January 2026

The global dental wax market size marked US$ 863 million in 2024 and is forecast to experience consistent growth, reaching US$ 897 million in 2025 and US$ 1270 million by 2034 at a CAGR of 3.95%.

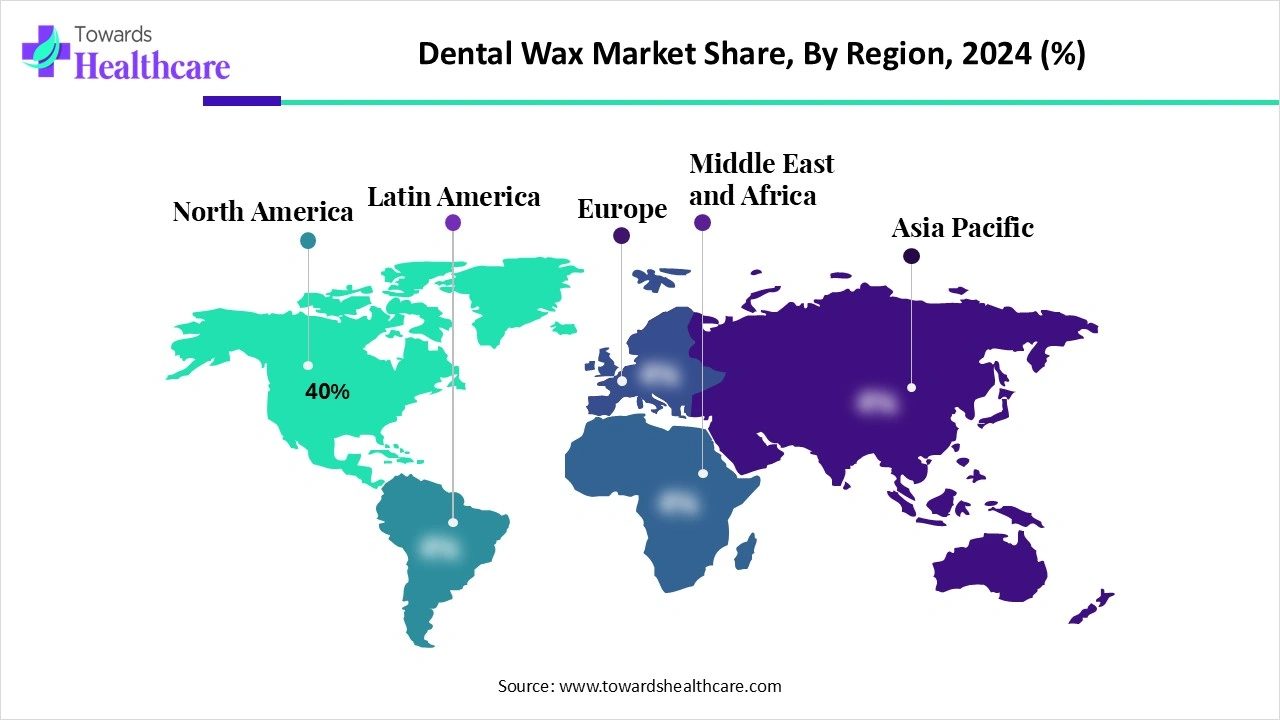

The dental wax market is expanding due to rising demand for dental restoration, orthodontics, and oral hygiene procedures. North America dominates the market, driven by advanced healthcare infrastructure, high dental expenditure, and widespread adoption of biocompatible waxes. Increasing awareness of oral health, growth in dental training institutions, and technological advancements in dental materials further support the market’s steady growth globally.

| Table | Scope |

| Market Size in 2025 | USD 897 Million |

| Projected Market Size in 2034 | USD 1270 Million |

| CAGR (2025 - 2034) | 3.95% |

| Leading Region | North America by 40% |

| Market Segmentation | By Product Type, By Material Type, By Form, By Application, By End User, By Region |

| Top Key Players | Dentsply Sirona, 3M Oral Care, Kerr Corporation (Envista), GC Corporation, Kulzer GmbH (Mitsui Chemicals Group), Ivoclar Vivadent, SHOFU Dental, Whip Mix Corporation, BEGO Dental, Kettenbach GmbH, Metrodent Ltd., Renfert GmbH, Pyrax Polymars, Prevest DenPro, SpofaDental (Kerr), Dental Creations Ltd., MDM Dental Products, Yeti Dental, Carmel Industries, GEO Dental (DENTAL-Δ) |

The dental wax market is experiencing steady growth, driven by rising awareness of oral health and increasing demand for dental procedures. The market is primarily fueled by orthodontic treatments, such as clear aligners and braces, and restorative dental work like bridges and crowns. Dental wax is a specialized material used in dentistry for a variety of clinical and laboratory purposes. It is typically composed of natural or synthetic waxes, including beeswax, paraffin, and carnauba, often blended with resins, oils, and flavoring agents for ease of handling.

AI integration can improve the market by enhancing precision and efficiency in dental restorations. It enables digital modeling, 3D printing, and CAD/CAM workflows, reducing errors and material waste. AI-driven customization also allows patient-specific wax formulations, improving comfort, treatment outcomes, and overall adoption in dental practices.

Rising Demand for Dental Procedures

Rising demand for dental procedures drives the dental wax market growth by increasing the need for restorations, crowns, bridges, and orthodontic treatments. Innovations in dental care and more precise, patient-friendly procedures further boost the adoption of dental wax products in clinics worldwide.

For instance, in Victoria, Australia, the number of dental fillings surged by 36% from January to June 2024, with younger age groups (0–19) experiencing increases of 40% and 46% respectively. This rise is attributed to factors such as poor diet, inadequate oral hygiene, missed regular dental check-ups, and cost-of-living pressures.

Similarly, in Nagpur, India, the Government Dental College and Hospital reported treating nearly 4,000 patients monthly in 2025, offering procedures like fillings, extractions, and scaling at significantly lower rates compared to private clinics. This high patient volume is attributed to the steep rise in dental treatment costs at private clinics, leading to long queues at government hospitals.

Availability of Alternatives & Regulatory Challenges

The key players operating in the market are facing issues due to regulatory challenges and the availability of alternatives. Synthetic resins, silicone-based materials, and digital impression technologies reduce reliance on traditional dental wax. Strict safety and quality regulations can delay product approvals, especially for new formulations.

Technology Integration

Technology integration can significantly drive the growth of the dental wax market. The adoption of digital dentistry tools like CAD/CAM systems and 3D printing allows precise and customized wax patterns for crowns, bridges, and orthodontic appliances. This reduces errors, material waste, and procedure time, enhancing efficiency.

The inlay wax segment holds a dominant position with a revenue of approximately 25% in the market due to its suitability for indirect casting techniques. This wax is designed for creating patterns outside the mouth, offering precise control over the shape and dimensions of dental restorations. Its properties, such as a higher melting point and minimal flow at mouth temperature, ensure that the wax pattern maintains its integrity during the casting process. These characteristics make Inlay Wax Type II Indirect essential for producing accurate and durable dental restorations, thereby driving its dominance in the market.

The orthodontic wax segment is estimated to be the fastest-growing in the dental wax market because it provides comfort and protection for patients with braces or orthodontic appliances. Its easy moldability, biocompatibility, and soothing properties reduce irritation and ulcers, driving high demand among orthodontic patients and increasing adoption in dental clinics worldwide.

The natural wax segment dominates the market with a revenue of approximately 45% due to its biocompatibility, safety, and non-toxicity. Its excellent moldability, dimensional stability, and thermal consistency allow precise shaping for impressions, bite registrations, and restorations. These reliable properties ensure high-quality dental outcomes, driving widespread adoption and market dominance.

The synthetic wax segment is anticipated to be the fastest-growing in the dental wax market due to its customizable properties, consistent quality, and high thermal stability. It enables precise dental restorations, reduces material waste, and supports modern techniques like CAD/CAM and 3D printing, driving increased adoption in dental clinics and laboratories worldwide.

The sheets segment dominates the market with a revenue of approximately 30% due to its versatility, uniform thickness, and ease of shaping for bite registrations, crowns, bridges, and inlays. Their dimensional stability during heating and processing ensures accurate, consistent results, making sheets the preferred choice over sticks, blocks, or pellets in dental labs and clinics.

The blocks segment is estimated to be the fastest-growing in the dental wax market because it offers high material volume, uniform density, and easy handling for large-scale or customized dental restorations. Blocks can be precisely carved, milled, or shaped for crowns, bridges, and prosthetics, reducing errors and waste. Their compatibility with CAD/CAM and 3D printing technologies enhances efficiency and accuracy. Additionally, blocks provide better thermal stability and structural integrity during processing, making them ideal for modern dental laboratories and clinics adopting digital workflows, thereby driving rapid adoption and segment growth.

The crown & bridge work segment dominates the market with a share of approximately 35% due to its widespread application in restorative dentistry. Dental wax is essential for creating accurate patterns for crowns, bridges, and inlays, ensuring proper fit and occlusion. Its moldability, dimensional stability, and heat resistance allow precise shaping and reliable results. This segment benefits from the growing demand for dental restorations among aging populations and increasing awareness of oral health. The need for durable, patient-specific restorations drives consistent adoption of dental wax in crown and bridge procedures, maintaining its dominance in the market.

The orthodontic appliances segment is anticipated to be the fastest-growing in the dental wax market due to its ability to protect soft tissues, reduce irritation, and improve patient comfort. Its moldability and biocompatibility make it essential for braces and aligners, driving high demand in orthodontic treatments worldwide.

The dental laboratories segment dominates the market with a share of approximately 50% as they produce crowns, bridges, dentures, and orthodontic appliances requiring precise wax modeling. Dental wax offers moldability, dimensional stability, and heat resistance, ensuring accurate restorations. High-volume use, versatility, and CAD/CAM integration further reinforce laboratories’ position as the leading wax consumers.

The dental clinics segment is estimated to be the fastest-growing in the dental wax market due to increasing patient visits, rising demand for restorative and orthodontic procedures, and the need for precise, biocompatible, and easy-to-use wax for crowns, bridges, and impressions.

North America dominates the dental market with a revenue of approximately 40% due to advanced healthcare infrastructure, high healthcare spending, favorable reimbursement policies, and strong prevalence of dental diseases. The region leads in adopting innovations like CAD/CAM, 3D printing, and clear aligners, driven by strong R&D and key industry players. Rising cosmetic dentistry demand, higher awareness, and an aging population further strengthen its leadership.

The U.S. leads the dental market with advanced infrastructure, high dental expenditure, and widespread insurance coverage. Strong presence of key players, rapid adoption of digital dentistry, rising cosmetic procedures, and a large aging population drive consistent market growth.

Canada’s dental market benefits from universal healthcare influence, growing oral health awareness, and increasing cosmetic dentistry demand. Technological adoption, supportive government policies, and a rising geriatric population enhance service utilization, while strong collaborations between clinics and manufacturers strengthen their market position.

The Asia-Pacific region is the fastest-growing market for dental wax due to rising awareness of oral health, increasing adoption of cosmetic and restorative dentistry, and expanding dental infrastructure across countries like China, India, and Japan. Growing disposable income, urbanization, and a large patient pool drive demand for advanced dental treatments. Additionally, rapid adoption of digital dentistry technologies, collaborations between dental clinics and labs, and government initiatives to improve oral healthcare accessibility further accelerate the growth of the market in this region.

Dental wax development begins with formulation research to improve biocompatibility, durability, and molding properties. Research institutions, universities, and corporate labs like 3M Oral Care, Dentsply Sirona, and Ivoclar Vivadent play key roles. They conduct material innovation, pilot production, and product testing to meet evolving dentist and technician needs.

Although dental wax is a Class I/low-risk product, it undergoes safety and performance validation. Manufacturers collaborate with dental schools, labs, and clinics to test usability and precision. Regulatory approvals are required from bodies like the U.S. FDA (510(k) or Class I exemption), Health Canada, and the European Medicines Agency (EMA) before commercialization.

End-users include dental professionals, labs, and indirectly, patients needing restorations, crowns, or orthodontic models. Companies like Henry Schein, Patterson Dental, and Straumann provide distribution, training, technical support, and after-sales service. Educational programs and product support ensure efficient use in prosthetic and restorative dentistry practices.

In January 2025, Kulzer GmbH CEO Chris Holden highlighted the company's focus on innovations in restoration, aesthetics, and a new generation of 3D printing. He emphasized the importance of shaping innovations and advancing oral health together, indicating upcoming product launches in these areas.

By Product Type

By Material Type

By Form

By Application

By End User

By Region

January 2026

January 2026

January 2026

December 2025