January 2026

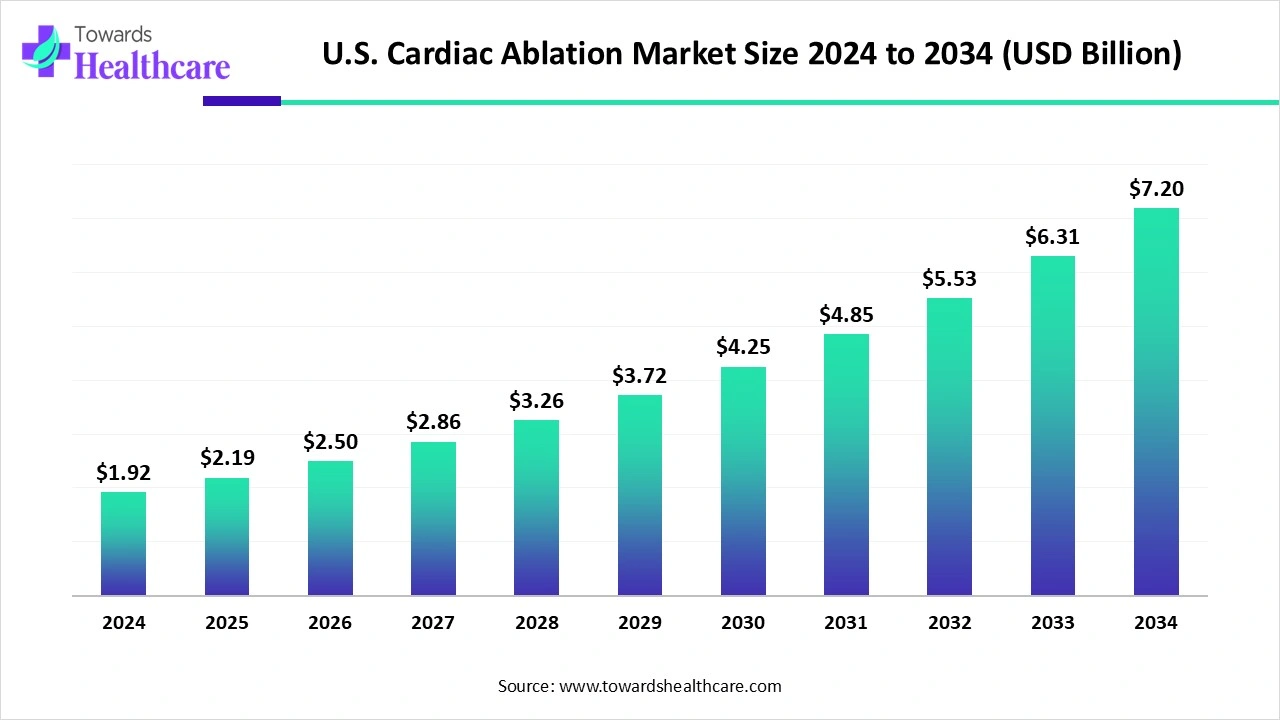

The U.S. cardiac ablation market size is calculated at US$ 1.92 billion in 2024, grew to US$ 2.19 billion in 2025, and is projected to reach around US$ 7.2 billion by 2034. The market is expanding at a CAGR of 14.19% between 2025 and 2034.

There is a rise in the demand for cardiac ablation solutions due to the growing prevalence of cardiac arrhythmias. This is increasing the development of cardiac ablation devices, which are supported by the growing investments and funding. AI is also being used in their development to increase their safety and accuracy. At the same time, the growing population, awareness, and cardiovascular disease are increasing their use and adoption rates in various regions. Moreover, new collaborations and launches are promoting their use. Thus, this is enhancing the market growth.

| Table | Scope |

| Market Size in 2025 | USD 2.19 Billion |

| Projected Market Size in 2034 | USD 7.2 Billion |

| CAGR (2025 - 2034) | 14.19% |

| Market Segmentation | By Product Type, By Application/Arrhythmia Type, By End User, By Energy Source, By Region |

| Top Key Players | Johnson & Johnson (Biosense Webster), Abbott Laboratories, Medtronic, Boston Scientific, AtriCure, Stereotaxis, AngioDynamics, Acutus Medical, Biotronik, Kardium, Hansen Medical (Aurora), Imricor Medical Systems, CathVision, Pulse Biosciences, Farapulse (Boston Scientific), MicroPort EP, OSYPKA Medical, Biosig Technologies, Adagio Medical, Volta Medical |

The cardiac ablation refers to the medical devices, technologies, and procedures used to treat abnormal heart rhythms (arrhythmias) by ablating or destroying malfunctioning cardiac tissue that causes irregular electrical signals. It is a cornerstone in the management of atrial fibrillation (AF), atrial flutter, supraventricular tachycardia (SVT), and ventricular tachycardia (VT). The market is driven by rising AF prevalence in the aging population, technological advancements in catheter-based ablation systems, adoption of minimally invasive techniques, and expanded reimbursement coverage. Increasing demand for alternative therapies to long-term drug treatment is fueling market expansion.

Growth in cardiac arrhythmia: Due to the growing incidence of cardiac arrhythmias in the U.S., there is a rise in the demand for the use of cardiac ablation solutions. Therefore, to tackle them, the companies are innovating various devices. Thus, to accelerate the development, companies are investing and launching new funding rounds.

For instance,

AI plays an important role in the detection of arrhythmias, promoting their early diagnosis. AI can also be used for cardiac mapping as it can provide 3D, high-resolution, and real-time electroanatomical maps of the heart. At the same time, they can also interpret the data without any errors. AI also helps in the development of personalized treatment plans by interpreting and analyzing the patients' conditions. At the same time, its monitoring also provides early detection and alerts of complications. This is increasing their use in the development of next-generation cardiac ablation technologies with improved safety.

Growing Demand for Minimally Invasive Procedures

Due to growing awareness about the minimally invasive procedure, there is a rise in the demand by patients to use the same treatment for arrhythmias. This increases the use of cardiac ablation as it is a minimally invasive technique, providing less pain and incision with faster recovery. It also helps in reducing the risk of complications due to reduced bleeding and infection rates. Additionally, with the use of novel devices, their accuracy is also increasing. Thus, this is driving the U.S. cardiac ablation market growth.

Limited Access

Advanced infrastructure is required for the use of cardiac ablation. Skilled personnel or specialist, along with the advanced instruments, are also essential for their use. Therefore, their lack can limit the use of this procedure as well as its utilization by the smaller hospitals and clinics. Moreover, the cost associated with their devices and procedures is high, along with limited insurance policies, which may limit their use by the patients. Thus, this limits access to the cardiac ablation solutions.

Growing Innovations

To deal with the growing cases of cardiac arrhythmias, there is a rise in the innovation of cardiac ablation solutions. These innovations are being focused on enhancing the accuracy, safety, efficiency, and success rates of the procedures. New non-thermal technologies are being developed to increase tissue sensitivity and minimize complications. New imaging and mapping systems are also being developed to enhance the image quality and accuracy of the procedures. Minimally invasive techniques are also being developed to simplify the workflow and increase patient safety profiles. Advancements are also being made to increase their portability. Thus, this is promoting the U.S. cardiac ablation market growth.

For instance,

By product type, the radiofrequency (RF) ablation devices segment held the dominating share of approximately 45% share in the market in 2024, due to their successful outcomes. This, in turn, increased their adoption by the cardiologists and electrophysiologists. At the same time, their enhanced availability and affordability increased their use. Thus, this enhanced the market growth.

By product type, the pulsed-field ablation (PFA) systems segment is expected to show the highest growth, with approximately a 15% share during the predicted time. Their high tissue selectivity is increasing their use. Moreover, their procedures are faster. Additionally, they are preferred due to their safety as they show a lower risk of thermal damage.

By application/arrhythmia type, the atrial fibrillation segment led the market with approximately a 55% share in 2024, driven by the highest clinical and procedural volume. At the same time, their growing incidences and aging population also increased the use of various cardiac ablation devices. Moreover, the presence of insurance policies also increased their use. Similarly, growing patient awareness also increased their adoption rates.

By application/arrhythmia type, the ventricular tachycardia (VT) segment is expected to show the fastest growth rate with approximately a15% share during the predicted time. Due to their growing severity, the demand for cardiac ablation devices is increasing. Additionally, the presence of ineffective drugs is increasing the use of these devices. The advanced mapping systems and tools are also being used to provide safe and effective treatment options.

By end user, the hospitals segment held the largest share of approximately 60% share in the global market in 2024, due to the equipped electrophysiology labs, tertiary care centers. Therefore, the high volume of patients was effectively treated with these devices by the skilled personnel. These devices were also used during emergency conditions. At the same time, the presence of policies attracted the patients.

By end user, the ambulatory surgery centers (ASCs) segment is expected to show the highest growth, with approximately a 10% share during the upcoming years. These ambulatory surgery centers are providing affordable services to the patients. They also consist of advanced technologies that shorten the procedure times. They also increase the safety profile, enhancing the patient outcomes.

By energy source type, the thermal ablation segment led the market with approximately a 75% share in 2024, as it ensured the safety and effectiveness of the treatment. Moreover, they were widely used for treating different types of arrhythmias. This, in turn, increased their use in both simple and complex cases. Thus, this enhances their adoption rates.

By energy source type, the non-thermal ablation segment is expected to show the fastest growth rate, with approximately a 25% share during the upcoming years. They provide targeted action, which minimizes the chances of damage to the other organs. Furthermore, the procedure requires less time, with enhanced safety and low rates of complications. Thus, this in turn is increasing the use of non-thermal ablation energy sources.

The U.S. cardiac ablation market is expected to show significant growth due to growing awareness about arrhythmia among the population of the U.S. There is a growth in the demand for advanced diagnostic and treatment options. This, in turn, is increasing the use of cardiac ablation. The growing rates of cardiac diseases are also increasing their demand. Their R&D is also increasing, which is supported by the investments. Moreover, the prevalence of policies in the hospitals and clinics is also increasing their use.

The Northeast U.S. held the major share of the U.S. cardiac ablation market. Due to a growth in the population, the cases of arrhythmia increased. This, in turn, has increased the demand for cardiac ablation solutions. The presence of a well-developed healthcare sector also increased their adoption rates. Moreover, the growth in healthcare investments also prompted their adoption rates, along with their use. Additionally, the companies also contributed to their development with a focus on enhancing their safety and effectiveness. Furthermore, the growth in the hospitals and ASC also contributed to their increased use to enhance the patient outcomes. Thus, this promoted the market growth.

The South U.S. is expected to host the fastest growth in the U.S. cardiac ablation market during the forecast period. Due to the growing incidence of cardiovascular diseases, there is a rise in the use of cardiac ablation treatment options. They are being used for the treatment of growing rates of atrial fibrillation and ventricular tachycardia. At the same time, growing specialty hospitals and ambulatory surgery centres, their use, which in turn is increasing their availability. The growing healthcare campaign is also increasing awareness, which is increasing its use. Additionally, rising medical tourism is also increasing its adoption rates, supported by the reimbursement policies, which are attracting patients.

The development of new techniques such as pulsed field ablation and refining the existing technologies to enhance their safety, efficiency, and effectiveness, and reduce their collateral tissue damage is the focus of the R&D of cardiac ablation.

Key Players: Medtronic, Johnson & Johnson, Abbott Laboratories, Boston Scientific.

The clinical trials and regulatory approval of the cardiac ablation focus on the evaluation of their safety and efficacy for the treatment of atrial fibrillation (AF) and ventricular tachycardia (VT).

Key Players: Johnson & Johnson, Medtronic, Abbott Laboratories, Boston Scientific.

The preoperative education, monitoring, and personalized postoperative care plans to promote successful recovery are included in the patient support and services of the cardiac ablation.

Key Players: Johnson & Johnson, Boston Scientific, Medtronic, Abbott Laboratories.

In April 2025, after announcing the positive clinical outcomes of the Affera™ family of technologies for atrial fibrillation (AFib), Director of Cardiac Arrhythmia Services for the Mount Sinai Health System in New York City, Vivek Reddy, stated that, various treatment option for different cardiac arrhythmias can be provided with this Affera technology which consists of intuitive, advanced mapping system and catheters. Moreover, circumferential lesions without using catheter rotation were provided by Sphere-360, which contributed to the positive results, safety, and performance profile without any serious adverse effects. Thus, its approval will be a valuable addition to the Affera system of Medtronic.

By Product Type

By Application/Arrhythmia Type

By End User

By Energy Source

By Region (U.S.)

January 2026

January 2026

January 2026

January 2026