December 2025

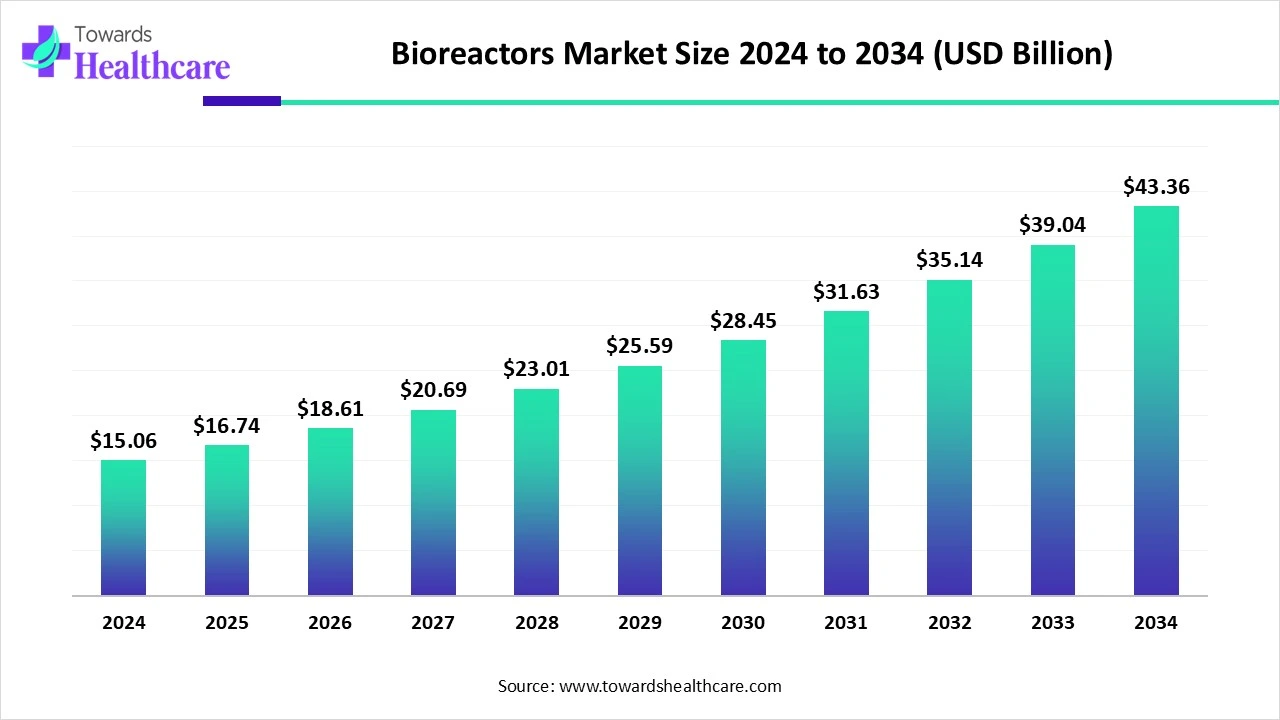

The global bioreactors market size is calculated at USD 15.06 billion in 2024, grows to USD 16.74 billion in 2025, and is projected to reach around USD 43.36 billion by 2034.The market is expanding at a CAGR of 11.14% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 15.06 Billion |

| Projected Market Size in 2034 | USD 43.36 billion |

| CAGR (2025 - 2034) | 11.14% |

| Leading Region | North America |

| Market Segmentation | By Fabrication Material, By Type of Bioprocess, By type of Biologic, By Regions |

| Top Key Players | GE Healthcare, Merck KGaA, Eppendorf AG, Sartorius AG, Thermo Fisher Scientific Inc., BBI-Biotech GmbH, Bioengineering AG, Danaher Corporation, Getinge, Infos HT, Solaris Biotech Solutions |

A bioreactor is a vessel or device that provides a controlled environment for the growth of microorganisms or cells to produce biological products. The bioreactors market is booming due to the growing need for efficient biologics production, especially in vaccines, cell therapies, and monoclonal antibodies. Advances in biotechnology, the rising adoption of personalized medicine, and the shift towards single-use systems are driving demand. These systems reduce the risk of contamination and speed up production. Additionally, increased R&D in pharmaceuticals and global focus on health innovation contribute to the surge.

Artificial Intelligence (AI) can significantly impact the market by enhancing process optimization, real-time monitoring, and predictive maintenance. AI-driven systems can analyze large volumes of data to improve yield, reduce operational costs, and ensure consistent product quality. By automating complex tasks, AI enables faster decision-making and adaptive control of bioreactor environments. This leads to increased efficiency, reduced downtime, and greater scalability, ultimately transforming biopharmaceutical manufacturing and accelerating advancements in biotechnology and personalized medicine.

Increasing Demand for Biopharma Solutions

The need for biologics such as vaccines, monoclonal antibodies, and gene therapies grows, and bioreactors become essential for scalable, high-quality production. The rise of personalized medicine and advancements in cell and gene therapy further boost this demand. Additionally, innovation like single-use bioreactors enhances efficiency, reduces contamination risks, research and commercial costs, making them ideal for both research and commercial-scale applications in the evolving biopharma landscape.

For Instance,

Strict and Long Approval Processes

The strict and long approval process restrains the bioreactors market by delaying product launches and increasing development costs. Regulatory hurdles, especially in biopharmaceutical applications, require extensive testing and documentation to ensure safety and compliance. These prolonged timelines can deter investment and innovation, particularly for smaller companies. Additionally, navigating complex international regulations slows global market expansion, limiting the ability of manufacturers to quickly respond to evolving demand and technological advancements.

Development of Sustainable Bioprocessing

The development of sustainable bioprocessing presents a significant opportunity for the bioreactors market by driving demand for innovative, eco-friendly technologies as industries seek to reduce their environmental impact. As industries seek to reduce environmental impact and meet regulatory standards, bioreactors designed for efficient resource use and waste reduction gain prominence. This shift encourages the adoption of single-use systems, renewable feedstocks, and attracts investment. Sustainability trends also align with global goals. Enhancing the market's long-term growth potential.

By fabrication material, the stainless-steel bioreactors segment held a dominant presence in the bioreactors market in 2024, due to durability, corrosion resistance, and suitability for larger-scale production. These bioreactors are ideal for high-pressure operations and can withstand repeated cleaning and sterilization, ensuring compliance with GMP standards. Though they involve higher initial costs, their long-term reusability and efficiency make them a cost-effective solution, especially for commercial manufacturing in the biopharmaceutical and industrial biotechnology sectors.

By fabrication material, the single-use bioreactors segment is anticipated to grow at the fastest CAGR in the market during the studied years, because of its flexibility, lower capital investment, and reduced risk of cross-contamination. These systems eliminate the need for cleaning and sterilization, saving time and operational costs. They are especially beneficial for small-scale and multiproduct facilities, such as in R and D and clinical production. Additionally, their ease of use and faster turnaround times make them ideal for accelerating biopharmaceutical development and production.

By type of bioprocess, the batch and fed-batch bioreactors segment accounted largest share in the market in 2024. These bioreactor types are well-established in the biopharmaceutical industry for producing vaccines, monoclonal antibodies, and therapeutic proteins. Fed-batch systems, in particular, allow for better control over nutrient supply, enhancing yield and productivity. Their proven scalability, regulatory acceptance, and suitability for various cell cultures further contributed to their dominant bioreactors market presence.

By type of bioprocess, the continuous bioreactors segment is expected to grow at the highest rate in the market during the forecast period due to its ability to offer higher productivity, consistent product quality, and reduced downtime. Continuous bioprocessing enables real-time control and monitoring, leading to more efficient use of resources and lower operational costs. It is increasingly adopted in biopharmaceutical manufacturing for its potential to streamline production, accelerate time to market, and support the growing demand for biologics and personalized medicine.

By type of biologic, the antibody segment was dominant in the market in 2024, due to the high global demand for monoclonal antibodies used in treating cancer, autoimmune diseases, and infectious disorders. Bioreactors are essential for the large-scale production of these complex biologics, offering a controlled environment for high-yield expression. The growing pipelines of antibody-based therapies and their proven clinical efficacy further support the bioreactors market expansion.

By type of biologic, the cell therapies segment is predicted to grow at the fastest CAGR in the bioreactors market due to increasing demand for personalized medicines and rising approvals of cell-based therapies like CAR-T. These therapies require precise, scalable, and sterile manufacturing conditions, which bioreactors provide. Advancements in automated and closed bioreactor systems, along with growing investments in cell therapy research and production infrastructure, are further accelerating this segment's rapid expansion within the biologics manufacturing landscape.

North America dominated the bioreactor market in 2024 due to strong investments in biopharmaceutical R&D, a well-established biotechnology sector, and increasing demand for personalized medicine. The region benefits from the presence of major industry players, advanced healthcare infrastructure, and supportive government initiatives. Additionally, the rapid adoption of single-use bioreactors and continuous manufacturing technologies boosted market growth, particularly in the U.S., which remains a global hub for biologics production and innovation.

The U.S. market is growing rapidly due to rising demand for biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies. This growth is driven by the country’s strong biotechnology infrastructure, significant R&D investments, and focus on personalized medicine. The increasing adoption of single-use bioreactors offers benefits like reduced contamination risk, lower costs, and flexible production. Additionally, technological advancements in automation and real-time monitoring enhance efficiency. A supportive regulatory environment led by the FDA also fosters innovation and ensures high-quality manufacturing standards across the industry.

For instance,

Canada's market is expanding due to strong government support for biomanufacturing and life sciences. Major federal investments have accelerated the development of advanced research and production facilities, aiming to boost domestic capabilities for vaccines and biologics. Projects like STEMCELL Technologies' GMP facility in British Columbia and Entos Pharmaceuticals’ plant in Alberta highlight this growth. These initiatives not only enhance production capacity and innovation but also build workforce skills and infrastructure, strengthening Canada's preparedness for future health needs and its global position in biotechnology.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period, due to rising investments in biotechnology and biomanufacturing, especially in countries like China and India. The increasing demand for personalized medicine and the expansion of biopharmaceutical production facilities are driving the adoption of advanced bioreactor technologies. Additionally, government initiatives and funding programs are boosting the regional biotech sector. The growing use of single-use and automated bioreactors in countries like Japan and South Korea further supports this growth, making Asia-Pacific a key emerging market in this field.

China's market is growing rapidly due to strong government investments in biotechnology, aiming to establish the country as a global leader in life sciences. The rise of biopharmaceutical companies, increased demand for biologics and gene therapies, and a growing elderly population are key drivers. Additionally, major players like WuXi Biologics are expanding large-scale biomanufacturing facilities using advanced single-use technologies, which boost efficiency and reduce contamination risks. These factors collectively support the rapid expansion of China's bioreactor industry.

The country's burgeoning pharmaceutical and biotechnology sectors are driving demand for advanced bioreactor systems. Government initiatives, such as funding through BIRAC, support innovation and infrastructure development in biotech. Additionally, the rise in chronic diseases necessitates increased production of biologics and vaccines, further propelling market growth. The adoption of cost-effective manufacturing practices and the presence of a skilled workforce also contribute to India's attractiveness as a hub for biopharmaceutical production.

For instance,

Europe is expected to see significant growth in the bioreactors market during the forecast period due to rising demand for personalized medicine, advancements in single-use bioreactor technologies, and increased biopharmaceutical R&D investments. Countries like Germany and France are enhancing biomanufacturing capacities, supported by government initiatives and collaborations. The shift towards sustainable, automated production systems and the growing prevalence of chronic diseases further drive the need for efficient biologics production, propelling market growth across the region.

For instance,

The UK's market is accelerating due to increasing demand for biopharmaceuticals, including vaccines and monoclonal antibodies. Government support through initiatives like Innovate UK and the Industrial Strategy fosters innovation and infrastructure development. The adoption of single-use bioreactors, which offer cost-effectiveness and reduced contamination risks, is on the rise. Technological advancements, such as automation and real-time monitoring systems, enhance process efficiency and product quality, further propelling market growth.

For instance,

Germany's market is experiencing significant growth due to its robust biopharmaceutical sector, bolstered by substantial investments in research and development. The country hosts approximately 774 biotechnology companies engaged in innovative projects, supported by initiatives like "BioRegions" that foster biotechnology advancements. Germany's advanced healthcare infrastructure, favorable regulatory environment, and emphasis on sustainable practices, such as the adoption of single-use bioreactors, further drive market expansion. These factors collectively position Germany as a leading hub for biomanufacturing in Europe.

There are a total of 196 clinical trials related to vaccines registered on the clinicaltrials.gov website as of June 2025. The Portal Fiocruz in Brazil is the world’s largest manufacturer of vaccines against yellow fever. According to a recent survey, the implementation of the bioeconomy in Brazil could generate an annual industrial revenue of US$284 billion by 2050.(Source: Embrapa)

On April 1, 2025, at the INTERPHEX conference in New York, Culture Biosciences launched the Stratyx 250, a mobile, cloud-integrated bioreactor. Designed for flexibility, automation, and remote control, it allows real-time monitoring and adjustments through the Culture Console software. The company defines cloud-based bioprocessing as combining physical bioreactors with remote data access, automation, and AI-driven optimization. CEO Chris Williams stated that the biotech and biopharma sectors are shifting toward cloud-powered, modular systems and need tools that can keep up.

By Fabrication Material

By Type of Bioprocess

By type of Biologic

By Regions

December 2025

December 2025

November 2025

November 2025