omics strategy. This enables researchers to develop novel drugs based on patients’ needs. Advancements in molecular biology and genomics & proteomics boost the segment’s growth. Biomarker services offer precise measurement of immune responses, gene expression, and protein biomarkers.

By services, the genetic services segment is expected to grow at the fastest CAGR in the market during the forecast period. The rising prevalence of genetic disorders and the growing need for biologics augment the segment’s growth. Genetic services refer to providing support for drug discovery, precision medicine, and clinical development. Experiments involving biologics development and validation require specialized infrastructure and equipment. Central labs possess relevant infrastructure and expertise that provide tailored solutions for genetic research.

| Segments | Shares 2025 % |

| Pharmaceutical Companies | 45% |

| Biotechnology Companies | 30% |

| Academic & Research Institutes | 15% |

| Others | 10% |

Which End-User Segment Led the North America Central Lab Market?

By end-user, the pharmaceutical companies segment led the market by 45% in 2025, due to the increasing development of small-molecule drugs and suitable capital investments. Pharmaceutical companies conduct multiple experiments simultaneously, potentiating the need for outsourcing their complex clinical trial services. The U.S. Food and Drug Administration (FDA) approved a total of 50 new drugs in 2024, of which 34 are small-molecule drugs.

By end-user, the biotechnology companies segment is expected to expand rapidly in the market in the coming years. Biotech companies develop innovative biologics and biosimilars to provide targeted treatment for patients. The evolving regulatory landscape for biologics and the need for a specialized testing facility encourage biotech companies to avail central lab services. In 2024, the U.S. FDA approved 16 novel biologics and 18 biosimilars, resulting in a total of 34 biologics. Central lab services enhance efficiency, enabling faster time-to-market.

The rising prevalence of chronic disorders, the increasing number of complex clinical trials, and the growing demand for personalized medicines are the major factors that contribute to market growth. Favorable regulatory support facilitates the development of novel drugs, biologics, and medical devices. Government and private organizations provide funding and launch initiatives for revolutionizing research and clinical trial activities. Additionally, the rising adoption of advanced technologies in central labs fosters market growth.

The U.S. dominated the North America central lab market in 2024. The presence of key players and the presence of a robust clinical trial infrastructure propel the market. Key players, such as LabCorp, PPD, and IQVIA, are the major contributors to the market in the U.S. As of September 2025, 185,901 clinical trials based in the U.S. were registered on the clinicaltrials.gov website. The National Institute of Health (NIH) invests approximately $30.1 billion in medical research every year.

Canada is expected to host the fastest-growing market in the coming years. Central Labs and Central Testing Laboratory Ltd. are the key laboratories that provide clinical trial testing services in Canada. There are 30,966 clinical trials in Canada registered on clinicaltrials.gov, as of September 2025. Canada ranks 6th in the global pharmaceutical market, with a global share of 2.1%. Additionally, Canada accounts for 4% of the global clinical trials and is a G7 leader in clinical trial productivity.

Our experts analyzed that the demand for central labs is booming in North America, with technological innovations and evolving regulatory landscapes. Countries like the U.S. and Canada are at the forefront of developing novel products, strengthening their global position in the clinical trial market. According to our analysis, the growing need for decentralized clinical trials and the development of an established central lab network across the continent positively impact market growth.

By Services

By End-User

By Geography

February 2026

February 2026

February 2026

October 2025