December 2025

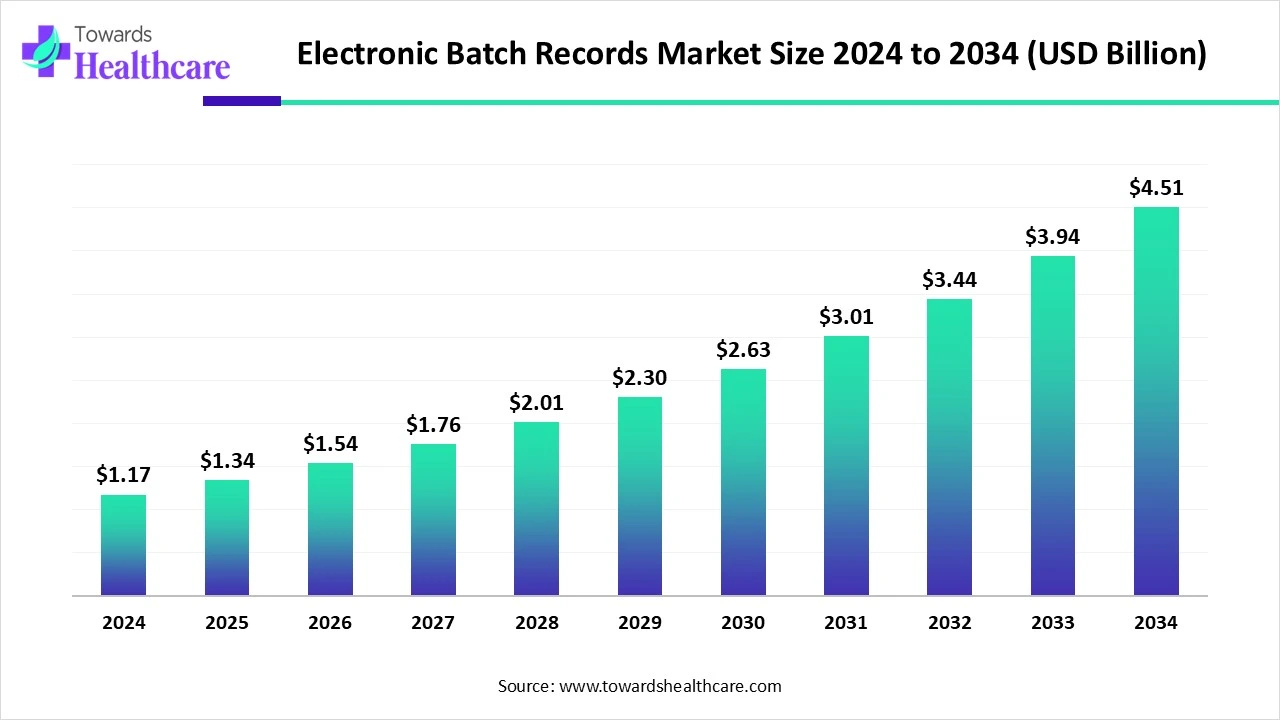

The global electronic batch records market size is calculated at US$ 1.17 in 2024, grew to US$ 1.34 billion in 2025, and is projected to reach around US$ 4.51 billion by 2034. The market is expanding at a CAGR of 14.44% between 2025 and 2034.

There is a rise in the demand for the use of EBR systems for various purposes in the healthcare sector globally. This is increasing their cloud-based innovations and integration with various platforms, leading to new partnership deals. AI is also being used to enhance its workflow. Due to strict regulatory standards and manufacturing complexities, their use in various industries is increasing. These developments are increasing their adoption across various regions. Moreover, new approval and launch are driving their use. Thus, this promotes the market growth.

| Table | Scope |

| Market Size in 2025 | USD 1.34 Billion |

| Projected Market Size in 2034 | USD 4.51 Billion |

| CAGR (2025 - 2034) | 14.44% |

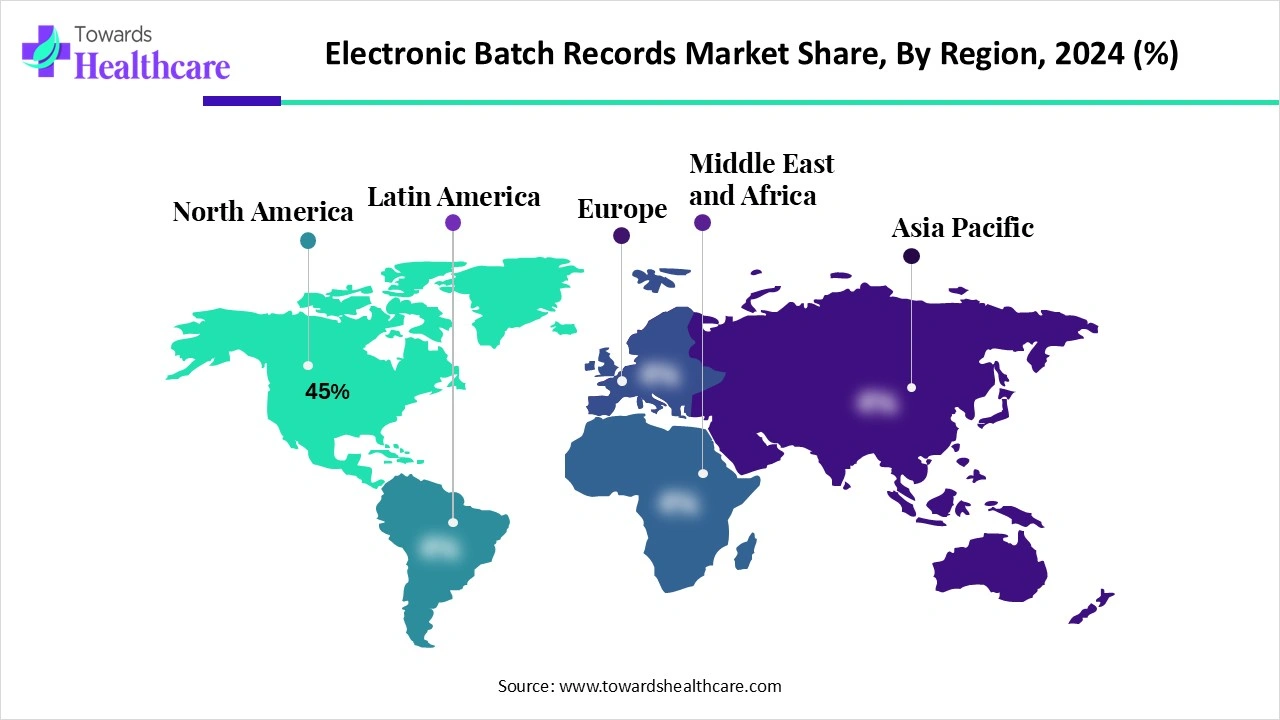

| Leading Region | North America Share 45% |

| Market Segmentation | By Component, By Deployment Mode, By Functionality, By End User, By Enterprise Size, By Region |

| Top Key Players | Siemens Healthineers, Werum IT Solutions, Emerson Electric, Honeywell International, Rockwell Automation, Sparta Systems, MasterControl, SAP SE, Oracle, Dassault Systèmes, AspenTech, QAD Precision, Yokogawa Electric Corporation, ZenQMS, EBR Systems Inc., Seratec, LZ Lifescience, ValGenesis, ABB Ltd., Accenture |

Electronic Batch Records (EBR) are digital versions of paper-based batch records used in pharmaceutical, biotechnology, and food & beverage manufacturing. They capture, store, and manage production data in compliance with GMP (Good Manufacturing Practices) and regulatory requirements (FDA 21 CFR Part 11, EU Annex 11). EBR systems streamline batch production, ensure data integrity, reduce errors, and improve compliance by integrating with Manufacturing Execution Systems (MES), ERP platforms, and LIMS. Growing digital transformation, stricter regulatory compliance, and demand for efficiency in pharmaceutical manufacturing are driving market adoption.

Growing SaaS Model Adoption: The SaaS models do not require any sophisticated hardware or IT infrastructure. This, in turn, helps in minimizing the upfront costs. They provide rapid implementation, along with enhanced scalability. This increases their adoption rates.

Increasing MES Integration: By integrating MES with EBR, the data transfer can be streamlined. It also helps in automated batch creation and execution. It also enhances the batch record reviews. Thus, their growing integration is resulting in new collaborations among the companies.

For instance,

AI impacts the electronic batch records, using predefined settings to generate automatic batch records with reduced human errors. It helps in maintaining the consistent quality in the manufacturing processes, analyzing past batch data to provide the best production settings, and finding patterns. The equipment maintenance needs are anticipated, compliance checks are automated, and data entry is streamlined in the EBR using AI. It helps in real-time monitoring of batch quality and enhances the process documentation accuracy. It also improves productivity by analyzing production deviations.

Increasing Manufacturing Complexities

The manufacturing processes involve multiple steps. This makes the process more complex. This, in turn, increases the demand for EBR systems to improve the product quality and reduce the chances of batch failures. It is also being used in the development of biologics and cell and gene therapies. EBR helps in reducing their errors and provides precise documentation. It also helps in monitoring the manufacturing process by tracking it and reducing the deviations. Thus, this drives the electronic batch records market growth.

Limited Skilled Personnel

Personnel with deep knowledge about manufacturing processes, IT, and regulatory guidelines are required for the handling of electronic batch records. They are also required for system configuration and integration tasks. Moreover, regular software updates and revalidation are also required for EBR maintenance. Thus, the lack of skilled personnel or experts affects the use and adoption of EBR.

Growing EBR Innovations

There is a rise in the innovations of EBR. Different types of EBR software products are being developed to enhance their integration with MES and ERP. They are also enhancing different features of EBR to provide a customizable workflow to the manufacturers. This, in turn, helps them to make the EBR more affordable. At the same time, new SaaS models or cloud-based models are also being developed, enhancing their use across various facilities. Thus, all these advancements are promoting the electronic batch records market growth.

For instance,

By component type, the software segment held the largest share of approximately 62% in the market in 2024, because it enhanced the EBR functionality. It provided easy integration with manufacturing, MES, and EPR systems. Moreover, the growing developments have increased its use for developing AI or cloud-based systems.

By component type, the services segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. They are being used for consulting. At the same time, their implementation is increasing to enhance validation and integration. They are also being used for training purposes.

By deployment mode type, the on-premises segment led the market with approximately a 55% share in 2024, due to EBR's enhanced data security. This increased their adoption by pharma and biotech companies. Moreover, due to their regulatory compliance, they were the preferred option. This enhanced the market growth.

By deployment mode type, the cloud-based segment is expected to show the highest growth during the upcoming years. They are being used in remote batch reviews. Furthermore, their enhanced scalability is increasing their use at multiple sites. The growing SaaS adoption is also increasing its use.

By functionality type, the batch creation & review segment held the dominating share of approximately 34% in the market in 2024, as it helped in transforming paper-based batch records to digital batch records. It provided faster batch release. This, in turn, reduced the errors during documentation. The compliance with regulatory standards increased its use.

By functionality type, the analytics & reporting segment is expected to show the fastest growth rate during the predicted time. The growing AI or ML integration is increasing its use as it provides automated batch reviews. It also helps in providing data-driven decisions. Additionally, helps in detecting the deviations.

By end user, the pharmaceutical & biotechnology companies segment led the global market with approximately 67% share in 2024, due to high production. The EBR helps in reducing the complexities in the manufacturing process. They also provided data integrity in compliance with regulatory standards. This, in turn, increased their adoption.

By end user, the contract development & manufacturing organizations segment is expected to show the highest growth during the upcoming years. The growing manufacturing and production rates are increasing the outsourcing to CDMOs. This is increasing the demand for EBR. Furthermore, the EBR scalability is increasing its use to serve different CDMO clients.

By enterprise size type, the large enterprises segment held approximately a 72% share in the market in 2024, as they used EBR to meet the regulatory standards. Due to frequent audits, they increased the use of EBR to maintain data integrity and traceability. The large-scale production also contributed to the same. This promoted the market growth.

By enterprise size type, the small & mid-sized enterprises segment is expected to show the highest growth during the predicted time. They are utilizing EBR to enhance the batch accuracy. Additionally, their scalability and flexibility are increasing their demand. Moreover, there is a rise in the SaaS-based adoption due to their affordability.

North America dominated the electronic batch records market share 45% in 2024. North America consisted of advanced pharmaceutical industries, which in turn increased the use of EBR by pharma manufacturers. Moreover, the presence of advanced technologies enhanced their innovations. Thus, this contributed to the market growth.

The industries present in the U.S. are focusing on developing EBR solutions. This, in turn, is leading to new collaborations among them. Moreover, they are also developing a new MES. This is further supported by the growing digital initiatives.

Due to the presence of various pharmaceutical and biotechnology industries, there is a rise in the demand for EBR. They are being used for large-scale operations. Moreover, cloud-based platforms are also being developed. Additionally, due to strong regulatory compliance, they are providing stronger data security, encouraging their adoption.

Asia Pacific is expected to host the fastest-growing electronic batch records market during the forecast period. The industries in the Asia Pacific are expanding, which is increasing their manufacturing process, R&D, and investments. This is increasing the use of EBR systems in pharmaceutical companies. Thus, this enhances the market growth.

Due to growing CDMOs in China, there is a rise in the demand for the use of EBR. Similarly, the growing pharma and biotech companies are also utilizing it for enhancing the manufacturing of active pharmaceutical ingredients. Furthermore, the data integrity is being enhanced by the guidelines of regulatory bodies. The government is also providing its support to promote its use.

The expanding healthcare sector in India is increasing the demand for EBR. The increasing pharma manufacturing hubs are also leveraging it in the production of generic drugs. They are also being used for the manufacturing of these products in compliance with the regulatory standards. Moreover, the presence of the pharma and IT industries is making the EBR maintenance more affordable.

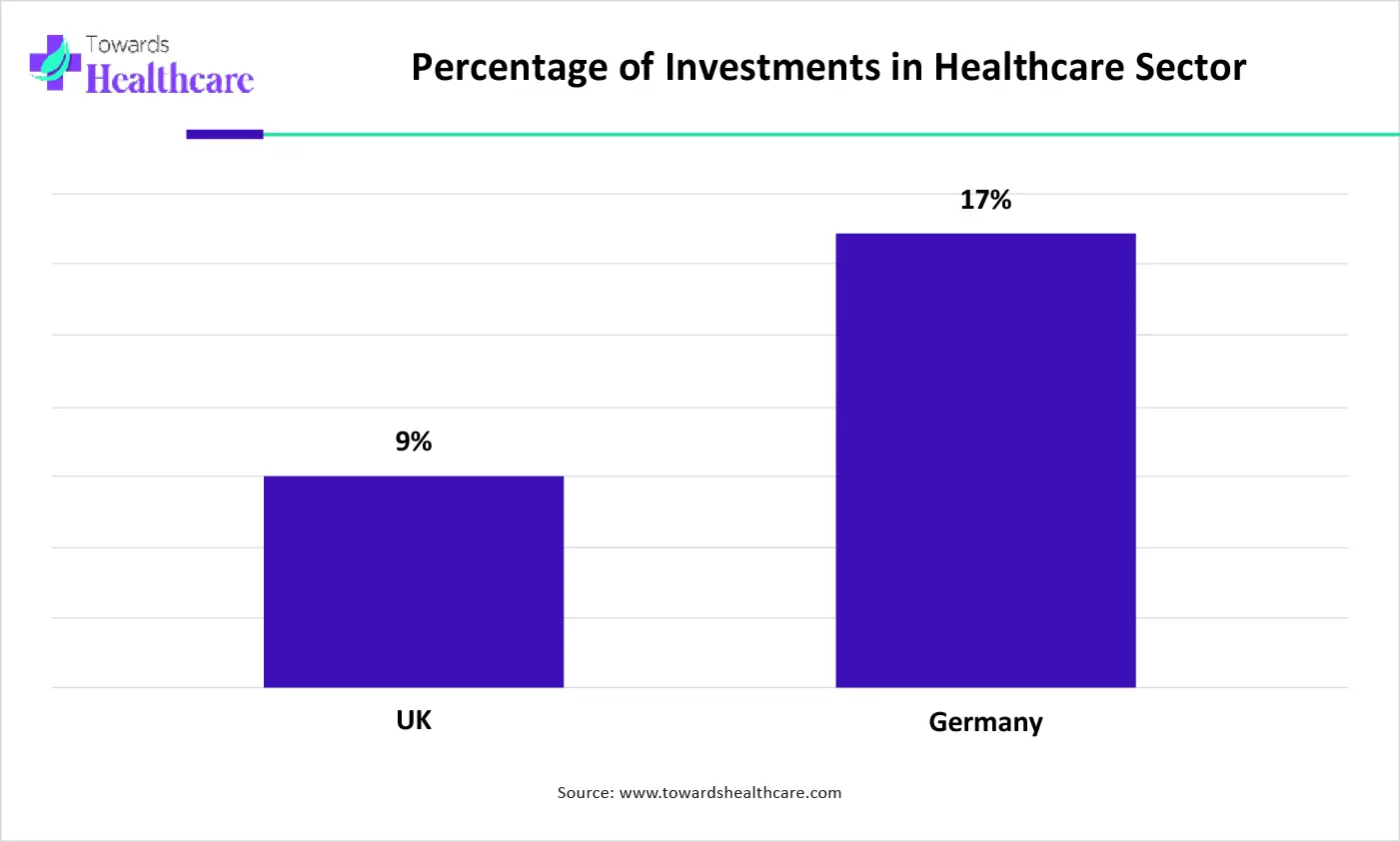

Europe is expected to grow significantly in the electronic batch records market during the forecast period. Due to the presence of a strict regulatory framework, the EBRs are developed to promote safety, efficiency, and data integrity. Moreover, the growing healthcare investments are increasing the adoption of EBR in Europe. Thus, this promotes the market growth.

The graph represents the total percentage of healthcare investments in the UK and Germany in the year 2024. It indicates that there is a rise in healthcare investments. Hence, it promotes the adoption of electronic batch records for multiple purposes in the healthcare sector. Thus, this in turn will ultimately enhance the market growth.

The growing industries are increasing the adoption of EBR to meet regulatory standards. They are also integrating the EBR systems with MES. At the same time, advanced technologies are also being used to enhance automation. Additionally, the presence of skilled personnel is increasing their use.

The UK is experiencing a rise in biotech startups. This is increasing the use of EBR systems to enhance the development of various therapies. Moreover, the growing digitalization is increasing the development of cloud-based platforms. Furthermore, as they comply with the regulatory standards, their adoption by CDMOs is also increasing.

In October 2024, to provide pharmaceutical manufacturers with comprehensive Electronic Batch Recording (EBR) solutions, a collaboration between Siemens Process Automation and Engineering Industries eXcellence was announced. Highlighting this collaboration, the Director of Life Sciences, Siemens USA, Christian Korner, stated that, to deliver value and fuel innovations, collaborations are important. Hence, to accelerate their customers’ innovation, ensuring high-quality standards and improved operational efficiency with Electronic Batch Records will help them to deepen their collaboration with Engineering Industries eXcellence. Thus, their customers will be supported to achieve their goals with confidence, through this collaboration, setting new benchmarks.

By Component

By Deployment Mode

By Functionality

By End User

By Enterprise Size

By Region

December 2025

December 2025

January 2026

December 2025