February 2026

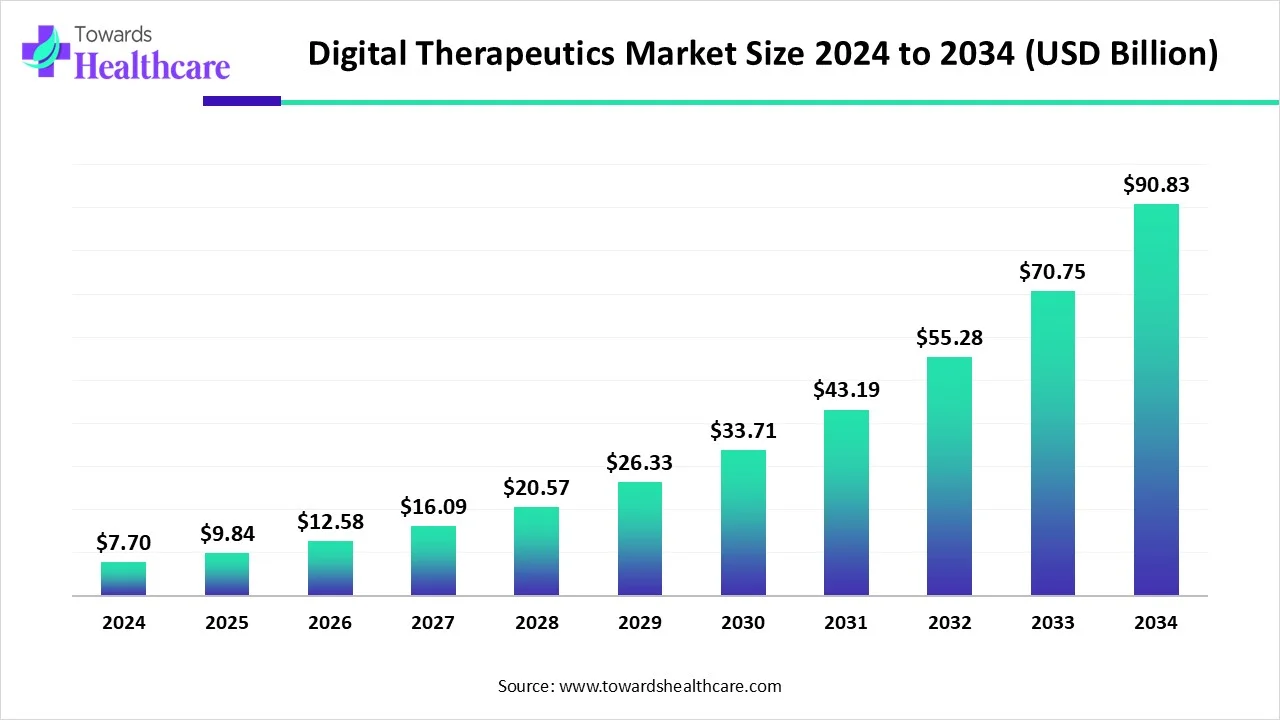

The global digital therapeutics market size is calculated at USD 9.84 billion in 2025, grow to USD 12.58 billion in 2026, and is projected to reach around USD 114.37 billion by 2035. The market is expanding at a CAGR of 27.8% between 2026 and 2035.

Digital therapeutics are evidence-based software solutions that deliver clinically validated interventions to prevent, manage, or treat medical and behavioral health conditions, often through apps or digital devices. Innovation is significantly propelling the digital therapeutics market by integrating advanced technologies like artificial intelligence(AI) and machine learning (ML), which enhance personalized treatment plans and predictive analytics. These advancements enable real-time monitoring and engagement. Additionally, the incorporation of wearable devices and mobile health applications facilitates more accessibility and cost-effectiveness. Regulatory support and increased investment in digital health are further accelerating market growth.

For Instance,

AI is fueling the market by enabling personalized, data-driven treatment plans that adapt to individual patient needs. It enhances real-time monitoring, predicts health risks, and supports early interventions, improving treatment outcomes. AI also streamlines data analysis for healthcare providers, boosts patient engagement through intelligent feedback, and increases the scalability and efficiency of digital therapies, making them more accessible and effective.

Rising Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is driving the digital healthcare market by encouraging early diagnosis, real-time monitoring, and proactive health management. Digital tools such as mobile apps, wearables, and telehealth platforms enable individuals to track vital signs, manage lifestyle habits, and detect potential health issues before they become serious. This shift not only helps in improving patient outcomes but also reduces overall healthcare costs, making digital solutions essential for modern preventive-focused healthcare systems.

Limitations Associated with Digital Therapeutics to Limit Its Adoption

Limitations such as regulatory challenges, limited clinical validation, data privacy concerns, and lack of reimbursement policies hinder the widespread adoption of digital therapeutics. These issues can affect users, slow down product approvals, and limit accessibility, especially in traditional healthcare providers, and patients may be hesitant to adopt digital interventions over conventional treatment, creating a barrier to market growth and acting as a restraint in the digital therapeutics sector.

Large Undiagnosed and Untreated Population

The large population of undiagnosed and untreated individuals presents a significant opportunity for the digital therapeutics market. With accessible, scalable, and cost-effective digital solutions, these tools can help reach underserved communities and individuals who lack access to traditional healthcare. By enabling early screening, continuous monitoring, and personalized interventions, digital therapeutics can bridge gaps in care, improve health outcomes, and expand market potential across both developed and developing regions.

For Instance,

| Metric | Details |

| Market Size in 2026 | USD 12.58 Billion |

| Projected Market Size in 2035 | USD 114.37 Billion |

| CAGR (2026 - 2035) | 27.8% |

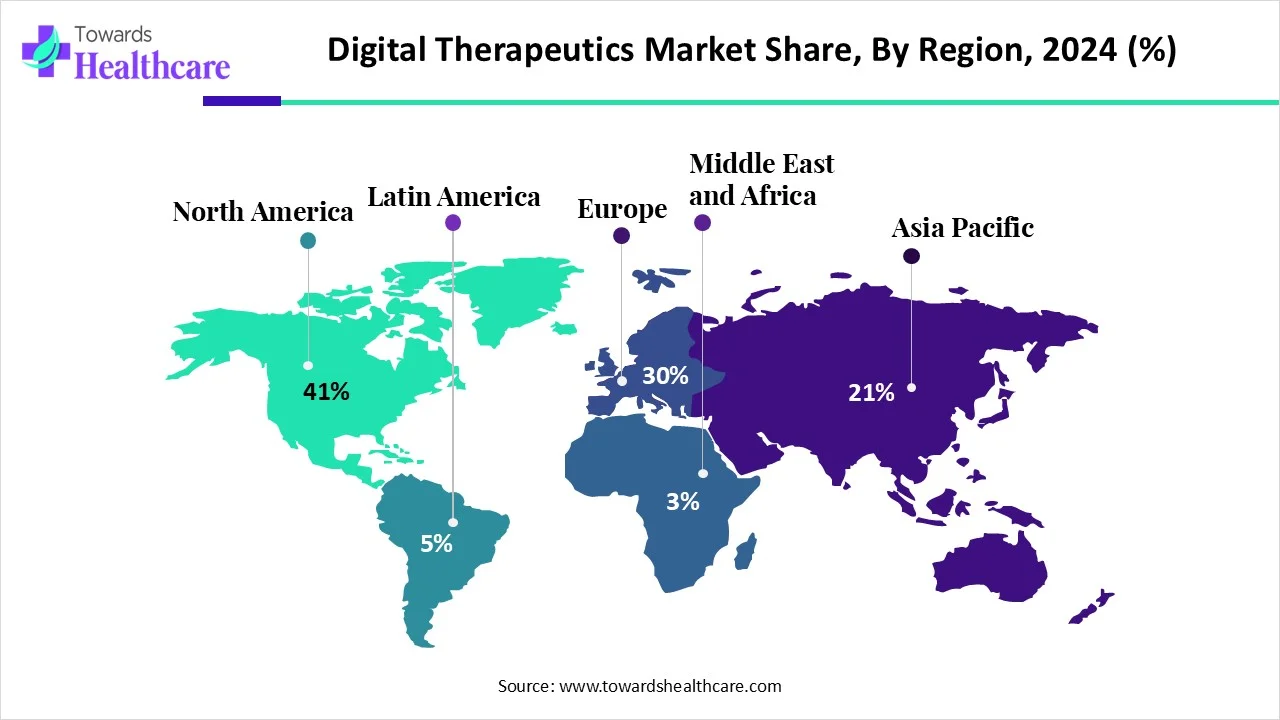

| Leading Region | North America share by 41% |

| Market Segmentation | By Application, By End Use, By Regions |

| Top Key Players | OMADA HEALTH, INC., Welldoc, Inc., 2Morrow, Inc, Livongo Health, Inc. (Teladoc Health, Inc.), Propeller Health (ResMed), Fitbit LLC, Mango Health, CANARY HEALTH, Noom, Inc., Pear Therapeutics, Inc., Akili Interactive Labs, Inc., HYGIEIA, DarioHealth Corp., BigHealth, GAIA AG, Limbix Health, Inc. |

By Application

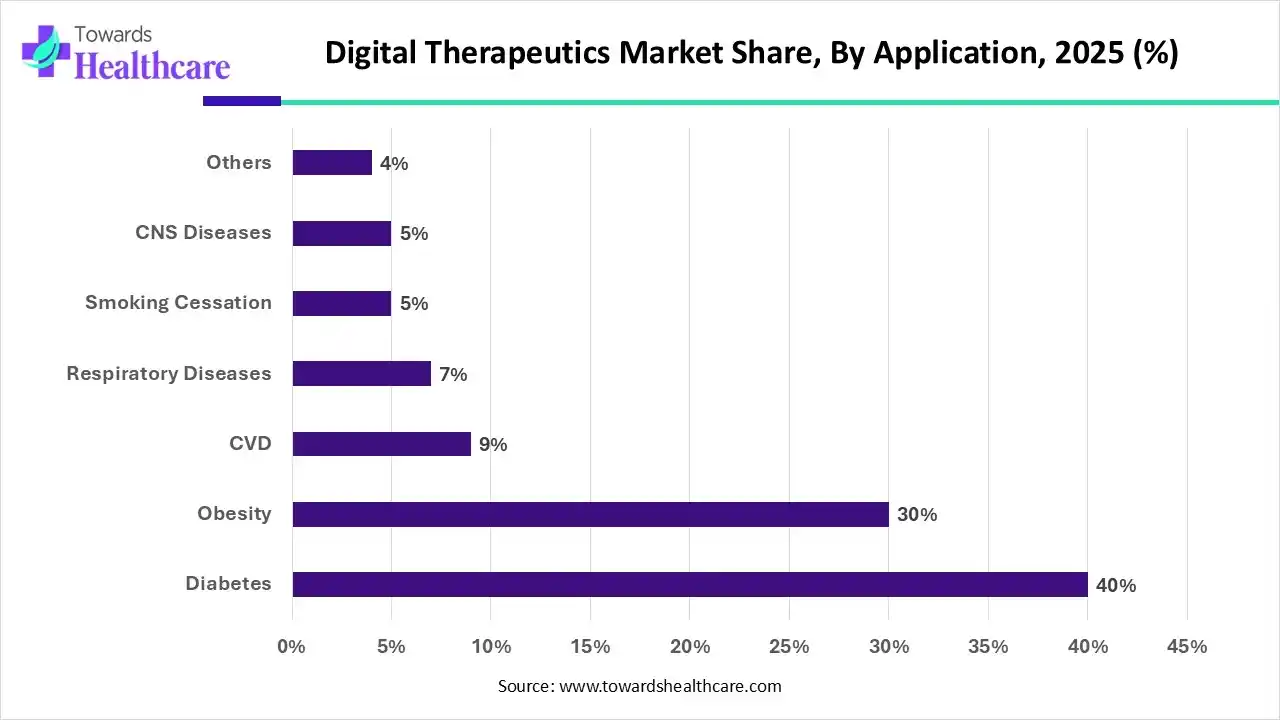

The Diabetes Segment Major Shares

By application, the diabetes segment held the major digital therapeutics market by 40% share, due to the high global prevalence of diabetes and the increasing demand for continuous monitoring and management solutions. Digital tools like mobile apps, wearables, and connected glucose monitors offer real-time tracking, personalized feedback, and improved adherence to treatment plans. These technologies help patients manage their blood sugar levels more effectively, reduce complications, and lower healthcare costs, making them widely adopted in diabetes care.

For Instance,

The Obesity Segment: Fastest Growing

By application, the obesity segment is projected to grow at the fastest rate between 2025 and 2034, driven by the escalating global prevalence of obesity and the increasing adoption of digital health solutions. Advancements in technologies such as artificial intelligence and data analytics are enabling personalized interventions and enhancing the effectiveness of weight management programs. Additionally, the widespread use of smartphones and wearable devices facilitates continued monitoring and engagement, making digital therapeutics more accessible and appealing to individuals seeking to manage their weight effectively. These factors collectively contribute to the rapid expansion of the digital therapeutics market.

For Instance,

| Segment | Share 2025 (%) |

| Patients | 50% |

| Providers | 30% |

| Payers | 10% |

| Employers | 6% |

| Others | 4% |

The Patient Segment: Biggest Shares

By end-use, the patient segment contributed the biggest market share by 50% in 2025. The increasing prevalence of chronic conditions such as diabetes, hypertension, and mental health disorders prompts patients to seek accessible and personalized healthcare solutions. The widespread adoption of smartphones and internet services has facilitated the use of digital therapeutic applications, enabling real-time health monitoring and tailored treatment plans. Furthermore, the shift towards patient-centric care models and the emphasis on preventive healthcare have reinforced the adoption of digital therapeutics among patients.

The Provider's Segment: Fastest Growing

By end-use, the provider's segment is predicted to grow at the fastest rate in the digital therapeutics market during the studied years. Healthcare providers are increasingly integrating digital therapeutics solutions into their clinical workflows to enhance patient outcomes and streamline care delivery. The adoption of value-based care models emphasizes preventive and personalized treatments, aligning well with digital therapeutics capabilities. Additionally, advancements in technology and favorable reimbursement policies are encouraging providers to adopt these innovative solutions, further propelling the digital therapeutics market.

For Instance,

North America dominated the market share by 41% in 2025 due to its advanced healthcare infrastructure, high adoption of digital health technologies, and supportive regulatory frameworks. The presence of key industry players such as Pear Therapeutics and Omada Health further boosted innovation and accessibility. Additionally, favorable reimbursement policies and growing awareness among patients and providers contributed to the region's leadership. These combined factors have made North America a hub for the development and integration of digital therapeutic solutions.

For Instance,

The U.S. market is expanding rapidly due to the growing burden of chronic diseases like diabetes and heart conditions, which demand scalable and effective treatment options. Technological advancements, including AI and wearable integration, have enhanced treatment personalization and engagement. Supportive FDA regulations and increased investments from tech firms and healthcare partnerships are further driving growth. These combined factors position the U.S. as a global leader in digital therapeutic adoption and innovation.

For Instance,

The Canadian market is growing steadily due to the rising incidence of chronic conditions such as diabetes, cardiovascular diseases, and mental health disorders. Increased adoption of smartphones and digital devices has made these therapies more accessible. Integration with wearables and IoT technology enables real-time monitoring and personalized care. Additionally, expanding use in behavioral and mental health, along with a growing focus on preventive and patient-centric healthcare, is fueling further adoption and market expansion across the country.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period, due to the increasing prevalence of chronic diseases, rising smartphone usage, and advancements in mobile health technologies. Government support for digital health initiatives, such as India’s National Digital Health Mission, further boosts adoption. Additionally, the region's aging population and a surge in health tech startups and collaborations are driving demand for innovative, accessible, and personalized therapeutic solutions, making Asia-Pacific a key growth region in the global digital health landscape.

China's market is expanding rapidly, driven by a high prevalence of chronic diseases like diabetes and cardiovascular conditions. Government initiatives, such as the Healthy China 2030 plan, promote digital health integration. Advancements in mobile health, AI technologies, and widespread smartphone usage enhance accessibility and personalization of care. Additionally, increased investments and collaborations between tech firms and healthcare providers are accelerating the development and adoption of digital therapeutic solutions across the country.

For Instance,

India’s market is rapidly expanding due to the increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and mental health disorders. Government programs like the Ayushman Bharat Digital Mission are enhancing the country’s digital health infrastructure, promoting easier integration of digital therapies. Additionally, widespread smartphone penetration and technological advancements in mobile health are making these solutions more accessible. Together, these factors are driving strong growth and wider adoption of digital therapeutics across India.

Europe stands out in the market due to its strong healthcare infrastructure, supportive government policies, and high digital health awareness among its population. The region benefits from the early adoption of innovative technologies and significant investments in digital health startups. Additionally, the increasing prevalence of chronic diseases and aging populations drives demand for effective digital therapies. Collaborations between healthcare providers, tech companies, and regulators further accelerate market growth and integration across European countries.

The UK market is growing rapidly due to the rising prevalence of chronic diseases like diabetes, obesity, and mental health issues. Government support, including recommendations from NICE for digital treatments, boosts adoption. Additionally, a shift towards preventive and value-based healthcare drives demand for effective digital solutions. Technological advancements, widespread smartphone use, and improved internet connectivity further enable market expansion, positioning the UK as a key player in the global digital therapeutics landscape.

Germany’s market is growing rapidly due to strong regulatory support, including the Digital Healthcare Act, which allows doctors to prescribe digital health apps covered by public insurance. The increasing prevalence of chronic diseases like diabetes and cardiovascular conditions is driving demand for effective digital treatments. Additionally, Germany’s advanced healthcare infrastructure, widespread use of electronic health records, and telemedicine adoption make it easier to integrate digital therapeutics into patient care, fueling market expansion.

Latin America is expected to grow at a notable CAGR in the digital therapeutics market in the foreseeable future. The rising adoption of advanced technologies and favorable government support are the major contributors to the market in Latin America. Government organizations launch initiatives and provide funding to adopt digitization in the healthcare sector. The increasing use of wearable devices and mobile health apps drives the market. The increasing investments and collaborations among key players facilitate the development of digital therapeutics.

According to a 2023 study conducted on Mexican patients, 65% of respondents used some type of mobile technology to manage health conditions, such as medication reminders and virtual consultations. In June 2025, Mexico’s health authority COFEPRIS approved Medsi AI’s digital platform as a medical device. The software can convert a 20-second video selfie into personalized health information with 20 vital signs and biomarkers.

IDC Brasil reported that more than 1.46 million units of wearable devices were sold in Brazil in the second quarter of 2023, representing an increase of 6.4% from the second quarter of 2022. The Ministry of Health formed the Secretariat of Information and Digital Health to expand access and promote integral and continuous healthcare.

In April 2025, the American Telemedicine Association (ATA) announced that its advocacy arm, ATA Action, has acquired the Digital Therapeutics Alliance to strengthen support for software-driven healthcare tools. Together, they’re launching the Advancing Digital Health Coalition, aiming to make telehealth and digital therapeutics key parts of U.S. healthcare. Kyle Zebley, ATA Action's executive director, stated that their mission is to form a unified voice to shape policies that secure the future of digital care solutions. (Source - Healthcare IT News)

By Application

By End Use

By Regions

February 2026

February 2026

February 2026

February 2026