January 2026

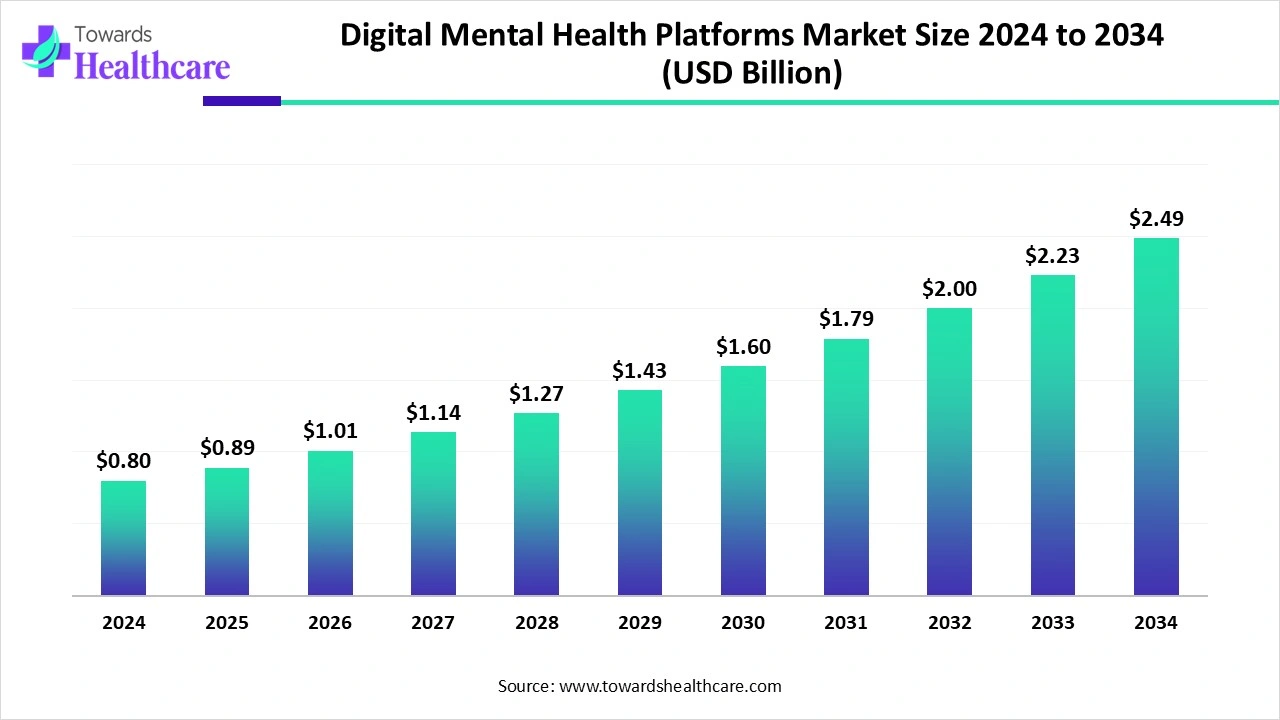

The global digital mental health platforms market size is calculated at US$ 0.80 billion in 2024, grew to US$ 0.89 billion in 2025, and is projected to reach around US$ 2.49 billion by 2034. The market is expanding at a CAGR of 12.37% between 2025 and 2034.

Around the world, a rise in the huge burden of diverse mental disorders cases, including depression, anxiety, and employee work pressure, is mainly fueling the widespread adoption of advanced digital mental health solutions. Moreover, the global digital mental health platforms market is fostering the development of numerous mental health programs among broader companies to reduce stress and expand goal achievement. Alongside AI integration with other healthcare platforms, developing social media platforms and other tele-health services are supporting the widespread management of mental health issues.

| Table | Scope |

| Market Size in 2025 | USD 0.89 Billion |

| Projected Market Size in 2034 | USD 2.49 Billion |

| CAGR (2025 - 2034) | 12.37% |

| Leading Region | North America |

| Market Segmentation | By Component, By Delivery Model, By Clinical Focus/Use Case, By Technology, By End-User, By Region |

| Top Key Players | BetterHelp, Talkspace, Headspace Health, Calm, Woebot Health, Ginger, Lyra Health, Spring Health, Cerebral, Quartet Health, Teladoc Health, SilverCloud Health, Big Health, Happify Health, Pear Therapeutics, Meru Health, Mindstrong Health, Modern Health, ableTo, Lantern |

The digital mental health platforms market comprises software platforms, mobile applications, and integrated services that deliver mental health assessment, therapy, coaching, crisis support, and care coordination digitally. Solutions include teletherapy/telepsychiatry, app-based cognitive behavioral therapy (CBT), AI-driven conversational agents, clinician workflows, measurement-based care, and employer-facing mental health programs. Platforms enable screening, symptom tracking, guided self-help, synchronous and asynchronous therapy, medication management support, and referrals into higher-intensity care. Adoption is driven by demand for access, convenience, reduced stigma, and employer/payer interest in scalable behavioral health solutions. Core enablers include teleconferencing, secure messaging, analytics, AI triage, integrations with EHRs, and reimbursement models that support virtual behavioral care across consumer, clinical, and enterprise channels.

The expanding smartphone/internet penetration and advancements in technologies like AI and telehealth are supporting the innovations in mental health approaches.

Currently, the globe is stepping into the refinement of AI-driven chatbots for customized support and the application of wearable devices and biofeedback systems to track physiological indicators of mental distress. As well as ongoing AI-enabled chatbots, mainly Woebot and Wysa are providing 24/7, non-judgmental, and cost-effective assistance, delivering Cognitive Behavioral Therapy (CBT)-based interventions. Moreover, AI models are escalating the analysis of smartphone use and other digital footprints to find potential indicators of declining mental health.

Emerging Advantages and Advancements

In 2025 and the coming era, the global digital mental health platforms market is driven by platforms convenience, remote and inexpensive alternatives to conventional in-person care, reaching a wider population, specifically in home settings, alongside consistent technological breakthroughs, including AI integration with wearables, which allow remote patient monitoring, facilitating data to support precision mental health management. A broader range of adoption of telehealth and online counseling platforms has notably enhanced the accessibility of mental health support.

Limitations in Clinical Validation

It is quite difficult to clinically validate certain digital mental health tools and apps, is developing issues regarding their efficiency and accuracy in offering correct mental health assessments. Besides this, inconsistency in internet access and poor network connectivity can create a barrier to the digital solutions of beneficiary.

Emerging Enterprise Solution and Other Applications

During the prospective period, the global digital mental health platforms market will expand several enterprise solutions, such as those that can be boosted by establishing B2B2C platforms. These platforms further assist businesses and educational institutions, addressing employee well-being, productivity, and student social-emotional learning (SEL). Alongside the raising more applications of stepped and blended care approaches, it unites digital tools with traditional therapy for a more feasible and accessible user experience.

In 2024, the software platforms segment was dominant in the digital mental health platforms market. This segment mainly includes various platforms, such as meditation and wellness apps, AI-powered platforms, EHR and behavioral health software, and personalized mental health apps. The world is focusing on covering the increased demand for telehealth approaches, and governments are also providing heavy funding and incentives to encourage mental health software and the application of electronic health records (EHR).

Under this segment, the teletherapy/telepsychiatry modules sub-segment held a major share of the market. It encompasses different types of psychotherapy, such as cognitive behavioral therapy (CBT), trauma-focused therapy, supportive psychotherapy, and group therapy. As well as teletherapy is also facilitating crisis counseling through numerous platforms, providing immediate support when required.

Whereas the services segment is predicted to expand rapidly during 2025-2034 in the digital mental health platforms market. The segment will be fueled by the incorporation of services, like AI-enabled chatbots and virtual assistants, to accelerate preliminary support, triage, and personalized treatment recommendations. Currently, companies are developing specific wearables that can sense and analyze emotions, offering more nuanced data for mental health monitoring.

Under this segment, the coaching & peer support services subsegment is estimated to grow at a rapid CAGR. This segment possesses several benefits over the other approaches, such as enhanced patient engagement, excellent outcomes, escalated use of self-management techniques, and improved well-being. Nowadays, a raised emphasis on artificial peer support, integration with clinical care, and accelerated access, especially for vulnerable populations, by leveraging technology, including asynchronous messaging and AI for customized interventions, is widely impacting the market expansion.

In 2024, the provider-integrated platforms segment accounted for the biggest revenue share of the digital mental health platforms market. The segment is propelled by transforming digital tools that are empowering patients, also offering self-management tools, personalized treatment strategies, and access to support, resulting in better engagement and adherence. The developing digital clinic platforms integrate digital tools, mainly smartphone apps, into regular care, focused on investigating limitations, like low user engagement, and expanding clinical integration.

On the other hand, the employer/workplace mental health platforms segment will grow fastest in the coming era. A rise in demand for feasible, accessible digital solutions, and the applicable for employers to appeal and retain talent by facilitating comprehensive well-being advantages is assisting the widespread adoption of digital tools among employers. The globe is increasingly adopting stepped care models, which assess the needs of employees and automatically provide the most suitable level of care, starting with self-guided tools and progressing to coaching or therapy as needed.

The depression & mood disorders segment led the digital mental health platforms market in 2024. The segment is fueled by the increasing global instances of mood disorders, the growing demand for accessible and scalable mental healthcare. Recently introduced prescription-level digital therapeutics for Major Depressive Disorder (MDD) and Generalized Anxiety Disorder (GAD), the utilization of large language models for advanced chatbot features is widely supporting these cases. Additionally, a raised integration of real-world data from sensors to determine potential crises before they occur is also assisting in managing various depression & mood disorders.

The workplace mental health & burnout segment is anticipated to expand rapidly. Nowadays, diverse companies are greatly involved in implementing wellness programs to expand employee satisfaction, productivity, and retention. For these programs, digital solutions are playing a crucial role by offering cost-effective and scalable solutions over traditional programs. The application of huge language models for diagnostic precision and patient engagement is assisting in developing personalized interventions based on user input, and integrating these tools into the widespread blended programs with professional healthcare assistance.

In 2024, the teleconferencing & secure messaging segment captured a major share of the digital mental health platforms market. The expansion in technological advances, including video conferencing technology, secure data encryption, and user-friendly interfaces, is boosting the reliability and attractiveness of teletherapy. The integration of secure messaging with other solutions, particularly digital diaries, thought records, and task planning, for an entire approach to care, is helping to resolve mental health issues efficiently. These efforts are further progressing remote monitoring, enhancing affordability by minimizing travel, and demonstrating comparable clinical results to traditional approaches.

However, the AI/ML triage & personalization segment will expand fastest during 2025-2034. Mainly, AI algorithms are widely assisting in the analysis of huge datasets of patient information, like biomarkers, genetics, medical history, and lifestyle factors, to recommend robust, individualized, and efficient interventions. Whereas ML-powered approaches support the study of various data sources, especially patient records, social media, speech, and behavior patterns, to identify early signs of mental health concerns and estimate challenges. Besides this, AI-driven chatbots and virtual assistants convey cognitive-behavioral interventions, assist users in finding thought patterns, and teach coping skills, providing accessible and out-of-hours support.

By end-user, the consumers/patients segment accounted for the dominating share of the digital mental health platforms market in 2024. A rise in awareness regarding mental health issues, expanding smartphone penetrations, and boosting focus on patient-centric approaches are increasingly fueling the adoption of digital platforms by consumers/patients. Patients are broadly preferring telepsychiatry and telehealth to get connected with healthcare professionals for remote therapy sessions via video or phone, which received critical traction during the COVID-19 pandemic.

The employers/corporate wellness programs segment is predicted to witness rapid expansion during 2025-2034. After COVID-19, employees are looking for mental health support and flexibility in their work arrangements, which accelerates companies to facilitate digital wellness solutions. The widespread coupling of digital platforms with smartwatches and other wearables enables more precise tracking of physical and physiological data, leading to a holistic view of employee health. The personalized and gamified programs are incorporating tailored health plans and gamification with real-world rewards for aiming wellness goals, escalating engagement.

The digital mental health platforms market in North America captured a major share in 2024. A broader range of well-established internet and mobile network infrastructure in North America is supporting the continuous delivery of online mental health services. Recently, in this region, the authorized prescription digital therapeutics (PDTs) like Rejoyn have enabled specific, evidence-based programs that integrate cognitive behavioral therapy with engaging tasks for treating major depressive disorder. Alongside, ongoing partnerships and acquisitions in companies in North America are involved in the wider progress of novel digital mental health platforms among people.

The emerging awareness, destigmatization of mental health issues, and supportive government initiatives and funding, likewise the 21st Century Cures Act, are contributing to the overall market development in the U.S.

For instance,

Ongoing technological advancements, particularly AI-driven tools and telehealth, and a raised willingness by Canadians to adopt these digital solutions, are impacting the growth of the digital mental health platforms market.

For this market,

In the prospective period, the Asia Pacific will witness the fastest growth in the digital mental health platforms market. Different regions of ASAP, such as China, Japan, and South Korea, are increasingly adopting novel technologies, including smartphones with inexpensive internet access and expanding digital literacy, making digital platforms a prominent access point for healthcare services. As these transforming digital technologies are providing immediate and convenient access to mental health support from the comfort of home remotely, they provide an option to the time-consuming previous services. Also, the wider applications of affordable smartphones and smartwatches are impacting the fastest growth of the Asia Pacific mental health apps sector.

Consistent investment in mental health platforms and the integration of social platforms, including WeChat and Douyin, are developing to contribute to mental health education and resources, further boosting their role more than traditional social interactions in China. The development of co-creation and community engagement to confirm cultural sensitivity and stepping into more evidence-based digital interventions are enhancing health equity, eventually in rural areas.

In 2024, the digital mental health platforms market in Japan comprises the regulatory approval for digital therapeutics (DTx) apps, with certain DTx for nicotine dependence and hypertension management gaining national health insurance coverage.

For instance,

A significant expansion of Europe in the digital mental health platforms market is fueled by the increasing focus on early sign detection of depression and anxiety. Especially, emerging startups, such as Myndgard in Ireland, are highly involved in these early detections by using AI and app technology. Along with this, groundbreaking advances are boosting the progression of assessment reports evolved before the first in-person session, and are offering clinicians vital information for better decision-making. Involvement of other platforms is further combined with healthcare systems, including the NHS, applying SilverCloud, and through initiatives, such as DiGA of Germany.

The German Association for Psychiatry, Psychotherapy and Psychosomatics (DGPPN) emphasizes the development of quality criteria to guide practitioners, further focusing on evidence of efficacy and safety. In Germany, DiGA is highly prescribed by physicians or psychotherapists, or, after the diagnosis has been developed, directly by the statutory health insurance.

The digital mental health platforms market in the UK is propelled by various innovations, such as Togetherall is facilitating moderated peer support. As well as the growth of telepsychiatry post-pandemic, and the expansion of AI-powered tools, like chatbots and mood-tracking algorithms.

For this market,

By Component

By Delivery Model

By Clinical Focus/Use Case

By Technology

By End-User

By Region

January 2026

January 2026

January 2026

January 2026