January 2026

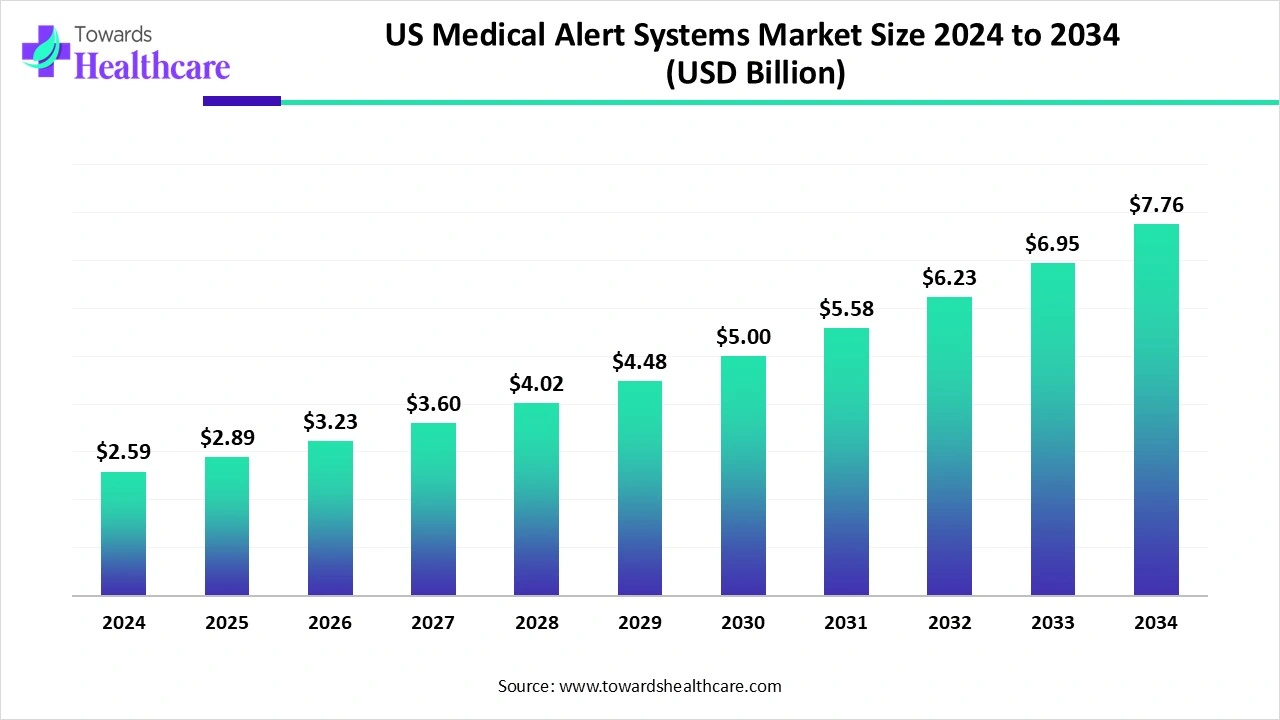

The U.S. medical alert systems market size is calculated at US$ 2.59 billion in 2024, grew to US$ 2.89 billion in 2025, and is projected to reach around US$ 7.76 billion by 2034. The market is expanding at a CAGR of 11.6% between 2025 and 2034.

Medical alarm systems are becoming more and more necessary in senior citizens' homes as a result of the population's sharp rise. One of the most frequent reasons why older people get hurt is falls. Key businesses are concentrating on diversifying their product lines in order to gain a larger portion of the market. Additionally, they are implementing tactics like partnerships and acquisitions.

Growing technological developments, especially in wearable medical equipment and the combination of medical alert systems with smartphones and the internet of things (IoT), are increasing the functionality and usability of these systems, which will increase their uptake. Favourable healthcare regulations that encourage independent living and remote patient monitoring, as well as the rising incidence of chronic illnesses, are major factors driving market expansion.

| Table | Scope |

| Market Size in 2025 | USD 2.89 Billion |

| Projected Market Size in 2034 | USD 7.76 Billion |

| CAGR (2025 - 2034) | 11.6% |

| Leading Region | North-East U.S. Share 28% |

| Market Segmentation | By System Type, By Offering, By Connection Technology, By End User |

| Top Key Players | Philips Lifeline, ADT Health, Connect America, Bay Alarm Medical, Medical Guardian, LifeStation, MobileHelp, GreatCall (Lively, by Best Buy), AlertOne Services, ResponseNow, Rescue Alert, Life Alert Emergency Response, LogicMark, Nortek Security & Control, Guardian Medical Monitoring, Critical Signal Technologies, QMedic, VRI (Valued Relationships, Inc.) |

The U.S. medical alert systems market comprises devices and services designed to enable immediate communication and emergency assistance for elderly, chronically ill, or high-risk individuals. These systems typically include wearable pendants, bracelets, or smart devices that connect users to monitoring centers or caregivers. The demand is driven by the rapidly aging U.S. population, the rise in chronic conditions, and the increasing preference for independent living among seniors. Technological advancements such as fall detection, GPS tracking, integration with smartphones, and AI-enabled monitoring are further expanding the adoption of these systems.

Government Initiatives: Medical alters are highly needed in chronic conditions, where patient needs continuous attention. Due to this the government of the U.S. is taking efforts to provide medical alert systems to the Americans.

For instance,

There will probably be even more technical developments in the U.S. medical alert systems market in the future. Numerous businesses are already investigating how to combine machine learning, artificial intelligence, and smart home technology. Advanced health analytics, voice activation, and automatic carer notifications are just a few of the features that will keep improving support and safety. AI makes it possible for quicker reactions, improved monitoring, and more individualised care. By automating crucial choices and analysing data in real-time, AI health alert systems enhance patient monitoring.

Rising Geriatric Population in the U.S.

The number of Americans 65 and older is expected to climb from 58 million in 2022 to 82 million by 2050, a 47% increase. Additionally, the proportion of the population that is 65 and older is expected to increase from 17% to 23%. It is almost hard for older persons to escape becoming a chronic illness statistic due to factors including age, gender, and family genes. A 2025 study found that 79% of persons 65 and older have two or more conditions, and 93% have at least one.

Privacy and Security Concerns

However, there are several drawbacks to medical alert systems that limit the U.S. medical alert systems market expansion. When it comes to pairing a device with other devices in more complex configurations or connecting it to home internet networks, privacy and security are two of the main concerns.

Customization of Medical Alter Systems

Customisation enables a more responsive and individualised approach to each patient's unique health demands, even while conventional medical alert systems provide a general level of protection. Since every person's health situation is different, a one-size-fits-all approach might not offer the best support. By enabling customers to customise their medical alert system to meet particular needs, customisation makes the gadget as responsive and pertinent as feasible.

By system type, the personal emergency response systems (PERS) segment led the major revenue of the U.S. medical alert systems market in 2024 and is estimated to grow at the highest CAGR during the forecast period. Many people utilise these devices to improve their safety and independence, especially those who live alone or are vulnerable to medical problems or falls. The PERS device was first developed for the elderly and the sick, but it is now being used more and more for lone workers, such field technicians and delivery drivers, as well as anyone working in dangerous conditions, like construction workers.

Under the PERS segment, the mobile PERS (mPERS) sub-segment held a revenue of approximately 46% of the U.S. medical alert systems market in 2024. People can carry mPERS devices around their neck, on a wristband, or in their pockets because they are often lightweight and compact. The gadgets might enable two-way communication between the end user and the pre-programmed emergency responder if necessary by connecting to a specific kind of network (which could be Wi-Fi or cellular). mPERS devices might also employ GPS or other location-related technologies to track the end user's location, which would facilitate the responder's ability to get to the spot where an urgent need for on-site help is made.

Under the PERS segment, the VoIP-based PERS sub-segment is expected to grow at the fastest CAGR in the U.S. medical alert systems market during the forecast period. Benefits of VoIP technology for personal emergency response systems include increased portability and mobility, which enables users to call for assistance from any location with an internet connection, and cost savings because call rates are cheaper than with traditional landlines.

By offering, the hardware segment was dominant in the U.S. medical alert systems market in 2024. In order to identify crises and send alerts, medical alert system hardware development focuses on wearable and stationary devices that employ sensors, microcontrollers, and communication modules. Miniaturisation, improved sensor accuracy, extended battery life, voice activation, smarter designs, and connectivity with cloud platforms and smart home systems are the main areas of focus for future development.

By offering, the software & apps segment is anticipated to be the fastest-growing during the upcoming period. Medical alert systems assist users and their carers in remotely managing care, monitoring devices, and tracking location and battery life through the use of mobile applications and software. These apps, including the My Lifeline app from Lifeline and the MyMedicalGuardian app from Medical Guardian, enable functions like activity tracking, carer texting, and the safe storing of critical medical data.

By connection technology, the wireless segment held the major share of the U.S. medical alert systems market in 2024 and is estimated to grow at the highest rate during the forecast period. Just like a cell phone, fully wireless medical alert devices make use of cellular technology. More independence is provided by wireless technologies, especially for elderly people. For seniors who want a little additional protection but yet want to stay active and independent, a wireless medical alert system is the perfect answer.

By end-user, the home-based users segment led the U.S. medical alert systems market in 2024. One service that helps people who are alone at home and require assistance is an at-home medical alert system. Typically, the system consists of a wearable gadget, such a necklace or bracelet. Certain gadgets are able to recognise whether a person has fallen or is having another medical crisis. After that, it can notify emergency response centres or carers like family members or neighbours.

By end-user, the hospitals & clinics segment is estimated to witness the fastest growth during 2025-2034. Through colour codes and connected IT systems, medical alert systems and associated communication platforms at a hospital or clinic guarantee that staff members get timely, vital alerts for a variety of crises, such as a fire or a medical incident.

The most common cause of injuries among persons 65 and older is falls. In the U.S., one in four older persons, or over 14 million, report falling annually. Falls among persons 65 and older are frequent, expensive, and avoidable. Among older persons, falls are the primary cause of both fatal and nonfatal injuries. The National Falls Prevention Resource Centre, run by the National Council on Ageing (NCOA), encourages evidence-based fall prevention programmes and techniques across the country and supports fall awareness and education initiatives.

North-East U.S. dominated the U.S. medical alert systems market in 2024. With several prestigious hospitals and university medical centres, especially in states like New York, Massachusetts, and Pennsylvania, the Northeastern U.S. has a significant healthcare market share in the U.S. Massachusetts is the first state to require that anyone over the age of 18 have a plan that requires drug coverage, and it was the first to define universally applicable requirements.

Southern U.S. is expected to grow at the fastest CAGR in the U.S. medical alert systems market during the forecast period. More over one-third of the country's population lives in the American South. According to the U.S. Census Bureau, there are seventeen states in the South. Compared to those in the rest of the country, Southerners are often more prone to suffer from certain chronic illnesses and have lower health outcomes. In addition to having the greatest rates of obesity in the country, the South also has the highest rates of adult diabetes.

Medical alert system research and development (R&D) is conducted using a typical product development process, which includes phases such as strategy and concept, design and development, testing and validation, and regulatory assessment.

Companies: ADT, Medical Guardian, Lifeline, Bay Alarm Medical, Medical alert logo, etc.

Both direct-to-consumer internet sales and physical distribution channels, such as pharmacies, hypermarkets, and medical equipment suppliers, are used to sell medical alert systems. Additionally, hospitals and pharmacies act as distribution centres, providing these systems directly to their clients and patients, especially those who must keep an eye on their health at home.

Initial setup, user training, frequent check-ins, false alarm monitoring, technical support for device problems, and help updating emergency contact details are typical patient care and services for medical alert systems.

Companies: Bay Alarm Medical, Medical Guardian, MobileHelp, and ADT Medical Alert

In April 2025, it is a great honour for us to be the VA's and other government agencies' go-to source for medical alert systems. With this approval, veterans and seniors will have greater access to our most advanced medical alert device to date, the Freedom Alert Max, stated Chia-Lin Simmons, president and CEO of LogicMark. The number of elderly people in our country is increasing. Our goal is to use technology to make their lives safer, longer, and happier because they are the most susceptible to falls and other health problems. We are thrilled to provide the benefits of the Freedom Alert Max to Veterans, who in particular depend on the VA for their health, safety, and security.

By System Type

By Offering

By Connection Technology

By End User

January 2026

January 2026

January 2026

January 2026