January 2026

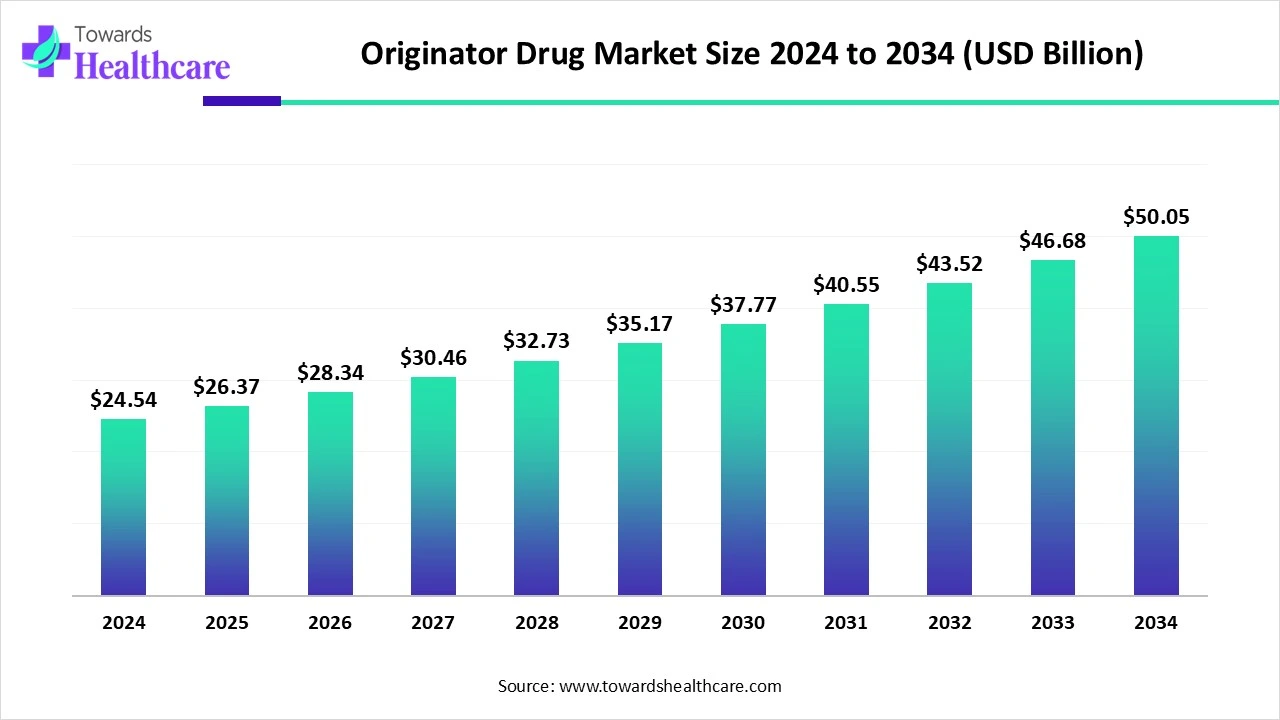

The global originator drug market size is calculated at US$ 24.54 in billion 2024, grew to US$ 26.37 billion in 2025, and is projected to reach around US$ 50.05 billion by 2034. The market is expanding at a CAGR of 7.44% between 2025 and 2034.

The original goods created and sold by pharmaceutical corporations are known as branded medications. They need FDA (Food and Drug Administration) permission and go through a lot of clinical trials. The ageing population, which is more prone to chronic conditions including obesity, diabetes, and hypertension, as well as the rising burden of infectious and non-infectious diseases, is expected to have a beneficial effect on space expansion. Businesses are expanding their product lines by launching new items. Additionally, players use partnerships and agreements to expand the reach of their product offerings and boost their manufacturing capacity.

| Metric | Details |

| Market Size in 2025 | USD 26.37 Billion |

| Projected Market Size in 2034 | USD 50.05 Billion |

| CAGR (2025 - 2034) | 7.44% |

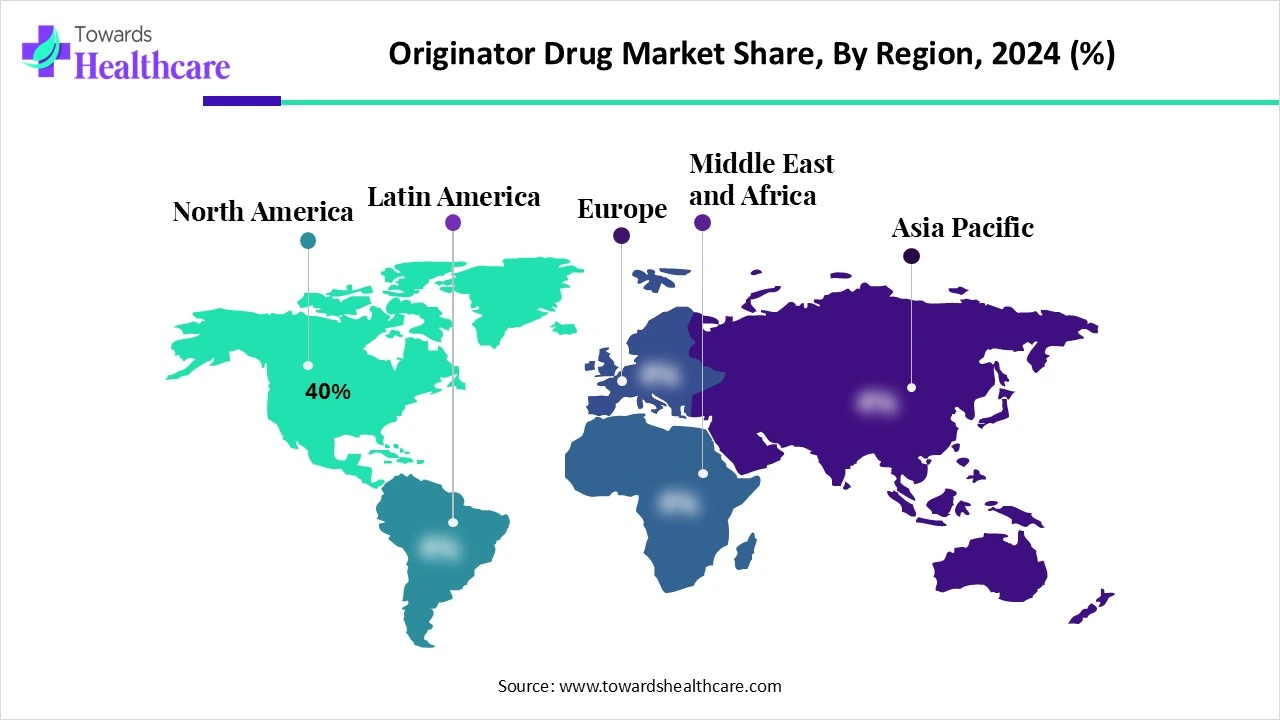

| Leading Region | North America share by 40% |

| Market Segmentation | By Drug Type, By Therapeutic Area, By Route of Administration, By Patent Status, By Distribution Channel, By Pricing Segment, By Region |

| Top Key Players | Pfizer Inc., Roche Holding AG, Johnson & Johnson, Novartis AG, Merck & Co., Inc. (MSD), Bristol-Myers Squibb, Sanofi S.A., GlaxoSmithKline (GSK), AstraZeneca plc, AbbVie Inc., Eli Lilly and Company, Bayer AG, Amgen Inc., Novo Nordisk A/S, Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Biogen Inc., Regeneron Pharmaceuticals, Inc., Moderna, Inc., CSL Limited |

The originator drug market refers to the market segment involving pharmaceutical products developed, patented, and marketed by innovator companies (originators) that hold exclusive rights to manufacture and sell these drugs. These drugs are typically novel chemical entities or biologics that undergo extensive research and development (R&D) and clinical trials before regulatory approval. The originator drugs command premium pricing due to their patented status, innovation, and clinical benefits. This market contrasts with generic drugs, which are copies of originator drugs produced after patent expiration.

Pharmaceutical innovation has been transformed by the use of artificial intelligence (AI) in drug development, which has solved the problems associated with conventional approaches that are expensive, time-consuming, and prone to failure. Artificial Intelligence (AI) improves several phases of drug development, such as target discovery, lead optimisation, de novo drug design, and drug repurposing, by employing machine learning (ML), deep learning (DL), and natural language processing (NLP).

Consumers’ Trust in Originator Drugs Promotes Market Expansion

The degree of trust that customers have in brand-name drugs is one of their primary advantages. Patients are reassured that they are getting the finest care available for their disease because these medications have undergone rigors clinical studies and have been shown to be safe and effective. Additionally, pharmaceutical firms' marketing campaigns aid in increasing public knowledge of specific illnesses and their treatments.

The High Cost of Originator Drugs Restrains the Market

Health care providers and the government have taken steps to reduce and optimise costs as a result of rising medical expenses. Generally speaking, brand-name drugs cost between 30% and 60% more than generic versions. Health authorities across the world are thus promoting the use of less expensive generic prescription medications as substitutes for more costly branded ones.

How will Precision Medicine Promote the Growth of the Originator Drug Market?

Because they provide special features and advantages that improve treatment efficacy and personalisation, name-brand medications are essential in precision medicine. Brand-name pharmaceuticals are important in precision medicine's approach to targeted therapy since they frequently include unique formulations, delivery methods, and clinical data tailored to the needs of specific patients, even when generic medications are less expensive. The need for precision medicine will grow in the future as the number of rare illnesses, cancer, and other chronic conditions rises.

By drug type, the small molecule drugs segment dominated the originator drug market in 2024. Small-molecule medications have a number of benefits, the first of which is their high oral bioavailability, which makes self-administration easy. These pharmaceuticals are often taken as oral solid doses (OSDs). Because of their increased compliance, patients are more suited for the long-term management of chronic illnesses. Additionally, because tiny molecules have well-established production capabilities, they are frequently less expensive to make than their equivalents.

In the small molecule drugs segment, the oral solids segment was dominant in 2024. Because of their effectiveness, affordability, convenience of administration, and shelf stability, the majority of small-molecule medications are made in oral solid dose (OSD) forms, such as tablets or capsules. OSD has played a significant role in the worldwide pharmaceutical industry.

By drug type, the biologics segment is estimated to grow at the highest rate in the originator drug market during the forecast period. The FDA has authorised 63 biosimilars as of the end of 2024, which include 17 distinct reference products. Many of these biosimilars are in competition with the same reference product. Of the 63 biosimilar products that have received FDA approval, 43 have been introduced in the U.S. These unprecedented figures show that biosimilars are becoming more widely accepted and integrated into the U.S. market.

In the biologics segment, the monoclonal antibodies sub-segment is expected to be the fastest-growing. 50 new medications were approved by the U.S. Food and Drug Administration (FDA) in 2024, which is in line with the average for the previous several years (2018–2023). More than 25% of all medications approved this year are monoclonal antibodies (mAbs), and the approval of 13 of these molecules establishes a new record.

By therapeutic area, the oncology segment held the largest share of the originator drug market in 2024. 2024 saw a modest rise in oncology trials to 2,162, with a primary focus on solid tumours and uncommon malignancies. Currently, 35% of oncology trials are new oncology modalities, including gene and cell treatments, antibody-drug conjugates (ADCs), and multispecific antibodies. There have been 132 oncology NAS released worldwide in the last five years, and 282 during the previous 20 years. There have been significant regional variances, with China seeing a major increase in debuts since 2019.

By therapeutic area, the rare diseases/orphan drugs segment is estimated to grow at the highest CAGR during 2025-2034. The FDA has approved medications for a number of illnesses and ailments in 2024, including uncommon disorders. For patients with limited or no therapy alternatives, the FDA authorised a large number of rare illness medicines with orphan drug classification. Our strong commitment to addressing the enormous unmet medical need in rare illnesses is demonstrated by the fact that more than 50% of our innovative therapeutic approvals were for therapies with orphan drug designations. Of the 50 new drugs that CDER authorised in 2024, 26 (52%) were approved to treat "orphan" or uncommon disorders.

By route of administration, the oral segment led the originator drug market in 2024. Approximately 90 percent of all pharmacological substances meant for human use are taken orally. Because they are easy, non-invasive, and, most importantly, allow for self-administration, oral medications are typically the preferred delivery method for both patients and treating physicians. These factors all contribute to increased patient compliance.

By route of administration, the injectable segment is expected to be the fastest-growing during the forecast period. In both Europe and the U.S., the manufacture of sterile injectable drugs is expanding at an unprecedented rate. The spike is caused by a number of things, such as rising demand for high-value treatments like vaccinations and biologics.

By patent status, the under patent protection segment dominated the originator drug market in 2024. One of the most important legal tools in the pharmaceutical industry is the patent. This type of intellectual property gives creators, usually pharmaceutical firms, the exclusive right to market a newly created medication for a predetermined amount of time, usually 20 years after the date the patent application was filed. A strong incentive for ongoing research and development and the promotion of ground-breaking scientific discoveries is provided by this temporary monopoly, which forbids other organisations from producing, using, importing, or selling the patented innovation without express consent.

By patent status, the patent expired segment is anticipated to witness the highest rate during the forecast period. Cost containment in healthcare and pharmaceuticals is influenced by the introduction of generic versions of original medications onto the market following patent expiration and the subsequent generic replacement. In the upcoming years, the patents on a number of well-known drugs will expire, drastically altering the pharmaceutical industry. The world's best-selling medication, Merck's cancer treatment Keytruda, which generated $29.5 billion in sales in 2023, will no longer be protected by a patent in 2028. Other significant patent expirations include Bristol Myers Squibb's blood thinner Eliquis, Pfizer's breast cancer treatment Ibrance (2027), and Eli Lilly's diabetic medicine Trulicity (2027).

By distribution channel, the hospital pharmacies segment was dominant in the originator drug market in 2024. Hospital pharmacies play a crucial role in ensuring that healthcare systems operate correctly by providing timely, equitable access to safe, suitable medications, medical equipment, and top-notch pharmaceutical care.

By distribution channel, the online pharmacies segment is estimated to grow at the highest rate during the upcoming timeframe. The advent of digital health solutions has altered how patients interact with healthcare providers. One advancement that has made it feasible to provide prompt and efficient medical consultations is the use of online pharmacy applications. Patient care is being revolutionised by these apps, which are the outcome of excellent online pharmacy app development. They give patients unparalleled access to medical advice and prescription services.

By pricing, the premium pricing segment dominated the originator drug market in 2024. Because of things like patent exclusivity, brand awareness, and research and development expenses, branded medications are frequently more expensive than generic ones. Given that generic medications are 80–85% less expensive than their branded equivalents, this premium can be substantial.

By pricing, the value-based pricing segment is anticipated to be the fastest-growing during the forecast period. A seller can raise an item's price to the maximum amount that buyers are prepared to pay by using value-based pricing. It may support the development of the brand and consumer loyalty. Having a better understanding of the characteristics that consumers appreciate most can also help stimulate improvements in future goods.

North America dominated the originator drug market share by 40% in 2024. Because of its strong pharmaceutical industry, sophisticated research facilities, and significant biotechnology and R&D investments, the area has the advantages of top pharmaceutical corporations, state-of-the-art technology, and reputable university institutions that spur innovation in drug discovery. The FDA and other regulatory bodies provide robust assistance by expediting approvals and providing incentives for innovative medicines, which further stimulate the creation of ground-breaking cures. Furthermore, the strong demand for cutting-edge treatments solidifies North America's market-leading position.

CDER used a range of regulatory tactics in 2024 to enhance and expedite drug review. These tactics enable improved communication, flexibility, and efficacy between CDER staff and drug developers. In order to speed up the delivery of novel drugs to patients with serious illnesses, especially where there are no suitable substitutes, the FDA usually allows shorter review periods while upholding its stringent safety and effectiveness standards.

With 2.1 percent of the global pharmaceutical market, Canada is the sixth biggest pharmaceutical market in the world. By quantity, brand-name medications make up 23.4% of prescriptions and 80.5% of Canadian sales by value. In 2023, patented medicines accounted for $19.9 billion, or 47.3 percent of all drug sales in Canada, according to the PMPRB Annual Report for 2023.

Asia Pacific is estimated to host the fastest-growing originator drug market during the forecast period. Rising healthcare costs and an increase in the demand for pharmaceuticals are two of the reasons contributing to this trend. Due to the region's affordable pricing, advantageous regulatory framework, and high-quality data, it is also becoming a centre for outsourcing drug development operations. Additionally, an increasing number of current drug development studies in the area, government efforts, and private-public partnerships are some of the major elements that are projected to drive the rise.

It states that China hopes to have its pharmaceutical sector more innovative, creative, and globally competitive by 2035, with a modernised regulatory framework, and to completely guarantee the safety, effectiveness, and accessibility of medications and medical equipment. China authorised the market launch of 65 new medical equipment and 48 unique pharmaceuticals in 2024. It had the second-highest number of pharmaceuticals under development worldwide, and a number of its locally produced medications were approved for international markets.

With the third-largest volume and the fourteenth-largest value, India's pharmaceutical sector is a worldwide powerhouse. The fiscal year 2024–2025 had FDI inflows of ₹11,888 Crore in pharmaceuticals and medical devices between April 2024 and December 2024. Additionally, during FY 2024–2025, the Department of Pharmaceuticals has authorised 13 FDI applications for brownfield projects totalling ₹7,246.40 Crore.

Europe is expected to grow significantly in the originator drug market during the forecast period. Europe's drug discovery services industry contributes significantly, with Germany, France, and the UK accounting for a major portion of the market. Quality drug discovery services are in high demand due to the region's robust pharmaceutical infrastructure and strict European Medicines Agency (EMA) standards.

The largest pharmaceutical market in Europe is found in Germany. German pharmaceutical sector sales reached EUR 59.8 billion in 2023, a 5.8% rise. Based on R&D expenditure and patent application levels, Germany is among the top clinical trial destinations in the world. Germany has also become a major provider of innovative biopharmaceuticals in response to the need for personalised treatment throughout the world.

In August 2024, a combined public-private investment was used to launch the Voluntary Scheme for Branded Medicine Pricing, Access, and Growth (VPAG) Investment Programme. Investments of up to £400 million will enhance clinical studies, boost UK pharmaceutical production, and provide quicker patient access to innovative medications. To speed up research, the UK will establish 18 new clinical trial sites. In the globe, this is the first significant public-private partnership of this magnitude.

In March 2025, as part of its worldwide growth plan, Eli Lilly may consider producing its popular original medicine, Mounjaro, in India, according to David Ricks, the company's global CEO. Ricks discussed the company's ambitious $50 billion growth plan in an exclusive interview. The strategy aims to increase production capacity to satisfy the increasing demand for diabetes and weight management treatments. Mounjaro has the potential to change that, since India might grow to be a significant market for us. He went on to say, "We are open-minded about the possibilities here."

By Drug Type

By Therapeutic Area

By Route of Administration

By Patent Status

By Distribution Channel

By Pricing Segment

By Region

January 2026

January 2026

January 2026

January 2026