January 2026

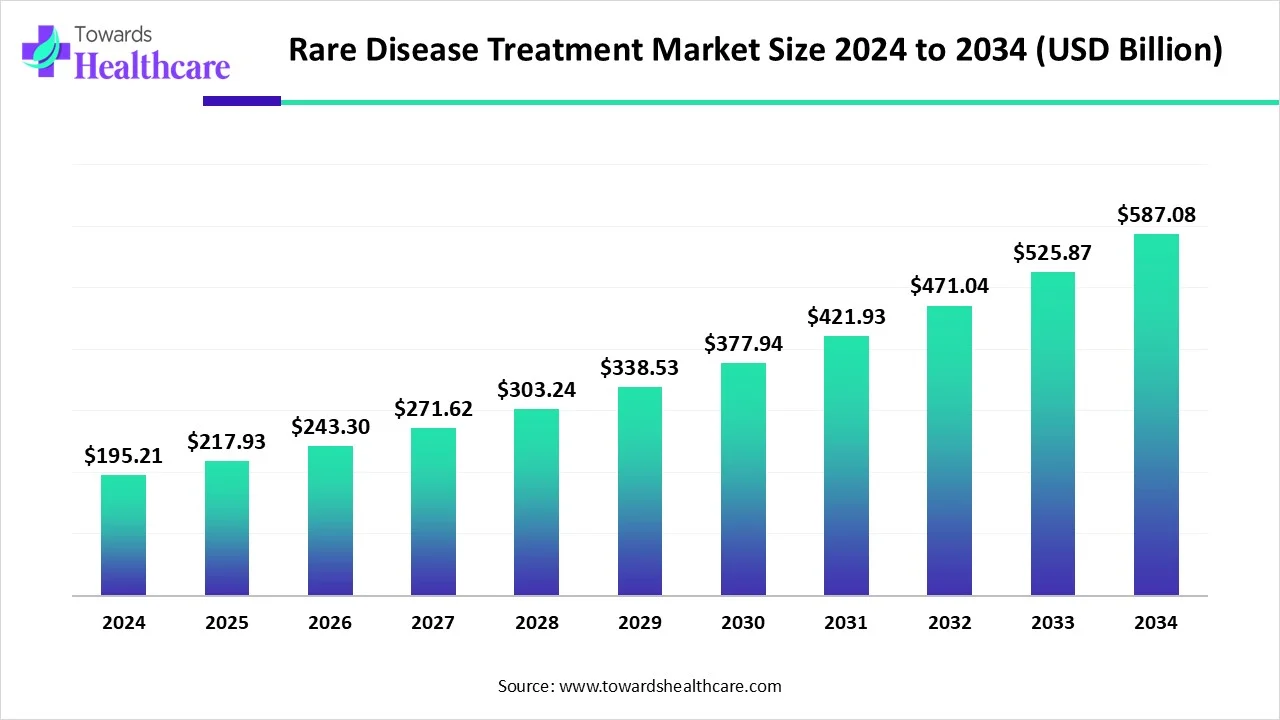

The global rare disease treatment market size is calculated at USD 195.21 billion in 2024, grew to USD 217.93 billion in 2025, and is projected to reach around USD 587.08 billion by 2034. The market is expanding at a CAGR of 11.64% between 2025 and 2034.

The rare disease treatment market is primarily driven by the rising prevalence of rare diseases and the need for personalized medicines. Constant efforts are made to develop personalized medicines, such as cell and gene therapy, monoclonal antibodies, and other biologics.

These biologics are developed due to growing research and development activities and increasing investments by government and private organizations. The future looks promising due to technological advancements, such as AI and ML, and favorable government support.

| Metric | Details |

| Market Size in 2025 | USD 217.93 Billion |

| Projected Market Size in 2034 | USD 587.08 Billion |

| CAGR (2025 - 2034) | 11.64% |

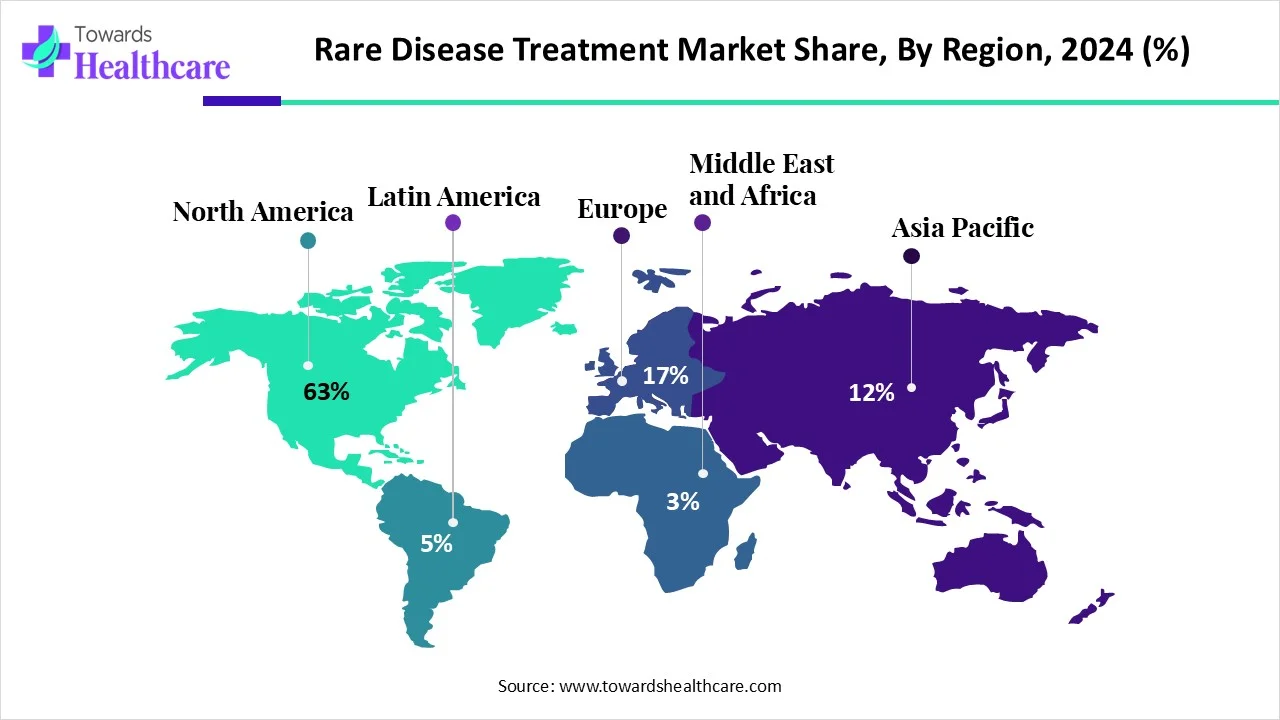

| Leading Region | North America share by 63% |

| Market Segmentation | By Therapeutic Area, By Drug, By Route of Administration, By Distribution Channel, By Region |

| Top Key Players | Arrowhead Pharmaceuticals, Biogen, Inc., Eterna Therapeutics, EveryONE Medicines, Evotec, Genethon, Novartis AG, Pfizer, Reata Pharmaceuticals, Inc., Stoke Therapeutics, Inc., SynaptixBio, Takeda Pharmaceuticals |

Rare diseases are a group of diseases that affect a limited population and have a lower prevalence than other diseases. They require an accurate diagnosis and timely treatment using a wide range of treatment modalities, including diet therapy, surgery, medications, and bone marrow transplantations. Some of the common medications used for treating are small-molecule medications, antibody therapy, enzyme replacement therapy, gene therapy, and stem cell therapy.

Numerous factors influence market growth, including the rising prevalence of rare diseases. Rare diseases are estimated to affect approximately 400 million people worldwide, with over 10,000 known rare disorders. The growing research and development activities lead to the development of novel therapeutics. Government organizations launch initiatives and provide funding to create awareness for the early diagnosis of rare diseases and new drug development.

Artificial intelligence (AI) can offer immense potential to revolutionize the diagnosis and treatment of rare diseases. AI can screen individuals who are at high risk of developing a rare disease. AI and machine learning (ML) algorithms can analyze a vast amount of genetic information to study the disease progression, enabling them to develop personalized therapeutics. They can reduce the time and overall cost of research. AI-based quantitative structure-activity relationship (QSAR) can generate novel treatment compounds with more desired properties. AI and ML can also predict potential adverse effects of therapeutics before their administration.

Cell and Gene Therapy

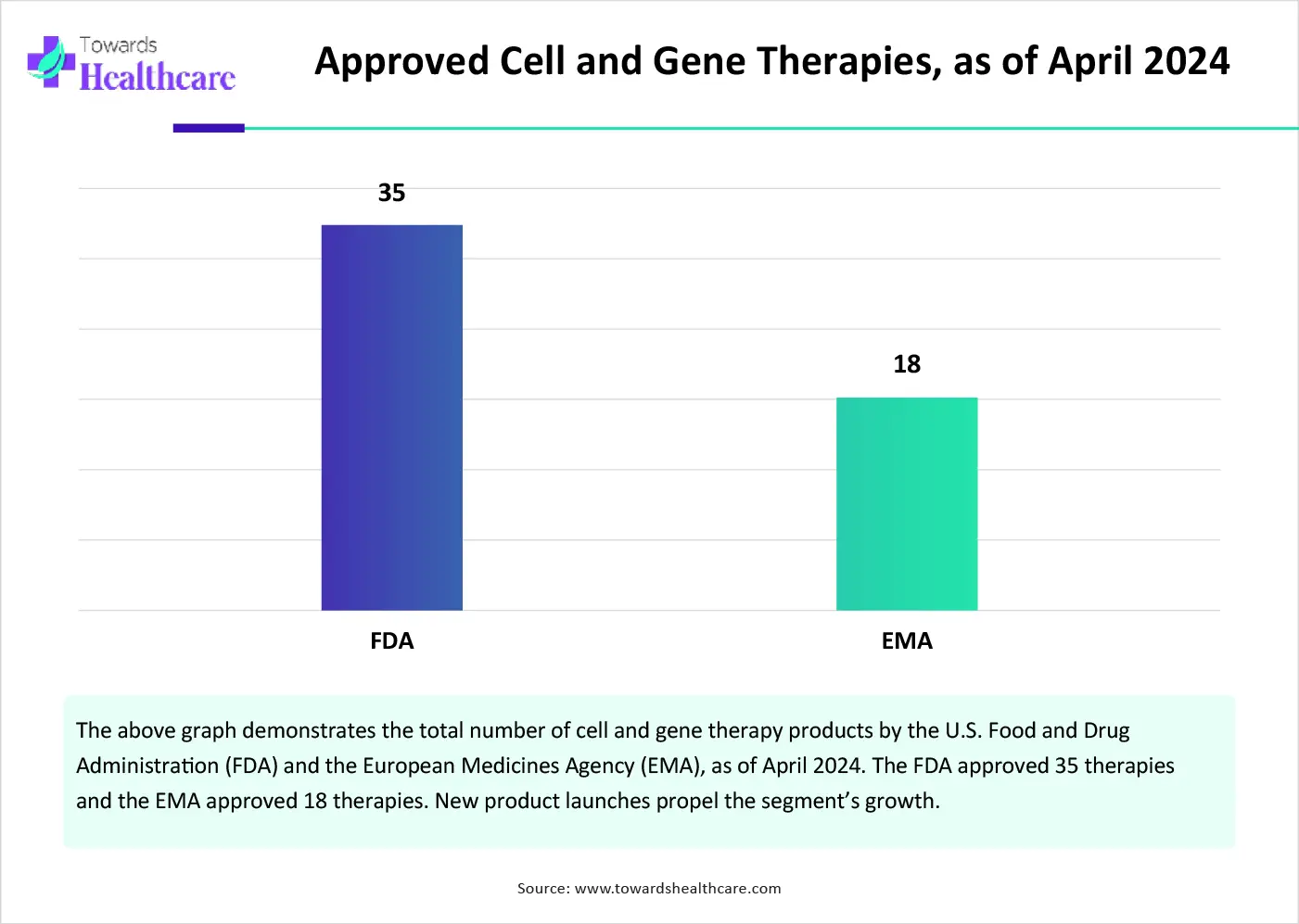

The major growth factor of the rare disease treatment market is the growing demand for cell and gene therapy. Cell therapy includes CAR T-cells and stem cells that are derived from human cells, whereas gene therapy alters the genetic material of a patient. They are highly preferred as they cure a disease from its root cause, reducing the chances of recurrence. More than 80% of rare diseases are reported to have genetic origins. The increasing investments and evolving regulatory landscapes potentiate the launch of novel cell and gene therapy. Efforts are made to advance health system infrastructure and address the complexities of the journey.

Lack of Data

Since rare diseases affect a limited population, only limited information about their prevalence, symptoms, and diagnosis pathways is available. This acts as a barrier for researchers to develop disease patterns and develop better diagnosis and treatment alternatives.

What is the Future of the Rare Disease Treatment Market?

The future of the market is promising, driven by the increasing number of clinical trials and the growing demand for drug repurposing. The increasing clinical trials is a result of the growing research and development activities and stringent regulations. Novel therapeutics, including small molecules and biologics, are evaluated in humans for their safety and efficacy. Researchers also assess expanded applications of existing drugs, also called drug repurposing. Drug repurposing is favored as researchers know the safety profile of the drug. The approval process of the existing drugs for novel applications is comparatively simple. As of June 2025, there are 930 clinical trials registered on the clinicaltrials.gov website related to rare diseases. (Source - Clinical Trials)

By therapeutic area, the cancer segment held a dominant presence in the market in 2024. This segment dominated because of the increasing cases of a rare type of cancer and the complexity of the disease. The International Agency for Research on Cancer (IARC) reported that fewer than 6 newly diagnosed cases per 100,000 people annually are affected by rare cancer types. Rare cancer accounts for 25% of all cancer diagnoses. (Source - IARC) Technological advancements, such as AI, ML, and digital twins, favor the development of diagnostics and therapeutics for rare cancer diseases.

By therapeutic area, the musculoskeletal conditions segment is expected to grow at a significant CAGR in the market during the forecast period. The rising incidences of musculoskeletal disorders and growing research activities boost the segment’s growth. Osteogenesis imperfecta, achondroplasia, hypophosphatasia, and pseudohypoparathyroidism are some examples of rare musculoskeletal disorders. Medical interventions, such as surgical interventions and physical therapy, and biologics, such as enzyme replacement therapy, are treatment regimens for rare musculoskeletal disorders.

By drug, the biologics segment led the global market in 2024. The segmental growth is attributed to the enhanced efficacy of biologics in rare diseases and the growing demand for personalized medicines. Biologics can cure the underlying cause of a disease, leading to reduced adverse effects. They are highly preferred due to their high specificity and selectivity. Biologics can target specific biological pathways involved in disease progression. According to the DrugBank database, 1,739 biologics are approved.

By drug, the biosimilars segment is expected to grow with a lucrative CAGR in the market during the studied years. Biosimilars provide a generic alternative to costly biologics, which are developed after the expiry of a patent. They have a similar efficacy and safety profile compared to biologics. CDER approved a total of 18 biosimilars for 8 reference products in 2024. (Source - FDA)This brings the count of biosimilars to a total of 63 biosimilars, as of 2024.

By route of administration, the injectable segment held the largest revenue share of the market in 2024. The injectable route is mostly preferred due to its faster onset of action and reduced systemic side effects. It has higher bioavailability as it is directly administered to body fluids. Additionally, injectable results in faster absorption and quicker therapeutic effects. Biologics and biosimilars are stable in injectable fluids and can only be administered through the injection route.

By route of administration, the oral segment is predicted to witness significant growth in the market over the forecast period. Drugs administered through the oral route are easily available and absorbed. They do not require the presence of any trained professionals to administer drugs. They are comparatively safer and cost-effective, making them a suitable choice. They are available in various forms, such as tablets, capsules, and syrups, and can be administered to any age group. The availability of sustained-release and immediate-release tablets also promotes the segment’s growth.

By distribution channel, the specialty pharmacy segment held a major revenue share of the market in 2024. Specialty pharmacy focuses on high-cost, high-touch medication therapy for patients with complex, rare diseases. These pharmacies have favorable infrastructure and suitable capital investment to handle complex medications for rare diseases. They have skilled professionals to offer extensive patient support and education, ensuring optimal medication management.

By distribution channel, the hospital pharmacy segment is expected to expand rapidly in the market in the coming years. The increasing number of patients in hospitals due to favorable reimbursement policies and the presence of multidisciplinary experts foster the segment’s growth. Hospitals are part of several clinical trials for rare diseases. This enables patients to access novel medications before market approval. Hospital pharmacies have suitable space for handling and storing complex medications.

North America dominated the global market share by 63% in 2024. The presence of key players, the rising adoption of advanced technologies, and advanced healthcare infrastructure are the major growth factors of the market in North America. Several institutions in North America have state-of-the-art research and development facilities to develop advanced therapeutics. The increasing number of clinical trials and favorable government support boost the market.

Key players, such as Pfizer, Arrowhead Pharmaceuticals, and Biogen, Inc., are the major contributors to the market in the U.S. It is reported that more than 7,000 rare diseases affect over 30 million people in the U.S. (Source - FDA) The FDA has around 18 rare disease-specific programs to help address complexities common to rare disease drug development.

Rare disease treatment companies in Canada are Medunik Canada, BIOTECanada, and Alexion. It is estimated that 1 in 12 Canadians has a rare disease, of which two-thirds are children. The Canadian government announced an investment of $1.5 billion over three years (2023-2025) to support the National Strategy for Drugs for Rare Diseases.

Asia-Pacific is expected to grow at the fastest CAGR in the rare disease treatment market during the forecast period. Favorable government initiatives and funding augment the market. Government and private organizations conduct workshops, seminars, and conferences to create awareness among the general public for the screening and early diagnosis of rare diseases. The increasing collaborations and mergers & acquisitions among key players favor the development of rare disease treatments.

In China, more than 20 million people are estimated to suffer from rare diseases. As of July 2024, about 419 medical institutions designated by China’s National Health Commission are linked to the medical service network for rare diseases. This enables the institutions to cooperate on rare-disease programs and receive and treat patients. (Source - English)

In February 2025, the Union Health Ministry organized a two-day workshop at KEM Hospital, focusing on treatment options for rare diseases. The workshop was attended by 130 doctors and a few rare disease patients. Under the National Policy for Rare Diseases (NPRD), 63 rare treatable diseases were approved to receive one-time financial assistance of Rs 50 lakh. (Source - Times of India)

Europe is expected to grow at a considerable CAGR in the rare disease treatment market in the upcoming period. The growing research and development activities and the presence of a robust healthcare infrastructure foster the market. The rising demand for personalized medicines and favorable regulatory policies also contribute to market growth. The increasing investments and collaborations also contribute to market growth. The increasing healthcare expenditure and favorable reimbursement policies for rare diseases bolster market growth.

More than 3 million people are estimated to live with rare diseases in France. In February 2025, France launched the Fourth National Rare Diseases Plan (PNMR4) to improve care for people, expedite research, and support innovation in healthcare. Under the plan, 132 new reference centers for rare diseases were launched, bringing the total to 603 centers. (Source - Vascern)

The England Rare Diseases Action Plan 2025 aims to recognize, diagnose, and treat rare diseases in 3.5 million people. The NHS plans to launch 20 Advanced Therapy Medicinal Products (ATMPs) for 24 indications by the end of 2026. The NIHR also provided funding of £17.9 million for ATMP clinical trials and to progress research in the Advanced Therapy Treatment Centres. (Source - Gov.uk)

Frederic Revah, Chief Executive Officer of Genethon, commented that the company led the medical scientific field in pioneering gene therapy for rare diseases, and continues to innovate to develop novel-generation gene therapies. He also said that such scientific advances underline the potential of the company’s R&D and technology departments for designing, developing, and producing innovative and potent gene therapy treatments. (Source - Businesswire)

By Therapeutic Area

By Drug

By Route of Administration

By Distribution Channel

By Region

January 2026

January 2026

January 2026

December 2025