March 2026

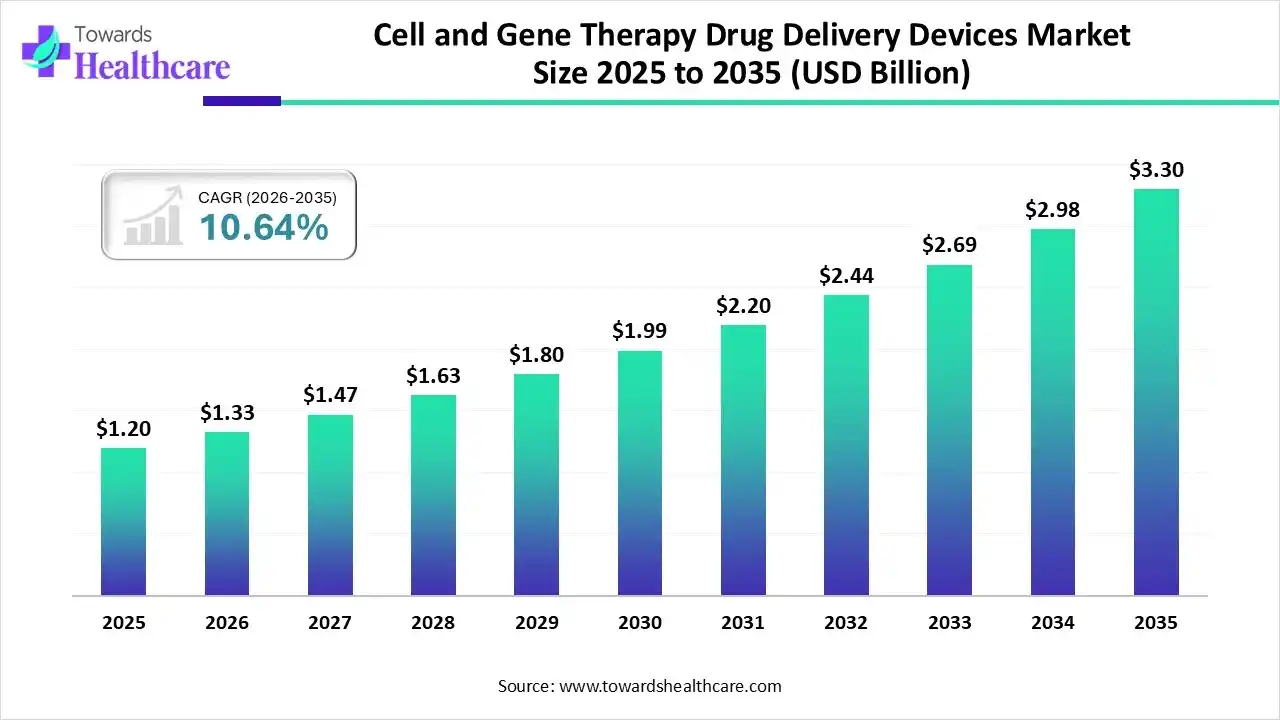

The cell and gene therapy drug delivery devices market size touched US$ 1.2 billion in 2025, with expectations of climbing to US$ 1.33 billion in 2026 and hitting US$ 3.3 billion by 2035, driven by a CAGR of 10.64% over the forecast period.

The cell and gene therapy drug delivery devices market is expanding rapidly, driven by the rising adoption of advanced therapies for genetic, rare, and chronic diseases. These devices play a critical role in ensuring the precise, safe, and effective delivery of therapeutic agents. Technological advancements in viral and non-viral delivery systems, coupled with strong investments from biotech and pharmaceutical companies, are boosting innovation. Growing clinical trial activity and supportive regulatory pathways are further strengthening market growth and commercialization opportunities worldwide.

The cell and gene therapy (CGT) drug delivery devices market covers the specially designed devices, disposables, and accessory systems used to administer, transport to the patient, and dose cell- and gene-based therapies safely and effectively. This includes single-use tubing sets and infusion systems for autologous cell products, prefilled syringes and autoinjectors for off-the-shelf biologics, wearable injectors for high-volume biologics, implantable/infusion pumps for localized delivery, and point-of-care kits (apheresis & administration kits) that maintain sterility, chain-of-identity, and precise dosing during complex CGT workflows.

The market is driven by the growth in CAR-T and other cell therapies, rising commercialization of gene therapies, need for closed/aseptic delivery solutions, and demand for patient-centric routes (home infusion, wearable devices). The cell and gene therapy drug delivery devices market is growing due to rising demand for targeted treatments, increasing prevalence of genetic and chronic diseases, and advancements in delivery technologies. Strong investments, expanding clinical trials, and supportive regulatory frameworks further accelerate adoption and commercialization across healthcare applications.

Strategic Announcements and Milestones: The rollout of innovative delivery platforms and automated devices is transforming therapy manufacturing and administration. These launches improve precision, reduce costs and contamination risks, and expand access to cell and gene therapies across wider patient populations.

AI can significantly impact the market by optimizing design, predicting device performance, and enhancing precision in therapeutic delivery. It enables real-time monitoring, automation, and data-driven adjustments during manufacturing and administration, reducing errors and improving efficiency. AI-driven analytics also accelerate R&D, streamline clinical trials, and support predictive maintenance of devices. By integrating machine learning with delivery technologies, AI helps improve treatment outcomes, scalability, and cost-effectiveness, driving broader adoption of advanced therapies.

Rising Prevalence of Genetic and Chronic Diseases

The increasing incidence of genetic and chronic diseases fuels the cell and gene therapy drug delivery devices market as healthcare systems seek more effective and long-lasting treatment solutions with Conditions like hemophilia, muscular dystrophy, and certain cancers create a need for sophisticated delivery devices that can safely transport therapies to targeted cells. This trend also encourages biotech and pharmaceutical companies to develop scalable, reliable, and precise delivery technologies, driving innovation and expanding the adoption of cell and gene therapies worldwide.

For Instance,

The expensive nature of advanced delivery devices restricts market growth by making it challenging for smaller biotech firms and the emerging healthcare market to adopt them. High procurements and maintenance costs, along with the need for specialized infrastructure, limit widespread deployment. Additionally, insurers and healthcare systems may be hesitant to cover therapies involving costly devices, slowing commercialization. This financial barrier reduces patient access and can delay the adoption of innovative cell and gene therapy delivery solutions globally.

Development of Next-Generation Delivery Platforms

Next-generation delivery platforms offer future opportunities by enabling faster, more reliable, and patient-specific administration of cell and gene therapies. These advanced systems support decentralized and point-of-care manufacturing, reduce logistical challenges, and allow integration with digital monitoring and AI-driven control. As the cell and gene therapy drug delivery devices market shifts towards complex multi-gene and combination therapies, these platforms provide flexibility, scalability, and improved safety, positioning manufacturers to meet growing demand and tap into new clinical and commercial applications globally.

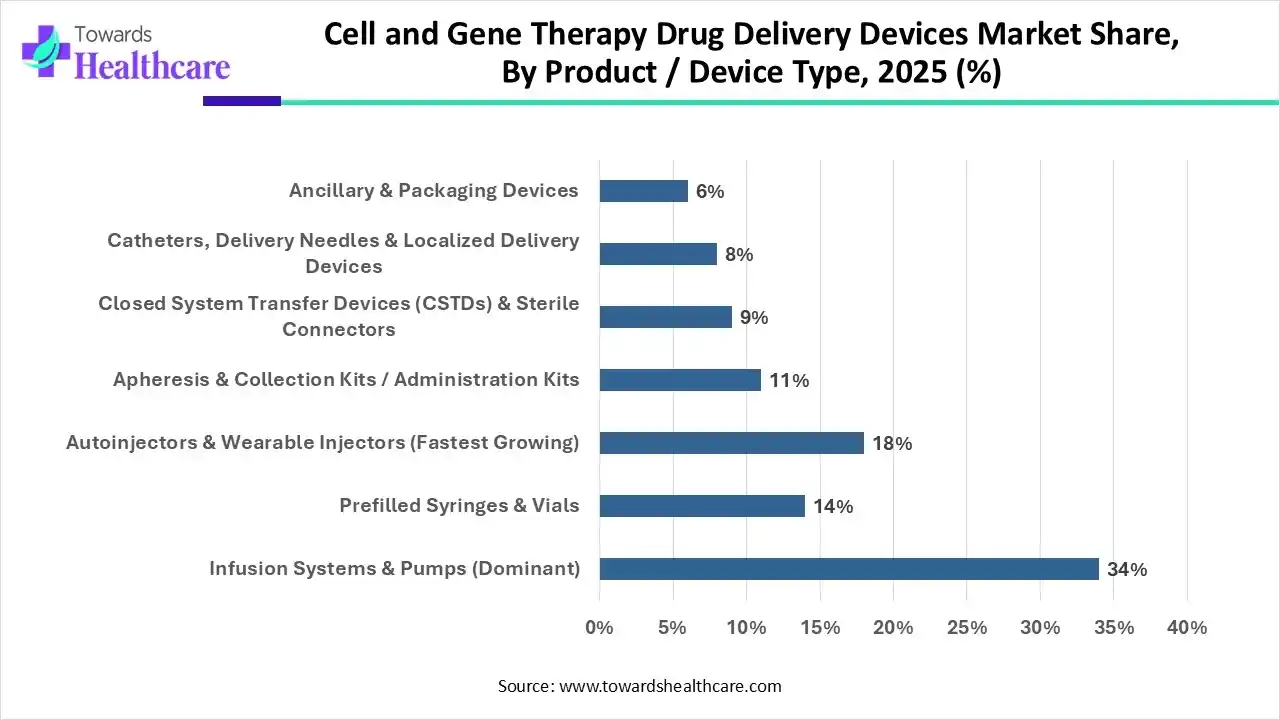

How Did the Infusion Systems & Pumps Segment Dominate the Market in 2025?

The infusion systems & pumps segment led the market by 34% as these devices simplify the administration of advanced therapies, allowing flexibility in both inpatient and outpatient settings. Their compatibility with diverse cell and gene therapy formulations, along with features like real-time monitoring and programmable delivery, enhances treatment safety and efficacy. Additionally, increasing preference for home-based and decentralized therapy administration has boosted demand, making infusion systems and pumps a key contributor to revenue growth in the cell and gene therapy drug delivery devices market.

The autoinjectors & wearable injectors segment captured a leading revenue share as it addresses the growing need for minimally invasive and patient-friendly delivery solutions. Their design reduces dosing errors, improves therapy adherence, and allows continuous or extended drug delivery for complex treatments. Rising awareness among patients and healthcare providers about convenient, home-based therapy options, along with technological improvements such as integrated sensors and connectivity features, has accelerated adoption, making this segment a major revenue driver in the market.

| Segment | Share 2025 (%) |

| Autologous Cell Therapy Administration | 45% |

| Allogeneic Off-the-Shelf Products | 25% |

| In Vivo Gene Therapy Delivery (Fastest Growing) | 18% |

| Intrathecal, Intramuscular, Intravitreal & Intratumoral Delivery | 12% |

Why Did the Autologous Cell Therapy Administration Segment Dominate the Market in 2025?

The autologous cell therapy administration segment dominated the cell and gene therapy drug delivery devices market by 45% in 2025 as healthcare providers prioritized therapies with a lower risk of immune rejection and enhanced patient-specific outcomes. Growing clinical application in oncology and rare diseases, coupled with increasing infrastructure for handling patient-derived cells, boosted adoption. Additionally, advancements in delivery devices tailored for autologous therapies improved safety, efficiency, and treatment scalability, making this segment a major revenue contributor in the cell and gene therapy drug delivery market.

The in vivo gene therapy delivery segment is projected to grow rapidly as it enables simplified administration without the need for complex cell extraction or manipulation. Its potential for outpatient and home-based treatment enhances accessibility and reduces healthcare costs. Ongoing innovations in vector design, nanoparticle carriers, and tissue-specific targeting are expanding therapeutic applications. Additionally, increasing collaborations between biotech firms and research institutes to develop scalable in vivo therapies are boosting adoption, positioning this segment for the fastest market growth.

How does the Intravenous/intracavitary Infusion Segment Dominate the Market?

The intravenous/intracavitary infusion segment dominated the cell and gene therapy drug delivery devices market by 50% in 2025 as it allows the administration of complex therapies with minimal procedural complexity and higher patient throughput. Its versatility in treating systemic conditions, combined with compatibility with advanced delivery devices and monitoring systems, makes it widely preferred. Additionally, growing demand for hospital-and clinic-based treatments, along with established safety profiles and ease of integration into with established safety profiles and ease of integration into existing healthcare workflows, has strengthened its adoption, securing the segment’s largest market share.

The intrathecal/intracerebral segment is projected to expand rapidly as demand rises for targeted treatments of rare neurological disorders and spinal conditions. These delivery methods allow bypassing biological barriers, such as the blood-brain barrier, enabling more effective therapy at lower doses. Innovations in minimally invasive catheters, implantable devices, and real-time monitoring systems enhance safety and precision. Increasing collaboration between biotech firms and academic centers to develop CNS-focused therapies further accelerates adoption, driving the market growth.

How will the Hospitals & Specialty Clinics Segment dominate the Market in 2025?

The hospitals & specialty clinics segment led the cell and gene therapy drug delivery devices market by 58% in 2025 as it provides comprehensive care for patients requiring complex and high-risk cell and gene therapy treatments. These centers offer integrated services, including therapy preparation, administration, and post-treatment monitoring. Growing patient preference for expert-led treatment, along with the expansion of specialized therapy centers and adoption of advanced delivery devices, has increased the reliance on hospitals and clinics, making them the primary end users and key contributors to market revenue.

The ambulatory & home infusion segment is projected to expand rapidly as patients and healthcare providers seek flexible and decentralized treatment options. Portable and wearable delivery devices enable safe administration in home or outpatient settings, improving accessibility for patients in remote areas. Growing awareness of self-administration benefits, combined with technological innovations that allow real-time monitoring and dose control, is driving adoption. This shift toward patient-centric care is expected to make the segment the fastest-growing end-user category in the market.

Why Did the Single-use, Closed-system Technologies Segment Dominate the Market in 2025?

The single-use, closed-system technologies segment led the cell and gene therapy drug delivery devices market by 57% in 2025 as it offers streamlined, ready-to-use solutions that enhance process reliability and reduce downtime. Their modular design allows flexible scaling for different therapy volumes, while minimizing operator exposure and contamination risks. Increasing adoption in both clinical and commercial manufacturing settings, coupled with the need for efficient, compliant, and cost-effective production of complex cell and gene therapies, has strengthened the segment’s revenue dominance in the market.

The wearable, on-body high-volume injectors segment is projected to expand rapidly as healthcare shifts toward decentralized and outpatient therapy models. These devices allow continuous or programmed dosing, reducing the need for frequent clinical visits and supporting complex therapies requiring large volumes. Integration of digital tracking, automated alerts, and compatibility with diverse formulations enhances safety and patient compliance. Increasing focus on patient-centered care and the rising prevalence of chronic and rare diseases are fueling demand, driving the segment’s fastest CAGR in the market.

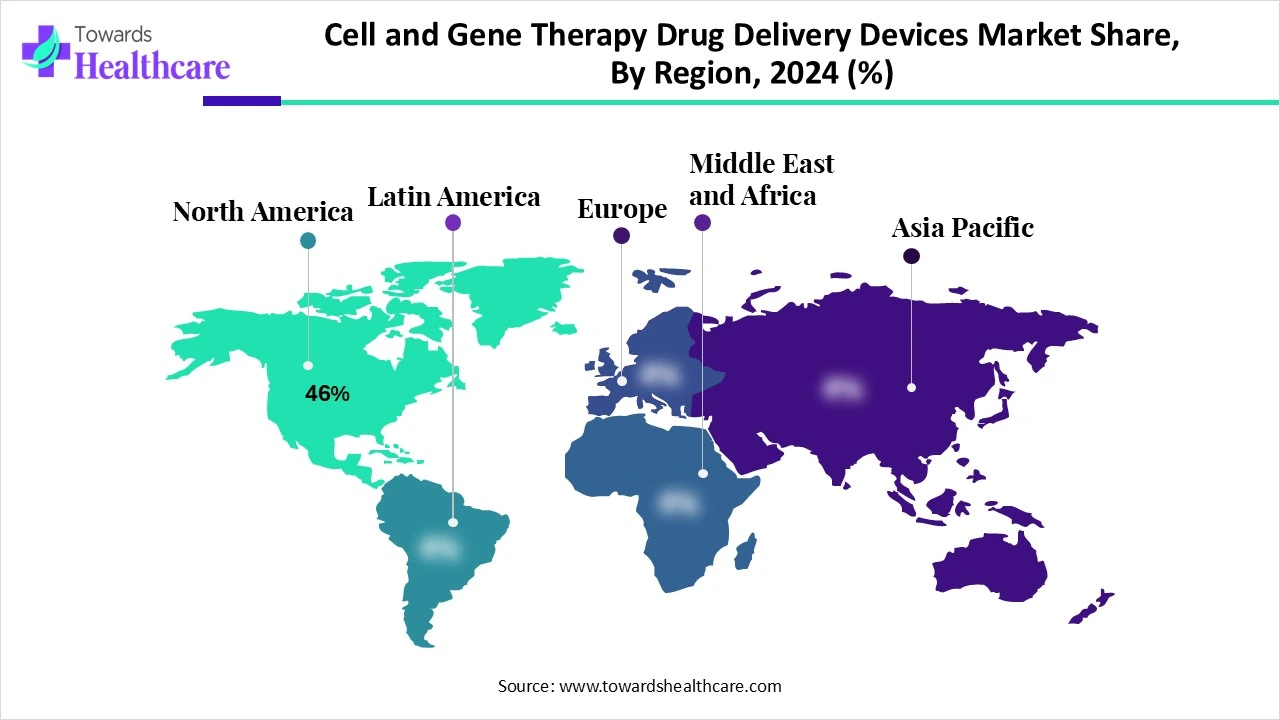

North America led the market share 46% in 2025 as it benefits from a robust ecosystem of research institutions, CDMOs, and specialized treatment centers focused on cell and gene therapies. Advanced manufacturing capabilities, widespread adoption of next-generation delivery technologies, and early commercialization of novel therapies contributed to strong revenue generation. Additionally, well-established reimbursement policies and high patient demand for innovative treatments further strengthened the region’s dominance in the cell and gene therapy drug delivery devices market.

The U.S. market is growing steadily as hospitals and specialty clinics increasingly adopt automated and patient-centric delivery systems. Expansion of clinical trials, rising demand for outpatient and home-based therapies, and advancements in wearable and high-volume injectors are fueling growth. Strong collaborations between biotech firms, research institutes, and device manufacturers are also accelerating innovation, making the U.S. a key driver of technological adoption and revenue in the global cell and gene therapy delivery market.

The Canadian market is growing as biotech companies focus on developing innovative therapies for rare and complex diseases. Increasing partnerships between domestic and international firms, expansion of specialized treatment centers, and rising awareness of personalized medicine are driving adoption. Additionally, advancements in wearable, portable, and automated delivery technologies, along with supportive research initiatives, are enabling safer and more efficient therapy administration, fueling market growth across the country.

Asia Pacific is projected to achieve the fastest CAGR in the cell and gene therapy drug delivery devices market as countries in the region focus on developing local manufacturing capabilities and advanced therapy hubs. Rapidly growing patient populations, increasing affordability of innovative treatments, and rising demand for home-based and outpatient therapy solutions are driving market expansion. Collaborations between regional biotech firms and global leaders, along with regulatory reforms facilitating faster approvals, are further supporting the adoption of cell and gene therapy delivery devices, positioning the region for significant growth.

R&D in cell and gene therapy drug delivery devices aims to develop systems that accurately deliver modified cells and gene-editing tools, enhancing treatment effectiveness while addressing manufacturing and safety challenges.

Packaging and sterilization of cell and gene therapy devices use specialized materials and processes to ensure sterility, preserve product integrity, and maintain viability, particularly during ultra-low and cryogenic storage.

Patient support services for cell and gene therapy delivery devices provide personalized guidance, educational materials, financial aid, and logistical assistance to help patients navigate the complexities of treatment from start to finish.

In May 2024, ProPharma, a U.S.-based regulatory and compliance services provider, partnered with Italy’s PBL to launch the Cell Factory Box (CF Box), an enclosed, fully automated device for decentralized manufacturing of all cell and gene therapies (CGTs) in Class D (ISO8) or controlled areas. Eleonora Casucci, ProPharma’s VP of Quality & Compliance EU, stated that “many are adopting a decentralized approach to manufacturing [CGTs],” and highlighted that the CF Box offers significant advantages over existing devices, strengthening their position in the CGT market.

By Product / Device Type

By Therapy Type / Use Case

By Delivery Route

By End User

By Technology / Features

By Region

March 2026

March 2026

March 2026

March 2026