March 2026

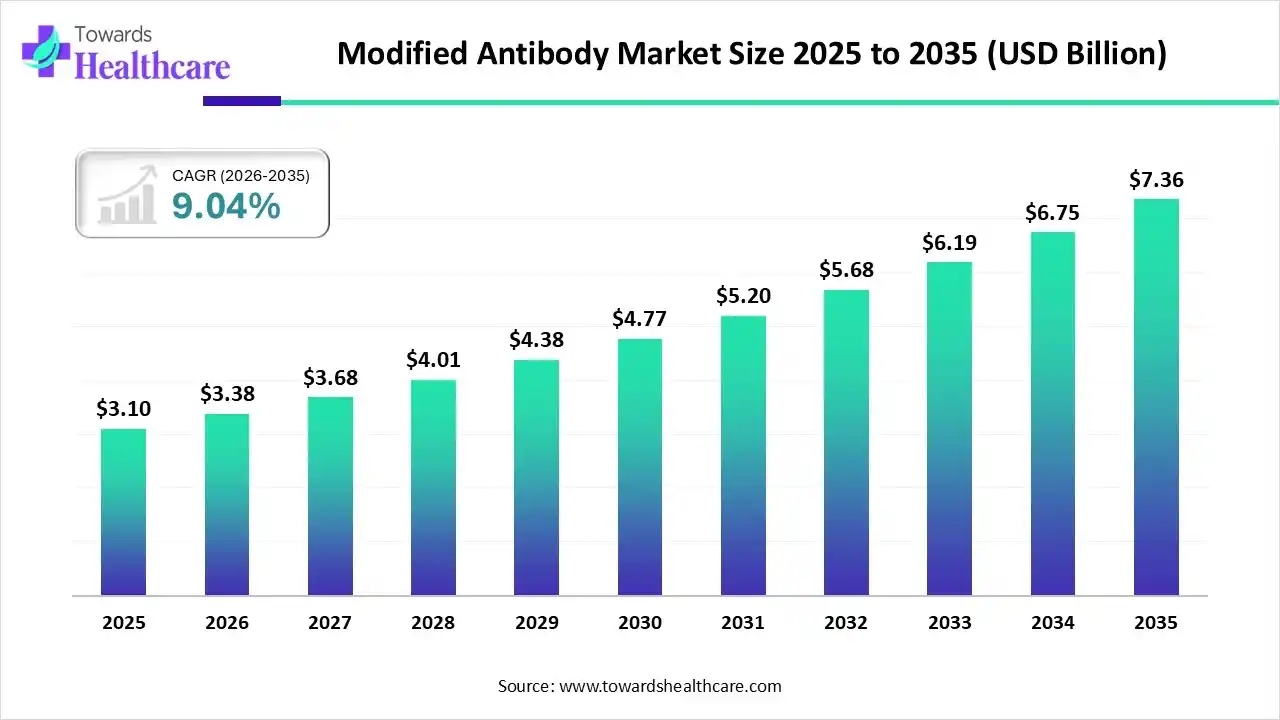

The modified antibody market size recorded US$ 3.10 billion in 2025, set to grow to US$ 3.38 billion in 2026 and projected to hit nearly US$ 7.36 billion by 2035, with a CAGR of 9.04% throughout the forecast timeline from 2026 to 2035.

In the prospective era, China, Japan, and South Korea will expand their biotechnology skills, AI exploration, and other genetic engineering approaches to develop novel modified antibodies. The global modified antibody market is mainly experiencing a huge burden of chronic cases, the wider demand for customized therapies, and broader R&D investments. Moreover, the market is promoting robust clinical trial pipelines by leveraging the efficacy, safety of new antibodies. Researchers are designing new antibody formats to raise efficiency and overcome resistance mechanisms.

| Key Elements | Scope |

| Market Size in 2025 | USD 3.10 Billion |

| Projected Market Size in 2035 | USD 7.36 Billion |

| CAGR (2025 - 2035) | 9.04% |

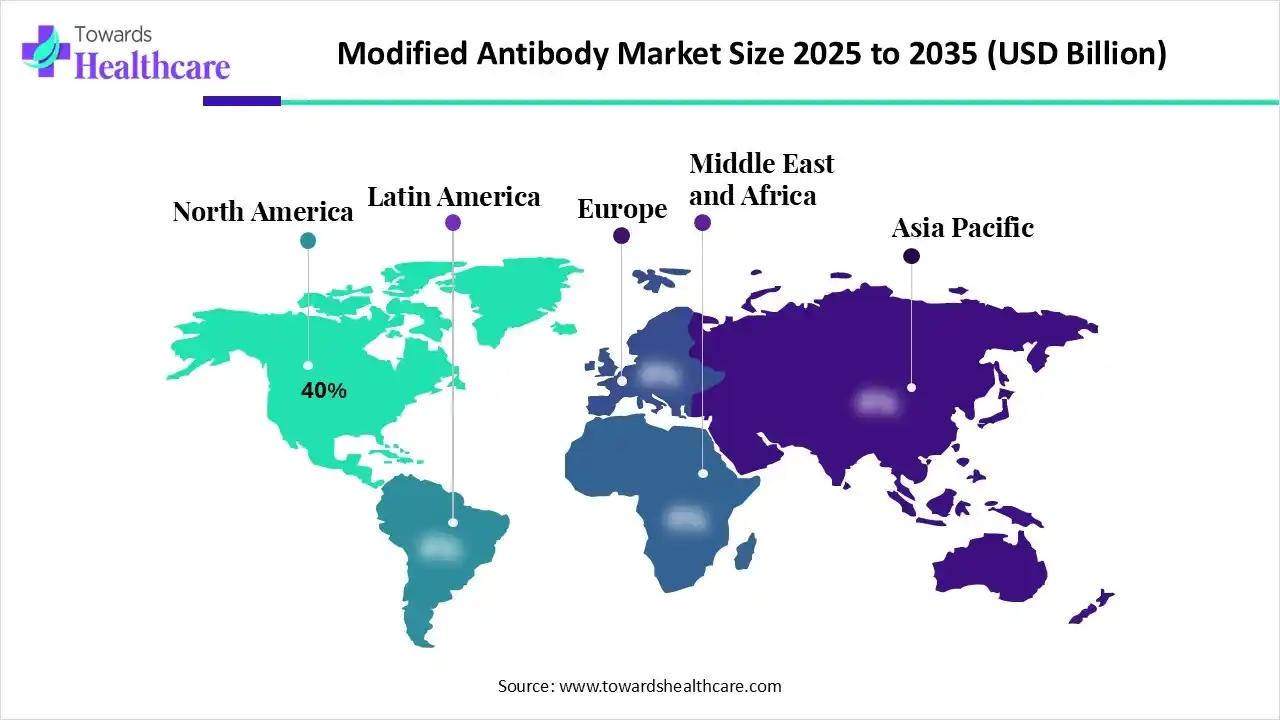

| Leading Region | North America by 40% |

| Market Segmentation | By Type of Modification, By Therapeutic Area, By End-User, By Region |

| Top Key Players | Pfizer Inc., Sanofi, Johnson & Johnson Services, Inc., Merck & Co., Inc., AbbVie Inc., Genmab A/S, Bristol Myers Squibb, AstraZeneca plc, GlaxoSmithKline plc (GSK), Bayer AG, Seagen Inc., Biogen Inc., Amgen Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd. |

The modified antibody market encompasses the development, production, and commercialization of antibodies that have been engineered or modified to enhance their specificity, affinity, stability, or therapeutic efficacy. These modifications can include alterations to the antibody's structure, such as glycosylation changes, bispecific configurations, or the incorporation of payloads for targeted drug delivery. Modified antibodies are pivotal in various therapeutic areas, including oncology, autoimmune diseases, and infectious diseases, offering improved treatment outcomes compared to conventional antibodies.

| National Cancer Institute (NCI) | In August 2025, scientists from the NCI, the Frederick National Laboratory, and their collaborators announced a novel mAb, designated F5, that selectively targets pancreatic cancer cells. |

| The Ministry of Science and ICT (South Korea) | Developed "AI-designed gene editors" and "Anti-ageing antibodies" as transforming technologies in 2025. |

| Ensilicated Technologies Ltd. | Explored "Antibodies unchained" project was awarded a grant of over £1.1 million in March 2025 by UK Research and Innovation (UKRI). |

| Economic Development Board (EDB) | Supported AstraZeneca's new $1.5 billion ADC manufacturing facility. |

In the market, AI plays a vital role in designing and improvements in modified antibodies, which further allows quicker evolution of new therapeutics with expanded properties. Alongside, certain AI-driven platforms are functionalizing diverse tasks that range from establishing new sequences from scratch (de novo) to enhancing existing antibodies for optimizing binding affinity, stability, and manufacturability. The recently designed ABS-101 by Absci's AI platform, an anti-TL1A antibody, was merged into an Investigational New Drug (IND) application for inflammatory bowel disease, leveraging AI's ability to establish viable therapeutic candidates.

By capturing a 35% revenue share, the bispecific antibodies segment dominated the modified antibody market in 2024. These kinds of antibodies have a specific ability to bind simultaneously to two different antigens, which supports their wider adoption. Ongoing advances are exploring new formats for enhanced pharmacokinetics and accelerated use in both hematological and solid tumors. From 2023-2025, Elrexfio (elranatamab) for multiple myeloma, Talvey (talquetamab) also for multiple myeloma, Columvi (glofitamab) for DLBCL, and Imdellra (tarlatamab) for SCLC are approved bispecific antibodies.

However, the Fc-engineered antibodies segment is predicted to witness the fastest growth. They possess accelerated antibody effector functions, like ADCC, ADCP, and CDC, extend half-life, and further offer the development of new bispecific antibodies. The emerging key transformations include the application of innovative techniques, like glycoengineering and specific Fc region mutations, as well as consistent modification leads to a boost in binding to the neonatal Fc receptor (FcRn).

In 2024, the oncology segment accounted for a 50% revenue share of the market. A rise in various cancer prevalence, a huge demand for personalized medicine, including biomarker-based therapies, NGS, and growth in immune-oncology solutions, are fueling further developments. Additionally, researchers are promoting new formats, particularly nanoparticles, and also leveraging intracellular targeting to widen the range of treatable cancers and overcome resistance mechanisms.

During 2025-2034, the autoimmune diseases segment is anticipated to expand at a rapid CAGR. Many regions are facing a huge burden of rheumatoid arthritis, multiple sclerosis, and lupus cases, with certain limitations of conventional drugs driving the use of novel modified antibodies. Among different types of autoimmune diseases, rheumatoid arthritis affected 17.6 million individuals worldwide in 2020, and which further anticipated to rise by 80.2% to 31.7 million by 2050.

The pharmaceutical and biotechnology companies segment held a 60% share of the modified antibody market in 2024. The emergence of innovative next-generation antibody formats, advancements in AI algorithms, and sophisticated discovery solutions are impacting the expansion of these companies.

In January 2025, Biocytogen and Acepodia entered into an innovative strategic partnership to advance bispecific antibodies and dual-payload ADCs for treating complex tumors.

Although the contract research organizations (CROs) segment is estimated to register rapid expansion. Nowadays, these facilities are implementing highly sophisticated technologies, such as AI and single-cell platforms, to escalate the progress of next-generation therapies, specifically bispecific antibodies and antibody-drug conjugates (ADCs). CROs are also exploring their roles in offering end-to-end services, managing complex clinical trials, and adapting to varying regulatory frameworks.

In 2024, North America captured a 40% share of the modified antibody market. The growing incidences of cancer, autoimmune disorders, and infectious diseases, major investment in biopharmaceutical research and development (R&D), and encouraging government and regulatory initiatives are impacting the regional market growth.

For instance,

The US’s modified antibody market is putting efforts into strengthening next-generation ADC approaches by emphasizing improvements in linker technology to boost stability and payload potency, with exploration of bispecific ADCs and multi-payload ADCs. Moreover, leading clinical-stage companies are expanding their promising results in clinical trials of ADCs by revealing their efficiency and safety.

In 2025, Canada’s market is propelled by the continuous push in BsAb development by their researchers, with a major emphasis on T-cell-engaging formats for oncology. Whereas this region is executing specific projects, like Canada's Immunoengineering and Biomanufacturing Hub, which is fostering Project PROGENITER to create an arsenal of antibody drugs against high-risk viruses identified by Health Canada and the WHO.

In the coming era, the Asia Pacific is predicted to witness rapid expansion in the modified antibody market. Different countries' governments, like China, South Korea, and Japan, are widely investing in the establishment of well-advanced infrastructure for biopharmaceutical research, development, and production. Various countries are streamlining and escalating their approval processes for novel biologic drugs, with a focus on rapid market entry.

For instance,

Day by day, China is increasingly supporting innovations in biologic drugs and other solutions, including multi-specific antibodies. They mainly comprise bispecific and trispecific formats, which enable a single antibody to target multiple antigens simultaneously, with expanded therapeutic effects.

For instance,

Eventually, the modified antibody market in Japan is expanding due to a rise in government-backed projects, like the Cancer Genome Screening Project, which are generating vast databases of genetic information. This further allows the development a new, highly specific antibody drugs for cancer and other diseases. Alongside, Japan is leveraging integrated AI and genomic data approaches, which enable more tailored treatments for diverse diseases.

It mainly encompasses initial antibody discovery with genetic engineering and chemical modifications to boost function, affinity, and stability.

Key Players: Bristol Myers Squibb (BMS), Regeneron Pharmaceuticals, Pfizer, etc.

The modified antibody market has different clinical trial phases, which describe safety, efficacy, and adverse effects of these antibodies. Finally, by applying for an IND, companies receive approvals from either the US FDA or EMA.

Key Players: US FDA, EMA, IRB, Novartis, Octapharma, etc.

The leading companies are providing Therapy and adherence support, holistic patient care, and other various programs for widespread adoption of novel therapies.

Key Players: MrMed, Orsini, Piramal, Asembia, etc.

By Type of Modification

By Therapeutic Area

By End-User

By Region

March 2026

March 2026

March 2026

March 2026