February 2026

The global osteoarthritis therapeutics market size began at US$ 9.95 billion in 2024 and is forecast to rise to US$ 10.89 billion by 2025. By the end of 2034, it is expected to surpass US$ 24.52 billion, growing steadily at a CAGR of 9.45%.

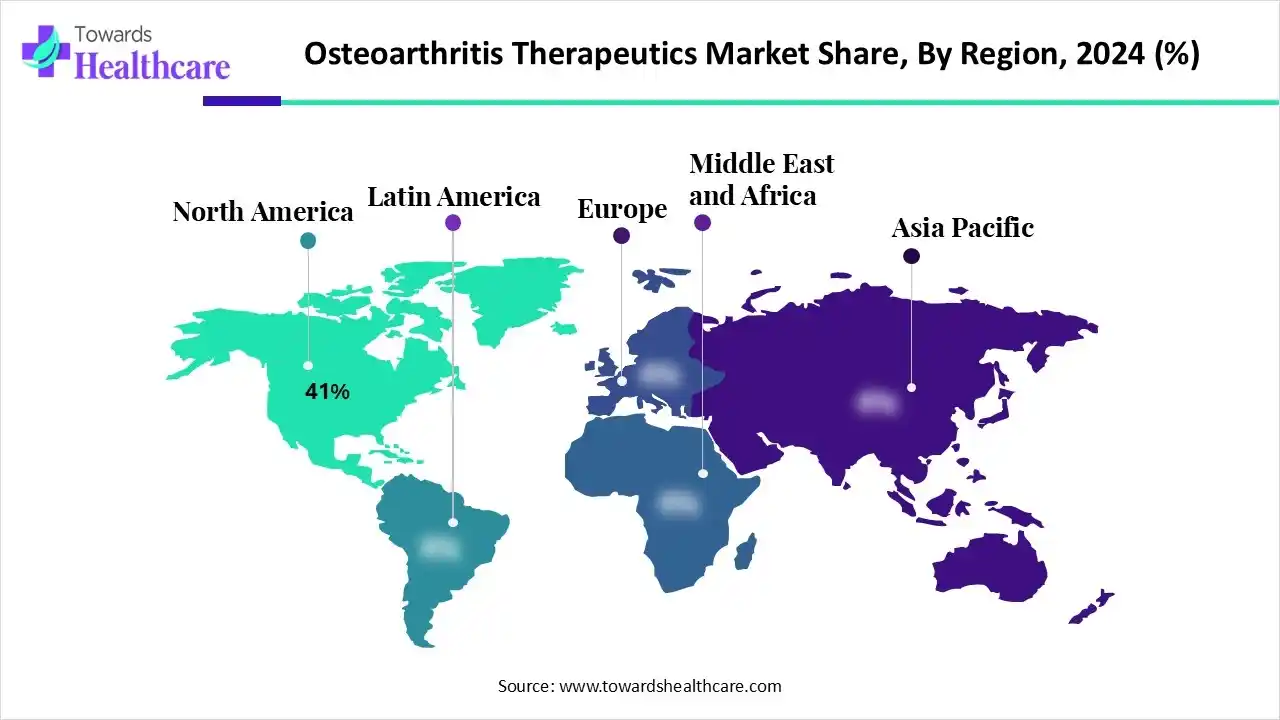

The osteoarthritis therapeutics market is witnessing steady growth, driven by the rising prevalence of osteoarthritis, aging populations, and increasing obesity rates. Advancements in drug development, biologics, and disease-modifying therapies are enhancing treatment options and patient outcomes. North America dominates the market due to its high patient pool, advanced healthcare infrastructure, strong R&D presence, and favorable reimbursement policies. Growing awareness, early diagnosis, and the presence of leading pharmaceutical companies in the region further strengthen its leadership in the global osteoarthritis therapeutics market.

| Table | Scope |

| Market Size in 2025 | USD 10.89 Billion |

| Projected Market Size in 2034 | USD 24.52 Billion |

| CAGR (2025 - 2034) | 9.45% |

| Leading Region | North America by 41% |

| Market Segmentation | By Drug Class, By Route of Administration, By Joint Type, By Distribution Channel, By Region |

| Top Key Players | Pfizer, Johnson & Johnson (Janssen), Novartis, Eli Lilly, GlaxoSmithKline (GSK), AbbVie, Sanofi, Bayer AG, AstraZeneca, Merck & Co., Horizon Therapeutics (acquired by Amgen), Flexion Therapeutics, Pacira BioSciences, Bioventus (orthobiologics, HA), Ferring Pharmaceuticals, Teva Pharmaceuticals, Regeneron Pharmaceuticals, Anika Therapeutics (HA viscosupplementation), Smith+Nephew (orthobiologics), Kolon Life Science (Invossa regenerative therapy in Asia) |

The osteoarthritis therapeutics market growth is driven by the increasing demand for non-surgical and minimally invasive treatments, growing obese and aging populations, and advancements in targeted therapies and regenerative medicine. Osteoarthritis therapeutics include treatments that manage pain, stiffness, and mobility loss caused by cartilage degeneration. Approaches range from medications like NSAIDs, corticosteroids, and emerging DMosteoarthritis Ds to biologics, regenerative therapies, physical therapy, and surgery. These therapies aim to improve quality of life, delay progression, and restore joint function.

There is increasing R&D focus on DMosteoarthritis Ds therapies that aim to alter the disease process (cartilage degradation, inflammation) rather than just relieve symptoms.

Improved intra-articular injections (e.g., more effective viscosupplementation agents, lubricants, liposomal carriers) are being developed to offer better pain relief with fewer side effects.

Collaborations, partnerships, and acquisitions drive osteoarthritis therapeutics growth by expanding R&D, reducing costs, and accelerating innovative therapies. These strategies enhance technology access, broaden pipelines, and speed entry into new markets.

In July 2025, Pacira BioSciences entered a strategic collaboration with Johnson & Johnson MedTech to co-promote ZILRETTA, an extended-release injectable treatment for knee osteoarthritis pain. The partnership aims to expand patient access and enhance promotional reach by leveraging J&J MedTech’s early-intervention sales force.

AI integration can significantly improve the market by enhancing early diagnosis, personalized treatment, and drug development efficiency. AI-driven imaging analysis can detect subtle joint changes earlier than traditional methods, allowing timely intervention. Machine learning models help tailor therapies based on patient genetics, lifestyle, and disease progression. In drug discovery, AI accelerates the identification of new therapeutic targets, reduces trial costs, and improves clinical trial design. Additionally, AI-powered digital health tools and wearable devices can monitor patient mobility, pain levels, and treatment response, enabling continuous care and better disease management.

Advancement in Drug Development

Advancements in drug development drive osteoarthritis therapeutics market growth by introducing disease-modifying drugs, biologics, and regenerative therapies that slow disease progression, improve pain management, and enhance joint function. These innovations expand treatment options, attract investment, and increase patient adoption globally. Additionally, the FDA granted Fast Track and Regenerative Medicine Advanced Therapy (RMAT) designations to MOTYS, a novel gene therapy for knee osteoarthritis, in January 2025. These designations highlight the therapy's potential to address unmet medical needs and expedite its development and review process.

In July 2025, Genascence's gene therapy, GNSC-001, received RMAT designation from the FDA, highlighting its potential in treating knee osteoarthritis through innovative gene therapy approaches.

Stringent Regulatory Requirements & Slow Adoption of Novel Treatments

The key players operating in the market are facing issues due to the slow adoption of novel treatments and stringent regulatory requirements, which are estimated to restrict the growth of the market. Lengthy clinical trials and complex approval processes slow the introduction of new treatments.

Adoption and Incorporation of Patient-centric Care Models

Patient-centric care models focus on long-term management and quality of life improvements. Incorporating patient-centric care emphasizes personalized treatment, shared decision-making, and non-pharmacologic interventions, which enhance treatment adherence, satisfaction, and functional outcomes. Models that integrate patient education, goal setting, and feedback loops allow therapies to be tailored to individual needs and comorbid conditions, expanding the osteoarthritis therapeutics market.

In 2025, the Arthritis Foundation teamed with Northwestern University to launch a “Patient Reported Outcomes (PRO)” initiative to enhance osteoarthritis care by systematically using patient-reported measurements of pain, function, and quality of life, thereby improving clinical decision making and alignment with patient preferences.

The Nonsteroidal Anti-inflammatory Drugs (NSAIDs) segment dominates the market, with a revenue of approximately 38% due to its widespread use for effective pain management, affordability, and rapid relief. Physicians frequently prescribe NSAIDs as first-line treatment, driving consistent demand and maintaining their leading position.

The Disease-Modifying Osteoarthritis Drugs (DMOADs) segment is estimated to be the fastest-growing segment due to their potential to alter disease progression rather than just manage pain. Advances in biologics, regenerative therapies, and precision medicine drive strong R&D pipelines, addressing unmet needs and attracting significant investment.

The oral segment dominates the market, with a revenue of approximately 45% because it offers ease of administration (swallowing pills versus injections), better patient compliance, and cost-effectiveness. Oral NSAIDs, analgesics, and supplements are widely available and familiar to both patients and physicians, making them the go-to first-line therapy for symptom management. Additionally, continuous use without the need for clinical visits for each dose strengthens their adoption over other administration routes.

For instance, AKL Therapeutics’ APPA, a novel oral investigational therapy, showed promising results in its 2025 Phase-2a trial for reducing pain and cartilage-damage enzymes.

The parenteral segment is anticipated to grow rapidly due to injections (like hyaluronic acid, corticosteroids, and PRP) that deliver drugs directly into joints, enabling better pharmacokinetics and pharmacodynamics. Its effectiveness for severe cases, faster onset, and suitability when oral drugs may be less effective or poorly tolerated contribute to its rising adoption.

The knee osteoarthritis segment dominates the market, with a revenue of approximately 42% because it is the most common and debilitating form, especially among older and obese populations. The knee is load-bearing, so it experiences high mechanical stress, frequent injury, inflammation, and cartilage damage. Also, diagnostic tools, treatment options, and clinical trials often focus on knee osteoarthritis due to its higher prevalence and larger patient pool.

The hand & wrist osteoarthritis segment is estimated to be the fastest-growing segment because it’s more recognized now due to aging and increased manual, repetitive activities. Research has uncovered joint-specific risk factors like genetics, inflammation, and adipokines in hand joints. Also, regenerative treatments like PRP, stem cell therapies, and biologics targeting thumb CMC joints gain traction, driving therapeutic innovation and demand.

The hospital pharmacies segment is the dominant distribution channel in the market, with a revenue of approximately 37% due to several key factors. Hospitals manage a significant volume of osteoarthritis patients, facilitating direct access to advanced treatments like injectable therapies and biologics. This setting allows for the immediate administration of medications under professional supervision, enhancing patient outcomes. Additionally, the comprehensive care provided in hospitals, including diagnostic services and multidisciplinary treatment approaches, supports effective disease management and contributes to the segment's leading position in the market.

The online pharmacies segment is anticipated to be the fastest-growing segment in the osteoarthritis therapeutics market due to factors like increased consumer preference for convenient home delivery, availability of over-the-counter medications, and the growing trend of self-medication. Additionally, the expansion of e-commerce platforms and digital health services has made it easier for patients to access a variety of osteoarthritis treatments online. This shift towards online purchasing aligns with the broader trend of digitalization in healthcare, offering patients more accessible and flexible treatment options.

North America dominates the market, with a revenue share of approximately 41% due to a combination of factors. The high prevalence of osteoarthritis, particularly among the aging population, drives demand for effective treatments. Advanced healthcare infrastructure and robust research and development activities foster innovation in therapeutic options. Additionally, the presence of key pharmaceutical companies and supportive government policies contributes to the region's leading position in the market. These elements collectively enhance the accessibility and advancement of osteoarthritis therapies in North America.

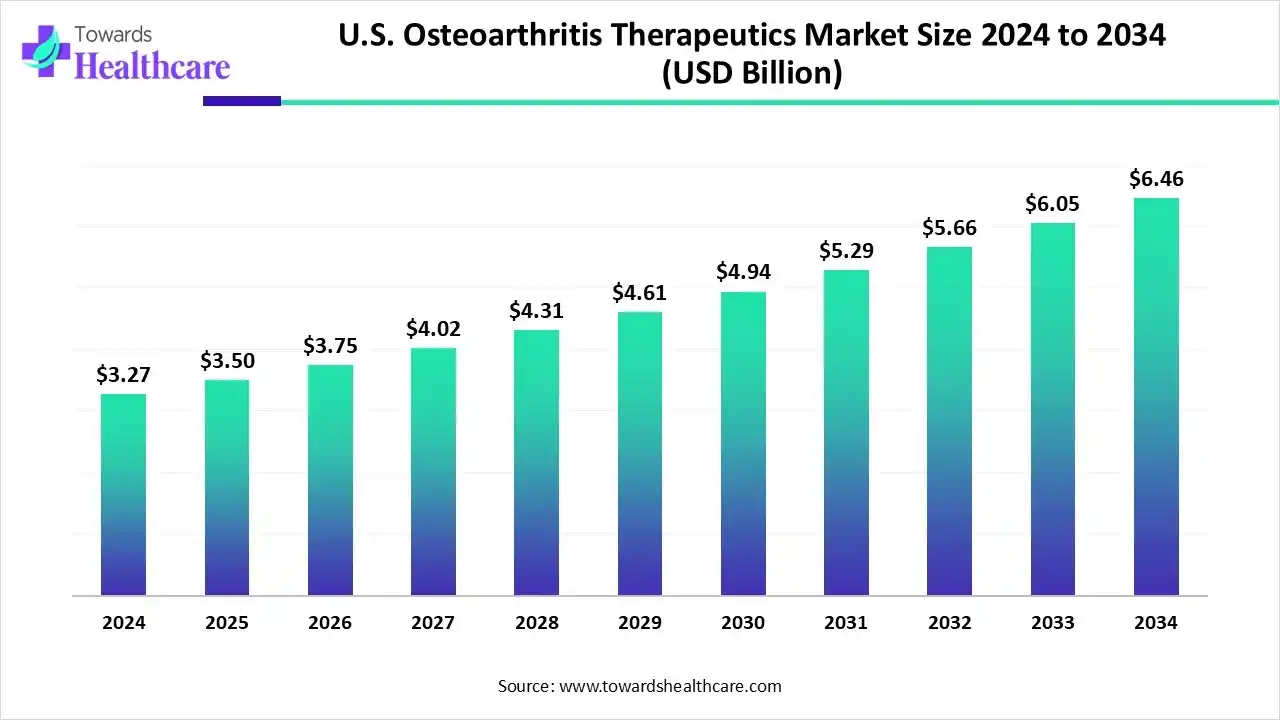

The U.S. dominates the North American osteoarthritis therapeutics market due to the high prevalence of osteoarthritis, particularly among the aging population. Advanced healthcare infrastructure, widespread adoption of innovative therapies, robust reimbursement frameworks, and the presence of leading pharmaceutical companies drive market growth. Additionally, ongoing clinical trials and emphasis on personalized medicine further strengthen the U.S.’s leading position in osteoarthritis therapeutics

The U.S. osteoarthritis therapeutics market is valued at approximately US$ 3.27 billion in 2024 and is expected to grow to US$ 3.5 billion in 2025. Looking ahead, the market is projected to reach around US$ 6.46 billion by 2034, growing at a CAGR of 7.14% between 2025 and 2034.

Canada’s osteoarthritis therapeutics market is growing steadily, supported by an aging population, increasing obesity rates, and rising osteoarthritis prevalence. Expanding access to advanced treatments such as regenerative therapies and viscosupplementation, along with supportive healthcare policies and increasing patient awareness, fuels the market’s growth.

The Asia-Pacific region is growing fastest in the osteoarthritis therapeutics market due to rising aging populations, increasing obesity rates, and growing awareness of osteoarthritis treatments. Expanding healthcare infrastructure, government initiatives, and the adoption of innovative therapies further accelerate market growth across the region.

Target Identification & Validation: Pharmaceutical and biotech companies identify molecular targets, biomarkers, or pathways involved in osteoarthritis progression.

Preclinical Research: In vitro and animal studies evaluate drug efficacy, toxicity, and pharmacokinetics.

Key Organizations: Pfizer, Novartis, Johnson & Johnson, Regeneron, Amgen, and smaller biotech firms focusing on regenerative medicine or biologics.

Innovation Focus: Disease-modifying osteoarthritis drugs (DMosteoarthritis Ds), stem cell therapies, biologics, and gene therapies.

Key Organizations: Clinical research organizations (CROs) like Parexel, ICON, IQVIA, and pharmaceutical companies conducting in-house trials.

Treatment Delivery: Hospitals, clinics, and pharmacies dispense therapies, including oral drugs, injectables, and biologics.

Patient Education & Adherence Programs: Programs to educate patients on disease management, exercise, diet, and treatment adherence.

Monitoring & Follow-up: Digital health platforms and telemedicine for monitoring disease progression and treatment outcomes.

Key Organizations: Hospitals (Mayo Clinic, Cleveland Clinic), online pharmacies, patient advocacy groups (Arthritis Foundation), and digital health startups providing telehealth solutions.

In March 2025, Oren Hershkovitz, Ph.D, CEO of Enlivex Therapeutics company stated that the company received a Notice of Allowance for a Chinese patent application covering the use of Allocetra in patients with osteoarthritis. This approval expands the company's intellectual property rights in key international markets, supporting its global strategy for osteoarthritis treatment.

In March 2025, Lipogems announced the final patient enrollment in the ARISE II U.S. FDA Investigational Device Exemption (IDE) Study. This pivotal trial aims to evaluate the efficacy and safety of MicroFat injections compared to saline for the treatment of knee osteoarthritis. The study enrolled 173 subjects across 16 U.S. sites, with primary endpoints focusing on improvement in pain and function at 6 months post-injection.

By Drug Class

By Route of Administration

By Joint Type

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026