January 2026

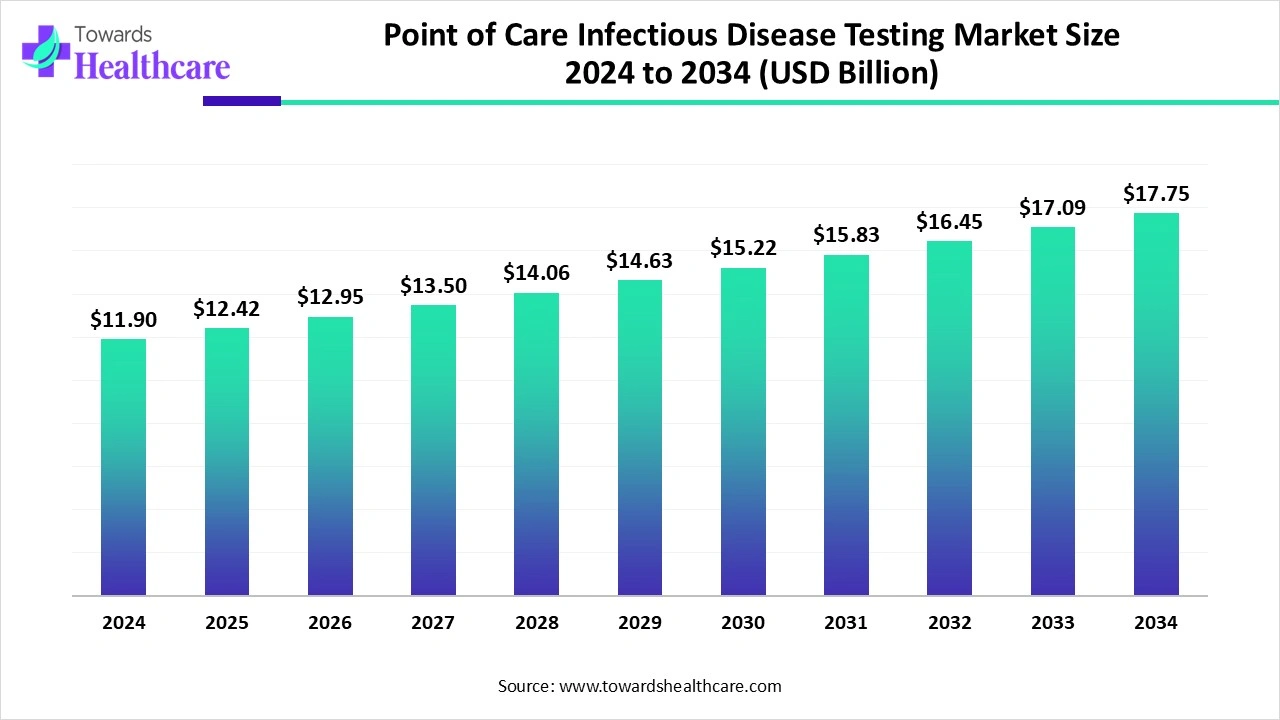

The global point of care infectious disease testing market size is calculated at US$ 12.42 billion in 2025, grew to US$ 12.96 billion in 2026, and is projected to reach around US$ 18.99 billion by 2035. The market is expanding at a CAGR of 4.34% between 2026 and 2035.

The use of point-of-care infectious disease testing is increasing due to the growing prevalence of diseases globally. The growing awareness is also increasing its use, leading to new collaborations among the companies. AI is also being used in these tests to enhance their accessibility, accuracy, and workflow. At the same time, the growing healthcare investments and their innovations are increasing their adoption rates in different regions, driving their use across remote areas and for at-home testing. The companies are also developing and launching such new POCT. Thus, this is promoting the market growth.

| Table | Scope |

| Market Size in 2026 | USD 12.96 Billion |

| Projected Market Size in 2035 | USD 18.99 Billion |

| CAGR (2026 - 2035) | 4.34% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Disease, By End Use, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd, Abbott, Siemens Healthineers, Thermo Fisher Scientific Inc, Trinity Biotech, Becton, Dickinson & Company, Cardinal Health, Chembio Diagnostics Inc., bioMérieux SA, Quest Diagnostics Incorporated, Sight Diagnostics Ltd., Bio-Rad Laboratories Inc., Ortho-Clinical Diagnostics., Trivitron Healthcare, Gene POC, OJ-Bio Ltd. |

The point-of-care infectious disease testing market focuses on the diagnosis of infectious diseases in remote or resource-limited areas. The biomarkers are used in the point-of-care (POC) tests, which enhance the sensitivity and specificity of the test. These tests encompass technologies such as lateral flow immunoassay, immunoconcentration assay, molecular diagnostics, and agglutination tests. Multiplex functionality POC tests are also being developed, along with the use of novel technologies like microfluidics and plasmonic technologies. Moreover, the market is driven by growing infectious diseases, increasing demand for decentralized testing, and technological advancements.

For instance,

The AI integration in the point-of-care infectious disease testing market is helping to move towards modern healthcare. The challenges, such as diagnostic accuracy, equitable access, and workflow efficiency, can be solved by AI integration in the POC infectious disease testing. The sensitivity of the testing can also be enhanced with the use of AI technologies like machine learning, natural language processing, and deep learning. Moreover, the AI-IoT systems are also being developed to predict the outbreaks of infectious diseases; thus, with the help of AI, patient-centred healthcare can be achieved using AI-based POC infectious diseases testing platforms.

Growing demand for Rapid Diagnostics

Due to growing incidences of infectious diseases, there is a rise in the demand for rapid diagnostics. This, in turn, is increasing the use of point-of-care infectious disease testing. With the use of these tests, the treatment can be initiated without any delay. It also helps in decreasing the transmission and outbreaks of the infections. Additionally, it helps in differentiating bacterial and viral infections, which in turn helps in reducing antibiotic misuse or antibiotic resistance. Thus, this drives the point-of-care infectious disease testing market growth.

Low sensitivity and specificity

The point-of-care infectious disease testing often has low sensitivity and specificity. This can provide false negative or false positive results, leading to improper treatment or no treatment of the patient. Moreover, the misdiagnosis can increase the infections. This, in turn, can discourage their use by the patient, as well as limit their adoption rates.

Why are Advancements in the Lateral Flow Tests an Opportunity in the Market?

There is a growth in the use of lateral flow tests (LFT) for the detection of infectious diseases. This, in turn, is driving their innovations to improve their sensitivity and specificity, with the use of different types of techniques such as nanoparticles or signal amplification. Similarly, to detect multiple causative agents simultaneously, multiplex LFTs are also being developed. Innovations to improve its stability are also being conducted to enhance its use in various settings. Additionally, to enhance its portability and accessibility, they are also being integrated with smartphone apps. Thus, all these advancements are promoting the point-of-care infectious disease testing market growth.

For instance,

By technology type, the molecular diagnostics segment led the point-of-care infectious disease testing market in 2024, driven by its high sensitivity and specificity. They provided accurate and fast results. At the same time, their multiplex testing approach also enhanced their use. Moreover, their compact size and affordability accelerated their adoption rates.

By technology type, the lateral flow immunoassay segment is expected to show the highest growth during the upcoming years. Due to their rapid result in 5 to 30 minutes, their use is increasing. They can also be used in the detection of various infectious agents or pathogens. This, in turn, is increasing their use in decentralized or remote areas.

By disease type, the COVID-19 segment held the largest share of the point-of-care infectious disease testing market in 2024, due to the large volume of testing. The POC testing was used for their early detection as well as to control their outbreaks. This increased their use in hospitals, homes, as well as at workplaces. Moreover, their innovation were also enhanced.

By disease type, the pneumonia or streptococcus-associated infections segment is expected to show the fastest growth rate during the predicted time. The growing incidence of pneumonia is increasing the demand for POC testing. Their early detection with these tests can accelerate the initiation of their treatment. Thus, the use of lateral flow immunoassay or molecular diagnostics is increasing for their accuracy and rapid diagnosis.

By end user, the clinics segment dominated the global point-of-care infectious disease testing market in 2024, as a variety of infectious diseases were tested. The POC tests were also used for patients with similar symptoms to infectious diseases. Moreover, it also helped in prescribing the patient with appropriate antibiotics or antivirals depending on their conditions. This enhanced the market growth.

By end user, the home segment is expected to show the highest growth during the forthcoming years. The POC infectious disease testing is increasing at home as it is enhancing patient convenience. Their fast and accurate results are driving their use. Moreover, their availability and affordability are increasing the online orders, which are also maintaining the patient's privacy.

North America dominated the point-of-care infectious disease testing market in 2024. North America consisted of a well-developed healthcare sector, which increased the use of POC tests for early and rapid detection of infectious diseases. The growing healthcare investments also increased their adoption along with other novel diagnostic technologies. Additionally, the growing infectious diseases also contributed to the same. Thus, this enhanced the market growth.

The presence of advanced healthcare infrastructure in the U.S. is increasing the use of POC tests. Moreover, the healthcare sector is also using advanced lateral flow tests or molecular diagnostics. At the same time, they are also being used for at-home testing. Additionally, the growing government and private funding and investments are increasing their development and adoption rates.

The growing infectious diseases in Canada is increasing the use of POC infectious disease testing. Their accessibility is also being increased with the use of government funding. They are increasingly being used for the detection of STIs, TB, and Hepatitis. Additionally, the use of molecular diagnostics is also increasing due to growing respiratory infections. Their use in remote areas, at home, and in schools is also increasing.

Asia Pacific is expected to host the fastest-growing point-of-care infectious disease testing market during the forecast period. Asia Pacific is experiencing a growth in the infectious disease burden, which is increasing the demand for POC infectious disease testing. This is increasing their innovation, manufacturing, as well as their adoption rates. Moreover, their adoptions are supported by the government investments and initiatives. Additionally, their affordability is increasing their use, driving their decentralized testing and acceptance rates.

The R&D of the point-of-care infectious disease testing focuses on the development of accurate, portable, and rapid diagnostic devices and their integration with digital health tools, biosensors, and microfluidic platforms.

Key Players: F. Hoffmann-La Roche Ltd, Siemens Healthineers, Abbott, Danaher Corporation, Thermo Fisher Scientific Inc.

The analytical and clinical validity are evaluated in the clinical trials of point-of-care infectious disease testing, while the performance, risk assessments, and safety are the focus for their regulatory approvals.

Key Players: F. Hoffmann-La Roche Ltd, Abbott, Danaher Corporation, bioMérieux SA, QIAGEN N.V., QuidelOrtho Corporation

The integration and stabilization of the reagents on the strips or within a closed cartridge are included in the point-of-care infectious disease formulation, while the application of the sample on the device to trigger the reaction is involved in their final dosage preparation.

Key Players: F. Hoffmann-La Roche Ltd, Abbott, Danaher Corporation, Thermo Fisher Scientific Inc., QIAGEN N.V.

The patient support and services of the point-of-care infectious disease testing focus on providing services such as integration with the telemedicine platforms, and guidance for the use of the device, specifically while home testing.

Key Players: Abbott, Danaher Corporation, Upfront Healthcare, OSP Labs, Portea Medical, and Itransition.

In July 2025, after announcing the investment in Principle Diagnostics, the new Chairman and CEO of Aqueous Health, Dan Eckert, stated that, by joining with Dr. Zyller and the Principal team for providing predictive diagnostic testing and services to a wide range of populations, they were delighted. They believe there is a rise in opportunity in the decentralized diagnostic testing market after the COVID-19 pandemic, positioning Aqueous Health to capitalize on the market. Therefore, with this collaboration, they are confident that they will be the industry leader in the diagnostics services and solutions.

By Technology

By Disease

By End Use

By Region

January 2026

January 2026

January 2026

January 2026