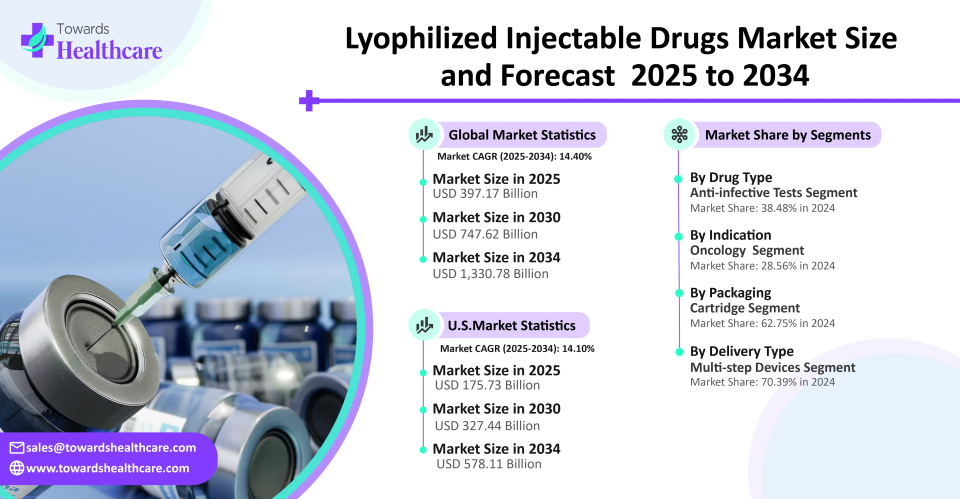

The global lyophilized injectable drugs market size is anticipated to reach USD 1,330.78 billion by 2034, increasing from USD 397.17 billion in 2025. The market is expected to grow at a CAGR of 14.40% from 2025 to 2034.

The global lyophilized injectable drugs market is evolving rapidly, driven by the expanding use of complex therapeutics and biologics, the growing need for improved drug stability, and decreased reliance on the cold chain. As healthcare systems prioritize cost-effectiveness, accurate dosage, and longer shelf-life, lyophilized formulations are becoming the go-to option in both hospital and home care settings. Demand for freeze-dried autoimmune anti-infective and cancer medications, as well as growing use of contract manufacturing, support the market's upward trend.

The expansion of lyophilized injectable production for temperature-sensitive biologics and new treatments in rare diseases, cancer, and vaccinations presents an alluring opportunity. Additionally, there is unrealized potential for prefilled, readily reconstitutable lyophilized vials due to the increased access to healthcare in emerging economies. Growing outsourcing contracts and the drive for patient-centric drug delivery present opportunities for pharmaceutical companies that incorporate cutting-edge lyophilization techniques and modular fill finish capabilities.

Lyophilized injectable medications require precise cycle development, specialized equipment, and capital-intensive processing despite their therapeutic and logistical benefits. Due to high upfront costs, protracted development timelines, and intricate regulatory compliance requirements about sterility and uniformity, small and medium-sized pharmaceutical companies frequently struggle with scalability. Furthermore, inconsistent global GMP guidelines for freeze drying make it difficult to enter regulated markets.

Anti-infective segment dominates the lyophilized injectable drugs market, driven by sustained worldwide demand for hospital-use antibodies and antivirals. The long shelf life and convenience of storage of lyophilized formulations made them the preferred choice in this market, especially in high acuity settings like intensive care units and emergency rooms. In addition to being essential for treating serious infections, these medications are frequently stocked for pandemic preparedness, which further solidifies their hegemony in both developed and developing nations.

Anti anti-neoplastic segment is the fastest growing due to the rise in the increased prevalence of cancer and the need for immunotherapy and stable biology-based chemotherapy. Highly sensitive cancer medications such as cytotoxic and monoclonal antibodies can be precisely reconstituted and stored for an extended period in lyophilized formats. The adoption of freeze-dried anti-neoplastic is being accelerated by a rise in the approval of innovative cancer treatments and an expansion of the global cancer care infrastructure.

Oncology is the leading indication for lyophilized injectables due to the widespread use of freeze-dried chemotherapy and immunotherapy drugs, because many cancer treatments are complex. Lyophilization offers stable, sterile formulations with long shelf lives. Additionally, injectable biologics that need to be freeze-dried for worldwide distribution are becoming more widely used because of the move toward personalized medicine and combination therapies.

Gastrointestinal (GI) disorder segment is witnessing the fastest growth as demand rises for injectable biologics used in conditions like Crohn’s disease and ulcerative colitis. These therapies often require stable delivery formats due to their sensitivity to heat and moisture. The trend toward biologic-based treatment for chronic GI disorders is creating strong momentum for lyophilized injectable development in this space.

Hospital pharmacy segment dominates the lyophilized injectable drugs market, due to they control the distribution of injectable lyophilized medications, especially in acute care settings where parenteral administration and quick reconstitution are crucial. Large-scale procurement, particularly for anti-infectives and oncology injectables, cold chain management, and the handling of high-risk formulations, is all made easier by the centralized nature of hospital pharmacy operations.

Pharmacy segment is witnessing the fastest growth, motivated by a change in treatment paradigms toward self-administration, chronic disease management, and decentralized care. Specialty medications are now easier to obtain through retail and online pharmacy channels thanks to the growing availability of user-friendly prefilled lyophilized formats. Adoption is speeding up due to the growing role of pharmacist-led care in developed economies. Retail pharmacies are essential to the accessibility of injectable therapy due to government incentives that support home-based treatments.

Cartridge segment dominates the lyophilized injectable drugs market, motivated by its ability to work with pen injectors and auto-injector devices, which are utilized in chronic treatment fields such as autoimmune diseases and diabetes. The portability, convenience, and dose accuracy of cartridges satisfy patients' increasing demands for minimal preparation and ease of use. The use of cartridges is encouraged by the growth of self-administration models and intelligent drug delivery systems. Pharmaceutical companies also prefer cartridges for long-term therapy branding and lifecycle management strategies.

Vials segment is witnessing the fastest growth, motivated by their adaptability in clinical trials and hospital settings, especially for formulations that are multidose or custom-dosed. In high-volume manufacturing, technological developments in stopper and glass quality are also increasing their allure. Vials are preferred in early-stage drug development due to their cost-effectiveness and ability to support large-scale lyophilization cycles. This increase in packaging is also a result of the need for injectable anti-infectives and temperature-stable biologics.

Prefilled segment dominated the lyophilized injectable drugs market, driven by rising demand for single-use, sterile, and ready-to-administer formats that reduce contamination risks and improve dosing precision. Prefilled options are increasingly used in biologics, vaccines, and long-acting injectables. These systems also reduce preparation time in clinical environments and minimize wastage. Growing adoption of dual-chamber prefilled syringes that allow in-device reconstitution further enhances this segment’s attractiveness.

Multi step segment is witnessing the fastest growth, driven by the growing number of intricate injectables that need to be handled carefully before being administered. Hospital-based treatments involving sensitive and potent medications still require these formats. User safety and compliance are being enhanced by advancements in reconstitution protocols and mixing devices. When it comes to immunology, hematology, and oncology medications that need to be administered in phases, this section is especially pertinent.

North America dominated the lyophilized injectable drugs market, driven by its established hospital infrastructure, robust pharmaceutical manufacturing ecosystem, and high adoption of biologics. the existence of significant CDMOs and sophisticated fill-finish capabilities throughout the U.S. can produce freeze-dried injectables in large quantities. Regulatory initiatives such as pandemic preparedness funding and expedited approvals have strengthened regional lyophilization facilities. Furthermore, the region's leadership is strengthened by significant investments in specialty biologics and personalized medicine.

The United States leads the regional market due to its advanced biologics pipeline, extensive hospital infrastructure, and pandemic-driven investments in drug stockpiling and national security reserves. The presence of large CDMOs, FDA support for accelerated approvals, and continuous innovation in prefilled, dual-chamber, and lyophilized formats solidifies the country’s dominant position. Moreover, increasing investments by pharmaceutical giants in sterile fill-finish and lyophilization expansion reinforce the U.S.’s long-term market control.

Asia Pacific was the fastest-growing region in the lyophilized injectable drugs market, driven by an increase in the demand for biologics and a quickening pace of pharmaceutical production capacity expansion. India is leading the way thanks to favorable government incentives, growing investments in bulk drug parks, and its solid reputation for producing generic injectables. India is rapidly becoming a major hub for high-volume, reasonably priced lyophilized drug manufacturing due to rising CDMO activity and a focus on domestic self-reliance.

India drives regional growth with its cost-efficient manufacturing model, skilled workforce, and strong presence in global generic injectables. The government’s Production-Linked Incentive (PLI) scheme and investment in pharma parks are catalyzing infrastructure for aseptic fill-finish and lyophilization. Increasing partnerships with multinational pharmaceutical firms for biologics and sterile formulations is further positioning India as a global hub for lyophilized drug outsourcing.

Source: https://www.precedenceresearch.com/lyophilized-injectable-drug-market