February 2026

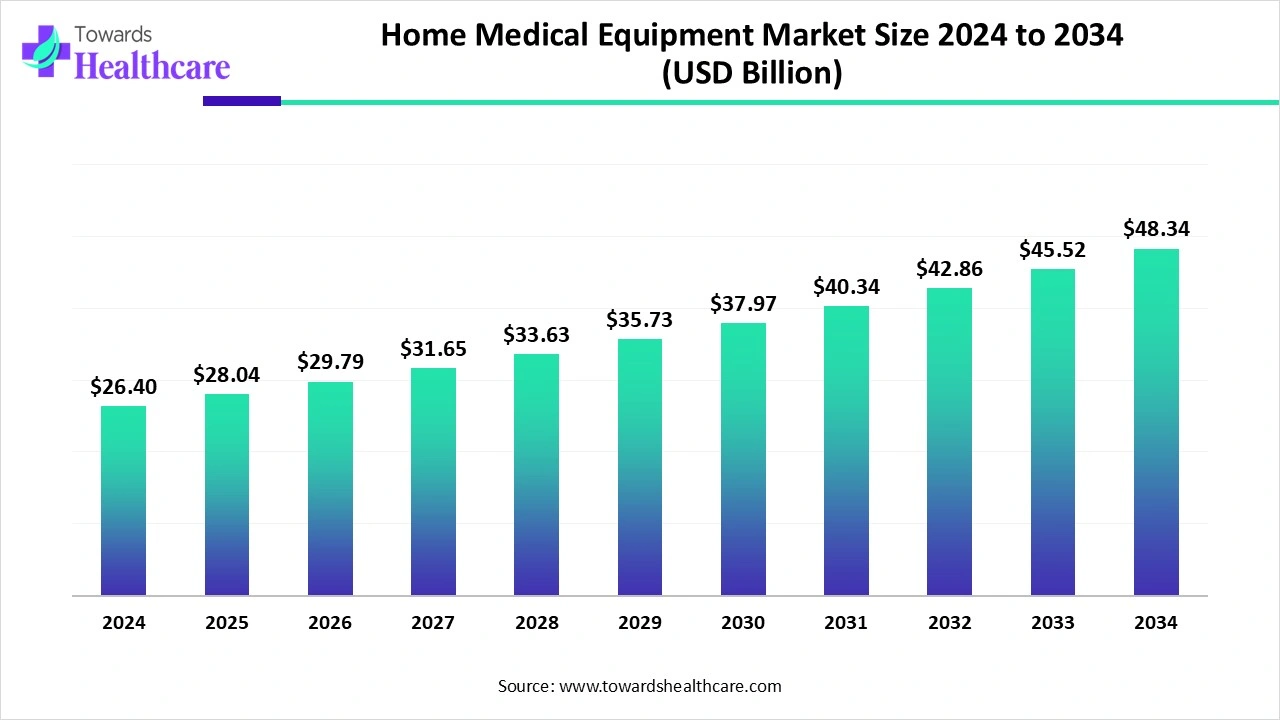

The global home medical equipment market size is calculated at US$ 26.4 billion in 2024, grew to US$ 28.04 billion in 2025, and is projected to reach around US$ 48.34 billion by 2034. The market is expanding at a CAGR of 6.24% between 2025 and 2034.

The home medical equipment market is accelerated by the rise of AI-powered diagnostics, increased demand for AI-integrated wearables, and continued growth of telemedicine and remote care. Moreover, global innovations for personalized medicine, including 3D printing technology and surgical robots, drive the expansion of medical devices. The regulatory and policy shifts across various regions contribute to the evolution of medical equipment. The huge adoption of patient monitoring devices, diagnostic and therapeutic appliances, and health tracking solutions expands the regulatory landscape of the medical devices market.

| Table | Scope |

| Market Size in 2025 | USD 28.04 Billion |

| Projected Market Size in 2034 | USD 48.34 Billion |

| CAGR (2025 - 2034) | 6.24% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Component, By End-User, By Distribution Channel, By Region |

| Top Key Players | 3B Medical, Inc., Abbott Laboratories, Becton Dickinson (BD), Boston Scientific Corporation, Drive DeVilbiss Healthcare, Fisher & Paykel Healthcare, GE Healthcare, Hill-Rom Holdings, Inc., Invacare Corporation, Medline Industries, Inc., Philips Healthcare, ResMed Inc., Smiths Medical, Stanley Healthcare/Stanley Black & Decker, Teva Pharmaceutical Industries Ltd. |

The home medical equipment (HME) market refers to medical devices and equipment designed for use by patients in their homes to manage chronic diseases, recover from illness or surgery, or improve quality of life. The market includes durable medical equipment (DME) such as respiratory devices, mobility aids, monitoring equipment, and therapeutic devices, as well as consumables. HMEs support remote healthcare, reduce hospital visits, and enable patient self-management under physician guidance.

The Union Minister of Health and Family Welfare focuses on uplifting the medical device industry. For instance, in November 2024, Medtech leaders felt delighted to accept the government initiative to launch a Rs. 500 Crore scheme for medical devices to increase self-reliance and domestic manufacturing of medical appliances.

India’s potential in the medical field is driven by advancements in healthcare infrastructure, increased foreign investments, and the rise of medical tourism. For instance, in May 2025, Invest India reported that India’s healthcare and medical technology (MedTech) sector is anticipated to reach around $14 billion and is estimated to grow to around $30 billion by 2030.

Artificial intelligence, in combination with deep learning techniques and neural networks, serves in the prediction and identification of diseases, optimization of medical therapies, and assistance in diagnostics. AI can classify and analyze data for disease outbreaks. AI integration into medical devices results in enhanced diagnostics, personalized treatments, predictive analytics, and remote monitoring. The medical device industry is experiencing rapid innovations in AI-based medical technologies like diagnostic imaging, health monitoring wearables, remote patient monitoring, surgical robots, etc.

What are the Major Drifts in the Home Medical Equipment Market?

The medical device industry is led by the innovative products and competitive pricing offered by prominent companies like Abbott Laboratories Inc., Johnson & Johnson, Medtronic Plc, Philips Healthcare, etc. People are welcoming the AI-integrated wearables like Fitbits and Apple watches to track health activity and fitness through wearable medical devices. The launch of hydration and sweat sensors, electrocardiogram (ECG) sensors, and photoplethysmogram (PPG) sensors expanded the capacity to diagnose and manage health conditions. These innovations empowered consumers and patients to manage their own health efficiently.

What are the Potential Challenges in the Home Medical Equipment Market?

Certain risks are associated with home-based medical devices, which include medication errors leading to hospitalization and operation errors in the ventilator. The unnoticed or unreported errors or malfunctions of medical devices create risks due to their improper monitoring. The unrealistic belief of patients and caregivers in the reliability of devices leads to malfunctioning.

What is the Future of the Home Medical Equipment Market?

According to Invest India, there are numerous investment opportunities in the medical device sector of countries like India and across the globe. The major investors are Johnson & Johnson, Medtronic Plc, GE Healthcare, Baxter, Boston Scientific, Abbott, 3M, Philips, Stryker, Siemens Healthineers, SMT, etc. Frost and Sullivan reported that the creation of innovative business models and disruptive technologies is led by increased healthcare costs and healthcare workforce burnout. Patients, payers, and healthcare providers are prioritizing out-of-hospital settings such as homes and ambulatory care centers to reduce healthcare costs and provide patient comfort and convenience.

The respiratory care devices segment dominated the market in 2024, owing to the numerous benefits of home respiratory care, which improve quality of life, reduce hospitalization, and deliver cost-effective and personalized treatments. The oxygen concentrators provide a reliable oxygen supply, increase mobility, and improve energy and sleep for patients. Patients and consumers are experiencing better sleep quality, reduced health risks, improved cognitive function, and enhanced comfort with the use of home respiratory care devices.

The monitoring & diagnostic devices segment is expected to grow at the fastest CAGR in the market during the forecast period due to the primary role of these devices in empowering patients with self-management. They offer increased safety, peace of mind, comfort, and convenience to patients. They help patients and healthcare professionals with data-driven decisions, increased efficiency, and enhanced care coordination.

The devices/equipment segment dominated the market in 2024, owing to the better assistance of certain medical equipment in chronic disease management with constant monitoring, self-management, timely intervention, and long-term health effects. These medical devices increase patient safety and offer convenience and support. Certain medical appliances are ideal to use in post-surgery recovery, which reduces infection risk, allows faster recovery of patients, and offers comfort and support.

The software & services segment is estimated to grow at the fastest rate in the market during the studied period due to the excellence of software & services in data security, cost savings, and compliance management. They drive patient engagement, improve medical billing, and facilitate data-driven decision-making. They result in improved patient outcomes and increased efficiency of healthcare.

The elderly patients segment dominated the market in 2024, owing to the assistance of home care medical appliances to elders in managing their chronic conditions effectively. The home-based medical devices save money, offer personalized care, and increase patient comfort. The elder patients experience increased confidence and mobility, which helps them to stay active and socially connected. These factors reduce the feelings of isolation and depression for elderly patients.

The chronic disease patients segment is anticipated to grow at a notable rate in the market during the predicted timeframe, due to the major contribution of home-based medical devices in continuous remote patient monitoring and a reduced risk of infection. The remote care devices are also equipped with emergency response features, which help patients with daily living and enhance their mobility. Patients experience a better quality of life through personalized treatment plans and cost-effective solutions.

The hospital & clinic pharmacies segment dominated the market in 2024, owing to the financial benefits in terms of new revenue streams, reduced patient costs, and increased purchasing power. The pharmacies play a vital role in improving health outcomes and empowering patient independence. They provide services and products that enhance the management of medication therapies and improve continuity of care.

The online/e-commerce channels segment is predicted to grow at a rapid rate in the market during the upcoming period due to the benefits of home medical equipment businesses in terms of wider access to the audience, reduced operational costs, and improved operational efficiency. The online platforms maintain product information and transparency in businesses by ensuring powerful marketing and analytics. They provide better prices, competitive options, and a wider product selection.

North America dominated the market in 2024, owing to the affordable alternative solutions to hospital stays and the patient-centered approach of healthcare systems. In September 2025, Philips, Philips Foundation, and MedShare launched a new initiative to make a strong U.S. healthcare readiness for natural disasters.

The World Health Organization (WHO) announced the launch of the MeDevIS platform to accelerate access to medical devices and technologies. This initiative of the WHO aims to support governments, users, and regulators in their decision-making on medical devices for diagnostics, testing, and treatment of various health conditions. The American Hospital Association (AHA) reported that the Biden Administration planned to raise tariffs on Chinese-made items, which also include imports of syringes, respirators, medical masks, and gloves from China. The AHA supports the domestic manufacturing of essential medical supplies that help to improve the resiliency of the healthcare supply chain. The AHA expanded its hospital-at-home program, where patients experience an acute level of care at their home instead of hospitals.

The U.S. depends on foreign countries like China for medical appliances and supplies. According to the AHA reports, the U.S. imported $14.9 billion in medical equipment in May 2024. The U.S. FDA launched the Healthcare at Home initiative to accelerate equity in digital medical care.

The U.S. home medical equipment market is valued at US$ 7.79 billion in 2024, and is expected to grow to US$ 8.29 billion in 2025. Looking ahead, the market is projected to reach around US$ 14.25 billion by 2034, expanding at a CAGR of 6.4% from 2025 to 2034.

Canada and Ontario agreed to work together to improve healthcare for Canadians during 2023-24 and 2025-26. In March 2025, Canada launched the caregiver program for foreign workers. The CAN Health network unites top innovators, industry partners, and healthcare leaders from across the country to display the power of Canadian technology that fuels economic growth and shapes the future of care.

Asia Pacific is estimated to grow at the fastest rate in the market during the upcoming period due to increased shift towards cost-effective care and expanding healthcare infrastructure. The Asian Pacific countries, like China and Malaysia, started a reciprocal medical device reliance pilot program that will provide grants to companies present in each country to expand the medical devices sector. The most promising investment sectors in the Asia Pacific region are health, pharmaceuticals, and medical devices.

There is a growing focus on telehealth, robotics, and AI across major markets like India, China, and Southeast Asia. The APACMed focuses on cybersecurity, interoperability, reimbursement, and regulatory measures to support digital health across the region. The key stakeholders in the digital health ecosystem include MedTech and pharmaceutical companies, start-ups, healthcare professionals, new market players, hospitals, patients, and governments. The governments are working on regulatory and reimbursement policies to introduce digital health applications and products to patients.

The Indian government planned to launch a new initiative or Rs. 500 Crore scheme that aims to encourage the domestic medical device industry and reduce India’s dependency on imported medical devices. India’s medical device regulations and reforms focus on accelerating the safety, quality, and transparency of its medical device sector. India aims to establish a smarter medical devices ecosystem through regulation, innovation, and accessibility.

China’s National Medical Products Administration (NMPA) introduced China’s new strategy to advance high-end medical devices in 2025. For this purpose, China released 10 measures to support high-end medical devices. The NMPA reported on the Chinese medical device law that keeps an eye on the safety, effectiveness, and innovation of medical devices.

The R&D process for home medical equipment involves concept development, feasibility analysis, design and development, verification and validation, regulatory submission, production, and post-market surveillance.

Key Players: Medtronic, Philips Healthcare, ResMed, Abbott Laboratories, GE Healthcare, Dexcom, Baxter International, and Omron Healthcare.

The major distribution channels include third-party logistics providers, wholesale distributors, e-commerce and online retailers, hospital pharmacies, and retail medical stores. They provide specialized services and facilitate integrated platforms.

Key Players: McKesson Corporation, Cardinal Health, Cencora, Medline Industries, Philips Healthcare.

The services are driven by the growth of e-commerce, omnichannel logistics, and aging-in-place initiatives to provide enhanced equipment features through telehealth services and AI-powered solutions.

Key Players: Philips Healthcare, Medtronic, ResMed, GE Healthcare, Abbott Laboratories, Johnson & Johnson.

In April 2025, Robert Ford, CEO of Abbott Laboratories, announced the production of Abbott’s continuous glucose monitor and FreeStyle Libre at six sites across the world, including two in the U.S.

By Product Type

By Component

By End-User

By Distribution Channel

By Region

February 2026

February 2026

February 2026

January 2026