January 2026

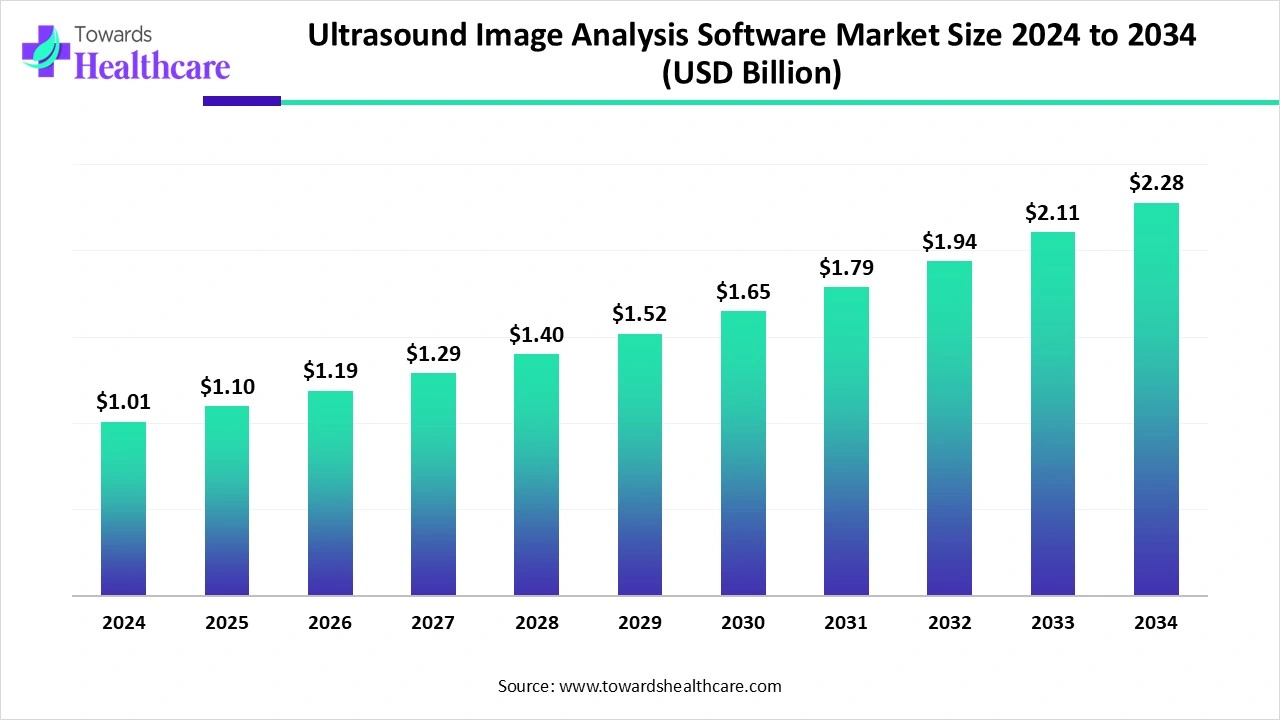

The global ultrasound image analysis software market size is calculated at US$ 1.01 billion in 2024, grew to US$ 1.1 billion in 2025, and is projected to reach around US$ 2.28 billion by 2034. The market is expanding at a CAGR of 8.41% between 2025 and 2034.

Due to developments in 3D ultrasound technology and improved picture quality, the ultrasound image analysis software market is expected to grow significantly. It is now more crucial than ever to be able to deliver and store photos remotely, especially for patients who live far away. It is also anticipated that when 3D ultrasound imaging becomes more accessible and affordable than MRI and CT scans, the growing use of ultrasound image analysis software in clinical decision-making will continue. Another factor propelling the market is the increasing need for the diagnosis and treatment of chronic illnesses including cancer, musculoskeletal disorders, and cardiovascular disorders.

| Table | Scope |

| Market Size in 2025 | USD 1.1 Billion |

| Projected Market Size in 2034 | USD 2.28 Billion |

| CAGR (2025 - 2034) | 8.41% |

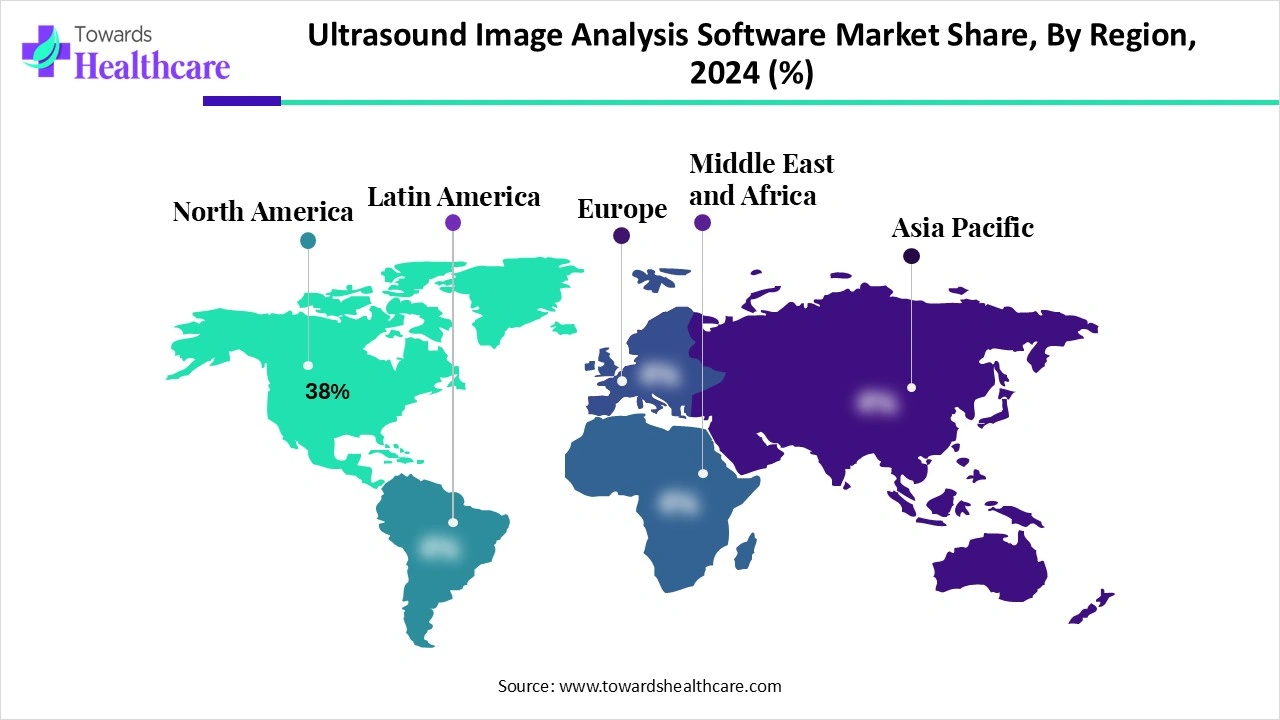

| Leading Region | North America 38% |

| Market Segmentation | By Software Type, By Imaging Mode, By Application, By Deployment Model, By End User, By Region |

| Top Key Players | GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Samsung Medison, FUJIFILM Sonosite, Esaote S.p.A., Hitachi Healthcare, ContextVision AB, TomTec Imaging Systems GmbH, Pie Medical Imaging, Clarius Mobile Health, Butterfly Network, Inc., Mindray Medical International, Terarecon (ConcertAI), Agfa HealthCare, Ambra Health (Intelerad), Median Technologies, Ultromics Ltd. (AI in Cardiology), Caption Health (AI-guided ultrasound) |

The ultrasound image analysis software market includes advanced digital solutions designed to process, interpret, and analyze ultrasound imaging data for diagnostic and therapeutic applications. These software platforms use AI, machine learning, and 3D/4D visualization to improve accuracy, speed, and reproducibility in clinical decision-making. They support radiologists, cardiologists, obstetricians, and other clinicians in detecting abnormalities, quantifying measurements, and integrating results with electronic health records (EHRs) and PACS. The market is driven by rising ultrasound adoption across point-of-care and portable devices, increasing focus on automation and workflow efficiency, and growing demand for early disease diagnosis.

Market expansion in other regions: The ultrasound image analysis software market is growing due to rising expansion of services in other regions. Key market players are investing and expanding their services in developing countries.

For instance,

Both inter-operator and inter-reader variability may be addressed by AI-powered solutions. AI can analyse enormous volumes of ultrasound data and replace some manual human involvement by utilising machine learning methods. All things considered, AI-guided ultrasound assists users of all skill levels in obtaining consistent, dependable, diagnostic-quality ultrasound pictures. AI has the ability to optimise resource usage and boost productivity in healthcare settings by streamlining the ultrasound workflow.

Rising Focus on Early & Accurate Diagnosis

The growing emphasis on early and precise diagnosis using cutting-edge imaging technologies is the primary factor propelling the ultrasound image analysis software market. Healthcare professionals are increasingly using ultrasound equipment and the software that supports them to deliver better patient care as a result of the growth in chronic illnesses and the ageing of the world's population. By assisting with ultrasound picture interpretation, this software speeds up the process of making an accurate diagnosis and boosts healthcare professionals' confidence.

Regulatory Hurdles

The ultrasound image analysis software market is severely constrained, mostly due to issues with data protection and regulations, despite the business's bright future. Market participants have operational challenges when complying with strict rules like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe.

Rising Usage of Hybrid Imaging Technologies

Combining two or more imaging modalities to produce a novel method is known as hybrid imaging. The inherent benefits of fusion imaging technologies are combined in a way that creates a new and more potent modality. various hospitals are increasingly switching from independent imaging systems to hybrid ones due to the various benefits of hybrid imaging systems. The market is expanding as a result of the rising demand for software employed in hybrid imaging systems brought on by their growing usage.

The standalone software segment was dominant in the ultrasound image analysis software market in 2024. Without the aid of external software, networks, or extra hardware, a standalone point-of-sale system can function on its own. It doesn't require internet connectivity or system integration to carry out its functions. It is trustworthy in the healthcare sector because of its self-sufficiency.

The AI-based image analysis platforms segment is estimated to be the fastest-growing in the ultrasound image analysis software market during the forecast period. The experience of healthcare professionals and information gleaned from training data can be used by artificial intelligence (AI) technology to forecast or make choices. Clinicians may use this technology to increase the effectiveness of illness evaluation and identification, support clinical therapy, and forecast post-treatment response. AI-based US imaging has the potential to significantly enhance diagnosis, lower medical expenses, and streamline US-based clinical workflow as AI technology advances.

The 2D ultrasound segment was dominant in the ultrasound image analysis software market in 2024. For the majority of prenatal exams, 2D ultrasounds are the usual instrument. They are essential to normal prenatal care because they provide enough information to track the health and development of the unborn child throughout the pregnancy.

The 3D & 4D ultrasound segment is estimated to be the fastest-growing in the ultrasound image analysis software market during the forecast period. For a number of reasons, 3D and 4D scans during pregnancy have become essential, radically changing prenatal treatment. These cutting-edge imaging methods provide a more thorough image of the growing foetus than conventional 2D scans, allowing medical practitioners to identify any anomalies and more precisely gauge general health.

The radiology/general imaging segment was dominant in the ultrasound image analysis software market in 2024. One of the medical specialities with the quickest rate of growth is radiology, and 2025 is looking to be a big year for the sector thanks to several advances and technical breakthroughs. Because it allows highly qualified professionals to remotely analyse medical pictures, teleradiology is still becoming more and more popular.

The cardiology segment is estimated to be the fastest-growing in the ultrasound image analysis software market during the forecast period. There will likely be 35.6 million cardiovascular deaths in 2050 (up from 20.5 million in 2025), with a 90.0% rise in cardiovascular prevalence, a 73.4% increase in crude mortality, and a 54.7% increase in crude DALYs between 2025 and 2050. The programme facilitates the acquisition of point-of-care cardiac ultrasound pictures in a range of care situations by medical workers who lack sonography knowledge.

The on-premises software segment was dominant in the ultrasound image analysis software market in 2024. An organisation that uses the on-premises software deployment approach installs and operates software on its own hardware and servers, which are housed in its own physical buildings or data centres. This conventional method gives businesses a great deal of control over their data and infrastructure, allowing for specialised security measures and guaranteeing adherence to rules.

The cloud-based/SaaS platforms segment is estimated to be the fastest-growing in the ultrasound image analysis software market during the forecast period. These technologies are transforming clinical collaboration, operational efficiency, and patient care by fusing the agility of cloud computing with the accuracy of corporate ultrasonography. Healthcare organisations of all sizes may easily increase their imaging capacity to meet expanding needs thanks to cloud solutions' unmatched scalability and flexibility.

The hospitals segment was dominant in the ultrasound image analysis software ultrasound image analysis software market in 2024. Faster, more precise diagnoses that enable individualised and successful treatment programmes are among the benefits of medical imaging in hospitals. It makes it possible to identify illnesses early on, frequently before symptoms appear, which enhances patient outcomes and may even save lives.

The diagnostic imaging centers segment is estimated to be the fastest-growing in the ultrasound image analysis software market during the forecast period. Diagnostic imaging centres offer a number of benefits, including as early and more accurate diagnosis, access to cutting-edge equipment, improved patient outcomes, and the avoidance of expensive problems. Compared to hospitals, patients frequently enjoy shorter wait times, more patient-focused environments, and lower expenses.

North America dominated the ultrasound image analysis software market share 38% in 2024. Throughout the forecast period, the rapid adoption of new technologies is one of the main factors that is anticipated to increase the use of ultrasound imaging software in this area. Major factors influencing the ultrasound imaging software market's growth during the forecast period include the incidence of chronic illnesses, rising healthcare spending due to digitisation, and an ageing population.

Cardiovascular diseases is a leading cause of mortality in the U.S. This has led to rising usage of ultrasound in the region. By 2050, obesity and hypertension will each impact over 180 million persons in the U.S., while the incidence of diabetes will rise to over 80 million. Additionally, it is anticipated that the expenditures of cardiovascular disease-related medical treatment will rise by 300% throughout that time.

The average number of general ultrasound exams performed by sonographers in Canada during an 8-hour workday is 11.25, with a range of 9 to 14. Using a specially made helmet that uses low-dose ultrasound to deliver medicine into the brain, Canadian researchers have started the first-ever trial in the world to combat ALS in a completely different method.

Asia Pacific is estimated to host the fastest-growing ultrasound image analysis software market during the forecast period because the healthcare industry is growing quickly, the government is investing more money in healthcare infrastructure, chronic illness rates are rising, and there is a growing need for affordable diagnostic imaging in developing nations like China and India.

China has separate ultrasound departments as opposed to many other nations where ultrasound services are incorporated into radiology departments. China created the NUQCC to strengthen medical service monitoring, assess performance, and improve quality management. The NUQCC, a national authority on ultrasound quality, is essential to guaranteeing the calibre and security of ultrasound services.

According to a research by the Harvard School of Public Health and the World Economic Forum, between 2012 and 2030, India is expected to lose almost $2.17 trillion in economic value as a result of CVDs. Due to their unique socioeconomic and cultural traits, older persons in India are more likely to experience the dual burden of both infectious and noncommunicable diseases.

Europe is estimated to grow at a significant CAGR in the ultrasound image analysis software market during the forecast period. The region is supported by government programmes, reimbursement regulations, and an ageing population with health problems that increases the need for diagnostic imaging services. As a result of increased healthcare system investment, modern technologies like ultrasound analysis software are becoming more widely used in European nations.

Between February 2024 and January 2025, 48.9 million imaging tests were recorded in England. According to reports, 4.03 million of these imaging examinations were performed in January 2025. In January 2025, 1.88 million X-rays (also known as plain radiography) were conducted, making it the most prevalent test. Diagnostic Ultrasonography (Ultrasound, 0.95 million), Computerised Axial Tomography (CT Scan, 0.67 million), and Magnetic Resonance Imaging (MRI, 0.39 million) were the next most popular treatments.

In September 2025, more than just a legal milestone, the acquisition of this most recent patent confirms our long-term goal that routine ultrasound may quickly and affordably provide significant, predictive clinical insights at the point of treatment, according to Robert S. Bunn, founder and president of Ultrasound AI. We're opening the door to safer, quicker, and more accessible care globally by safeguarding techniques that rely only on imaging to identify lab and clinical values.

By Software Type

By Imaging Mode

By Application

By Deployment Model

By End User

By Region

January 2026

January 2026

January 2026

January 2026