February 2026

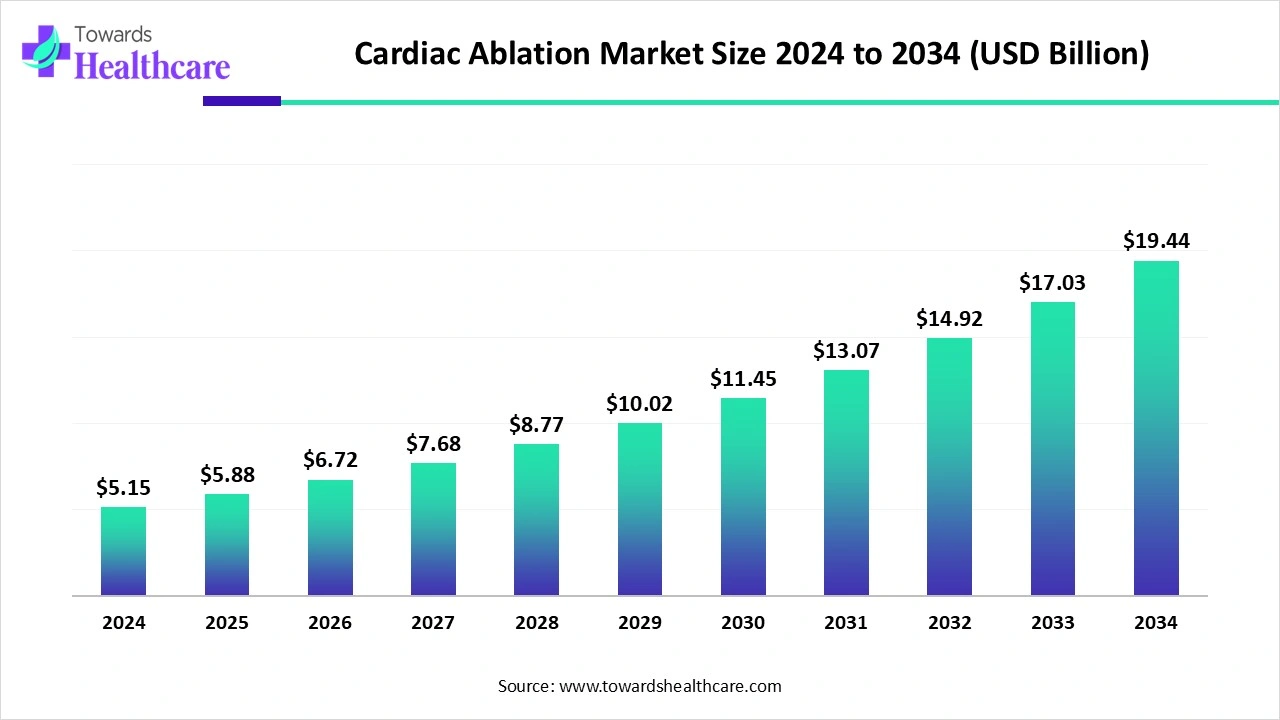

The global cardiac ablation market size is calculated at US$ 5.15 billion in 2024, grew to US$ 5.88 billion in 2025, and is projected to reach around US$ 19.44 billion by 2034. The market is expanding at a CAGR of 14.24% between 2025 and 2034.

Changing lifestyle leads to an expansion of obesity and hypertension concerns, which ultimately results in the development of various cardiac issues, including AF, VT, etc. These conditions are further demanding for advanced and minimally invasive procedures, like cardiac ablation. Nowadays, the global cardiac ablation market is emphasizing the advancements in imaging techniques, AI integrations, EP, catheter types, and other disposables & accessories. Alongside, the market is leveraging innovations in radiofrequency and cryoablation for diverse applications.

| Table | Scope |

| Market Size in 2025 | USD 5.88 Billion |

| Projected Market Size in 2034 | USD 19.44 Billion |

| CAGR (2025 - 2034) | 14.24% |

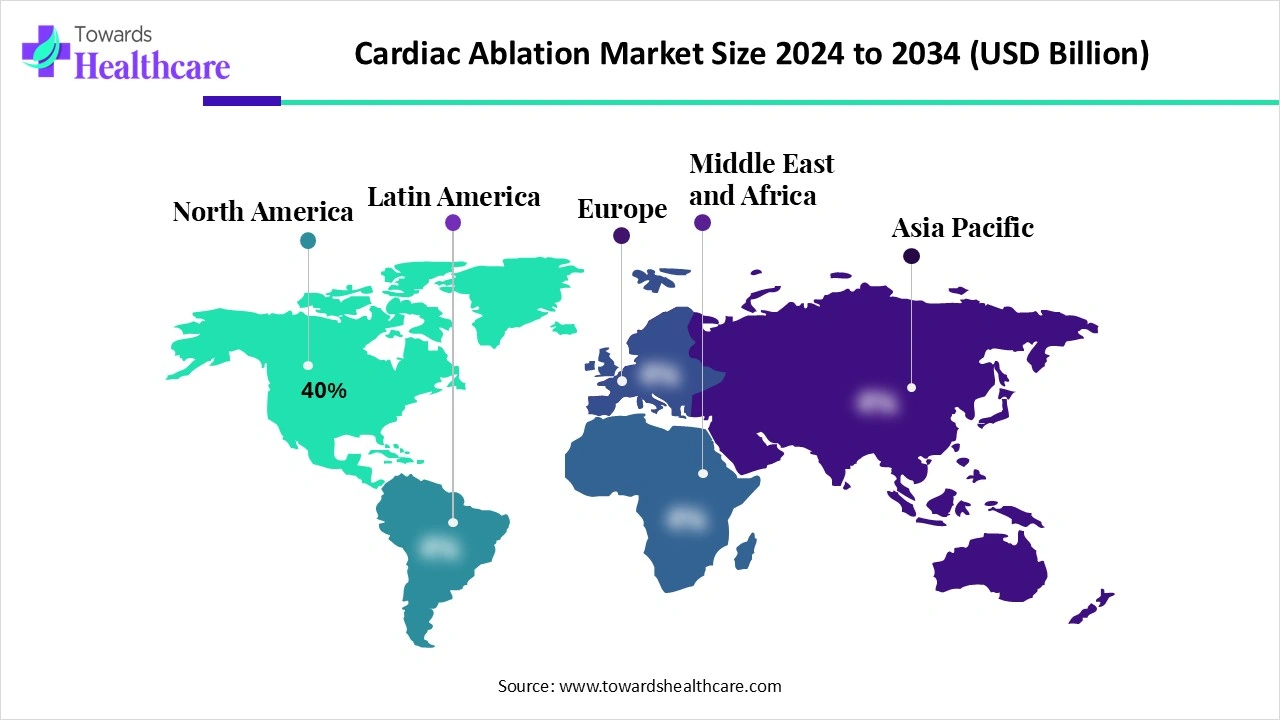

| Leading Region | North America by 40% |

| Market Segmentation | By Procedure/Indication, By Approach / Setting, By Energy/Technology, By Product Type, By End User/Facility, By Region |

| Top Key Players | Biosense Webster, Abbott Laboratories, Boston Scientific, Medtronic, Philips Healthcare, Siemens Healthineers, Stereotaxis, Acutus Medical, AtriCure, CardioFocus, Affera, Farapulse/Boston Scientific, IntellaMed/Corindus, MicroPort/Lepu Medical, Biotronik, Cook Medical, Merit Medical Systems, Rhythmia, EPD/EP-lab software vendors, Startups & innovators |

The cardiac ablation market comprises devices, consumables, and supporting technologies used to perform cardiac ablation procedures that treat arrhythmias by selectively destroying (ablating) myocardial tissue responsible for abnormal electrical conduction. Modalities include catheter-based radiofrequency (RF) ablation, cryoablation, laser, microwave, high-intensity focused ultrasound, and newer non-invasive approaches (e.g., stereotactic radiotherapy). The market includes ablation catheters, generators/power sources, mapping & navigation systems, intracardiac imaging, disposables, and procedural services. Growth is driven by rising prevalence of atrial fibrillation and other arrhythmias, aging populations, expanding indications (ventricular tachycardia, persistent AF), improvements in mapping/visualization, and shifting care to outpatient/interventional settings.

The growing cases of cardiac arrhythmias like atrial fibrillation and ventricular tachycardia, and ongoing technological advances are acting as key growth factors in the respective market expansion.

Several advances in the world are leveraging the use of AI in the analysis of local electrograms in real-time to guide catheters, detect gaps in ablation lines, and converge on optimal ablation sites, further supporting streamlining complex procedures. Other approaches, like customized "digital twin" models of the heart, are being established employing AI to simulate scarring patterns and estimate ablation outcomes, which enables tailored treatment plans for AF.

For instance,

Supportive Policies and Demand for Minimally Invasive Procedures

The global cardiac ablation market is mainly fueled by the increasing geriatric population, who are highly susceptible to cardiac arrhythmias, atrial fibrillation, and ventricular tachycardia. This further drives a greater demand for sophisticated cardiac ablation. Alongside, the emergence of supportive reimbursement policies and enhanced global healthcare spending offers robust financial access for advanced treatments. Also, the globe is widely preferring minimally invasive surgical procedures as they give rapid recovery times and expanded patient outcomes as compared to conventional open-heart surgery.

Higher Expenses and Future Complications

These surgical approaches carry rare but severe risks, particularly atrial-esophageal fistula, which can impact patient choice for the procedure. Moreover, the need for significant investment in specialized equipment for cardiac ablation, primarily mapping systems, energy generators, and advanced catheters, within healthcare institutions, is hindering market growth.

Breakthroughs in Robotic Systems and Imaging

The AI-driven era is creating several opportunities in the global cardiac ablation market, especially in robotic systems and AI. In this case, AI-powered mapping algorithms and robotic systems have been merged to boost the accuracy, safety, and accessibility of ablation procedures, which further offer deeper and individualized treatments. Along with this, highly sophisticated imaging approaches are integrated with real-time, high-fidelity multidomain mapping and functional mapping that assist in gaining insights into the electrical activity of the heart, guiding ablation to the precise sites.

In 2024, the atrial fibrillation (AF) segment captured the biggest revenue share of the cardiac ablation market. The growing instances of obesity and hypertension are leading to AF, which further fuels the need for treatment, in which cardiac ablation acts as a crucial and minimally invasive choice. Furthermore, the widespread adoption of pulsed field ablation (PFA) as a non-thermal energy source is facilitating a higher cardioselectivity and effectiveness than thermal approaches. Innovations in more durable ablation lesions using techniques, such as contact force feedback and real-time lesion assessment employing integrated ultrasound, are driving the market.

Whereas the ventricular tachycardia (VT) segment is anticipated to expand at a rapid CAGR. The segmental expansion is mainly driven by a rise in cases of ischemic heart disease, which is a significant cause of VT. Moreover, the public is moving towards less invasive, catheter ablation as an option to long-term antiarrhythmic drugs and implantable cardioverter-defibrillators (ICDs). The emergence of an ablation plan emphasizes the modification of the complete substrate, which comprises large areas of scar tissue, to mitigate prospective VT development.

The catheter-based segment registered dominance in the market in 2024. Primarily, this kind of approach provides targeted, more efficient treatment, resulting in better patient outcomes and probably minimizes long-term medication requirements. Specialized catheter-based technology, like steerable and multi-electrode systems that encompass the LUMINIZE RF balloon with built-in cameras and the QDOT MICRO, further focuses on accelerating maneuverability, improving visualization, and offering targeted energy delivery.

The non-invasive ablation segment is predicted to expand rapidly during 2025-2034. A wide range of patients and health care providers are highly preferring this type of setting, which provides shorter recovery times, decreased risks of complications, and minimized hospital stays. Additionally, the utilization of stereotactic radiotherapy, which applies focused energy beams, especially X-rays, to destroy arrhythmogenic tissue without surgery, is also boosting the segmental development. Involvement of hybrid approaches, which consist of an alliance among surgeons and electrophysiologists, often employing minimally invasive epicardial (outer heart) and endocardial (inner heart) ablation settings.

By energy/technology, the radiofrequency (RF) ablation segment held the largest share of the cardiac ablation market in 2024. This technology is a minimally invasive approach that uses contact force-sensing and multi-electrode systems for further enhancing procedural safety and efficacy. Besides this, optimizations in cardiac imaging techniques also accelerate pre-procedural planning and intra-procedural guidance. Advancements in multi-electrode systems are applying multiple electrodes with a multi-channel generator, enabling vast ablation zones and more efficient tissue destruction as compared to single-electrode systems.

However, the cryoablation segment is estimated to register rapid expansion in the coming era. The rising prevalence of cardiac arrhythmias and ongoing developments of more effective and robust cryoablation devices, comprising smart cryoablation devices and optimized cryoballoon systems, are accelerating the wider adoption of this technique. The current trend of cryoballoon systems (like Medtronic's Arctic Front Advance Pro and Boston Scientific's POLARx FIT) is supporting the improvements in tissue contact, enhancements in procedural success, and fostering safety for atrial fibrillation (AFib) treatment.

In 2024, the ablation catheters segment was dominant in the market. The growing cases of atrial fibrillation, increasing demand for minimally invasive procedures, and developing multi-electrode and contact force-sensing catheters are incorporated as significant drivers for this segment. The huge contribution of advanced lattice-tip design, like the Affera Sphere-9 catheter, allows a significantly larger surface area for energy delivery, further enabling greater power at lower risk of overheating. Recently evolved Abbott's TactiFlex catheter is a flexible tip with contact force technology, which offers accurate and consistent lesion delivery.

Eventually, the disposables & accessories segment will expand rapidly. Factors, like wider emphasis on patient safety and infection control through single-use disposables, and raised regulatory focus on traceability and infection prevention, are widely impacting the global market growth. The leading companies are developing single-use disposable catheters and accessories with novel materials, including bio-material polymers with flexible circuitry, to expand performance and patient safety. The Conform Medical Company established single, fully conformable catheters that can adapt to different heart shapes and sizes, streamlining procedures like pulmonary vein isolation.

The hospitals & cardiac centers segment accounted for a major share of the cardiac ablation market in 2024. These are the primary end-users of the accelerating cardiac issues, who are stepping into the expansion of electrophysiology (EP) labs with technologically advanced systems, consisting of those with AI and robotics, to meet the increasing demand for these procedures. Hospitals are integrating catheter ablation with real-time cardiac MRI, which further provides deeper imaging for more precise tissue targeting and escalated treatment outcomes.

Whereas the ambulatory surgery centers/outpatient EP labs segment will grow fastest during 2025-2034. This kind of end user is widely offering a cost-effective and efficient setting for specific EP procedures as compared to conventional hospitals, which accelerates treatment accessibility to more patients and insurers. Ongoing innovation in zero-fluoroscopy techniques, led by 3D electro-anatomical mapping, is becoming a reference that omits radiation exposure in ASCs. Alongside, hybrid laboratories with both EP and surgical capabilities are enabling a safe environment for procedures that may necessitate emergent surgical intervention.

Due to high AF prevalence, established EP programs, and reimbursement support, North America led the cardiac ablation markets share by 40% in 2024. As well as the presence of robust healthcare infrastructure, particularly well-developed hospitals and cardiac centers of this region, are offering essential facilities for complex ablation procedures. North America is further bolstering advancements in mapping systems, including CARTO 3 Version 7 with the OCTARAY Mapping Catheter, and the integration of contact force sensing is expanding precision and outcomes.

In September 2025, Pulse Biosciences, Inc., a company expanding its newer and proprietary Nanosecond Pulsed Field Ablation (nanosecond PFA or nsPFA) technology, received the U.S. Food and Drug Administration (FDA) approval for the Company’s Investigational Device Exemption (IDE), enabling Pulse Biosciences to proceed with the initiation of its nsPFA Cardiac Surgery System Study, NANOCLAMP AF, for the treatment of atrial fibrillation (AF).

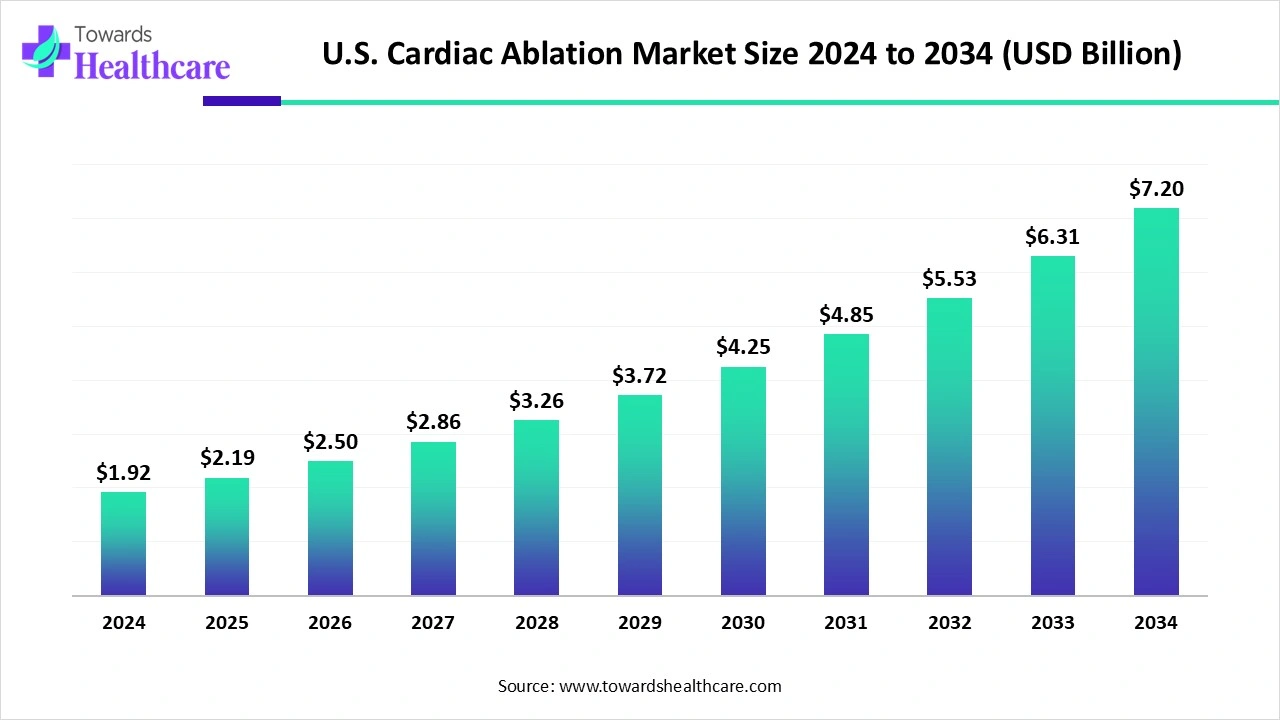

The U.S. cardiac ablation market is experiencing significant growth. Valued at $1.92 billion in 2024, it increased to $2.19 billion in 2025 and is expected to reach approximately $7.2 billion by 2034. This represents a strong compound annual growth rate (CAGR) of 14.19% from 2025 to 2034.

In September 2025, Sunnybrook unveiled the BIOTRONIK Biomonitor IV Loop Recorder, which applies AI and advanced detection algorithms to transform the detection and management of irregular heart rhythms.

In the upcoming years, the Asia Pacific is estimated to register the fastest growth in the cardiac ablation market. Mainly, China, India, Japan, and South Korea are putting efforts into raising healthcare access, enhancing the detection of AF/VT, and investing in electrophysiology infrastructure. Moreover, a rise in public awareness and more extensive screening programs in urban areas is resulting in greater diagnoses of arrhythmias, which ultimately escalates the demand for treatments like cardiac ablation.

For instance,

In July 2025, Omron Healthcare, a global player in innovative home health monitoring solutions, entered into its collaboration with Tricog Health to unveil KeeboHealth, an advanced connected health platform created to revolutionize remote cardiac care and escalate progress toward Omron’s ambitious ‘Going for Zero’ vision.

Nowadays, China’s market is aiming at the growth of Pulsed Field Ablation (PFA) technology with the approval of the first PFA systems. Alongside a major expansion in radiofrequency catheter ablation (RFCA) procedures, innovations in fluoroless techniques, intracardiac echocardiography (ICE), and robotic-assisted ablation systems are also supporting the overall market progression in China.

Europe is experiencing a significant growth in the cardiac ablation market. This expansion is mainly driven by the presence of strong EP centers in the UK, Germany, and France. These regions are further adopting updated European guidelines, in which the European Heart Rhythm Association (EHRA), Heart Rhythm Society (HRS), and other global societies delivered an updated consensus document in 2024 to offer a contemporary framework for AF ablation.

For instance,

In January 2025, IceCure Medical Ltd., a pioneer of minimally invasive cryoablation technology that destroys tumors by freezing as an alternative to surgical tumor removal, announced it had submitted a regulatory filing with China's National Medical Products Administration ("NMPA") for the approval of its ProSense Cryoablation System. IceCure CEO, Eyal Shamir, commented that they are fostering a line of available products, also securing reimbursement, so that IceCure can be ideally positioned to serve this important geography.

By Procedure/Indication

By Approach / Setting

By Energy/Technology

By Product Type

By End User/Facility

By Region

February 2026

February 2026

February 2026

February 2026