January 2026

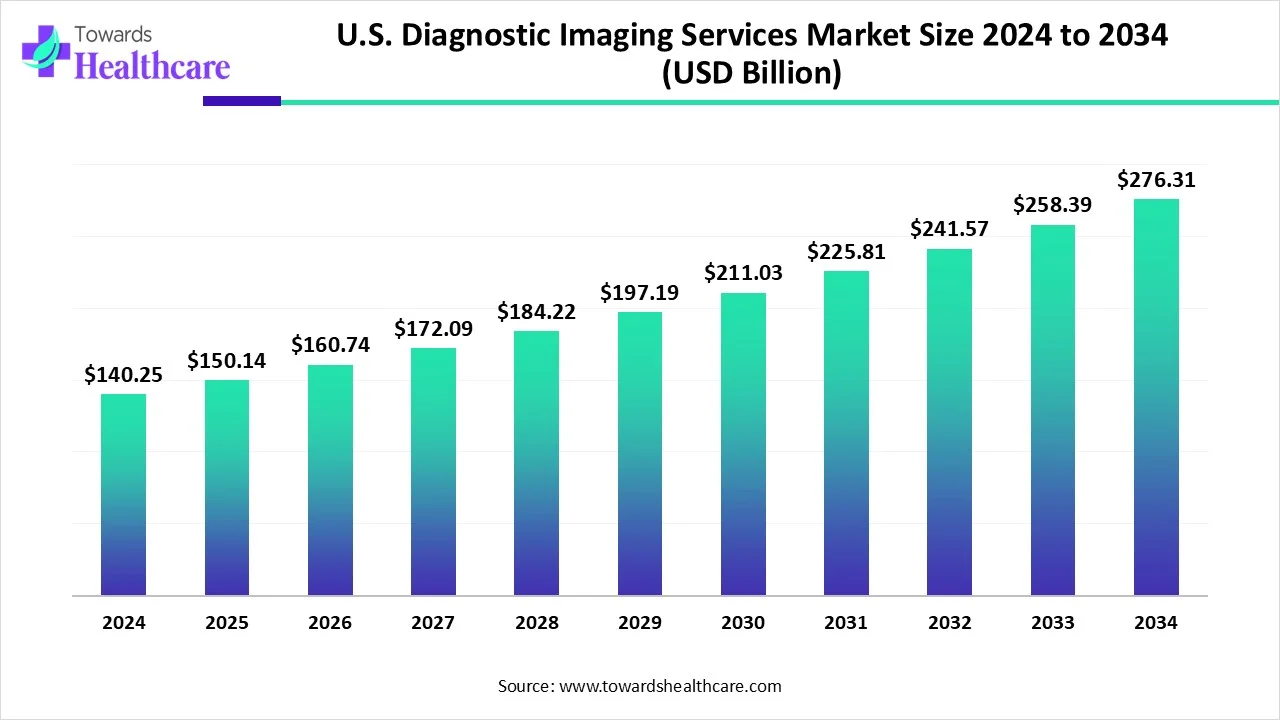

The U.S. diagnostic imaging services market size is calculated at USD 140.25 in 2024, grew to USD 150.14 billion in 2025, and is projected to reach around USD 276.31 billion by 2034. The market is expanding at a CAGR of 7.04% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 150.14 Billion |

| Projected Market Size in 2034 | USD 276.31 Billion |

| CAGR (2025 - 2034) | 7.04% |

| Market Segmentation | By Product, By Application, By Payor, By Setting |

| Top Key Players | RadNet, Inc., Akumin, Inc., Rayus Radiology, MedQuest Associates, LucidHealth, Inc., US Radiology Specialists, Radiology Partners, Envision Radiology, Capitol Imaging Services |

The U.S. diagnostic imaging services market is growing rapidly due to an increasing aging population, increasing prevalence of disease, growing awareness among consumers related to preventive diagnostic screening, and advancements in technology. In U.S. diagnostic imaging services, the application of many types of techniques and machines creates pictures of the structures and activities in the body. Various types of imaging tests are easy and painless. In some tests need to stay still for a long time in a machine. Recent revolutions like artificial intelligence (AI) and novel imaging modalities improve diagnostic precision, allow earlier disease identification, and increase healthcare access while addressing the challenges of environmental impact and radiologist shortages.

Integration of AI in the U.S. diagnostic imaging services is driving the growth due to AI has a strong potential to improve the efficiency and accuracy of interpreting medical images, such as CT scans, MRIs, and X-rays. AI-driven diagnostic devices not only accelerate the interpretation of complex images but also enhance early detection of disease, eventually delivering improved results for patients. AI-driven image processing facilitates personalized treatment plans, thus optimizing healthcare delivery. AI-based algorithms provide surgeons with navigation assistance, augmented visualization, and decision-making strategies. AI-driven algorithms rapidly analyze large amounts of imaging data, detecting abnormalities and patterns that are overlooked by human eyes. This technology helps in the early detection and treatment of diseases, like cancer and cardiovascular conditions, also offering precise and consistent image analysis.

For Instance,

Increasing Demand for Green Imaging

The U.S. diagnostic imaging services market is experiencing growth driven by the rising demand for green imaging, which enhances savings and improves quality in employer health plans by tailoring solutions. Key factors such as transparency and quality are pivotal in reforming the healthcare sector, and Green Imaging is at the forefront, delivering affordable yet high-quality imaging services. It addresses the issue of prohibitively expensive imaging in communities. By reducing energy consumption, minimizing waste, and utilizing renewable energy sources, healthcare providers can dramatically reduce their environmental impact.

Challenges of Prosthetics and Orthotics Services

Growing maintenance expenses of various diagnostic devices restraints the growth of the U.S. diagnostic imaging market. Maintenance for a single MRI or CT machine costs over $100,000 yearly. Various imaging tools require frequent maintenance. Increases cost because of complex and expensive technology involved, the need for specific technicians, which limits the growth of the market.

Recent Advancements in 4D Imaging Technology

Recent advancements in 4D imaging technology are creating new opportunities within the U.S. diagnostic imaging services market. By adding the dimension of time to traditional 3D scans, 4D imaging provides dynamic, real-time views that capture motion effectively. This development is particularly significant in fields such as cardiology and orthopedics, where understanding movement is crucial to disease progression. The use of 4D ultrasound is gaining traction, especially in obstetrics, where real-time imaging is essential for monitoring fetal growth. Furthermore, the rising trend of portable imaging devices for 4D scans is enhancing accessibility to diagnostic tools, particularly in remote or underserved regions. Additionally, 4D CT scans offer valuable insights into joint mobility, enabling radiologists to better assess biomechanical issues and intervene sooner to avert conditions like osteoarthritis.

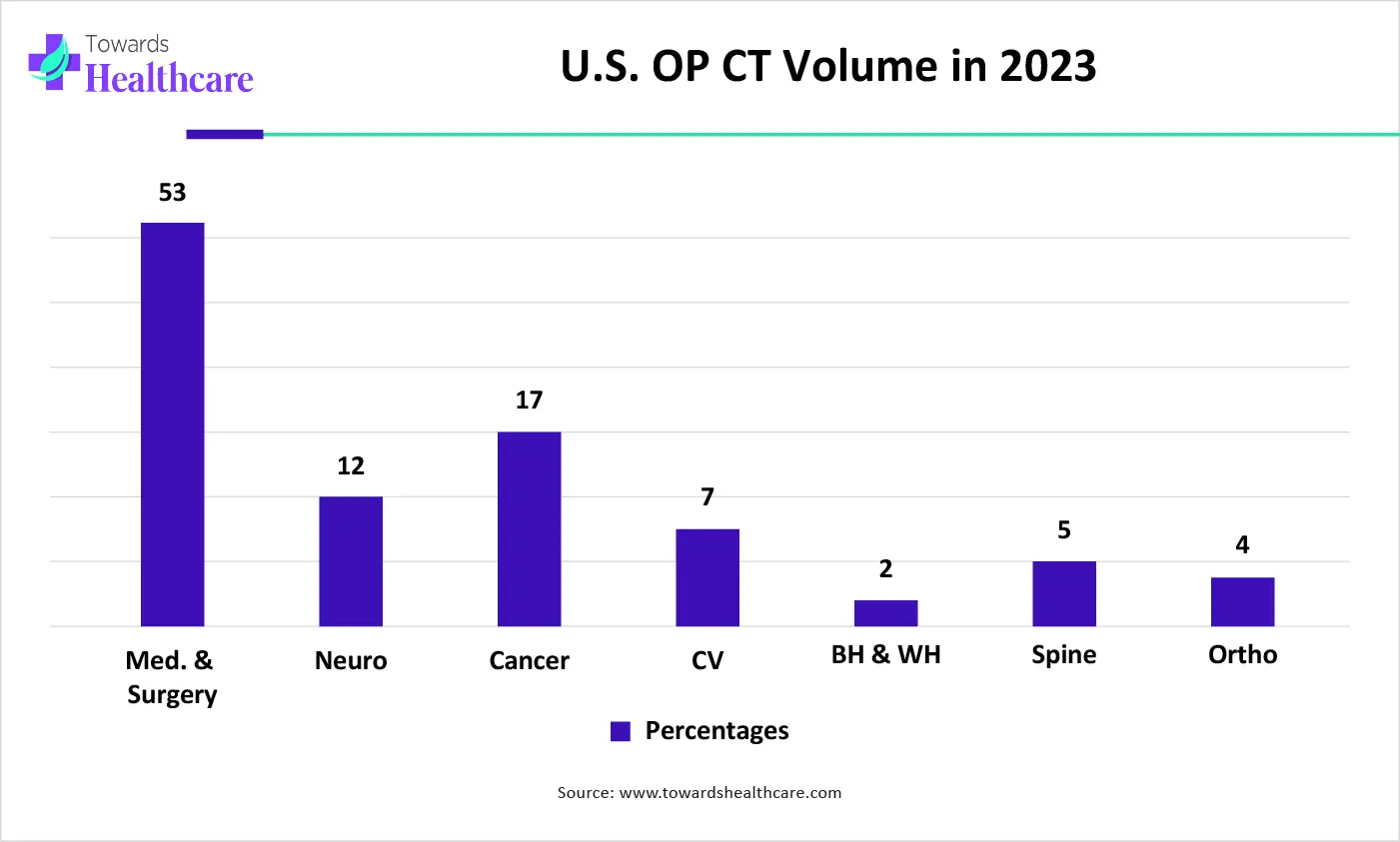

By procedure, the CT segment dominated the U.S. diagnostic imaging services market in 2024, as CT scan imaging provides a swift and painless process, creating detailed images for precise medical diagnosis. CT images of internal organs, soft tissue, bones, and blood vessels provide much greater clarity than conventional X-ray images. CT scans also help in the early detection of disease, and assist in treatment, providing a rapid and non-invasive diagnosis for different conditions. It is the most useful technique for severe condition identification.

The MRI segment is the fastest growing in the U.S. diagnostic imaging services market as MRI offers a better solution for soft tissue contrast than CT, and it differentiates better between fat, muscle, water, and other tissue than CT. These images provide data to doctors, and it is useful in diagnosing a broad range of diseases and conditions. MRI scans provide a more comfortable, safer experience with results that are generated rapidly and precisely. It is used virtually in any part of the human body, such as the head and joints, muscles, and spinal region.

By application, the neurology segment is dominant in the U.S. diagnostic imaging services market in 2024, as neurological diagnostics have been transformed by modern imaging processes, increasing accuracy in disease management and identification. Diagnostic imaging offers highly detailed images, enabling the detection of miniature abnormalities in the spinal cord and brain. This technology is consistently evolving, offering more precise and comprehensive devices for diagnosing neurological conditions.

The oncology segment is expected to grow at the fastest CAGR in the U.S. diagnostic imaging services market as novel medical imaging potentially enhances oncology results by accurate staging, early detection, and precise treatment. It progresses cancer diagnosis and is also an effective treatment for cancer and other diseases. It provides many benefits like real-time monitoring, accessibility instead of tissue destruction, minimal or no invasiveness, and function over broad ranges of time and size scales involved in pathological and biological processes. Diagnostic imaging monitors the efficiency of ongoing treatments of cancer, allowing physicians to adjust therapies based on the response of the disease.

The private health insurance/out-of-pocket segment dominated the U.S. diagnostic imaging services market, as most of the private health insurance plans provide pre- and post-hospitalisation coverage, which helps patients cover the cost of the diagnostic test. Most diagnostic tests, such as MRIs, X-rays, and blood tests, are covered under health insurance plans. They eradicate financial challenges and ensure that individuals receive the tests they require to detect and address health challenges early on, leading to better treatment results and improved overall health. Insurance-supported individuals receive timely and precise healthcare, leading to improved health outcomes and enhanced quality of life.

The public health insurance segment is expected to increase at a substantial growth rate during the forecast period as public health insurance helps to reduce the exposure of risk factors, ionizing radiation, or deal with quality in health care, in radiology. A public health insurance covers the expenses of an MRI, based on the policy purchase.

By setting, the hospital inpatient segment is dominant in the U.S. diagnostic imaging services market as it provides many benefits. Inpatient care is the immediate attention patients receive from healthcare experts. The imaging services provided in an inpatient setting are highly personalized. Physicians work closely with the patient to develop a rehabilitation plan that meets their specific goals, needs, and progress.

The hospital outpatient (HOPD) segment is estimated to be the fastest growing in the market as outpatient care enables patients to receive treatment for minor illnesses or injuries without the requirement for hospitalisation. Outpatient care is that the improvement of imaging technologies and treatments over time allowed for a higher degree of specialization. Outpatient services generally cost less because patients do not need to stay in the hospital.

In the United States, the increasing aging population will lead to the growing demand for diagnostic imaging services. Also growing prevalence of chronic diseases like orthopaedic challenges, cancer, and cardiovascular issues, which need regular monitoring and imaging services. Major advancements have been made in the sector of digital imaging services in recent years, like AI-aided X-ray interpretation, tomosynthesis, dual-energy imaging, automatic image stitching, computer-aided diagnosis, and digital radiography, which contribute to the growth of the U.S. diagnostic imaging services market.

For Instance,

In March 2025, Roland Rott, president and CEO, Imaging at GE HealthCare, stated, “GE HealthCare has a deep history in medical imaging technology, and we consistently build upon our legacy of revolution as a medical care solutions provider.” (Source - GE Healthcare)

By Product

By Application

By Payor

By Setting

January 2026

January 2026

January 2026

January 2026