January 2026

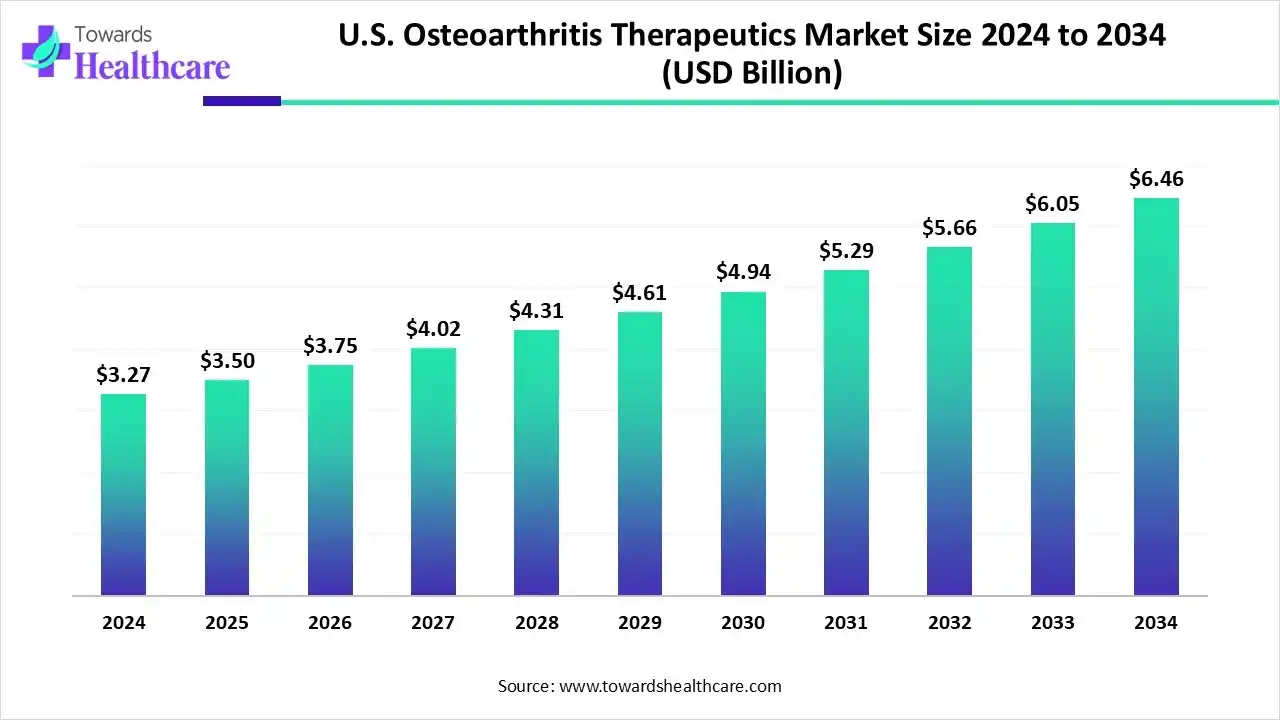

The U.S. osteoarthritis therapeutics market size is calculated at US$ 3.27 billion in 2024, grew to US$ 3.5 billion in 2025, and is projected to reach around US$ 6.46 billion by 2034. The market is expanding at a CAGR of 7.14% between 2025 and 2034.

The rise of innovative therapies transformed osteoarthritis treatments. Regenerative medicine has arisen as a promising strategy for osteoarthritis treatments. Several therapeutic approaches such as stem cell therapy, chronotherapy, organelle therapy, and polymeric biomaterials, supported the shift towards personalized treatments and precision medicine in osteoarthritis management. The current regulatory frameworks strongly impact the development and implementation of cell-based therapies that vary globally. The U.S. Food and Drug Administration (FDA) is vital in the regulation of cell therapies with robust frameworks.

| Table | Scope |

| Market Size in 2025 | USD 3.5 Billion |

| Projected Market Size in 2034 | USD 6.46 Billion |

| CAGR (2025 - 2034) | 7.14% |

| Market Segmentation | By Therapy / Drug Class, By Route / Mode of Administration, By Indication / Joint Site, By Disease Severity / Treatment Line |

| Top Key Players | Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, Novartis AG, Merck & Co., Inc., GlaxoSmithKline plc, Sanofi S.A., AbbVie Inc., Amgen Inc., Regeneron Pharmaceuticals, Inc., Stryker Corporation, Zimmer Biomet Holdings, Inc., Arthrex, Inc., Pacira BioSciences, Inc., Flexion Therapeutics |

The U.S. osteoarthritis therapeutics market deals with prevention, symptomatic relief, disease-modifying, and surgical-adjunct treatments for osteoarthritis in the United States that cover prescription and OTC drugs (analgesics, NSAIDs), intra-articular therapies (corticosteroids, hyaluronic acid, regenerative injectables), disease-modifying osteoarthritis drugs (DMOADs) in development, biologics, cell & gene therapies, topical agents, and peri-/post-surgical therapeutics, sold through hospitals, clinics, retail pharmacies, and specialty channels.

The FDA provides financial and technical assistance to research and innovations across healthcare sectors. For instance, in September 2024, the U.S. Food and Drug Administration (FDA) announced the grant of fast-track designation to a non-opioid treatment for osteoarthritis knee pain that could benefit more than 100 million people who are suffering from severe joint and knee pain.

The funding raised by the leading biotechnology players in the market helps in advancing clinical trials and therapeutics. For instance, in November 2024, Doron Therapeutics, a biotech firm, raised $11 million to advance a regenerative osteoarthritis drug into phase 3. It has also announced that its single injection of a drug can improve knee pain and function by delivering long-lasting effects.

AI-powered models can potentially optimize the detection of osteoarthritis progression. AI-assisted models improve predictive accuracy and enable earlier risk-based interventions. AI plays a vital role in clinical, imaging, and omics fields by advancing osteoarthritis research. AI algorithms like deep learning models help in the analysis of large-scale medical images and the identification of structural changes in joint tissues. AI can overcome several limitations and challenges associated with the diagnosis and treatment of joint pain.

What are the Major Drifts in the U.S. Osteoarthritis Therapeutics Market?

The surgical treatment is a widely adopted and cost-effective approach for treating end-stage knee osteoarthritis. The construction of intra-articular drug delivery systems is a promising treatment method for osteoarthritis. The increased focus of clinical management on pain relief contributes to maintaining and improving joint function, which also drives clinical progress. The intra-articular injection treatment method can reduce therapeutic risks associated with traditional administration systems, such as oral and intravenous injections. There is an urgent need for advanced intra-articular drug delivery systems to overcome the potential challenges.

What are the Potential Challenges in the U.S. Osteoarthritis Therapeutics Market?

The major challenges in clinical trials of stem cell therapy for osteoarthritis are the high costs associated with the therapies and a lack of clinical evaluation criteria. Moreover, researchers find slow progress in late-phase clinical trials and a lack of standardized quality control protocols. There is an urgent need to address these challenges to advance the clinical research field.

What is the Future of the U.S. Osteoarthritis Therapeutics Market?

Large-scale clinical trials play a crucial role in the validation and optimization of stem cell therapies for osteoarthritis. These clinical trials will significantly contribute to the development of innovative therapies as safe and effective treatment options. Regenerative medicine will advance treatments for degenerative joint diseases. There is a frequent utilization of regenerative products in clinical trials that showcases their importance as regenerative medicine solutions for osteoarthritis. China leads in clinical trials for stem cell therapies, followed by the U.S. and South Korea, which reflects a growing global preference for these innovative treatments.

The non-steroid anti-inflammatory drugs (NSAIDs) segment dominated the market in 2024, owing to the short-term and intermittent relief and preferential use of topical NSAIDs. The NSAIDs aid in the effective management of knee pain, stiffness, and swelling. They deliver superior safety, efficacy, and reduced systemic exposure.

The disease-modifying osteoarthritis drugs (DMOADs) segment is expected to grow at the fastest CAGR in the market during the forecast period due to promising research and notable success of cell/gene therapies. The disease-modifying osteoarthritis drugs (DMOADs) focus on pain relief and function. The emerging treatments, like approved non-pharmacologic and pharmacologic therapies, contribute to modify disease progression.

The oral segment dominated the market in 2024, owing to the primary role of the oral route of administration in palliative care, which focuses on pain relief and inflammation. The emerging oral therapies for osteoarthritis, including nanocrystals, oral enzyme combinations, anti-obesity medications, and disease-modifying osteoarthritis drugs, aim to overcome the limitations of oral delivery. Research focuses on developing more effective and targeted oral therapies to treat knee pain or joint inflammation.

The intra-articular injections segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the introduction of new therapies like intra-articular corticosteroids and hyaluronic acid, offering efficacy in pain relief. The novel delivery systems and therapies, including hydrogels, nanoparticles, and gene therapies, enabled the controlled and sustained drug release. These advanced drug delivery systems promote healing and regeneration of moderate to severe osteoarthritis, especially in younger patients.

The knee osteoarthritis segment dominated the market in 2024, owing to the conventional therapies for symptomatic relief and investigational therapeutics. The shift towards personalized medicine and the major role of surgical treatments drive the segmental growth. The foundational and standard conservative treatments for knee OA remain popular due to their long-term effectiveness.

The hand OA & multi-joint OA segment is anticipated to grow at a notable rate in the market during the upcoming period due to non-pharmacological and pharmacological therapies, driving better therapeutics for hand OA. The increased shift towards more targeted, personalized, and multimodal approaches expands the therapeutic landscape for hand and multi-joint osteoarthritis. Healthcare management aims to balance symptomatic relief with non-pharmacological interventions.

The moderate OA segment dominated the market in 2024, owing to traditional therapeutics and the emerging role of biologics. The growing focus on nutraceuticals introduced new solutions for pain relief and potential cartilage regeneration. The standard-of-care treatments for moderate OA aim to improve joint function and alleviate symptoms.

The early/mild OA segment is predicted to grow at a rapid rate in the market during the studied period due to key therapeutic strategies and targeted pharmacological interventions. The rise of CRISPR/Cas9, gene therapy, mesenchymal stem cell (MSC) therapy, and small extracellular vesicles (sEVs). The enhanced drug delivery, clinical translation, and multi-target combination therapies help to resolve limitations and create new opportunities.

The U.S. FDA granted a fast-track designation to a non-opioid product named MM-II to treat osteoarthritis knee pain. The U.S. government remains dedicated to funding research, supporting public health initiatives, and updating Medicare coverage. The U.S. experienced the most significant development through the continued investment in regenerative and reconstructive joint treatments by the Advanced Research Projects Agency for Health (ARPA-H). The National Institutes of Health (NIH) provided funding for the Osteoarthritis Initiative (OAI) database, images, and clinical data. The Advanced Research Projects Agency for Health (ARPA-H) introduced the Novel Innovations for Tissue Regeneration in Osteoarthritis (NITRO), which is designed to fund cutting-edge research. This research focuses on the development of bio-reconstructive and self-healing joints made from a patient’s own cells.

The global osteoarthritis therapeutics market for treatments was valued at US$ 9.95 billion in 2024 and is projected to reach US$ 10.89 billion by 2025. Looking ahead, the market is expected to continue its steady growth, surpassing US$ 24.52 billion by 2034, with a CAGR of 9.45%.

The R&D process for the U.S. osteoarthritis therapeutics includes R&D stages like discovery, preclinical development, clinical research and trials, FDA review, and post-market monitoring.

Key Players: Pfizer Inc., Johnson & Johnson, AbbVie Inc., Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., Flexion Therapeutics, Bioventus, Amgen Inc., etc.

The clinical pipeline focuses on developments in osteoarthritis research, from symptomatic relief to more disease-modifying treatments. The regulatory approvals are driven by the U.S. FDA for several therapies.

Key Players: Sun Pharmaceutical Industries and Moebius Medical, Pacira BioSciences, IBSA PHARMA, Novartis AG, Biosplice Therapeutics, Eupraxia Pharmaceuticals, Merck & Co.

The patient support programs are offered by major pharmaceutical companies that develop or drive the marketing of therapeutics for rheumatic diseases. Moreover, the non-profit organizations provide services like educational and self-management resources, and information on managing joint pain.

Key Players: Pfizer Inc., Novartis AG, Johnson & Johnson, AbbVie Inc., Sanofi S.A.

In April 2024, Albert Bourla, PhD, Chairman and CEO of Pfizer Inc., proclaimed the commitment of Pfizer to fight against cancer and its continuous collaboration across the healthcare ecosystem to deliver the next generation of cancer care. He also reported that the company felt honored to be recognized by the American Association for Cancer Research (AACR) for the work of its colleagues to bring new innovations for patients.

By Therapy / Drug Class

By Route / Mode of Administration

By Indication / Joint Site

By Disease Severity / Treatment Line

January 2026

January 2026

January 2026

January 2026