February 2026

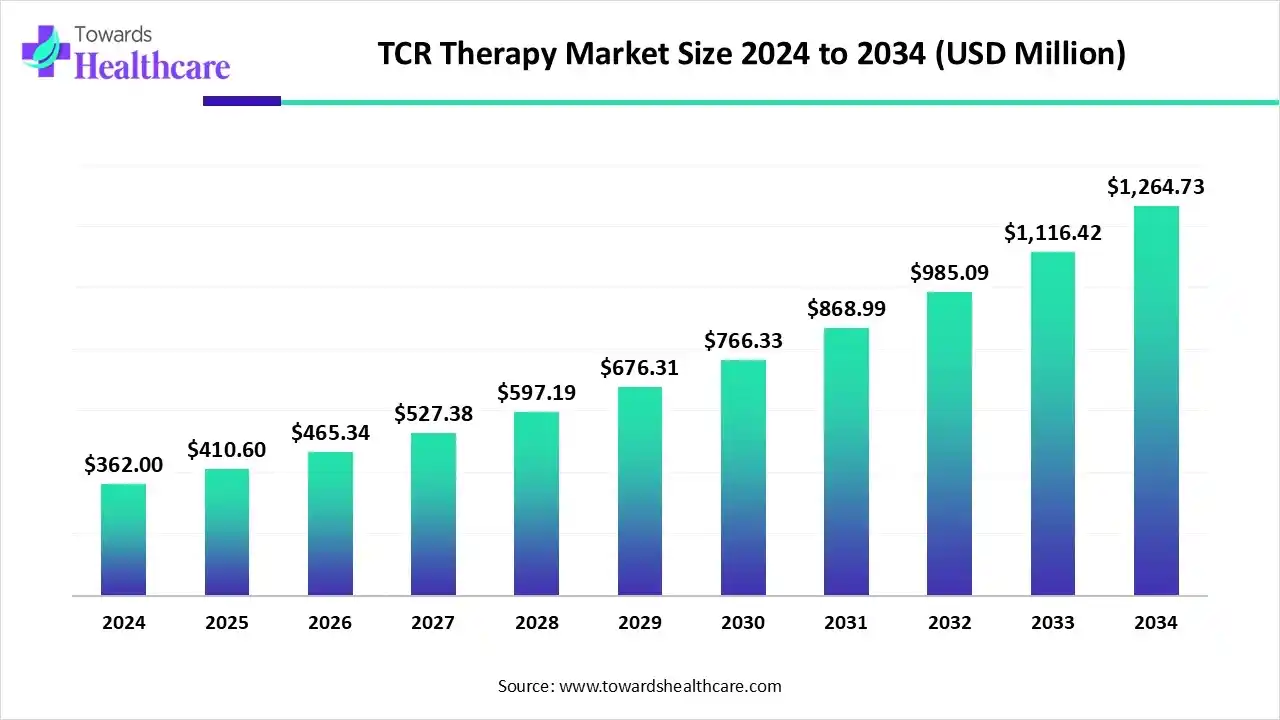

The global TCR therapy market size is calculated at US$ 362 million in 2024, grew to US$ 410.6 million in 2025, and is projected to reach around US$ 1264.73 million by 2034. The market is expanding at a CAGR of 13.44% between 2025 and 2034.

The T-cell receptor therapy is transforming cancer treatments and cancer care by potentially treating incurable cancers. The integration of innovative cell engineering techniques, advanced targeting capabilities, and robust protection strategies enables the creation of new ways to treat cancer. The leading companies like AstraZeneca have promisingly developed their oncology portfolio, including T-cell receptor therapies that support patients living with hard-to-treat solid cancers. These are a new class of engineered cell therapies that are designed to target cancer-specific mutations and will drive the significant growth of the TCR therapy market.

| Table | Scope |

| Market Size in 2025 | USD 410.6 Million |

| Projected Market Size in 2034 | USD 1264.73 Million |

| CAGR (2025 - 2034) | 13.44% |

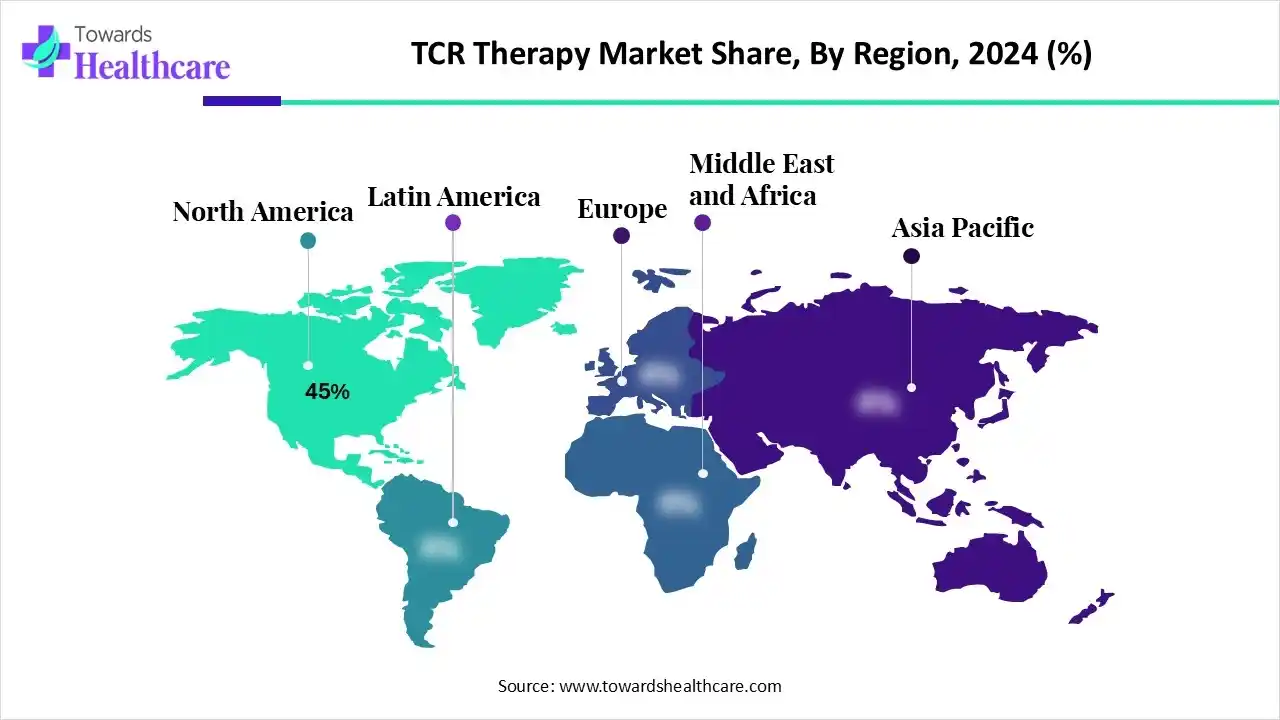

| Leading Region | North America by 45% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Technology, By End User, By Region |

| Top Key Players | Adaptimmune Therapeutics, Immatics Biotechnologies, Medigene AG, Kite Pharma, GlaxoSmithKline, CRISPR Therapeutics, TCR² Therapeutics, Bluebird Bio, MaxCyte, Alaunos Therapeutics, Novartis AG, Takeda Pharmaceutical, Zelluna Immunotherapy, BioNTech SE, Eureka Therapeutics, Intellia Therapeutics, Lyell Immunopharma, Poseida Therapeutics, Regeneron Pharmaceuticals, Caribou Biosciences |

The growing incidence of cancer, advancements in immunotherapy and genetic engineering, and expanded clinical trials fuel the acceptance of novel TCR therapy in cancer care. TCR (T-cell receptor) therapy is an advanced form of adoptive cell transfer immunotherapy that involves genetically engineering patient or donor T-cells to express specific T-cell receptors.

The TCR therapy market is driven by these receptors, which recognize cancer-associated antigens presented by HLA molecules, enabling the immune system to target solid tumors and hematologic malignancies more precisely. Unlike CAR-T therapies that typically target surface antigens, TCR therapies can access intracellular tumor antigens, expanding therapeutic possibilities. This makes TCR therapy a promising approach for difficult-to-treat cancers such as melanoma, sarcoma, and lung cancer.

Artificial intelligence-based platforms aid in improving the speed and accuracy of TCR screening and discovery. AI-based platforms aid in the selection of specific T-cell receptors. AI is used in the design of T-cell receptors for enhanced immunotherapies. AI, through its computational capabilities, is enhancing binding specificity, structural prediction, and interaction with antigenic targets.

The global innovative medicines companies like Novartis aim to establish a biomedical research innovation hub in the U.S. and new manufacturing facilities across the globe. For instance, in April 2025, Novartis announced its plan to expand its US-based R&D and manufacturing infrastructure with a total investment of $23 billion over the next 5 years, which will ensure the manufacturing of all Novartis medicines for U.S. patients only in the U.S.

The leading market players like Pfizer are committed to investing in community-led partnerships and solutions to address global health challenges and support the community. For instance, in January 2025, the Pfizer Foundation announced its progress through a three-year initiative of providing $15 million investment to improve breast cancer care in Sub-Saharan Africa.

| Sr. No. | Name of the Grant Program | Funding Organization | Grant Award |

| 1 | SITC-Merck Cancer Immunotherapy Clinical Fellowship | Society for Immunotherapy of Cancer (SITC) | $100,000 (1-year duration) |

| 2 | Adult Cancer Immunotherapy Fellowship |

|

1-year fellowship |

| 3 | AACR-Kure It Research Grant for Immunotherapy in Kidney Cancer | American Association for Cancer Research (AACR) | $250,000 over 2 years ($125,000/year) |

| 4 | Cancer Immunotherapy Response Research Platform – MRC (UK) | Medical Research Council, Office for Life Sciences | Up to £9 million |

| 5 | MRFF Stem Cell Therapies Mission Grant (Australia) | Australia’s Medical Research Future Fund (MRFF) | Variable, based on project scope and stream |

| 6 | AACR Immuno-Oncology Research Fellowship | American Association for Cancer Research (AACR) | $130,000 over 2 4 years |

| 7 | CRI Immuno-Informatics Postdoctoral Fellowship | Cancer Research Institute (CRI) | $74,000 to $78,000/year + $5,000 allowance (3 years) |

| 8 | High-Risk, High-Reward Immunology Innovation (ExCITe NOSI) – NCI/NIH | Exploratory Cancer Immunology Projects and Technologies (ExCITe) Notice of Special Interest (NOSI), issued by the National Cancer Institute (NCI) (ExCITe NOSI) – NCI/NIH | ~$275,000 over 2 years |

| 9 | NIH Immunotherapy Clinical Fellowship | Center for Cancer Research (CCR) at the National Cancer Institute (NCI) | 1-year duration |

| 10 | ASCO Career Development Award (CDA) | American Society of Clinical Oncology (ASCO) / Conquer Cancer® Foundation | $200,000 over 3 years |

The TCR-T cell therapy segment dominated the market in 2024, with a revenue share of approximately 52%, owing to advanced genetic engineering technologies, gene editing, allogeneic therapies, and combination therapies. The FDA approvals for cell and gene therapies and the expanding therapeutic pipeline for solid tumors raise the importance of TCR-T cell therapies. The increased focus of clinical studies on enhancing efficiency through combining different therapies and treatments fuels the clinical trial success in TCR-T cell therapy.

The TCR-engineered platforms segment is expected to grow at the fastest CAGR in the market during the forecast period due to manufacturing innovations and next-generation platforms. The clinical developments in cell engineering are driven by partnerships, strategic collaborations, and regulations. These platforms are expanding the reach of cancer immunotherapy beyond blood cancers to incurable solid tumors.

The oncology segment dominated the market in 2024, with a revenue share of approximately 68%, owing to the advancements in targeting tumors and genetic engineering. The in-vivo gene therapies and allogeneic therapies focus on enhancing scalability and accessibility to treatments. TCR therapy is becoming valuable in treating solid tumors, while CAR-T cell therapy potentially treats blood cancers.

The infectious diseases segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the promising applications of TCR therapy in treating chronic viral infections and acute viral infections. The promising clinical trials and the potential role of TCR-T cell therapy in oncology help to address infectious diseases. This cell therapy results in key developments like targeting viral antigens, optimizing T-cell function, and refining manufacturing processes.

The viral vector-based gene transfer segment dominated the market in 2024, with a revenue share of approximately 46%, owing to the key role of TCR therapy in the genetic engineering of T-cells with a new and highly specific TCR through viral vectors that enable them to identify and target cancer cells. The potential strategies to enhance T-cell function and gene editing technologies advance efficient gene transfer. The increased focus on safety and manufacturing advances viral vector manufacturing and preclinical testing.

The non-viral methods segment is anticipated to grow at a notable rate in the market during the upcoming period due to increased manufacturing efficiency, enhanced safety, and transient gene expression through non-viral methods for TCR therapy. The transposon systems are cost-effective, scalable, and enable long-term expression. CRISPR-Cas9 gene editing is vital in precision gene replacement, endogenous TCR knockout, and enhanced T-cell function.

The biotechnology & pharma companies segment dominated the market in 2024, with a revenue share of approximately 54%, owing to their key role in advancing next-generation technologies and supporting strategic alliances and acquisitions. They continuously navigate clinical trials and regulatory pathways to achieve progress, manage risk, and grab regulatory support. They grow through research collaborations and regional expansion, which accelerate development and overcome barriers.

The contract research & manufacturing organizations (CROs/CMOs) segment is predicted to grow at a rapid rate in the market during the studied period due to their remarkable efforts for process optimization, supply chain management, decentralized manufacturing, and technological innovation. The CROs contribute to TCR therapy research and clinical development through drug discovery, clinical trial management, and specialized services. They adopt a regulatory strategy and help with data analysis.

North America dominated the market in 2024, with a revenue share of approximately 45%, owing to the supportive regulatory environment and a robust research infrastructure. The American Society of Gene+Cell Therapy (ASGCT) organizes events for engaging people in addressing the emerging issues in the cell and gene therapy field and exploring innovative solutions. The Bespoke Gene Therapy Consortium (BGTC) is a public-private partnership dedicated to removing bottlenecks in the manufacturing and regulatory aspects of AAV gene therapies.

North America is moving forward towards immense growth through impactful regulatory reform, accelerated innovations, cell and gene therapy approvals, and support for manufacturing and modernization. The establishment of robust review processes and long-term follow-up standards helps to ensure the safe clinical integration of complex and high-risk therapies.

The regulatory advancements by the U.S. FDA are the key government-led action that enables commercial access and offers new treatment options to patients. In July 2025, the Centers for Medicare & Medicaid Services (CMS) introduced a new federal program that has expanded access to gene therapies for sickle cell and other diseases.

The U.S. government agencies are committed to advancing T-cell therapy through FDA guidance and support from the National Institutes of Health (NIH).

The federal government supports cutting-edge technologies, including AI and robotics-enabled cell and gene therapy manufacturing. In April 2025, BioCanRx announced new funding for translational cancer immunotherapy research.

The Government of Canada developed made-in-Canada CAR-T cell immunotherapies through the assessment of cost, access, risk, and alternatives.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing cancer incidence, government support, and favorable regulatory policies. The International Society for Stem Cell Research conducted the APAC virtual summit for cell and gene therapies, which focused on innovative development, regulatory framework, and commercialization strategies.

The Asian Pacific countries, like Singapore, China, and South Korea, invested in manufacturing capabilities. The leading providers of clinical research solutions enable successful expansion into the Asia Pacific. The grant opportunities for stem cell therapies, expanding foreign opportunities, and funding for biotechnology accelerate the development of cell therapy across the Asia Pacific region.

In April 2024, the President of India launched the first home-grown gene therapy of India for cancer developed by IIT-Bombay, ImmunoAct, and Tata Memorial Centre.

India also launched its first clinical trial for affordable CAR-T cell therapy, revolutionizing cancer treatment. The Indian government initiatives aim to reduce the cost of therapy in collaboration with the National Biopharma Mission (NBM), Biotechnology Industry Research Assistance Council (BIRAC), and researchers at Tata Memorial Centre (TMC), Mumbai.

In September 2024, the Chinese Society of Gene and Cell Therapy achieved a significant development for China’s cell and gene therapy sector.

This society mainly focuses on advancing policy support, clinical trials, academic research, and international collaboration. China’s biotechnology firms are experiencing stunning advancements in the drug discovery pipeline.

The R&D process for TCR therapy involves target antigen and TCR discovery, preclinical development and engineering, clinical manufacturing, and clinical translation.

Key Players: Immunocore, Adaptimmune Therapeutics, Immatics Biotechnologies, Alaunos Therapeutics, Bristol Myers Squibb, Gilead Sciences, Kite Pharma.

The clinical trials for TCR therapy focus on targeting solid tumors and expanding applications of Gamma-delta T-cell therapies. In August 2024, the U.S. FDA approved Tecelra as the first FDA-approved TCR therapy.

Key Players: Medigene, Affini-T Therapeutics, Lion TCR, T-Cure Bioscience, TScan Therapeutics, Immunocore, Adaptimmune Therapeutics, Immatics Biotechnologies.

The major market players like Bristol Myers Squibb, AstraZeneca, and others provide patient support programs as developers of cell therapies. Moreover, the cancer center programs by Tata Memorial Hospital, Moffitt Cancer Center, and others aim to support patients with services to guide them through the complex treatment process.

Key Players: Adaptimmune Therapeutics, Immunocore, Immatics Biotechnologies, Alaunos Therapeutics, Bristol Myers Squibb, Gilead Sciences, Kite Pharma.

By Product Type

By Therapeutic Area

By Technology

By End User

By Region

February 2026

February 2026

February 2026

February 2026