January 2026

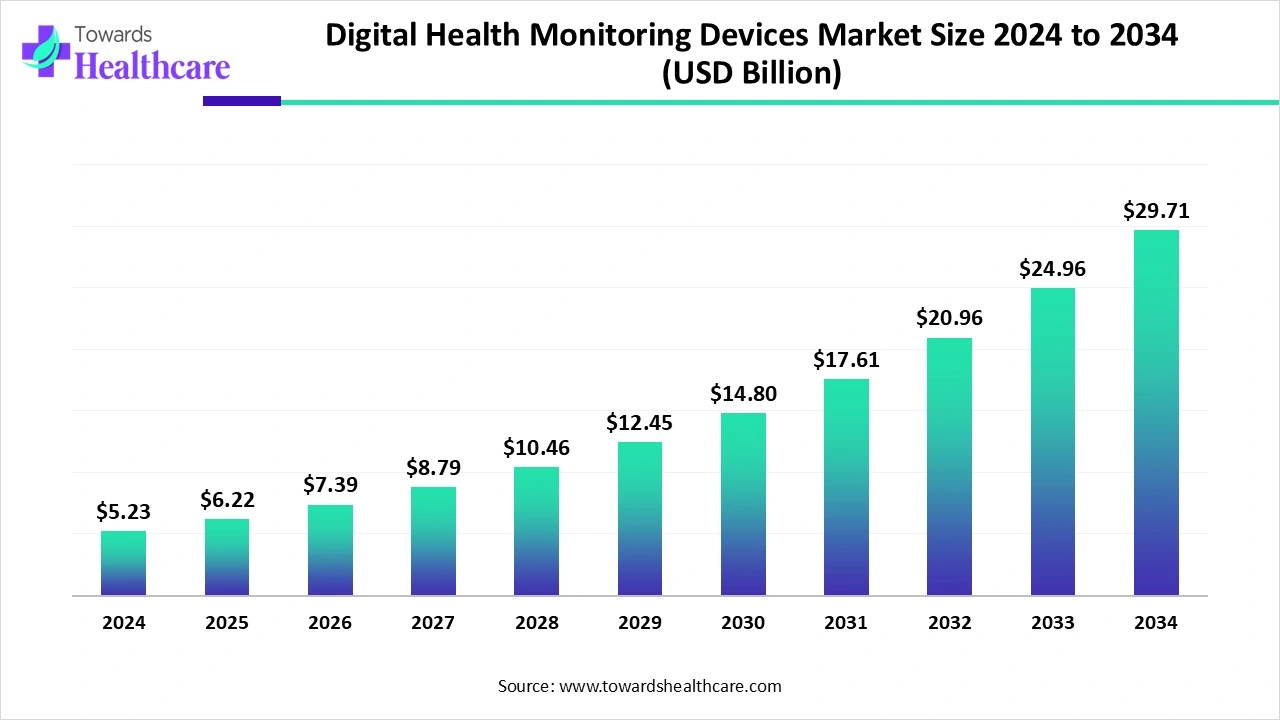

The global digital health monitoring devices market size reached US$ 5.23 billion in 2024 and is anticipate to increase to US$ 6.22 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 29.71 billion, growing at a CAGR of 18.9%.

The digital health monitoring devices market is expanding rapidly, driven by the rising prevalence of chronic diseases, growing consumer demand for personalized health solutions, and advancements in wearable technology and remote monitoring tools. North America dominates the market due to its advanced healthcare infrastructure, strong technological ecosystem, supportive regulatory frameworks, and the presence of leading industry players. Increased telehealth adoption, integration of digital solutions into healthcare and retail, and a focus on proactive patient care are further accelerating market growth.

| Table | Scope |

| Market Size in 2025 | USD 6.22 Billion |

| Projected Market Size in 2034 | USD 29.71 Billion |

| CAGR (2025 - 2034) | 18.9% |

| Leading Region | North America |

| Market Segmentation | By Device Type, By Monitoring Parameter / Biomarker, By Technology / Sensor Type, By Application / Use Case, By End-User, By Region |

| Top Key Players | Medtronic, Abbott Laboratories, Philips Healthcare, GE Healthcare, Siemens Healthineers, Roche Diagnostics, Johnson & Johnson, Boston Scientific, ResMed, Masimo, Dexcom, Omron Healthcare, iRhythm Technologies, BioTelemetry (now part of Philips), Withings, Fitbit (Google), Apple, Garmin, Huawei Health / Huawei Technologies, Xiaomi (Huami / Amazfit) |

Digital health monitoring devices are electronic tools and wearable technologies designed to continuously track, record, and transmit an individual’s vital health parameters, such as heart rate, blood pressure, glucose levels, oxygen saturation, and physical activity. These devices enable real-time monitoring, early detection of medical conditions, and personalized healthcare management, often integrated with mobile apps or cloud platforms for seamless data analysis and management. The digital health monitoring devices market is expanding rapidly, driven by increasing chronic disease prevalence, rising consumer awareness of health and wellness, technological advancements in wearable sensors, telehealth adoption, and North America’s advanced healthcare infrastructure and supportive regulatory environment.

Adoption of Inorganic Growth Strategies –Inorganic strategies like mergers, acquisitions, and partnerships enable digital health device companies to expand geographically, enhance technology and product portfolios, accelerate R&D, achieve cost efficiencies, strengthen competitiveness, and access larger patient data. These moves drive faster innovation and broader market reach.

Funding & Technology Advancements- Funding and technology boost innovation, device accuracy, AI integration, and adoption, driving growth in digital health monitoring devices.

AI integration can significantly enhance digital health monitoring devices by transforming them from simple trackers into intelligent healthcare tools. It enables predictive analytics, allowing early detection of potential health risks such as heart disease or diabetes. AI provides personalized insights by analyzing individual patterns, offers anomaly detection for sudden changes in vital signs, and facilitates remote monitoring through automated tracking. Additionally, it improves data management by efficiently interpreting large volumes of health information and enhances device functionality, optimizing performance and user experience. Overall, AI makes digital health devices more proactive, accurate, and user-centric.

The growing consumer focus on personalized health and wellness, coupled with the widespread adoption of telehealth and remote patient monitoring, is significantly driving the expansion of the digital health monitoring devices market. Consumers increasingly seek tailored health solutions that provide actionable insights into their well-being. Devices offering personalized health data, such as AI-powered smartwatches and wearables, are gaining popularity for their ability to monitor various health metrics and offer individualized recommendations. For instance, the AI Smart Watch with ChatGPT, priced under US$30, integrates health monitoring features with personalized wellness support, making advanced health technology more accessible to a broader audience.

Concurrently, the adoption of telehealth and remote patient monitoring has surged, especially in the United States. For instance, in September 2025, Remedy Meds, a telehealth startup, acquired Thirty Madison in an all-stock deal valued at over US$500 million, aiming to enhance its direct-to-consumer health services.

Limited Digital Literacy & Resistance to New Technology

The key players operating in the market are facing issues due to resistance to new technology and limited digital literacy. Some population segments may struggle to adopt and effectively use these technologies. Incompatibility between different devices and healthcare systems hinders seamless integration.

Government Initiatives

Government initiatives and healthcare digitalization are pivotal in propelling the growth of the digital health monitoring devices market. In India, the Ayushman Bharat Digital Mission (ABDM) exemplifies this transformation. Launched in 2021, ABDM aims to create an integrated digital health infrastructure by providing citizens with unique health IDs (ABHA), enabling secure access to electronic health records, and fostering interoperability across healthcare systems.

In December 2024, over 710 million ABHA IDs were created, linking nearly 46 crore health records, and registering more than 5 lakh healthcare professionals. This extensive digital framework facilitates seamless data exchange, enhancing the efficacy of digital health monitoring devices. Furthermore, the integration of AI technologies, as seen with Eka Care's digitization of over 110 million health records, underscores the synergy between government initiatives and technological advancements in improving healthcare delivery.

The wearable devices segment dominates the market due to their convenience, real-time tracking, and growing consumer demand for personalized health insights. Increasing use of smartwatches, fitness bands, and wearable sensors for monitoring heart rate, sleep, blood oxygen, and physical activity drives adoption. Integration with mobile health apps and telehealth platforms enhances accessibility and engagement. Additionally, rising health awareness, lifestyle-related diseases, and continuous innovation by tech giants like Apple, Fitbit, and Samsung further strengthen the dominance of wearable devices in this market.

The wearable patches & adhesive biosensors sub-segment is estimated to be the fastest-growing segment in the digital health monitoring devices market due to their non-invasive design, comfort, and ability to provide continuous, real-time health data. These devices are increasingly adopted for monitoring glucose levels, cardiac activity, hydration, and other vital parameters without restricting mobility. Their rising use in chronic disease management, clinical trials, and remote patient monitoring enhances demand. Technological advancements, miniaturization, and growing preference for discreet, skin-friendly solutions further accelerate their rapid market growth.

The cardiac segment dominates the market due to the rising global burden of cardiovascular diseases, which remain a leading cause of mortality. Continuous monitoring of cardiac health is crucial for early detection, timely intervention, and prevention of complications. Wearables and remote monitoring solutions integrated with ECG capabilities are increasingly adopted in hospitals and home care. Growing patient awareness, aging populations, and technological advancements in cardiac monitoring further strengthen the dominance of this segment.

The metabolic segment is the fastest-growing in the market due to the increasing prevalence of diabetes, obesity, and lifestyle-related disorders. Rising demand for continuous glucose monitoring (CGM) and ketone tracking devices supports better disease management and personalized health insights. Growing consumer interest in preventive health, fitness, and ketogenic diets further drives adoption. Technological advancements in non-invasive sensors and integration with mobile health apps make these devices more user-friendly, fueling rapid growth in this segment.

The optical sensors (PPG) segment dominates the market due to their widespread use in wearables like smartwatches and fitness trackers for real-time monitoring of heart rate, blood oxygen, and stress levels. Their non-invasive, cost-effective, and user-friendly nature has made them highly popular among consumers. The growing integration of PPG technology with telehealth platforms and mobile applications enhances continuous health tracking. Additionally, increasing adoption of chronic disease management and wellness monitoring further strengthens the dominance of this segment.

The electrochemical sensors segment is estimated to be the fastest-growing segment in the digital health monitoring devices market due to their high sensitivity, accuracy, and ability to detect biomarkers such as glucose, lactate, and cholesterol at low concentrations. Their integration into wearable patches and portable devices supports continuous and personalized health monitoring. The rising prevalence of diabetes and metabolic disorders fuels demand for these sensors in glucose monitoring systems. Additionally, ongoing innovations in miniaturization, non-invasive designs, and cost-effective manufacturing are accelerating their adoption and driving rapid market growth.

The remote patient monitoring (RPM) & chronic disease management segment dominates the digital health monitoring devices market due to the rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders that require continuous monitoring. These solutions enable timely interventions, reduce hospital visits, and improve patient outcomes. Growing adoption of telehealth, supportive government policies, and reimbursement programs further strengthen their use. Additionally, increasing elderly populations and advancements in connected devices make remote monitoring essential, solidifying this segment’s dominant position in the market.

The clinical trials & decentralized trials segment is anticipated to be the fastest-growing in the digital health monitoring devices market due to the rising adoption of digital tools that enable real-time data collection, patient monitoring, and remote participation. These devices improve trial efficiency, reduce costs, and enhance patient compliance by minimizing the need for physical site visits. Growing demand for virtual and hybrid trial models, accelerated by the pandemic, along with regulatory support for digital health integration, is driving the rapid growth of this segment in global clinical research.

The hospitals & clinics segment dominates the market due to the high demand for continuous patient monitoring, early disease detection, and efficient management of chronic and acute conditions. Healthcare facilities increasingly adopt advanced devices like wearable monitors, ECG sensors, and remote monitoring systems to improve patient outcomes and reduce hospital stays. Integration with electronic health records, telemedicine, and diagnostic tools enhances clinical decision-making. Strong infrastructure, skilled medical staff, and institutional investments further reinforce the dominance of this segment in the market.

The home healthcare patients & caregivers segment is the fastest-growing in the digital health monitoring devices market due to increasing demand for remote monitoring, convenience, and personalized care at home. Rising prevalence of chronic diseases, aging populations, and a preference for non-hospital care are driving adoption. Wearable devices, mobile health apps, and connected sensors enable real-time tracking of vital signs, medication adherence, and alerts for caregivers. Technological advancements, affordability, and growing awareness of home-based healthcare solutions further accelerate growth in this segment.

North America dominates the digital health monitoring devices market due to a combination of advanced healthcare infrastructure, high prevalence of chronic diseases, and a tech-savvy population. Government initiatives, such as campaigns promoting wearable health devices, encourage the adoption and integration of digital health solutions. Favorable reimbursement policies and strong regulatory support from agencies like the FDA further facilitate market growth. Additionally, the presence of leading industry players, continuous technological innovation, and widespread telehealth adoption reinforce North America’s position as the leading region for digital health monitoring devices.

The U.S. dominates due to its advanced healthcare infrastructure, high prevalence of chronic diseases, and a tech-savvy population. Strong regulatory support from the FDA, favorable reimbursement policies for remote patient monitoring, and widespread telehealth adoption drive the market. The presence of major industry players like Apple, Medtronic, and Fitbit fosters continuous innovation, while government campaigns promoting wearable and digital health devices encourage consumer adoption.

The Canadian digital health monitoring devices market is growing steadily, supported by increasing healthcare digitization and nationwide electronic health record initiatives. Rising consumer awareness of personalized health and wellness, combined with government funding for digital health programs, facilitates the adoption of digital health monitoring devices, particularly in urban centers and remote regions where telehealth services are expanding.

The Asia-Pacific region is emerging as the fastest-growing market for digital health monitoring devices, driven by several key factors. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions has heightened the demand for continuous and remote health monitoring solutions. Additionally, the aging population, more susceptible to chronic conditions, along with growing interest in preventive healthcare and wellness tracking, is significantly contributing to the adoption of digital health monitoring devices across the region.

China’s digital health monitoring devices market is growing rapidly due to government-led healthcare modernization initiatives, including the “Healthy China 2030” plan, which emphasizes preventive care and technology-driven healthcare. The increasing prevalence of chronic diseases and an aging population are driving demand for continuous health monitoring. Technological advancements, particularly in AI, IoT, and wearable devices, are enhancing device capabilities and adoption. Moreover, rising consumer awareness and growing private investments in healthcare startups are accelerating market growth. Urbanization, combined with improved digital infrastructure, ensures that digital health solutions reach a broad population, positioning China as a key growth market in Asia-Pacific.

The digital health monitoring devices market in India is expanding rapidly, fuelled by government initiatives like the National Digital Health Mission (NDHM), which promotes nationwide electronic health records and telehealth services. Rising incidence of chronic diseases and a large, underserved population create demand for remote health monitoring. Increasing adoption of smartphones, wearable devices, and AI-driven health applications enhances accessibility and usability. Additionally, growing health awareness among urban and semi-urban populations, coupled with rising private-sector investment in digital health startups, supports market growth. These factors collectively make India one of the fastest-growing digital health markets in the region.

Key Activities:

Key Organizations Involved:

Key Activities:

Key Organizations Involved:

Key Activities:

Key Organizations Involved:

In May 2025, Ketan Mehta of Apnimed highlighted that gathering minimal sleep data over an extended period is more valuable than extensive data from a single night, contrasting with traditional in-lab polysomnography. He emphasized that longitudinal data, showing trends and night-to-night variations, provides a more accurate picture of sleep quality and treatment response than a large amount of data from a short, isolated event. This approach can offer insights into patterns that a single, intensive study might miss.

By Device Type

By Monitoring Parameter / Biomarker

By Technology / Sensor Type

By Application / Use Case

By End-User

By Region

January 2026

January 2026

January 2026

January 2026