February 2026

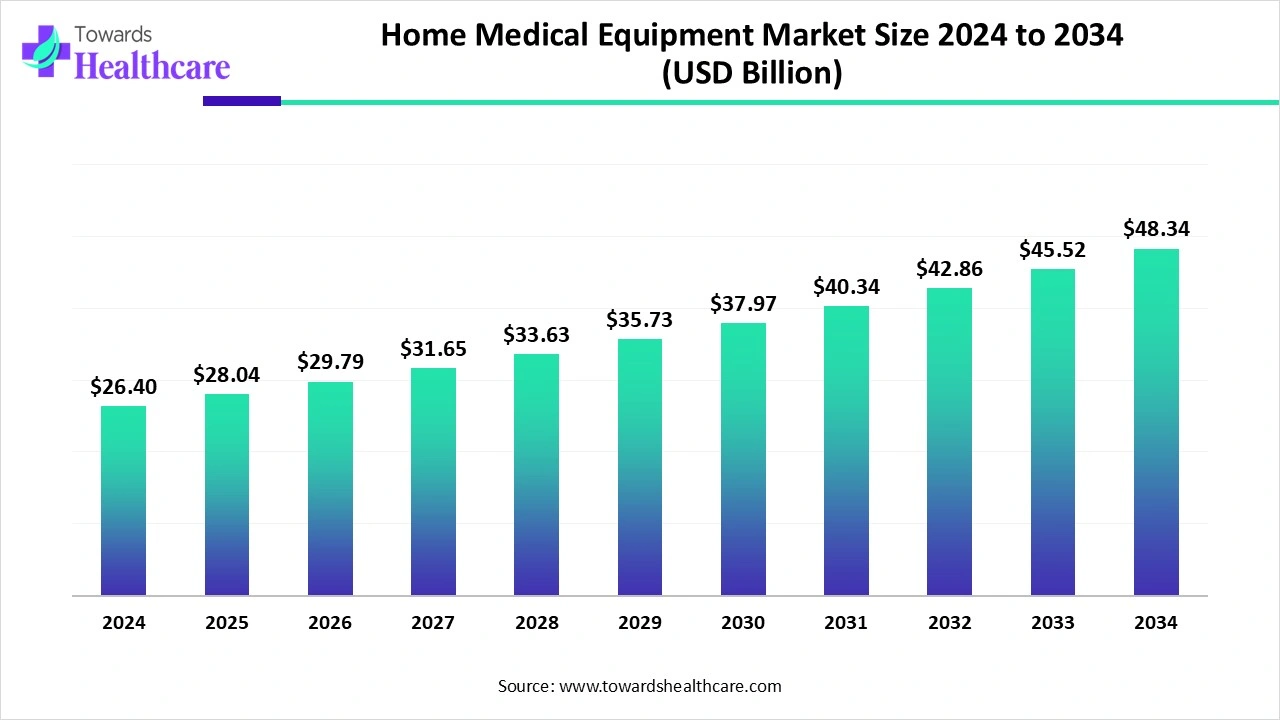

The U.S. home medical equipment market size is calculated at US$ 7.79 billion in 2024, grew to US$ 8.29 billion in 2025, and is projected to reach around US$ 14.25 billion by 2034. The market is expanding at a CAGR of 6.4% between 2025 and 2034.

The U.S. home medical equipment market is driven by a number of important factors. Among the factors contributing to the growing demand for medical devices are the growing number of elderly people, who are more inclined to receive care at home, and the growing number of patients with chronic illnesses like diabetes and respiratory issues, who also need home medical devices. The use of equipment at home is made easier by technological advancements like telemedicine and remote patient surveillance, which enhance patient care.

| Table | Scope |

| Market Size in 2025 | USD 8.29 Billion |

| Projected Market Size in 2034 | USD 14.25 Billion |

| CAGR (2025 - 2034) | 6.4% |

| Market Segmentation | By Product Type, By End User, By Distribution Channel, By Region |

| Top Key Players | Medtronic plc, ResMed Inc., Philips Respironics (Koninklijke Philips N.V.), Invacare Corporation, Drive DeVilbiss Healthcare, Hillrom Holdings (Baxter International), Cardinal Health, Inc., McKesson Corporation, GE HealthCare Technologies Inc., Abbott Laboratories, Becton, Dickinson and Company (BD), Smith & Nephew plc, Johnson & Johnson, Omron Healthcare, Inc., 3M Health Care, Sunrise Medical, Permobil AB, ArjoHuntleigh AB, Medline Industries, LP, Invivo Therapeutics |

Home medical equipment refers to medical devices and assistive equipment designed for use in home-care settings to manage chronic illnesses, support recovery, and enhance patient independence. These devices include mobility aids, respiratory care equipment, monitoring devices, and therapeutic systems that help reduce hospital stays, enable aging-in-place, and lower overall healthcare costs. Growth of the U.S. home medical equipment market is driven by an aging population, rising prevalence of chronic conditions (respiratory, diabetes, cardiovascular), healthcare cost containment strategies, and the expansion of home healthcare services.

Government Initiatives: Government organizations such as NIH and the FDA are crucial organizations in the U.S. healthcare industry. They are responsible for ensuring high-quality care is provided. These organizations also take initiatives to improve home-based healthcare.

For instance,

Incorporating cutting-edge computer algorithms and machine learning approaches into healthcare technology to improve diagnostic, therapeutic, and decision-making processes is known as artificial intelligence (AI) in medical devices. AI enables these gadgets to replicate and frequently outperform human talents by analysing and interpreting intricate medical data, identifying trends, and formulating well-informed forecasts. By increasing precision, effectiveness, and patient outcomes, the incorporation of AI into medical devices holds the potential to completely transform healthcare.

Rising Demand for Long-Term Care

The U.S. home medical equipment market’s expansion can be attributed to the rising demand for long-term care due to rising chronic conditions and the geriatric population. These populations require continuous care and, hence, require home medical equipment. The main causes of mortality and disability in the US are chronic illnesses including diabetes, cancer, and heart disease. They are also the main causes of the $4.9 trillion in yearly health care expenses in the country.

Limited Medical Procedures

The small number of medical treatments that may be carried out in a home environment is one of the possible disadvantages of home health care. More complicated medical treatments could necessitate a trip to a hospital, even if home health care specialists are capable of providing wound care, drug administration, and vital sign monitoring.

What are the Opportunities in the U.S. Home Medical Equipment Market?

There are several opportunities that can support the market’s expansion in the upcoming period. This includes telemedicine, remote consultations, smart home technology, robotics, and automation. Patients may now consult doctors remotely through video conversations thanks to telemedicine, which has revolutionised at-home healthcare. This lessens the need for repeated hospital stays, which can be difficult for elderly people who have mobility problems. Another field that is transforming home healthcare is robotics. Seniors can benefit from the companionship, mobility support, and dressing assistance that assistive robots can provide.

By product type, the therapeutic equipment segment held the major share of the U.S. home medical equipment market in 2024. Healthcare has seen a dramatic change in recent years, moving towards a more patient-centered approach. One factor that is essential to this development is home care medical equipment. As technology develops, more people are choosing home-based healthcare options, which enable them to get help and medical treatment in the convenience of their own homes.

By product type, the other home care supplies segment is estimated to achieve the highest growth during the forecast period. While wound care equipment enables appropriate healing by keeping a clean, moist environment, incontinence products, nutritional support devices, and in-home care are essential for preserving a patient's health, dignity, and avoiding problems. When used in tandem, these devices raise patients' quality of life, encourage independence and self-care, lower hospitalisation rates, and improve their general well-being at home.

By end-user, the elderly patients segment led the U.S. home medical equipment market in 2024. According to U.S. Census Bureau predictions, the number of Americans aged 100 and above is expected to more than quadruple over the next three decades, from an anticipated 101,000 in 2024 to around 422,000 in 2054. As of right now, only 0.03% of Americans are centenarians, but by 2054, that number is predicted to rise to 0.1%. This implies that future demands for home medical devices from elderly individuals are anticipated.

By end-user, the home healthcare providers segment is estimated to be the fastest-growing during the upcoming period. Seniors who choose to age in place can benefit from a wide range of services provided by home healthcare providers. They might help with daily living activities (ADLs) include clothing, bathing, taking medicine, and preparing meals. Additionally, they offer a range of medical services that call for equipment in order to deliver high-quality care.

By distribution channel, the retail medical stores segment was dominant in the U.S. home medical equipment market in 2024. Retail stores for medical equipment provide benefits like in-person product interaction, expert advice on-site, immediate availability for urgent needs, and individualised customer service. These are important for complex equipment that needs to be evaluated hands-on or for customers who need quick access and reassurance.

By distribution channel, the online platforms/e-commerce segment is estimated to grow at the highest rate during 2025-2034. Any pharmacy, equipment supplier, or healthcare organisation may benefit greatly from a medical eCommerce platform. Both patients and providers will benefit from the many features and capabilities that a quality platform will give. Online sales of medicines, medical devices, or equipment can benefit both the customer and the seller in a number of ways, including wider reach, simplicity of use, reduced expenses, simple price comparison, and enhanced transparency.

The South U.S. dominated the U.S. home medical equipment market in 2024. The Census Bureau projects that about 55 million Americans are 65 years of age or older in 2020. California, Florida, and Texas are home to one-fourth of these senior citizens. Aside from this, diagnosed HIV infections in rural regions have the greatest geographical impact in the South. These two elements play a vital role in the market's expansion in the southern United States.

The West U.S. is expected to grow at the fastest CAGR in the U.S. home medical equipment market during the forecast period. Although the expense may be a major hardship for older families, the demand for services that enable individuals to age in place has led to an increase in home care utilisation and prices in the western U.S. and nationwide.

Concept development, design and engineering, prototyping and testing, design validation and verification, and regulatory compliance are all part of research and development for home medical equipment. Device approval, production, and post-market monitoring are the last stages, which include thorough documentation, a strong emphasis on risk management, and adherence to regulatory norms.

Top Companies Include: Medline Industries, Invacare Corporation, Philips, Medtronic, Drive DeVilbiss Healthcare, and Sunrise Medical.

A multi-level channel system is used to market home medical equipment, with manufacturers selling to wholesalers and authorised distributors first. These organisations then provide gadgets to merchants, such as online marketplaces and medical supply stores, where final customers make purchases. Telemedicine, home healthcare providers, and direct-to-consumer sales are also becoming more significant outlets.

An initial evaluation, equipment selection, delivery and setup, patient/caregiver training, continuing monitoring and maintenance, and, if rented, equipment pickup are all steps in the process for patient assistance using home medical equipment.

The global home medical equipment market is valued at US$ 26.4 billion in 2024, expected to reach US$ 28.04 billion in 2025, and is projected to grow to around US$ 48.34 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034.

In October 2024, according to AARP's senior public policy and engagement officer, Nancy LeaMond, family carers save taxpayers billions of dollars annually and provide $600 billion in unpaid labour, making them the backbone of a dysfunctional long-term care system. Enacting sensible policies that assist family carers and enable elderly Americans to remain freely in their homes, where they want, is long overdue.

By Product Type

By End User

By Distribution Channel

By Region

February 2026

February 2026

February 2026

January 2026