January 2026

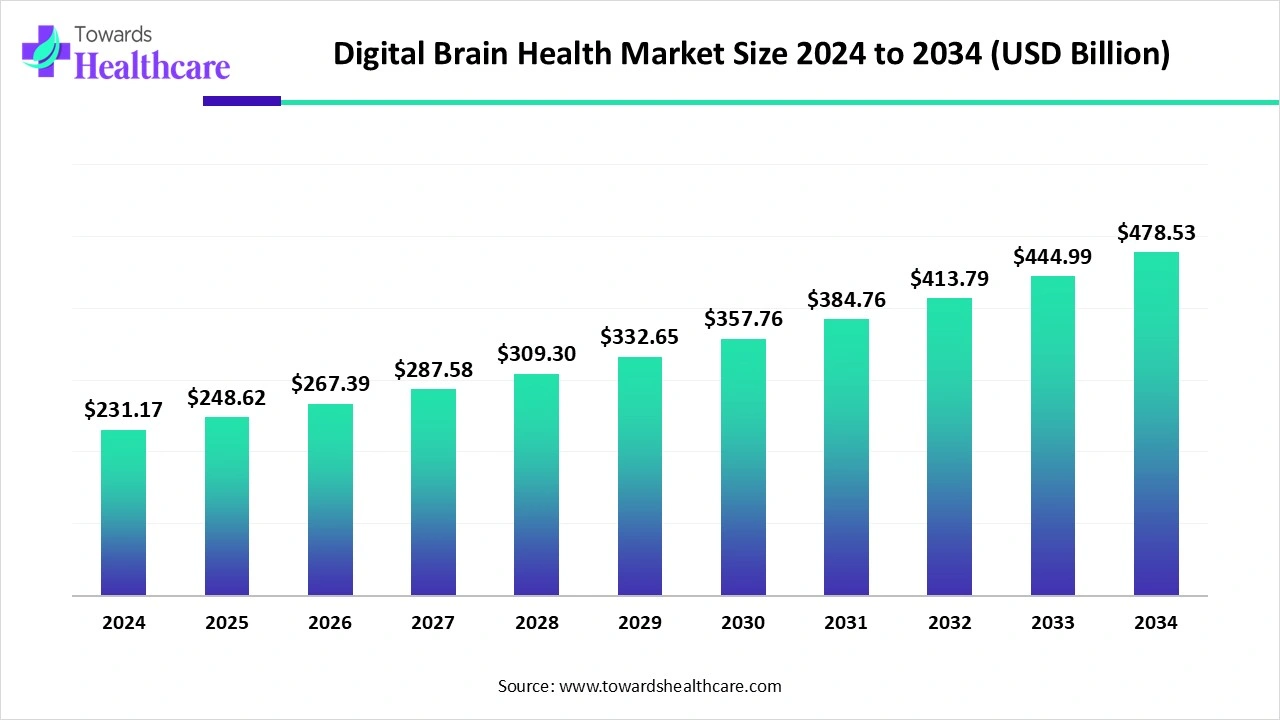

The global digital brain health market size is calculated at US$ 231.17 billion in 2024, grew to US$ 248.62 billion in 2025, and is projected to reach around US$ 478.53 billion by 2034. The market is expanding at a CAGR of 7.55% between 2025 and 2034.

Japan, China, and India are widely experiencing a rise in neurological disorders due to the growing geriatric burden, which is propelling the development of the global digital brain health market. This further assists in promising advancements in digital brain and mental programs, including the use of sophisticated wearable devices, AI platforms, chatbots, and other approaches. At the same time, numerous regional governments are stepping into the public awareness regarding cognitive decline, dementia, depression, and anxiety, coupled with their advanced digital solutions.

| Table | Scope |

| Market Size in 2025 | USD 248.62 Billion |

| Projected Market Size in 2034 | USD 478.53 Billion |

| CAGR (2025 - 2034) | 7.55% |

| Leading Region | North America |

| Market Segmentation | By Offering, By Therapeutic Area, By End User, By Distribution Channel, By Region |

| Top Key Players | Akili Interactive, Cogstate Ltd., Pear Therapeutics, Happify Health, Lumos Labs (Lumosity), Headspace, Calm, Elevate Labs, Peak (Brainbow Ltd.), MyBrainSolutions, Posit Science, MindMaze, NeuroSky, BrainCheck, Altoida, Happitech, Magellan Health (NeuroFlow partner), Woebot Health, Mindstrong Health, Emotiv |

The digital brain health market encompasses digital platforms, software, and devices aimed at monitoring, enhancing, and maintaining cognitive and neurological health. It includes mobile applications, brain training tools, neurofeedback systems, digital therapeutics (DTx), and AI-powered cognitive assessment platforms. These solutions support memory enhancement, attention and focus improvement, stress and anxiety management, sleep optimization, and management of neurological disorders such as Alzheimers, dementia, Parkinsons, and stroke recovery. The market serves individual consumers, healthcare providers, research institutes, and corporate wellness programs. Growth is driven by rising awareness of brain health, increasing prevalence of neurological and cognitive disorders, technological advances in AI, VR, and wearable devices, and expanding adoption of digital health interventions worldwide.

Continuous rising public awareness of mental wellness and advancements in neurotechnology and wearable devices are widely impacting the development of the respective markets.

For early detection of neurological and mental health concerns, and scalable, accessible care through AI-enabled platforms and wearable medical devices, are increasingly supporting the adoption of digitalization around the globe. Nowadays, the globe is propelled by mental health chatbots, such as Tess for depression, AI-powered analysis of facial and verbal expressions for distress detection, and virtual reality (VR) therapy for phobias and anxiety. Alongside, a rise in personalized exercise programs for the geriatric population with cardiovascular disease, coupled with AI-controlled data, and AI-enabled note-taking for clinical consultations by tools like Dragon Copilot of Microsoft, is supporting the ultimate progression around this market.

A Surge in Digital Accessibility

In 2025, there are several significant factors influencing the overall digital brain health market expansion. A prominent driver is the increasing incidence of neurological disorders, particularly Alzheimers and Parkinsons, and other mental health issues, like anxiety disorders, developing a wide range of requirements for efficient digital measures. Whereas the worldwide rising accessibility of digital tools and telemedicine platforms is making brain health assessments and interventions widely available and inexpensive for individuals, mainly through remote access from their homes.

Expensive Digital Approaches

In the progressing market, the need for greater investment in the development and deployment of digital health solutions, like apps and platforms, is creating a huge hindrance. As well as the application of highly advanced brain health devices, especially EEG machines, is immensely unaffordable, mainly in developing nations.

Broader Range of Prospective Applications

The expanding digital world is greatly developing new future applications in the digital brain health market, such as emerging data-driven brain health insights. This is accelerated by the collection and assessment of passive data from wearables and sensors. Furthermore, this supports establishing higher proactive and preventive care. Additionally, the growing emphasis on at-home digital therapeutics, likewise virtual reality (VR) for anxiety and depression treatment, and sophisticated remote monitoring for issues, particularly in ADHD and PTSD.

In 2024, the software & mobile applications segment accounted for the dominating share of the market. The fruitful effects of these applications, as they are convenient, self-operable solutions for cognitive enhancement and mental well-being, are boosting a more proactive approach to brain health. Consistent digital steps are developing brain-computer interfaces (BCI) by applying AI to decode brain signals, and the growth of AI-powered chatbots for mental health support and digital therapeutics that will further facilitate evidence-based interventions is impacting the overall development.

Although the wearable devices segment is predicted to expand rapidly during 2025-2034, the ongoing major demand for minimally invasive and non-invasive brain monitoring products is a vital driver, supporting wearable devices over conventional methods. Currently, the digital world is working on establishing more advanced EEG-based headbands for real-time brain activity monitoring and neurofeedback, as well as miniaturized, flexible biosensors that track physiological data, such as heart rate and temperature, to find stress patterns or estimate seizures. The integration of Artificial Intelligence for processing data and offering customized insights and predictive analytics for issues, especially epilepsy, sleep disorders, and mental health conditions, is assisting the wider adoption of these wearable devices.

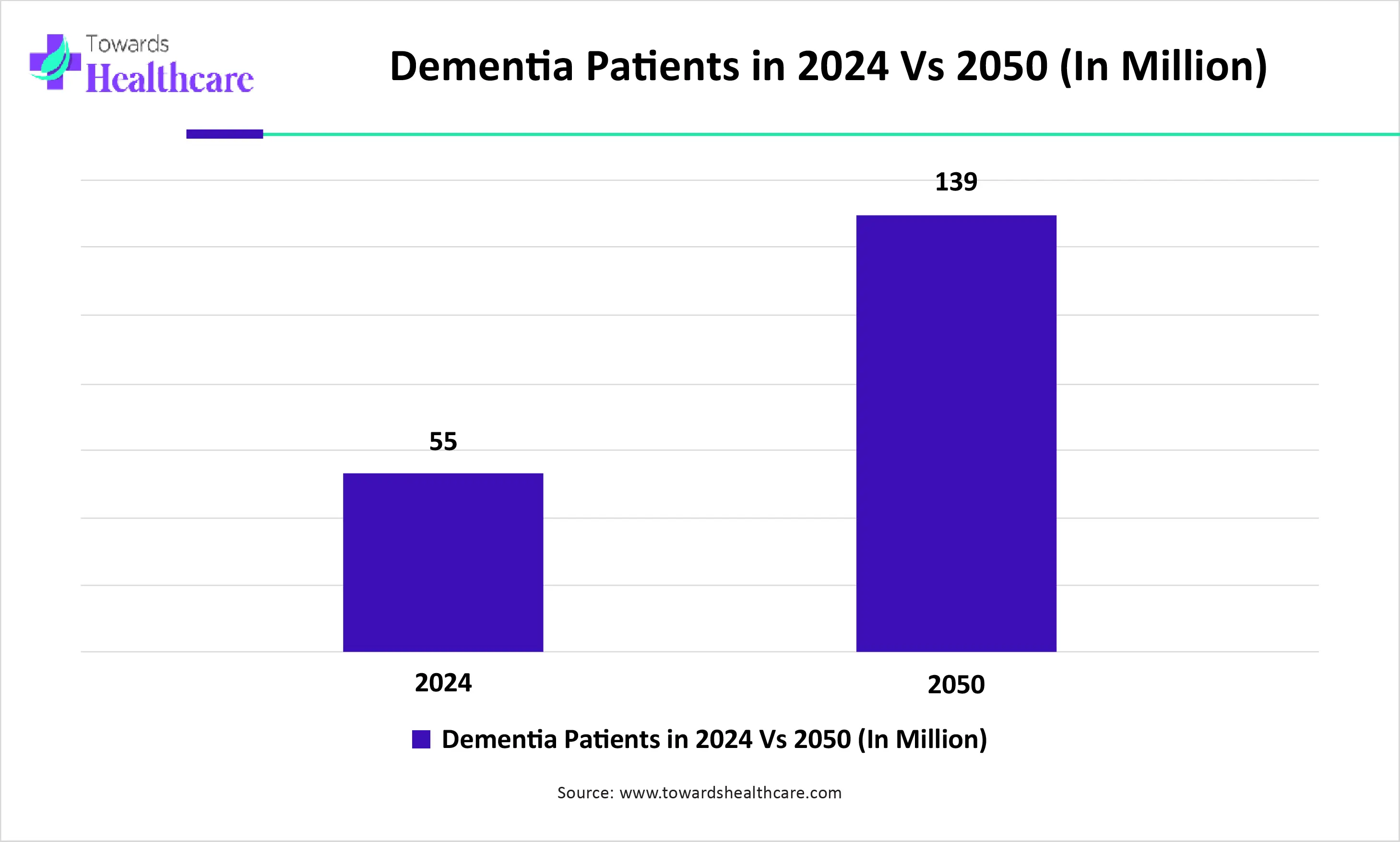

The cognitive decline & dementia segment captured a major revenue share of the digital brain health market in 2024. The segment is fueled by the increasing older adult population, which is highly susceptible to these conditions. Ongoing development of digital tools is assisting in handling cognitive impairment, coupled with the detection of risk factors, including hypertension, depression, and lack of physical activity, through educational and lifestyle guidance. Recently, a 2025 study in Nature Human Behavior has recommended that digital technology can support social connections, cognitive training, and engagement, contradicting the digital dementia theory.

However, the depression & anxiety segment is estimated to witness the fastest growth in the coming era. From COVID-19, mainly the young population is facing certain mental issues, like depression and anxiety, which are propelling the broader requirement for more accessible and scalable mental health services. These concerns can be overcome by widely adopting novel approaches, like Talkspace connects users with licensed therapists via text, audio, or video messaging. Some digital therapeutics are developing game-like features to accelerate engagement and deliver cognitive training for anxiety and depression. Alongside evolving data analytics, regulatory frameworks, and reimbursement policies are expanding the application of digital solutions in these issues.

Primarily, the hospitals & clinics segment led the market in 2024. Among the developing hospitals, there is a rise in specialized neuroscience institutes that facilitate advanced care, surgical and non-surgical therapies, and research, which is further fostering the integration of digital technologies. In hospitals, the use of AI models has unveiled an accuracy twice that of professionals in assessing brain scans of stroke patients and can also identify the duration of a stroke. The emergence of digital solutions supports hospitals and clinics in simplifying workflows, reducing spending, and escalating operational effectiveness.

Eventually, the corporate wellness programs segment will expand rapidly in the digital brain health market. Around the world, the progressing emphasis on mental health is fueling more investments in stress management, mindfulness training, and virtual counseling within corporate programs. Also, people are increasingly adopting preventive wellness programs at affordable healthcare expenditures and insurance premiums. The widespread development of centralized health portals is offering employees a single point of access for their health data, wellness resources, and program information, allied with the generation of a cohesive digital experience. These programs are also expanding mindfulness and meditation training, cognitive training apps, as well as educational workshops that are aiming at neuroplasticity to help cognitive health.

By distribution channel, the online platforms segment registered dominance in the digital brain health market in 2024 and is predicted to expand fastest during 2025-2034. A critical factor is a rise in demand for more accessible, patient-centric, and inexpensive care measures, particularly e-therapies and remote monitoring, which are also influencing the ultimate online progression of the platform. Mainly, in January 2025, India introduced its e-Sanjeevani, which provides doctor-to-patient remote consultations, raising accessibility to care. Alongside other evolutions, such as Brain Health PRO/Santé Cerveau PRO, promote structured, personalized guidance on lifestyle factors for dementia risk minimization.

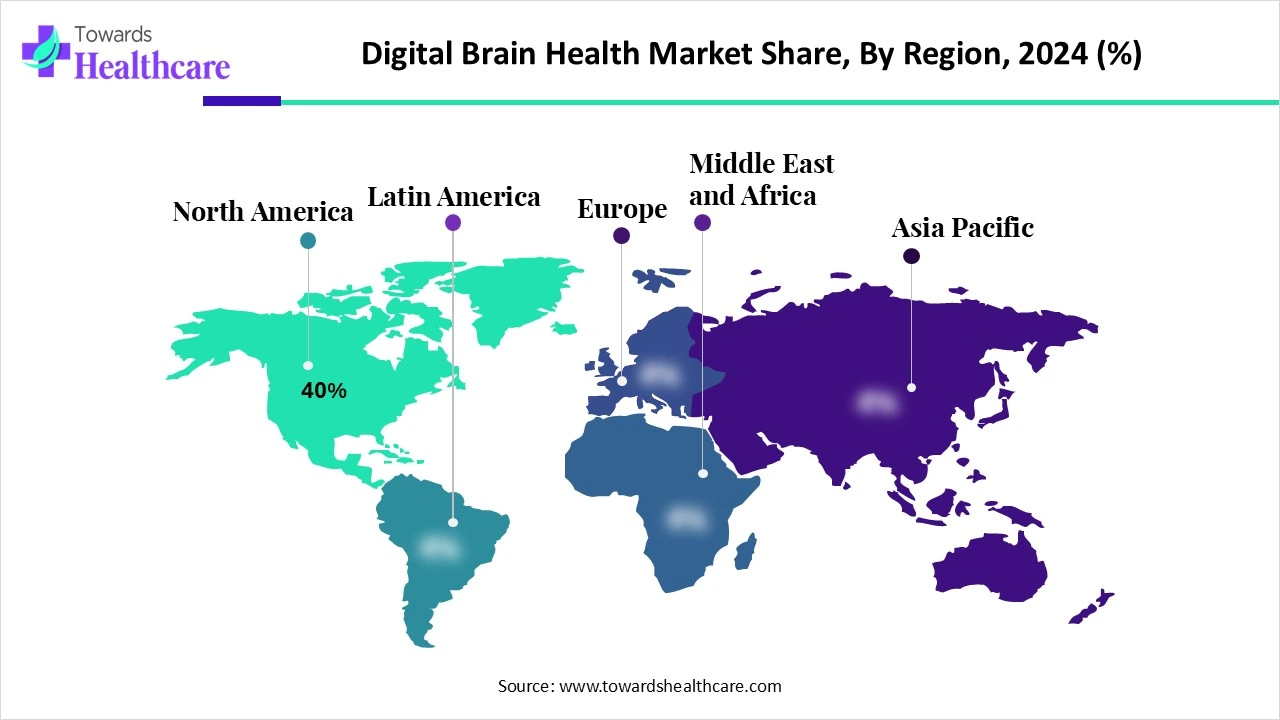

In the global digital brain health market, North America accounted for the biggest revenue share 40%, in 2024. The incorporation of highly developed healthcare IT infrastructure, wider smartphone penetration, and the availability of sophisticated digital technologies are boosting the adoption of digital brain health solutions in this region. An eminent participation of Linus Health company in the development of digital platforms for early detection of cognitive and brain disorders through clinical expertise and AI is supporting actionable insights and personalized action strategies in its surroundings.

The U.S. digital brain health market, emphasizing non-invasive ICP monitoring, such as Brain4care, is a technology that offers non-invasive access and interpretation of intracranial pressure waveform data. This further gives a graphic representation of pressure fluctuations without invasive procedures.

For instance,

Ongoing investments and collaborations are revolutionizing the digital brain health market in Canada and are expanding the overall development of novel research activities.

The digital brain health market in the Asia Pacific will expand at a rapid CAGR during 2025-2034. As Japan, South Korea, China, and India are facing a huge burden of a geriatric population, which is further highly prone to severe neurological concerns, like Alzheimers, Parkinsons, and dementia, this is impacting the adoption of digitalization in ASAP. Alongside these rising populations are encouraging the enhancement of public awareness and interest in mental health concerns, which results in widespread adoption of digital measures for stress management, cognitive fitness, and overall mental well-being.

Japan has approved several digital therapeutics, such as CureApp SC, CureApp HT, and SUSMED MedCBT-i, for covering diverse mental health concerns.

In March 2024, Eisai Co., Ltd. introduced its NouKNOW, a self-check tool of Eisai for brain health, which was certified as a ME-BYO BRAND by Kanagawa prefecture.

In 2024, South Korea achieved applause for approving DTx, mainly for insomnia, such as Somzz (using Cognitive Behavioral Therapy for Insomnia or CBT-I) and WELT-I. VIVID Brain, a VR-based DTx, is to help patients with visual field defects. This digital brain health market of this region is expanding AI and big data integration to establish more personalized healthcare solutions by developing AI platforms like CERVAI for brain health.

The emergence of supportive regulatory bodies through digital health approaches, including the European Health Data Space, is supporting the significant growth of the digital brain health market. Additionally, the European public is focusing on the use of advanced telemedicine and other virtual services, spurred by the COVID-19 pandemic, which is offering vital accessibility and timely care, with enhanced mental health support. Moreover, the European Partnership for Brain Health (EPBH) is a unified strategy, or Strategic Research and Innovation Agenda (SRIA), to support prospective steps in brain health, which is also accelerating the huge adoption of digitalization in Europe.

In March 2025, Digital mental health startup HelloBetter secured €6M and eyes French market entry, to introduce ten online therapy programmes, detecting common mental health conditions, like depression and panic disorders.

In August 2025, Mindler, a Stockholm-based digital therapy company, acquired Cambridge-based ieso Digital Health UK to evolve the most advanced digital mental health platform in Europe.

By Offering

By Therapeutic Area

By End User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026