March 2026

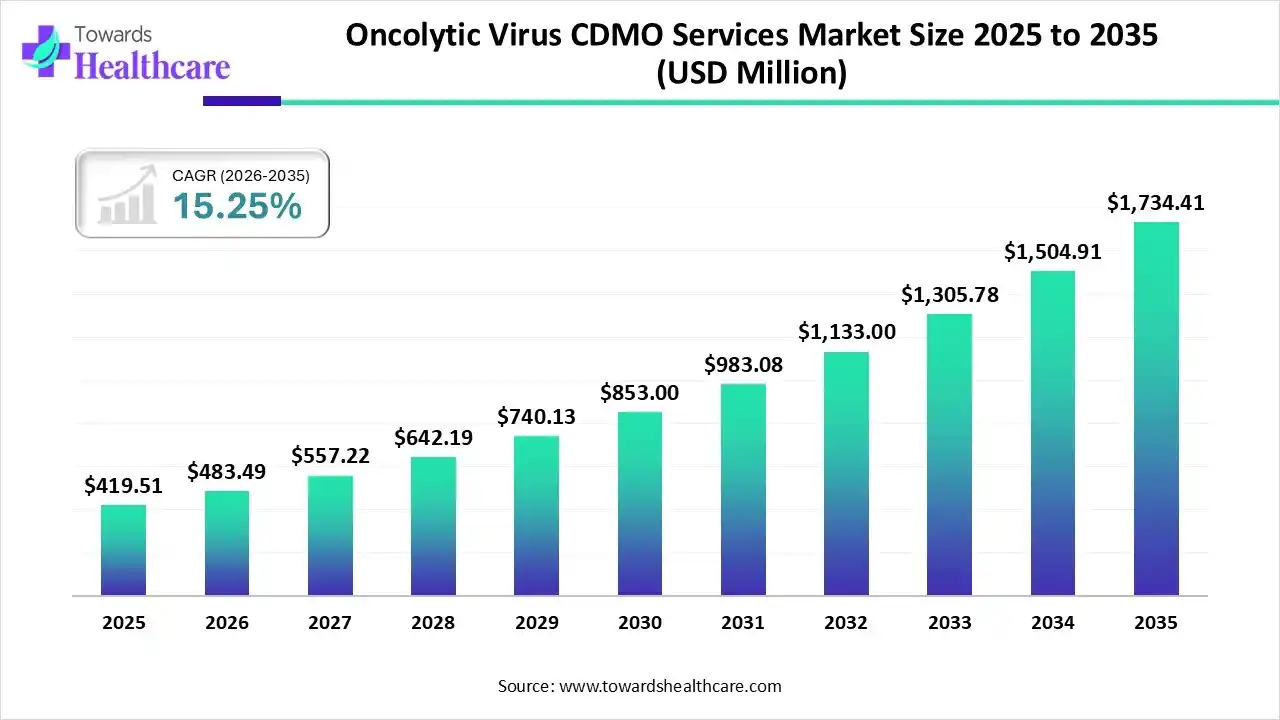

The oncolytic virus CDMO services market size reached US$ 419.51 million in 2025 and is anticipate to increase to US$ 483.49 million in 2026. By 2035, the market is forecasted to achieve a value of around US$ 1734.41 million, growing at a CAGR of 15.25%.

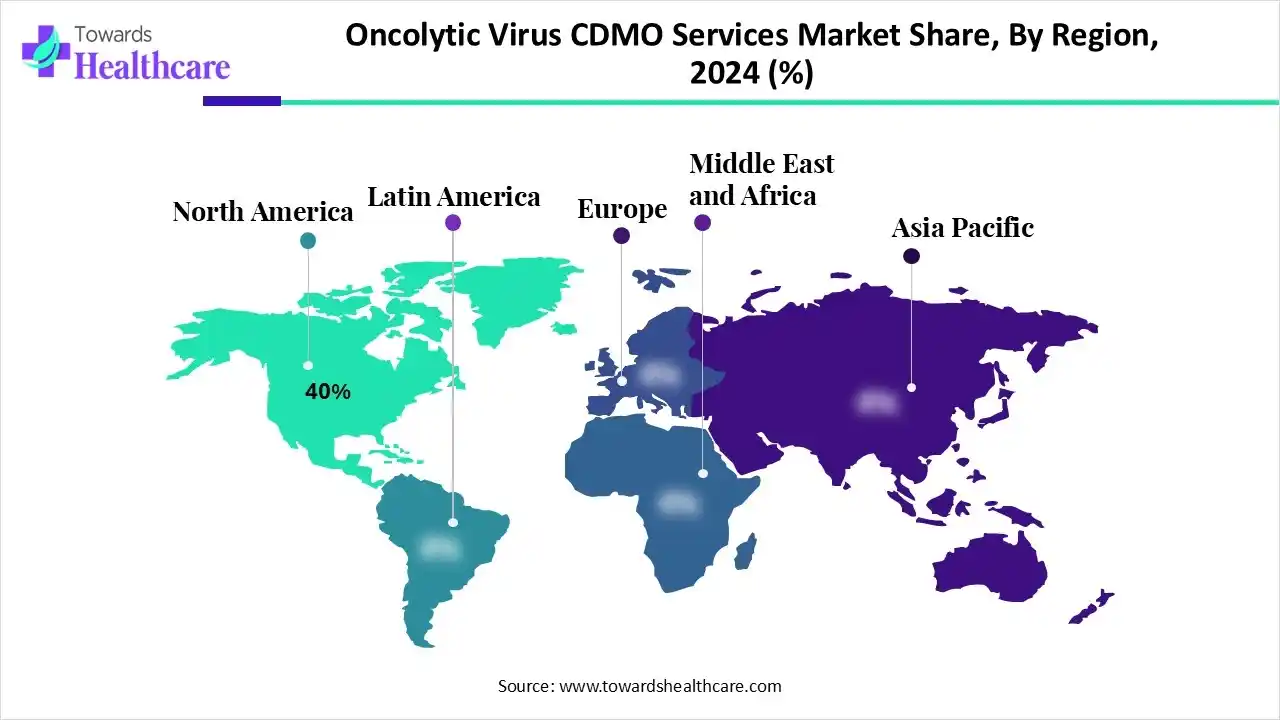

The oncolytic virus CDMO services market is experiencing significant growth, driven by the increasing prevalence of cancer and advancements in viral vector technologies. North America, particularly the United States, leads this market due to its robust healthcare infrastructure, substantial research and development investments, and supportive regulatory environment. Key players in the region are expanding their capabilities to meet the rising demand for oncolytic virus therapies. This growth is further fueled by the increasing success of oncolytic virus therapies in clinical trials, boosting investor confidence and driving further research and development.

| Key Elements | Scope |

| Market Size in 2025 | USD 419.51 Million |

| Projected Market Size in 2035 | USD 1734.41 Million |

| CAGR (2025 - 2035) | 15.25% |

| Leading Region | North America by 40% |

| Market Segmentation | By Service Type, By Virus Type, By Therapeutic Area, By End-User, By Region |

| Top Key Players | Catalent Inc., Lonza Group, WuXi AppTec, Brammer Bio (Thermo Fisher), Curia (formerly AMRI), Cobra Biologics, Vigene Biosciences, Oxford Biomedica, REGENXBIO, Oncolytics Biotech, Viralgen Vector Core, Avidity Biosciences, GenScript Biotech, Fujifilm Diosynth Biotechnologies, Asymchem, Sarepta Therapeutics, MeiraGTx, BioVectra, AGC Biologics, CleanCap Technologies |

The oncolytic virus CDMO services market is driven by the rising prevalence of cancer and the growing demand for innovative viral-based therapies. Increasing clinical trials and the success of oncolytic virus treatments present significant opportunities for specialized manufacturing services. Oncolytic virus CDMO services provide end-to-end solutions for the development, production, and scale-up of oncolytic viruses, which are genetically engineered viruses designed to selectively infect and destroy cancer cells. These services include process development, analytical testing, cGMP manufacturing, and regulatory support. By outsourcing to CDMOs, biotech companies can accelerate development timelines, reduce costs, and ensure high-quality, scalable production of oncolytic virus therapies.

The oncolytic virus CDMO services market is experiencing significant growth, driven by the increasing prevalence of cancer and the rising demand for innovative therapies. Advancements in viral vector engineering and gene editing technologies are enhancing the efficacy and safety profiles of oncolytic virus therapies. The growing number of clinical trials and successful outcomes is encouraging investment and accelerating development timelines. Additionally, the supportive regulatory environment and increasing collaborations between pharmaceutical companies and CDMOs are further fueling market expansion.

Ongoing innovations in viral vector engineering are enhancing the efficacy and safety profiles of oncolytic virus therapies. These advancements enable the development of more potent and targeted therapies, improving treatment outcomes and expanding the potential applications of oncolytic viruses in oncology. As a result, CDMOs are investing in state-of-the-art technologies to support the production of these advanced therapies.

The growing number of oncolytic virus therapies entering clinical trials and receiving regulatory approvals is a significant driver of market growth. Successful clinical outcomes and expedited approvals are boosting investor confidence and accelerating the development and commercialization of oncolytic virus therapies. This trend underscores the industry's commitment to advancing innovative cancer treatments.

The increasing global incidence of cancer is driving the demand for innovative treatment options, including oncolytic virus therapies. As traditional therapies reach their limits, oncolytic viruses offer a promising alternative, leading to heightened interest and investment in this therapeutic approach. CDMOs play a crucial role in meeting this growing demand by providing specialized manufacturing services.

The integration of Artificial Intelligence (AI) into oncolytic virus CDMO services is transforming the industry by enhancing efficiency, precision, and scalability in the development and production of therapies. AI accelerates drug development by analyzing large datasets to identify therapeutic candidates, optimize clinical trial designs, and predict outcomes, reducing time-to-market for oncolytic virus therapies. It improves process optimization through real-time monitoring and control, ensuring higher yield, consistency, and compliance with regulatory standards. AI also supports personalized medicine by tailoring treatments based on patient-specific genetic and tumor data, enhancing efficacy and minimizing side effects.

| Month/Year | Company | Launch / Service / Therapy | Description |

| January 2025 | Replimune Group Inc. | RP2 oncolytic virus therapy | An advanced clinical trial for melanoma treatment, enhancing anti-tumor immune response. |

| March 2025 | Amgen Inc. | Talimogene laherparepvec (T-VEC) expansion | Expanded manufacturing support via CDMO for multiple cancer indications. |

| May 2025 | Oncolytics Biotech Inc. | Pelareorep combination therapy | Clinical trial launched combining oncolytic virus with immunotherapy for solid tumors. |

| June 2025 | Vibalogics | Oncolytic virus manufacturing service | New CDMO service for scalable GMP production of multiple viral vectors. |

| August 2025 | TILT Biotherapeutics | Cytokine-armed oncolytic adenovirus | Initiated preclinical trials with innovative immune-enhancing viral therapy. |

| September 2025 | Jivana Biotechnology | Preclinical-stage oncolytic virus therapy | Focus on personalized cancer treatments and targeted viral delivery systems. |

| October 2025 | Ascend Advanced Therapies | AI-driven oncolytic virus CDMO platform | Integrated AI for scalable, efficient manufacturing and process optimization |

| Month/Year | Company | Initiative / Service Launched | Description |

| March 2025 | Vibalogics | Scalable viral vector manufacturing service | Expanded GMP manufacturing capabilities for oncolytic viruses to meet clinical and commercial demand. |

| May 2025 | Ascend Advanced Therapies | AI-driven oncolytic virus CDMO platform | Integrated AI for process optimization and scalable production of oncolytic viruses. |

| June 2025 | ABL Inc. | Advanced viral production services | Launched enhanced CDMO services for high-yield, high-quality oncolytic virus production. |

| August 2025 | TILT Biotherapeutics | Cytokine-armed oncolytic adenovirus preclinical program | Developed immune-enhancing viral therapies for personalized cancer treatment pipelines. |

| September 2025 | Jivana Biotechnology | Personalized oncolytic virus therapy development | Focused on patient-specific therapies with targeted viral delivery systems. |

The upstream manufacturing segment dominates the market with a share of approximately 45% due to its critical role in viral vector development, including cell line selection, viral replication, and initial production. High demand for scalable, high-quality viral yields, coupled with stringent regulatory requirements, drives CDMOs to focus on robust upstream processes, ensuring consistent and effective therapies.

The downstream manufacturing segment is estimated to grow at the fastest rate in the market due to increasing demand for high-purity, clinical-grade viral products. Advanced purification, filtration, and formulation technologies are essential to ensure the safety, potency, and stability of oncolytic virus therapies. Rising clinical trials and commercialization of viral therapies are driving investment and innovation in downstream processing capabilities.

The adenovirus segment dominates the market with a share of approximately 30% due to its well-established safety profile, strong immunogenicity, and ease of genetic modification. Its ability to selectively replicate in tumor cells and deliver therapeutic genes efficiently makes it the preferred vector for oncolytic virus development and large-scale CDMO manufacturing partnerships.

The herpes simplex virus (HSV) segment is anticipated to be the fastest-growing in the market due to its large genetic capacity, ability to target a wide range of cancers, and potential for genetic engineering to enhance tumor selectivity. The U.S. FDA approval of T-VEC, an HSV-based oncolytic therapy, has accelerated global research and manufacturing partnerships. Growing investment in HSV-based immunotherapies further supports the segment’s rapid expansion and clinical adoption.

The melanoma segment dominates the market with a share of approximately 35% due to the proven clinical success of oncolytic therapies like T-VEC, which effectively target melanoma cells and stimulate immune responses. High global prevalence of melanoma and strong research investment in viral immunotherapies drive demand for CDMO services specializing in scalable production of melanoma-targeted oncolytic viruses.

The glioblastoma segment is estimated to be the fastest-growing in the market due to the aggressive nature and poor prognosis of this brain cancer, driving urgent demand for novel therapies. Increasing clinical trials and research focus on viral immunotherapies for glioblastoma are accelerating CDMO engagement for scalable, high-quality viral vector production.

The pharmaceutical companies segment dominates the market with a share of approximately 45% due to their strong R&D infrastructure, extensive funding capabilities, and established global partnerships. These companies increasingly outsource viral vector development and manufacturing to specialized CDMOs for faster clinical translation. Their focus on expanding cancer immunotherapy portfolios further strengthens demand for scalable, compliant, and high-quality oncolytic virus production services.

The biotechnology companies segment is anticipated to be the fastest-growing end-user segment in the market due to their innovation-driven approach and focus on developing novel viral immunotherapies. Many biotechs rely on CDMOs for specialized expertise, GMP manufacturing, and regulatory compliance. Increased venture funding and strategic collaborations enable these companies to accelerate clinical pipelines and expand global research initiatives.

North America dominates the oncolytic virus CDMO services market with a share of approximately 40% due to its advanced biopharmaceutical infrastructure, strong presence of leading CDMOs, and high investment in cancer immunotherapy research. The region benefits from supportive regulatory frameworks, a robust clinical trial ecosystem, and collaborations between pharmaceutical companies, biotechnology firms, and academic institutes. Increasing demand for personalized cancer treatments and technological advancements in viral vector manufacturing further boost market leadership. Additionally, government initiatives promoting cell and gene therapy innovation, along with the presence of major players in the U.S. and Canada, position North America as the global hub for oncolytic virus development and production.

In the U.S., the growing cancer burden is a key driver for oncolytic virus CDMO demand. In 2025, an estimated 2,041,910 new cancer cases are expected in the country, with 618,120 deaths projected. Roughly 18.6 million Americans are living with cancer as of 2025. Presence intensifies the need for advanced viral therapies and specialized CDMO services.

Canada is emerging as the fastest-growing North American hub for oncolytic virus CDMO services due to strong government funding and incentives for biomanufacturing, major new facilities (e.g., OmniaBio’s large cell-and-gene therapy site), growing biotech R&D and skilled talent, and targeted investments in automation, AI, and GMP capacity that accelerate clinical-scale production and commercialization.

The Asia-Pacific region is the fastest-growing in the oncolytic virus CDMO services market due to expanding biotech infrastructure, increasing cancer prevalence, and rising government support for advanced therapy development. Countries like China, Japan, and South Korea are heavily investing in viral vector manufacturing and cross-border collaborations, accelerating regional growth and innovation.

In 2024, China is projected to report approximately 4.8 million new cancer cases, with 2.6 million cancer-related deaths. Lung, breast, and colorectal cancers remain the most prevalent. This escalating cancer burden is prompting increased investment in advanced therapies, including oncolytic virus treatments. Consequently, there is a growing reliance on specialized CDMOs for scalable, compliant manufacturing to meet the demands of clinical trials and commercialization.

India's cancer incidence is expected to rise by 12.8% in 2025 compared to 2020, with an estimated 1.46 million new cases. Breast cancer continues to be the most common, followed by cervical and colorectal cancers. This surge is driving the need for innovative treatment options, including oncolytic virus therapies. As a result, Indian biotech firms are increasingly partnering with CDMOs to develop and manufacture these advanced therapies, facilitating their entry into clinical trials and subsequent market availability.

According to the data published by the National Library of Medicine, Japan is anticipated to report approximately 1.02 million new cancer cases in 2025, with lung, stomach, and colorectal cancers being the most prevalent. The aging population and high detection rates are contributing to this increase. In response, pharmaceutical companies are focusing on developing targeted immunotherapies, including oncolytic virus treatments. To support these initiatives, there is a growing demand for specialized CDMOs capable of providing expertise in viral vector engineering, scale-up, and regulatory compliance, ensuring the successful development and commercialization of these therapies.

Europe is experiencing significant growth in the market, driven by several key factors. The region's robust healthcare infrastructure, coupled with substantial investments in biotechnology and pharmaceutical sectors, fosters innovation and development of advanced therapies. Additionally, Europe's stringent regulatory frameworks ensure high-quality standards, attracting global partnerships. The increasing prevalence of cancer further propels this growth; in 2025, Europe is projected to report approximately 4.47 million new cancer cases, with a mortality rate of 1.99 million. This escalating cancer burden underscores the urgent need for innovative treatment solutions, thereby expanding the demand for specialized CDMO services in the region.

Recipharm (Vibalogics)

IDT Biologika

FUJIFILM Diosynth Biotechnologies

Lonza

WuXi AppTec

By Service Type

By Virus Type

By Therapeutic Area

By End-User

By Region

March 2026

March 2026

February 2026

February 2026