January 2026

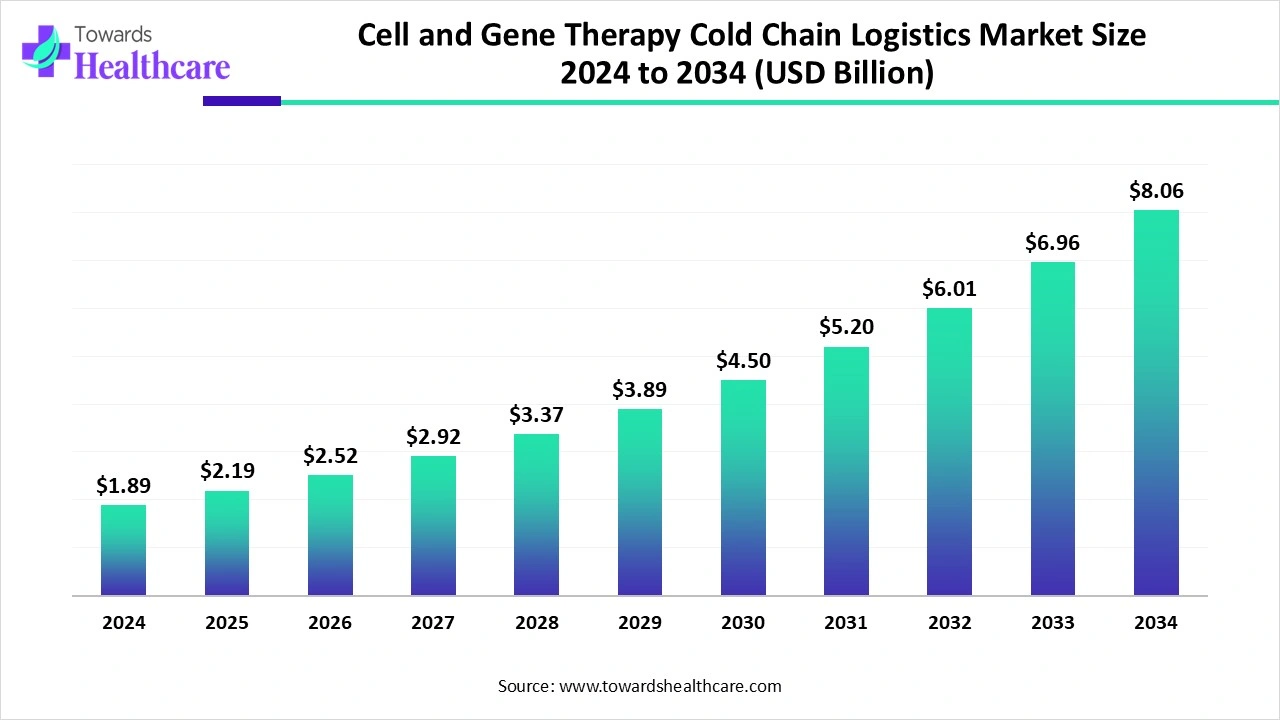

The global cell and gene therapy cold chain logistics market size is calculated at US$ 1.89 billion in 2024, grew to US$ 2.19 billion in 2025, and is projected to reach around US$ 8.06 billion by 2034. The market is expanding at a CAGR of 15.64% between 2025 and 2034.

Due to the growing production of cell and gene therapies, there is a rise in the demand for cell and gene therapy cold chain logistics. To leverage it, new collaborations among the companies are increasing. AI is also being used to enhance its workflow. Moreover, their demand in different regions is also increasing due to advanced logistics infrastructure and their growing investments. The companies are also contributing to the launch of new logistics platforms. Thus, this is promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 2.19 Billion |

| Projected Market Size in 2034 | USD 8.06 Billion |

| CAGR (2025 - 2034) | 15.64% |

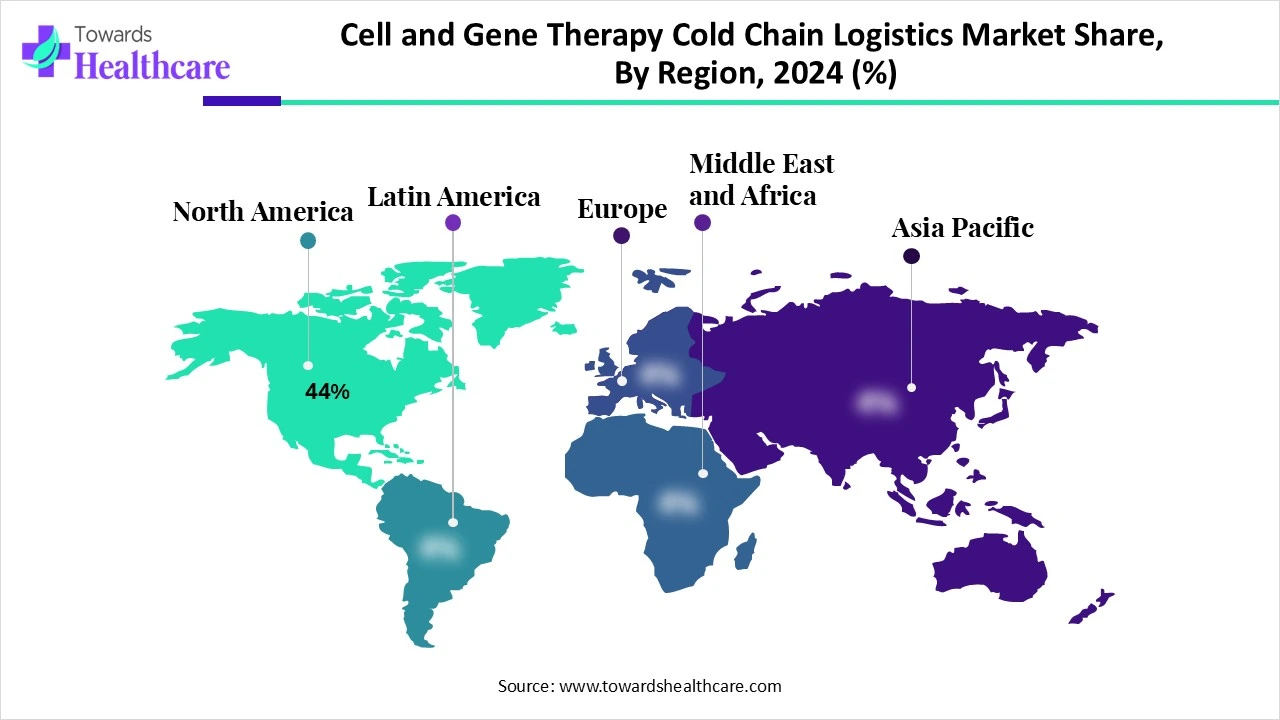

| Leading Region | North America 44% |

| Market Segmentation | By Service Type, By Therapy Type, By Temperature Range, By End User, By Region |

| Top Key Players | Cryoport, Inc., World Courier, Marken, Catalent Cell & Gene Therapy Logistics, Lonza Bioscience Logistics, Thermo Fisher Scientific, BioLife Solutions, TrakCel, Brooks Life Sciences, Be The Match BioTherapies, QuickSTAT , DHL Life Sciences & Healthcare, FedEx Custom Critical Healthcare Solutions, United Parcel Service, McKesson Specialty Health, Aramex Life Science Logistics, CryoStore Ltd., Integra LifeSciences Cold Storage Solutions, Peli BioThermal, Savsu Technologies |

The Cell and Gene Therapy (CGT) Cold Chain Logistics Market refers to the specialized supply chain infrastructure and services required for transporting, storing, and distributing temperature-sensitive CGT products. These therapies, including autologous and allogeneic treatments, require stringent conditions ranging from controlled refrigerated (+2°C to +8°C) to ultra-low and cryogenic temperatures (−80°C to −196°C). With the rise in commercial approvals of CGTs, the demand for reliable cold chain logistics has surged, ensuring product integrity, patient safety, and regulatory compliance. The market is shaped by innovations in cryogenic storage, real-time monitoring, and specialized distribution networks tailored to personalized medicine.

Growing collaborations: Due to the growing use of CGT, there is a rise in the demand for cell and gene therapy cold chain logistics. This is increasing the collaboration among the companies and CDMOs to enhance their development. Similarly, the collaboration among the companies and logistics providers is also increasing.

For instance,

The use of AI in the cell and gene therapy cold chain logistics market is increasing as it helps in real-time monitoring. It detects the deviations and minimizes the chances of failures. The AI algorithms also help to analyze the weather conditions, which in turn reduces the delayed deliveries. It also helps in managing the scheduled pickups and inventories. It also enhances the quality and risk management as it helps in detecting the failure routes. It can also be used for document verification. Thus, this enhances the safe deliveries with reduced costs.

Growing Demand for Personalized Therapies

There is a rise in the demand for personalized therapies, which is increasing the use of cold chain logistics. Individual logistics are also being used to ensure the timely and temperature-controlled deliveries. At the same time, with the use of real-time tracking, the patient are able to monitor their therapies. They also consist of a chain of custody and identity, which helps in reducing the mix-up of the therapies. Thus, this drives the cell and gene therapy cold chain logistics market growth.

Lack of Skilled Personnel

The proper handling of the cell and gene therapies is crucial during the manufacturing, packaging, delivery, and collection. The inappropriate documentation of these therapies can lead to identity mix-up, delivering them to the wrong patient. Moreover, the lack of expertise or a trained person can affect their integrity. Thus, the lack of skilled personnel can lead to delays or even product rejection.

Growing CGT Development

Due to the growing application of cell and gene therapies, there is a rise in their development and clinical trials. This increases the demand for cold chain logistics. Depending on the type of CGT developed, the use of specialized logistics solutions is increasing. This is enhancing their innovations, which can offer customized packaging and a wide range of temperature storage facilities. Similarly, cold chain logistics, which can provide real-time tracking and monitoring technologies, as well as customized or individual logistic solutions, are being developed. Thus, this enhances the cell and gene therapy cold chain logistics market growth.

For instance,

By service type, the transportation segment led the cell and gene therapy cold chain logistics market with approximately 48% share in 2024, due to its fast delivery. It also offered strict temperature controls, which are essential for the CGT. This, in turn, increased their use in clinical trials as well. Thus, this contributed to the market growth.

By service type, the monitoring & tracking solutions segment is expected to show the fastest growth rate during the predicted time. They are being used for the management of product integrity as they are temperature-sensitive. They help in detecting the delays. Thus, they help in providing the CGT with well-maintained integrity and effectiveness.

By therapy type, the gene therapies segment held the largest share of approximately 46% in the cell and gene therapy cold chain logistics market in 2024, as they were highly temperature sensitive. They also required a cryogenic temperature for their stability. Moreover, their growing development also contributed to the same. This increased the demand for cold chain logistics.

By therapy type, the cell therapies segment is expected to show the fastest growth rate during the upcoming years. There is a rise in the clinical trials of cell therapies. The personalized cell therapies are also being developed, and the use of immunotherapies is also increasing. This is growing the demand for the use of cold chain logistics.

By temperature range type, the cryogenic (−150°C to −196°C) segment led the cell and gene therapy cold chain logistics market with approximately 52% share in 2024, as it helps in maintaining the stability and functionality of the therapies. They were mostly used for autologous cell therapies to prevent their degradation. They were also used for logistics transportation due to the regulatory compliance, which enhanced the market growth.

By temperature range type, the refrigerated (+2°C to +8°C) segment is expected to show the highest growth during the predicted time. Due to growing allogeneic therapies, the demand for cold chain logistics is increasing. Moreover, due to their easy handling and regulatory standards, their use is increasing. Additionally, their low cost is also enhancing their acceptance rates.

By end user, the pharmaceutical & biotechnology companies segment held the dominating share of approximately 55% in the global cell and gene therapy cold chain logistics market in 2024, driven by growing CGT production. The companies also reflected a growth in the R&D. This, in turn, increased the shipments of CGT products. Thus, the demand for cold chain logistics increased.

By end user, the specialty logistics providers segment is expected to show the highest growth during the upcoming years. These providers are offering customized logistics solutions with experts in CGT product handling. They also provide end-to-end solutions with regulatory support. Furthermore, advanced technologies to maintain the product's integrity are also provided by them.

North America dominated the cell and gene therapy cold chain logistics market share 44% in 2024. North America consisted of robust industries that contributed to the increased development of cell and gene therapies. Moreover, their approvals increased the use of cold chain logistics. This enhanced the market growth.

There is a rise in the development of cell and gene therapies in the U.S. industry. This, in turn, is raising the demand for the use of cold chain logistics. Additionally, the presence of advanced logistics infrastructure offers them a variety of options with improved delivery. Moreover, the growing government investments are promoting their development.

Canada is experiencing a rise in the biotech clusters, which is increasing the development and innovations of CGT and regenerative medicines. The industries as well as the institutes are also focusing on their new research and development. This is leading to a growth in funding and collaboration. Thus, this is growing the use of cold chain logistics for timely deliveries.

Asia Pacific is expected to host the fastest-growing cell and gene therapy cold chain logistics market during the forecast period. Due to expanding industries, there is a rise in the development of cell and gene therapies. This is increasing their trials, enhancing the need for cold chain logistics. Therefore, to deal with this rapid expansion, the healthcare sector is investing in the cold chain infrastructure development. Thus, this is promoting the market growth.

To provide safe and effective delivery of temperature-sensitive and fragile therapeutics, the development of innovative thermal packaging, advanced cryopreservation techniques, smart tracking, and monitoring systems, along with the optimization of supply chain models, will be the focus for cell and gene therapy cold chain logistics R&D.

Key Players: Marken, Cryoport, QuickSTAT, World Courier, Biocair

The clinical trials and regulatory approvals of cell and gene therapy cold chain logistics include the validation of temperature control, real-time monitoring, and packaging solutions.

Key Players: Marken, Cryoport, World Courier, Biocair

To offer personalized and end-to-end guidance to the patient with emotional counselling, dedicated case managers, and financial assistance programs for the navigation of time-sensitive and complex logistics for the treatment are included in the patient support and services of cell and gene therapy cold chain logistics.

Key Players: Marken, Cryoport, Cencora, TrakCel, and Vineti, Cardinal Health

In January 2025, after revealing the Cryoport Express® Cryogenic HV3 Shipping System ("HV3"), the CEO of Cryoport, Jerrell Shelton, stated that to meet the needs of their patients and clients, they are continuously evolving their solution and are committed to predicting industry challenges. The patient access to vital cell therapies in remote areas and smaller cities is being enhanced, with the introduction of Cryoport Express® Cryogenic HV3 Shipping System, which in turn will enhance the patient outcomes.

By Service Type

By Therapy Type

By Temperature Range

By End User

By Region

January 2026

January 2026

January 2026

January 2026