February 2026

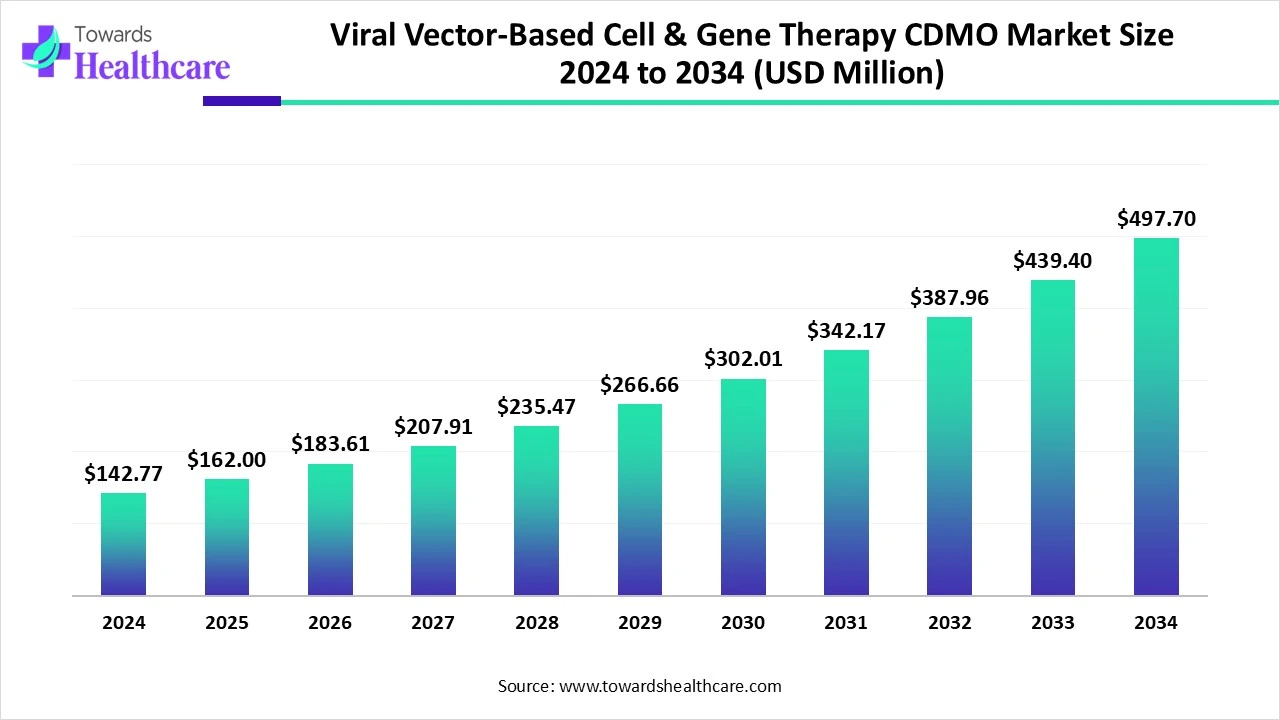

The global viral vector-based cell & gene therapy CDMO market size is calculated at US$ 142.77 million in 2024, grew to US$ 162 million in 2025, and is projected to reach around US$ 497.7 million by 2034. The market is expanding at a CAGR of 13.44% between 2025 and 2034.

The viral vectors revolutionized gene therapies by advancing innovative therapies. A viral vector CDMO is crucial in the development, production, and optimization of viral vectors for applications in cell and gene therapies. The CDMOs hold the expertise, regulatory compliance, and infrastructure that are needed to fulfil the demands of biotechnology industries. The viral vector CDMO offers several services to research institutions and biotechnology companies which include process development, vector design and optimization, quality control testing, large-scale vector production, and regulatory support.

| Table | Scope |

| Market Size in 2025 | USD 162 Million |

| Projected Market Size in 2034 | USD 497.7 Million |

| CAGR (2025 - 2034) | 13.44% |

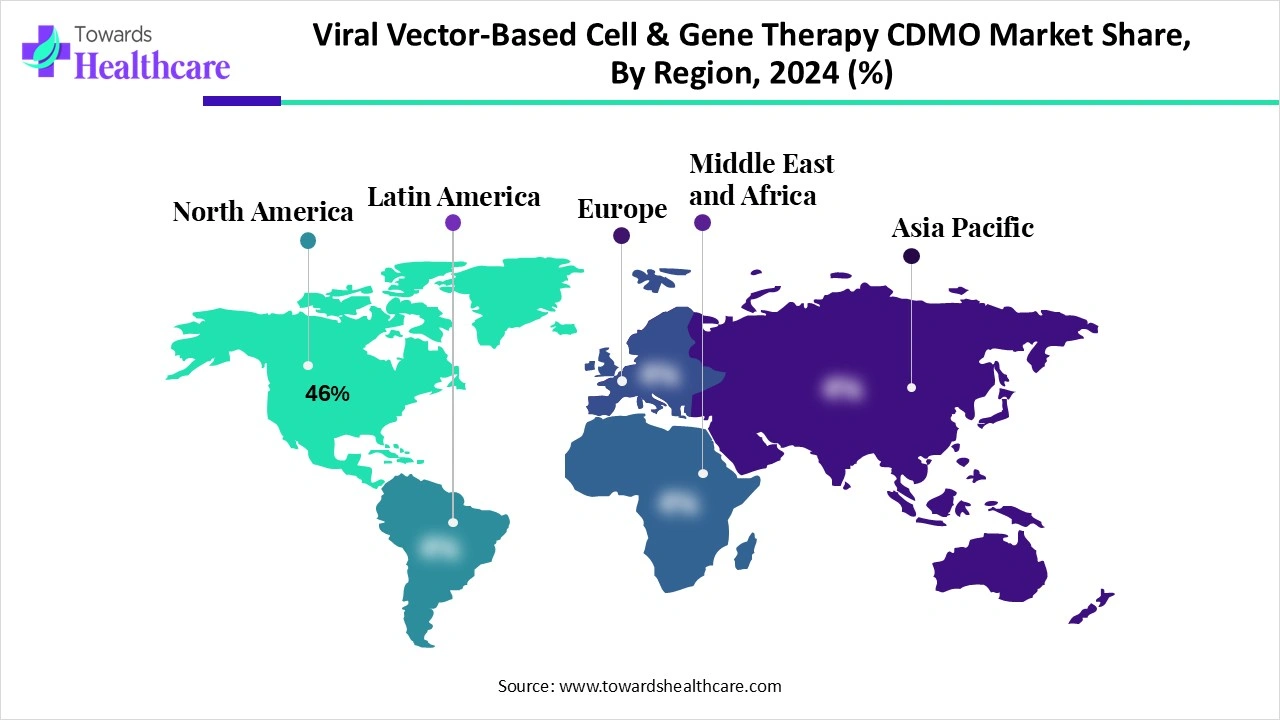

| Leading Region | North America 46% |

| Market Segmentation | By Service Type, By Vector Type/Modality, By Development Stage Served, By Customer Type/End User, By Scale/Manufacturing Format , By Region |

| Top Key Players | Lonza, Catalent, Thermo Fisher Scientific / Patheon, Charles River Laboratories, WuXi AppTec / WuXi Advanced Therapies, Fujifilm Diosynth Biotechnologies, Samsung Biologics, Novasep, Oxford Biomedica, VGXI, Viralgen / other European AAV specialists and regional specialists, Peli BioThermal, Agility Life Sciences / Marken, AGC Biologics, CMC Biologics / Avid Bioservices, Brammer Bio, Catalent / Paragon, BioVectra / regional specialty CDMOs, Analytics / assay providers, Small/mid specialist CDMOs and academic GMP manufacturers |

The viral vector-based cell & gene therapy CDMO market comprises contract development and manufacturing organizations that provide end-to-end services for viral vector production used in cell and gene therapies. Services include plasmid supply and GMP plasmid DNA production, upstream process development (cell line optimization, transfection), viral vector upstream manufacturing (AAV, lentivirus, adenovirus, retrovirus), downstream purification, analytical and release testing, fill-finish and aseptic packaging, regulatory support, and tech transfer to commercial scale. This market has expanded rapidly as developers outsource complex, capacity-intensive viral vector manufacturing to specialist CDMOs to accelerate clinical timelines and manage capital intensity.

AI can efficiently extract relevant information and create precise responses to regulatory queries. AI-driven tools identify common challenges and generate regulatory responses. AI technologies also contribute to gene therapy development and manufacturing.

What are the Major Drifts in the Viral Vector-Based Cell & Gene Therapy CDMO Market?

The cell and gene therapy manufacturing looks cheaper and more efficient over the next few years. There will be the use of more vectors in gene therapies. There are emerging needs for technological advancements, computer systems, and automation to meet the demands for cell and gene therapies.

What are the Potential Challenges in the Viral Vector-Based Cell & Gene Therapy CDMO Market?

The cell and gene therapy manufacturing remains a major challenge due to a lack of standardization and concerns related to regulatory approval and commercialization. A lack of infrastructure, workforce shortages, and the difficulties in ensuring quality create hurdles in the widespread and efficient manufacturing of cell and gene therapy products.

What is the Future of the Viral Vector-Based Cell & Gene Therapy CDMO Market?

There are several end-to-end services in cell therapy manufacturing including cell culture and cell modification in cGMP environments and process development. The viral vector platforms offered by the leading companies help to achieve good manufacturing practice (GMP) goals.

The GMP viral vector manufacturing segment dominated the market in 2024, owing to the major role of ready-to-use platforms, predictable and reliable processes, and integrated workflows offered by these manufacturing platforms. It enables reduced capital investment and regulatory expertise and ensures quality and safety. It provides improved scalability, efficiency, and access to advanced manufacturing technologies.

The analytical & release testing segment is expected to grow at the fastest CAGR in the market during the forecast period due to the significant role of these testing services in ensuring the safety and efficacy of cell and gene therapies. They result in enhanced product quality and safety while adhering to regulatory compliance. They support cost efficiency, scalability, and reduced capital expenditure.

The AAV segment dominated the market in 2024, owing to the scientific and therapeutic benefits of AAV which include continuous gene expression and proven clinical success. The increased shift to platform manufacturing, integrated service models, and strategic collaborations drives the demand for AAV in cell and gene therapies. AAVs deliver lower immunogenicity and helpful for technological innovations.

The lentivirus/retrovirus segment is expected to grow at the fastest CAGR in the market during the forecast period due to their ability of long-term gene expression and superior safety profile. They enable transduction of non-dividing cells, lower immunogenicity, and scalable manufacturing. Advancements in upstream and downstream processing also drive the demand for these viruses in cell and gene therapies.

The late-stage clinical/commercial scale segment dominated the market in 2024, owing to the operational benefits such as cost savings, efficiency, reduced capital expenditure, and established supply chains. It offers access to specialized expertise, enables integrated development, and expands analytical capabilities. It also provides strategic and commercial benefits such as risk mitigation, focus on core competencies, etc.

The bridging & tech transfer segment is expected to grow at the fastest CAGR in the market during the forecast period due to speed, efficiency, cost control, risk mitigation, and access to expertise and resources. It results in optimized costs, reduced capital expenditure, and avoids costly rework. It enhances regulatory compliance, decreases supply chain risk, and minimizes variability.

The Biotech/Small & Mid-sized Developers segment dominated the market in 2024, driven by significant benefits including reduced capital investments, process optimization, and enhanced flexibility and scalability. They can resolve risks, adhere to regulatory compliance, and favor an expansive reach to market. They support collaborations and communication and prioritize cost transparency.

The Large Pharma segment is expected to grow at the fastest CAGR in the market during the forecast period due to access to state-of-the-art facilities and expanded manufacturing capacity. It drives expertise in manufacturing, scale-up, operational efficiencies, and cost control. It supports expert regulatory guidance, robust quality management, and reduced risk of batch failures.

The Single-use Bioreactors segment dominated the market in 2024, owing to the reduced risk of contamination, improved speed and flexibility, and enhanced cost-effectiveness. They enable streamlined development, regulatory processes, and enhanced process monitoring. They support reduced capital investment, lower operational costs, and higher yields at smaller volumes.

The Modular/Flexible Suites segment is expected to grow at the fastest CAGR in the market during the forecast period due to rapid deployment and immediate response to demands facilitated by this equipment. It delivers improved adaptability, flexibility, increased safety, and reduced risk. It provides cost and operational efficiency, including benefits such as optimized energy use, reduced long-term cost, and financial and strategic advantages.

North America dominated the market share 46% in 2024 owing to the favorable investments, funding, and government initiatives for research and development of new products and services. The cell and gene therapy model introduced by the Centers for Medicare & Medicaid Services (CMS) aims to improve the lives of individuals with rare and severe diseases by increasing access to various treatments. The National Institute of Neurological Disorders and Stroke (NINDS) introduced the ultra-rare gene-based therapy network and the related URGenT program to support the development of state-of-the-art cell and gene-based therapies for ultra-rare neurological diseases.

The National Institute for Innovation in Manufacturing Biopharmaceuticals introduced the viral vector manufacturing and analytics program to develop and make robust access platform for the manufacturing, technical development, and characterization of AAV-based gene therapy vectors. The U.S. government provides funding for viral vector manufacturing and cell and gene therapy CDMOs through different initiatives such as Biomedical Advanced Research and Development Authority (BARDA), Biosecure act, and Roswell Park Comprehensive Cancer Center. In July 2025, the Centers for Medicare & Medicaid Services (CMS) expanded access to lifesaving gene therapies through innovative state agreements.

The Canadian government is making notable investments to modernize its manufacturing facilities, which will benefit advanced therapies. The government of Canada focuses on improving the lives of Canadian people through research and innovation. The promising treatments are included in clinical trials through the government's efforts.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to major initiatives by the Asian Pacific countries like India, South Korea, China, and Australia. The biomanufacturing initiatives, the national missions, and other efforts promoted development and manufacturing to increase patient access to healthcare and lower costs associated with it. The pilot programs, accelerated approvals, and biotechnology research plans foster the growth of Asian Pacific countries.

The R&D process in the Viral Vector-Based Cell & Gene Therapy CDMO market includes various stages such as preclinical and early process development, late-stage process development, process validation, and cGMP manufacturing.

Key Players: Lonza, Thermo Fisher Scientific (Patheon), Catalent, FUJIFILM Diosynth Biotechnologies, and Charles River Laboratories.

The clinical trials are driven by outsourcing demand and capacity expansion. The regulatory approvals are given by the USFDA, China's National Medical Products Administration (NMPA), and European EMA.

Key Players: Lonza, Catalent, Thermo Fisher Scientific Inc., Charles River Laboratories, AGC Biologics.

These services include logistics, supply chain management, patient education and engagement, financial and regulatory support.

Key Players: Thermo Fisher Scientific Inc., Lonza, Catalent, Charles River Laboratories, Novartis.

In April 2025, Wolfgang Wienand, Chief Executive Officer of Lonza announced the launch of its new CDMO structure with three business platforms such as integrated biologics, advanced synthesis, and specialized modalities. This innovation brought into practice to enhance customer proximity, strengthen company’s multimodality offering, and provide scalability for future growth.

By Service Type

By Vector Type/Modality

By Development Stage Served

By Customer Type/End Use

By Scale/Manufacturing Format

By Region

February 2026

January 2026

January 2026

January 2026